How To Purchase a Home in Pre Foreclosure for Investors

Learn how to purchase a home in pre foreclosure with this guide. Discover proven strategies for finding, negotiating, and closing on distressed properties.

By James Le

Buying a home in pre-foreclosure means finding a property where the owner has defaulted on their mortgage, but before the bank has actually taken it back. This lets you negotiate directly with the homeowner, often striking a deal below market value before the property ever hits a public auction.

The whole game is about finding motivated sellers and offering them a real solution to a very stressful financial problem.

The Pre Foreclosure Opportunity for Savvy Investors

For agents and investors who know what they're doing, the pre-foreclosure market is a landscape rich with opportunity, though it's often misunderstood by the masses. It's a critical window of time—that period after a homeowner gets a Notice of Default but before their home is sold on the courthouse steps.

During this phase, the homeowner is still the legal owner. And, critically, they are usually highly motivated to find a way out that avoids the credit-destroying, financially devastating blow of a completed foreclosure.

This is where a sharp operator can step in. Unlike fighting it out at a crowded auction or making lowball offers on bank-owned (REO) properties, pre-foreclosure opens the door for direct, nuanced negotiation. You're not just buying a house; you're solving someone's very real, very complex problem.

Key Benefits of Pre Foreclosure Investing

The appeal of pre-foreclosure investing goes way beyond just getting a discount. When you strategically acquire these properties, you can build a truly robust and profitable portfolio. Here’s why it works so well:

- Acquire Properties Below Market Value: Homeowners in distress are often willing to sell for less than the property is worth to quickly pay off their debt and salvage what's left of their credit.

- Less Competition: When you source deals directly, you sidestep the bidding wars that are so common at public auctions and on the open market. This is your chance to find deals no one else sees.

- More Control and Flexibility: You’re talking to a person, not a bank's asset manager. This allows for creative deal structures like short sales or subject-to acquisitions that can be tailored to the seller's specific situation.

- Build a Predictable Deal Pipeline: Once you nail down a system, this niche lets you create a repeatable process for finding, qualifying, and closing deals. You move from sporadic, one-off transactions to a consistent flow of opportunities.

Understanding the Modern Market Dynamics

Today's real estate climate presents a unique environment for pre-foreclosure investing. Foreclosure filings hit 187,659 in the first half of a recent year, which was a 5.8% increase from the year before. This steady uptick is creating a buyer's market for those who know where to find these deals.

This is where technology gives modern investors a huge edge. Operators who use advanced tools like an always-on AI ISA can qualify these leads in seconds and automate their pipeline, setting themselves up for high-volume success. You can discover more insights about the foreclosure market and its trends to stay ahead of the curve.

