Tax Guide: taxes flipping houses to maximize profits

Discover taxes flipping houses essentials, from capital gains to deductions, and learn how investor vs. dealer status affects your profits.

By James Le

Flipping a house means your profit is taxable—that part is a given. The real question, the one that makes all the difference, is how the IRS decides to tax that income.

It all comes down to one critical distinction: does the IRS see you as a casual investor or a professional dealer? Getting a handle on this is the single most important thing you can do to manage your tax bill and keep more of the money you earn.

Understanding the Tax Foundation of House Flipping

When you sell a property for more than you paid, the IRS calls that profit "income." Simple enough. But not all income is treated equally. For house flippers, the tax world splits into two very different paths, each with its own rulebook, tax rates, and strategic plays.

What's wild is that you don't get to just pick a path. Your actions—how often you flip, how long you hold properties, and your primary motivation—are what put you on one path or the other.

Think of it like this: if you buy a vintage car, enjoy it for a couple of years, and then sell it for a profit, you’re an enthusiast—an investor. That profit gets taxed at the more favorable capital gains rate. But if you own a dealership and your entire business is buying and selling cars quickly, you're a dealer. Your profit is just regular business income, hit with both income tax and self-employment taxes.

That's the core concept. It's the foundation for everything else we're about to cover.

The Investor vs. Dealer Distinction

The IRS has a sort of checklist they run through to figure out where you land, and we'll dig into those specifics soon. For now, let’s just focus on the big picture. This framework will influence every decision you make, from how you structure your business to whether you hold a property for 11 months or 13.

Some flippers even get creative with the types of properties they target, and understanding the process of buying a foreclosed home can introduce a whole different set of financial variables from day one.

Here’s the simplest way to think about the two classifications:

- Investor: This is someone who flips maybe one or two properties a year, often as a side hustle. Their goal is appreciation over time, even if that "time" is just over a year to get long-term capital gains treatment.

- Dealer: This person is in the business of flipping houses. It’s their main gig. They are buying and selling frequently and consistently—it’s how they make a living.

This isn't just semantics; your classification directly changes the type of tax you pay, the rate you're charged, and which deductions you can take. Nailing this down is crucial for smart financial planning and avoiding a nasty surprise come tax time.

At the end of the day, the IRS is most concerned with your intent. If you bought the property with the clear goal of holding it for appreciation, you’re leaning toward investor status. If you bought it to renovate and sell as quickly as possible as part of your day-to-day business, you’re leaning hard toward dealer status.

For a deeper dive into these rules, this comprehensive guide to house flipping taxes is an excellent resource that breaks things down for flippers at any experience level.

Now, let's pull these concepts together in a quick comparison to see how the two statuses stack up side-by-side.

Investor vs. Dealer Tax Treatment at a Glance

This table offers a clear, high-level summary of the major tax differences between being treated as an investor versus a dealer. It's a handy cheat sheet for understanding the core financial implications of each classification.

| Tax Aspect | Investor Status | Dealer Status (Business) |

|---|---|---|

| Primary Tax Type | Capital Gains Tax | Ordinary Income Tax |

| Tax Rates | Lower long-term rates (0%, 15%, 20%) | Higher marginal rates (up to 37%) |

| Self-Employment Tax | No, not applicable | Yes, an additional 15.3% on net earnings |

| Holding Period | Critical (Over 1 year for lower rates) | Irrelevant |

| Offsetting Losses | Limited to $3,000 against ordinary income/year | Can fully offset other ordinary income without limit |

| Expense Deductions | Capitalized into the cost basis of the property | Deductible as ordinary and necessary business expenses |

| Primary Goal | Hold for appreciation | Sell quickly for profit |

Seeing the numbers laid out like this really highlights the stakes. The difference between paying a 15% capital gains tax and a combined 37% income tax plus 15.3% self-employment tax is massive. As we move on, we'll dissect what each of these classifications means for your tax bill in more detail.

Are You an Investor or a Dealer in the Eyes of the IRS?

This is it—the single most important question that shapes your entire tax situation as a flipper. How the IRS sees you isn't something you get to choose on a form. It’s a label they assign based entirely on how you operate.

The answer determines whether your hard-earned profits get taxed at favorable capital gains rates or as regular business income, which is a whole different (and often more expensive) ballgame.

Put simply, your intent and behavior are under a microscope. Is this a side gig, a one-off project? Or is this your bread and butter? That distinction is the linchpin for everything that follows.