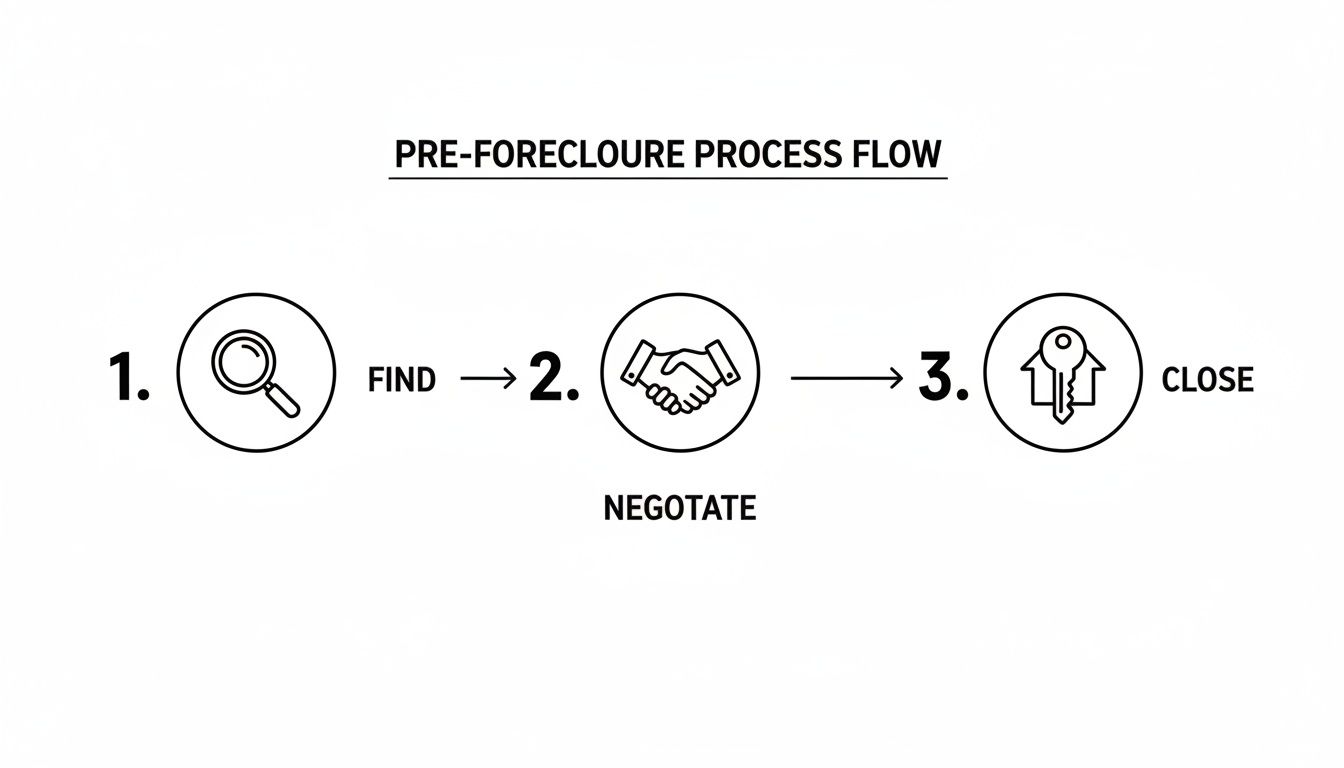

The whole process really boils down to three core stages, as this simple graphic shows.

This illustrates that your success hinges on a streamlined workflow, from spotting the right opportunities to getting the deal closed efficiently.

Quick Guide to the Pre Foreclosure Purchase Process

To give you a clearer picture, I've broken down the pre-foreclosure purchase journey into its core stages. Think of this table as your high-level roadmap.

| Stage | Key Action | Primary Goal |

|---|---|---|

| 1. Find | Identify properties in pre-foreclosure | Build a list of viable leads with distressed homeowners. |

| 2. Qualify | Analyze financials, title, and property condition | Determine if there's enough equity and motivation to make a deal work. |

| 3. Contact | Reach out to the homeowner with a solution | Open a line of communication based on empathy and problem-solving. |

| 4. Negotiate | Structure and agree upon purchase terms | Create a win-win offer that solves the seller's problem and meets your goals. |

| 5. Due Diligence | Conduct inspections and verify all legal/financial details | Confirm the property's condition and ensure a clear path to closing. |

| 6. Close | Execute contracts and transfer ownership | Finalize the purchase, pay off the existing lender, and take title to the property. |

Each step requires its own set of skills and careful attention to detail, but mastering this flow is what separates the pros from the amateurs in this space.

Finding and Qualifying Pre Foreclosure Leads

To consistently buy homes in pre-foreclosure, you have to stop fighting over the same stale, national lists everyone else is using. The real edge comes when you move past generic advice and start sourcing exclusive deals directly from the source: proprietary, county-level data. This is how you find homeowners in distress before the competition even knows they exist.

The goal isn't just to find leads; it's to build a predictable pipeline of genuinely motivated sellers. That means looking for distress signals that go much deeper than a single missed payment.

Tapping Into Exclusive County-Level Data

The most successful operators I know build their deal flow by looking for nuanced signs of distress straight from county records. While everyone else is waiting for a Notice of Default to be published, you can get a massive head start by tracking the precursor issues.

These signals often point to a homeowner under serious financial or personal pressure, making them far more likely to need a quick, clean exit from their property. Key data points I always monitor include:

- Tax Liens: Unpaid property taxes are a huge red flag for financial trouble.

- Probates: The death of a homeowner often creates a situation where heirs need to sell fast to settle the estate.

- Code Violations: A stack of fines for property neglect usually points to an owner who is overwhelmed and can't keep up with the home.

- Civil Court Records: Lawsuits, divorces, or other legal battles can easily force the sale of a property.

By tracking these sources, you can spot potential sellers weeks, or even months, before any formal pre-foreclosure process kicks off. That first-mover advantage is everything.

Identifying Hidden Opportunities Like Zombie Foreclosures

Beyond the usual distress signals, some truly unique opportunities are hiding in plain sight for those willing to dig a bit deeper. One of the most compelling is the zombie foreclosure—this is a property where the owner has already walked away, but the lender hasn't finished the foreclosure process yet.

These homes are often vacant and falling apart, creating a neighborhood eyesore that you can solve. Recent data shows just how big this opportunity is. In the third quarter of one year, there were 222,318 properties in some stage of pre-foreclosure across the U.S. A shocking 3.38% of these—or 7,519 homes—were classified as zombie foreclosures. You can read the full analysis on zombie foreclosure trends to get a better sense of the market dynamics. Finding these vacant gems before they hit any national list means you can negotiate without any competition.

Key Takeaway: The best pre-foreclosure leads aren't on public lists. They're discovered by digging into raw, county-level data and looking for a combination of distress signals that point to a truly motivated seller.

Qualifying Leads with Modern Technology

Finding a potential lead is only half the battle. The next, and arguably more critical, step is qualifying them without wasting your time. Burning through your resources and killing your deal flow by chasing unmotivated or unqualified homeowners is a rookie mistake.

This is where modern tools, like an AI-powered Inside Sales Agent (ISA), become a game-changer. An AI ISA can engage and vet homeowners the second they show interest, 24/7. It can fire off crucial qualifying questions, gauge their motivation level, and collect essential info in just a few seconds.

For example, an AI can instantly ask:

- Are you the owner of the property at [Address]?

- Have you considered selling to resolve your situation?

- How much do you currently owe on the mortgage?

This immediate, automated engagement means that by the time you or your team books an appointment, you’re talking to someone who is actually ready to have a serious conversation about selling. It completely transforms your process from chasing cold leads to having a calendar full of pre-vetted, high-intent sellers. Our guide on how to find pre foreclosure homes dives deeper into strategies for building out a robust lead gen system.

When you combine deep data sourcing with intelligent automation for qualification, you stop competing over the same recycled leads. Instead, you build a proprietary and predictable deal pipeline that fuels real growth in your real estate business.

Mastering Outreach and Negotiation Strategies

Successfully contacting a homeowner in pre-foreclosure is an art form. It's a delicate dance between empathy, professionalism, and a sharp business sense. Your whole approach will determine whether you're seen as a vulture or a genuine problem-solver throwing them a lifeline.

The goal here isn't to strong-arm anyone into a sale. It's to position yourself as a helpful expert with a viable solution, building enough rapport to have a real conversation about their options. One of those options, of course, might be selling their home to you.

Crafting Your Initial Outreach

Your first contact sets the entire tone for whatever follows. Whether you choose direct mail, a phone call, or something else entirely, the message has to be sensitive and focused on solutions. Ditch any aggressive language and don't make assumptions about their situation.

Instead, think of yourself as a resource. Frame your outreach around providing information and exploring alternatives to foreclosure. Trust me, most homeowners in this spot feel completely isolated and overwhelmed; a calm, professional voice can cut through all that noise.

Sample Direct Mail Script

Direct mail is still a surprisingly powerful tool, especially for reaching homeowners who are screening their calls. A simple, personal letter often breaks through where other methods fail.

Here's a snippet that has worked for me:

"Hi [Homeowner Name],

My name is [Your Name], and I'm a local real estate professional who specializes in helping homeowners explore all their options. I understand you may be in a difficult situation with your property at [Property Address].

I just wanted to let you know there are alternatives to foreclosure that can help you move forward. If you're open to a brief, no-pressure chat about your options, please call or text me at [Your Number]."

See how it’s non-threatening? It positions you as a helpful guide, not just a buyer looking for a deal.

Effective Phone Call Strategies

If you decide to pick up the phone, your tone and opening line are everything. You have just a few seconds to establish that you're a credible professional and not just another sales drone.

Lead with empathy and be transparent. Acknowledge the sensitivity of the situation without being patronizing. Your only goal on this first call is to open a dialogue, not to close a deal. For a deeper dive, checking out a collection of proven scripts can give you some solid frameworks. You can find some excellent examples in these real estate cold calling scripts.

Key Negotiation Points to Address

Once you've made contact and built a bit of rapport, the conversation will naturally turn to the nuts and bolts of a potential deal. Your negotiation has to be grounded in the facts and a crystal-clear understanding of what the homeowner actually needs.

Be ready to talk through these core elements:

- The Outstanding Mortgage Balance: You'll need the exact payoff amount to structure any offer that makes sense.

- Presence of Other Liens: Gently ask about second mortgages, tax liens, or judgments. These all have to be cleared at closing.

- Property Condition: You need to get a sense of the home's condition to factor in potential repair costs.

- The Seller's Desired Outcome: This is the most important one. What do they truly want? Is it to walk away with cash in hand, to simply save their credit, or something else?

Understanding their core motivation is the absolute key to crafting an offer they’ll actually consider.

Pro Tip: Always lead with the seller's problem and frame your offer as the solution. If they need to move fast, emphasize a quick, no-hassle closing. If their credit score is their biggest worry, explain how a short sale is far less damaging than a full foreclosure.

This problem-solving mindset is everything when you purchase a home in pre foreclosure. And communication doesn't stop after the first call. Smart email marketing for real estate can be a game-changer for nurturing these relationships and showing your value over time. By consistently offering help and keeping the lines of communication open, you build the trust needed to get a contract signed and see the deal all the way through to closing.

Getting Serious: Due Diligence and Creative Deal Structuring

Alright, you’ve got a verbal agreement with the homeowner. That handshake is a great first step, but it’s just the beginning. The real work—the nitty-gritty, meticulous effort that separates a profitable deal from a financial catastrophe—starts right now. This is the due diligence phase, and for a pre-foreclosure, it's a minefield of unique challenges.

Your entire goal here is to sniff out every single issue that could kill the deal or bleed your profits dry. That means digging deep into the property's title, getting a rock-solid valuation, and figuring out the right financing strategy to actually get this thing closed. Every move you make from here on out is about managing risk.

Uncovering the Truth With a Thorough Title Search

If you do only one thing, do this: order a comprehensive title search. Distressed properties are notorious for having messy, clouded titles, and you absolutely must know what you're walking into before you commit a dime. A preliminary title report from a reputable title company isn't optional; it's essential.

This report is your treasure map to all recorded claims against the property. You'll often find a whole host of liens and other problems, such as:

- Second or third mortgages: Incredibly common. You'll need to negotiate payoffs with these junior lienholders.

- Tax liens: Unpaid federal, state, or local taxes that stick to the property like glue.

- Mechanic's liens: Filed by contractors who did work on the home and never got paid.

- Judgment liens: These pop up from lawsuits where the homeowner was ordered to pay a debt.

Every one of these liens has to be settled at closing for you to get a clear title. You can’t just ignore them and hope they go away; they will come back to haunt you. For a deeper dive, you can learn more about finding property liens in our comprehensive guide.

Nailing an Accurate Property Valuation

Once you have a clear picture of the debts tied to the house, your next job is figuring out what it’s actually worth. An accurate valuation is the bedrock of a good deal. The two fastest ways to lose your shirt in this business are overestimating the After Repair Value (ARV) and underestimating repair costs.

Part of this process involves knowing how to determine fair market value by pulling "comps" (comparable sales) of similar homes that have sold recently in the neighborhood. You'll need to adjust your numbers based on differences in size, condition, and features.

Investor Insight: Never, ever trust an automated valuation model (AVM) like a Zestimate. Get your boots on the ground, walk through the property yourself, and build a detailed scope of work with real-world numbers from contractors. What looks like a simple cosmetic fix online could be hiding a cracked foundation or a fried electrical system.

Exploring Creative Financing and Transaction Structures

When you decide to purchase a home in pre-foreclosure, traditional bank financing often isn't your friend. Lenders get skittish about properties in rough shape, and their slow, bureaucratic 30- to 45-day closing process rarely works with the tight timelines you're up against. This is where you have to get creative.

Cash Offers: Cash is king. It's the cleanest, fastest way to close a deal, which is exactly what a stressed-out seller and their lender want to see.

Hard Money Loans: These are short-term, asset-based loans from private lenders. They can close incredibly fast (often in 7-10 days) but come with higher interest rates and fees. Hard money is a fantastic tool for snapping up a property, getting the renovations done, and then refinancing into a conventional long-term mortgage.

"Subject-To" Acquisitions: In a "subject-to" deal, you take over the seller's existing mortgage payments without formally assuming the loan through the bank. This can be a game-changer if the seller has a mortgage with a great interest rate. But be warned: this is an advanced strategy that carries significant risks, including the infamous "due-on-sale" clause, so you need to know exactly what you're doing.

The Short Sale Hurdle

What if the homeowner owes more on their mortgage than the house is worth? This is where your journey takes a detour into a short sale. In this scenario, you negotiate a purchase price with the seller, but that offer has to be approved by their lender before you can close.

Lender approval can be a painfully slow and frustrating process. But the payoff can be huge.

Consider a recent market snapshot: in one quarter, 101,513 U.S. properties had foreclosure filings, with over 72,000 starting the process for the first time. It's in this environment that pre-foreclosure deals, especially short sales, become so valuable. You have the chance to secure properties at a 15-30% discount below market value before they ever hit the courthouse steps.

Mastering the due diligence and financing maze is what separates the seasoned pros from the amateurs. It takes precision, patience, and a willingness to look for solutions well beyond the standard playbook.

Executing the Purchase from Contract to Closing

You've navigated the tricky waters of outreach, built some real rapport with the homeowner, and now you’re holding a signed contract. That's a huge milestone, but don't pop the champagne just yet. The race isn't over. In fact, the most complex and tedious part is just getting started.

Getting a pre-foreclosure deal from a signed piece of paper to a successful closing demands precision, a ton of patience, and a proactive mindset to juggle all the moving parts.

This final leg of the journey means you’ll be coordinating with the seller, their lender (who is not your friend), a title company, and maybe even a couple of attorneys. Your role instantly shifts from negotiator to project manager. Every document has to be perfect, and every deadline has to be met. Drop the ball here, and the whole deal can—and likely will—unravel.

Decoding the Pre-Foreclosure Purchase Agreement

Let's be clear: a standard, off-the-shelf real estate contract probably won't cut it for these deals. Your purchase agreement needs specific clauses and contingencies that shield you from the unique risks that come with pre-foreclosure. A weak contract leaves you completely exposed to nasty title surprises or a flat-out denial from the bank in a short sale.

Make sure your agreement includes these critical components:

- Contingency for Clear Title: This clause makes the entire sale conditional on the title company’s ability to clear every single lien and deliver a clean, insurable title. Think of it as your ultimate safety net. If they can't clear the title, you walk away with your earnest money.

- Lender Approval Contingency (for Short Sales): If it's a short sale, this is absolutely non-negotiable. It explicitly states that the contract is only valid if the seller's lender approves the sale terms in writing. Without this, you're just hoping the bank plays ball.

- A Realistic Closing Timeline: You have to be brutally honest about the timeline. Short sales, in particular, are a marathon. They can take anywhere from 90 days to over a year. Your contract needs to reflect this extended timeframe so it doesn't expire while you're still stuck in bank bureaucracy.

These contingencies are your legal "out" if things go sideways, protecting your earnest money and your time.

Navigating the Short Sale Approval Gauntlet

When a seller is underwater on their mortgage, the deal lives or dies based on one thing: getting the lender’s loss mitigation department to approve a short sale. This process is notoriously slow, frustrating, and bureaucratic. Your job is to make it as painfully easy as possible for them to stamp "APPROVED" on your file.

That means submitting a complete and compelling short sale package. This package is their entire world, and it typically includes:

- The fully executed purchase agreement.

- The seller’s hardship letter, which explains why they can't pay their mortgage.

- A mountain of financial documents like bank statements, tax returns, and pay stubs.

- A preliminary settlement statement (HUD-1 or ALTA) that outlines every single cost.

Pro Tip: Don't just lob the package over the fence and wait by the phone. Follow up relentlessly. A designated negotiator or an agent experienced in short sales is worth their weight in gold here. They often have existing relationships inside these bank departments and know exactly whose cage to rattle when a file gets "lost" on someone's desk.

Managing the Key Players and Timeline

Closing a pre-foreclosure deal is a team sport, and you're the quarterback. Understanding each person's role is the only way to keep the transaction from grinding to a halt.

- The Title Company: They are the gatekeepers of a clean transaction. They're the ones who will dig through public records to find every lien, prepare the closing documents, and ultimately issue the title insurance that protects your investment.

- Attorneys: Both you and the seller should seriously consider having legal counsel. A good real estate attorney can review contracts for pitfalls, negotiate with stubborn lienholders, and offer a life raft when complex legal issues pop up.

- Lender's Loss Mitigation Department: In a short sale, this department is your main point of contact and, frankly, your biggest obstacle. They review the offer, order their own valuation, and ultimately decide if they’ll take the loss.

Roadblocks are the norm, not the exception. The lender will lose paperwork. A surprise lien will pop up on the title search a week before closing. The seller will get overwhelmed and consider backing out.

The only way through is with proactive, constant communication. By managing these relationships closely and anticipating delays before they happen, you can steer the deal through the inevitable turbulence and turn that signed contract into a valuable asset.

Your Pre Foreclosure Investing Questions Answered

Diving into pre-foreclosures for the first time? You've got questions. Everyone does. This isn't your typical real estate deal—it's a niche with its own set of rules, headaches, and huge potential rewards. Let's tackle some of the most common things that come up when you're getting your feet wet.

What Are the Biggest Risks When Buying a Pre Foreclosure Home?

Two words: title and condition. These are the twin landmines that can blow up an otherwise great deal.

Distressed properties are almost always sold 'as-is,' and you have to take that phrase literally. The seller isn’t fixing a leaky faucet, let alone the foundation cracks they've been ignoring for years. What seems like a simple cosmetic job can easily hide tens of thousands in deferred maintenance. A thorough inspection isn't just a good idea; it's your financial lifeline.

Even scarier are the hidden title issues. Pre-foreclosure homes often come with a whole circus of liens attached—second mortgages, mechanic's liens from an unpaid contractor, outstanding tax bills, you name it. Every single one needs to be tracked down and paid off before you can close. This is where a simple deal gets complicated, fast.

A professional title search and a detailed property inspection are completely non-negotiable. Skipping either one is the fastest way I've seen investors turn a home run into a financial nightmare. And don't forget, if you're working a short sale, there's always the risk the bank says "no" or just drags its feet until the house is gone at the auction.

How Is Buying a Pre Foreclosure Different From Buying an REO Property?

It all boils down to who you're talking to across the table.

With a pre-foreclosure, you’re dealing directly with the homeowner. They’re a real person with a real problem you can help solve. This opens the door for much more creative deal-making—think subject-to deals or seller financing. You're not just buying a house; you're crafting a solution.

An REO (Real Estate Owned) property, on the other hand, is already bank-owned. The foreclosure auction happened, nobody bought it, and now it's just another asset on the bank's books. Here, your negotiation is with a faceless asset manager. The process is rigid, bureaucratic, and purely transactional. Forget creativity. The one silver lining? The bank has typically wiped the title clean by the time it becomes an REO.

Can I Use Traditional Financing to Buy a Pre Foreclosure Property?

You can try, but honestly, it’s an uphill battle. Traditional mortgage lenders are incredibly picky, with strict underwriting and appraisal rules that most distressed properties just can't meet. If the house has a busted HVAC system or a kitchen that's been torn apart, good luck getting it to pass an FHA appraisal.

The bigger problem is the clock. The pre-foreclosure world moves at lightning speed. When a foreclosure auction is just weeks away, you don't have the 30-45 days it takes for a conventional loan to crawl through underwriting. Time is a luxury you just don't have. This is exactly why cash is king in this space. If you don't have the cash, hard money loans or private lenders are your next best bet—they bring the speed you need to actually close the deal.

Do I Need a Real Estate Agent Who Specializes in Foreclosures?

Legally, no. But should you have one on your team? Absolutely. Trying to navigate this world without an agent who gets distressed properties is like trying to climb a mountain in flip-flops.

Their expertise is worth its weight in gold. A specialist knows the labyrinth of legal paperwork, lives and breathes the tight timelines, and understands the subtle art of negotiating with desperate sellers and stubborn banks. They have the right contacts—the title agents, attorneys, and even people inside the bank's loss mitigation department—that can make or break your deal.

Think of them less as just an agent and more as an essential guide who knows where all the traps are hidden. They'll help you avoid rookie mistakes, nail your valuations, and put together an offer that actually has a fighting chance.

Are you tired of fighting over the same stale lists as every other investor in your market? At Tab Tab Labs, we provide serious real estate operators with proprietary county-level data and AI-powered automation to fill your pipeline with exclusive, pre-qualified seller appointments. Stop competing and start owning your market. Book a free strategy call today and see how we can help you scale.