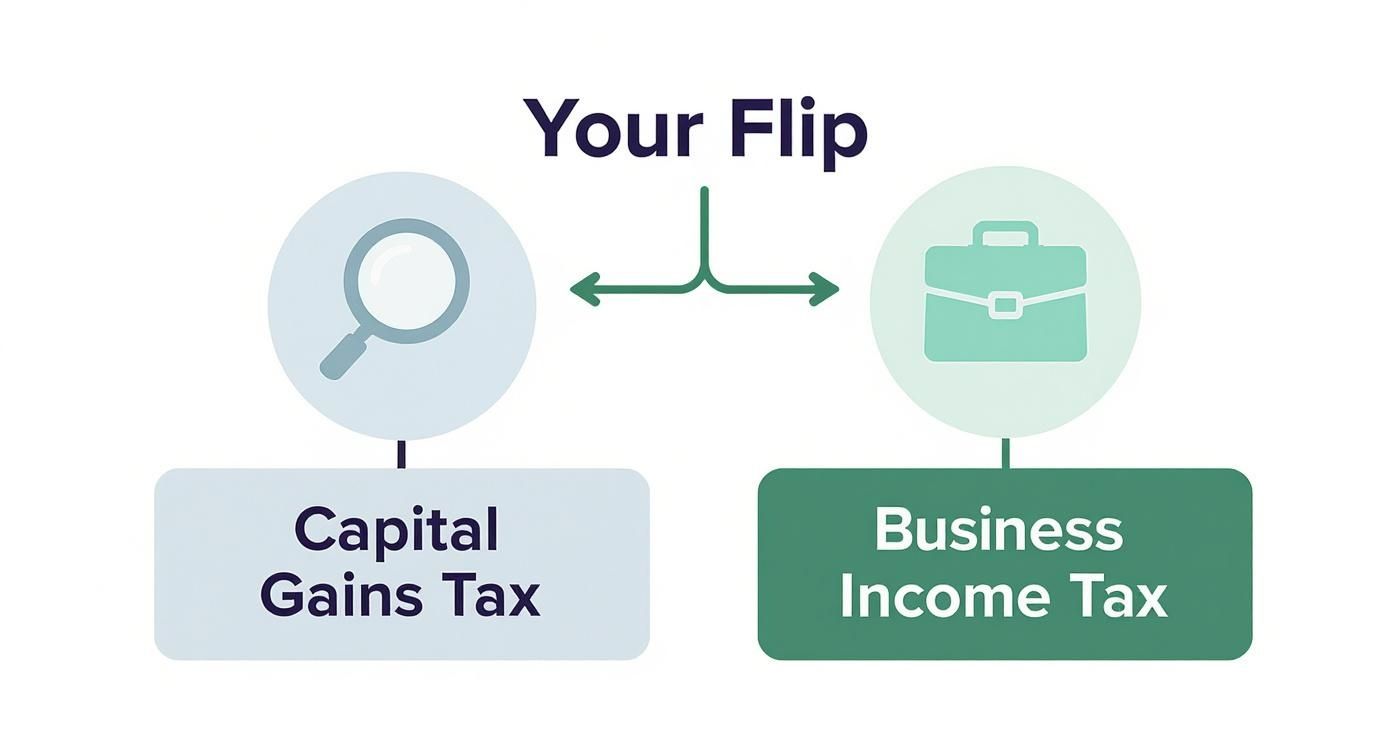

This quick decision tree shows the two paths your taxes can take.

As you can see, being pegged as an "investor" leads you down the capital gains path. But if the IRS calls you a "dealer," you're looking at business income tax, which can come with a much bigger price tag.

Key Factors the IRS Examines

There’s no magic formula here. The IRS looks at the whole picture, what they call the "facts and circumstances," to figure out which category you fall into. The more your flipping activity looks and feels like a full-fledged business, the more likely you’ll be classified as a dealer.

Here's what they're looking at:

- Frequency and Volume of Sales: How many houses are you flipping a year? One flip every few years feels like an investment. Five flips a year starts to look a lot like a business.

- Holding Period: Are you holding onto properties for more than a year, or are you in and out as fast as possible? Quick turnarounds signal an intent to profit from sales, not long-term appreciation—a classic dealer trait.

- Purpose of Acquisition: Did you buy the property with the express purpose of renovating and reselling it for a quick profit? That's a strong tell.

- Extent of Improvements: Were the renovations significant and clearly done to get the property market-ready for a fast sale?

- Business Operations: This is a big one. Do you have an LLC? A separate business bank account? Are you hiring contractors, running marketing campaigns, or maintaining an office? These are all hallmarks of a dealer.

Real-World Scenarios: Investor vs. Dealer

Let's make this concrete. Imagine two flippers, Anna and Ben.

Anna the Investor: Anna has a full-time job in marketing but decides to try flipping a house. She finds a fixer-upper, spends 14 months working on it during her weekends, and then sells it for a nice profit. This is the only house she's flipped in the last three years. The IRS would almost certainly see her as an investor—the activity is infrequent, and the holding period is long.

Ben the Dealer: Ben, on the other hand, quit his day job to flip houses. He set up "Ben Buys Houses LLC," has a dedicated business account, and flips four to five properties a year. He has a team of contractors on speed dial and markets his finished homes aggressively. His average holding time is just six months. Ben is, without a doubt, a dealer in the eyes of the IRS. Flipping is his trade.

The core difference lies in the regularity and continuity of the activity. If flipping houses is your main source of income and you do it consistently, you are almost certainly a dealer.

Why This Classification Matters So Much

The financial stakes here are massive. It’s not a small difference.

An investor holding a property for over a year pays long-term capital gains tax on the profit. Those rates are 0%, 15%, or 20%, depending on their income. A dealer, however, pays ordinary income tax rates on their profit—which can go all the way up to 37%.

And it gets worse. Dealers also have to pay self-employment taxes (15.3% for Social Security and Medicare) on top of their income tax. That’s a huge hit.

Now, being a dealer isn't all bad news. It opens the door to more immediate business expense deductions that investors can't take. But you have to know which game you're playing. Understanding your classification is the first and most critical step in building a smart tax strategy for your flips. For flippers operating as a business, maintaining a steady deal flow is crucial, which is why many learn how to find pre-foreclosure homes to keep their pipeline full.

Navigating Capital Gains Tax as an Investor

If the IRS pegs you as an investor, your entire tax strategy boils down to one thing: capital gains. This is a completely different—and usually much better—way to be taxed compared to a full-time dealer. Getting a handle on how capital gains work isn't just a minor detail; it's the key to timing your sales and keeping more of your hard-earned profit.

You can almost think of it as a reward for being patient. The tax code gives a pretty sweet discount to investors who hold onto assets, which encourages longer-term ownership instead of quick-and-dirty sales. For a house flipper, this creates a massive incentive to watch the calendar and cross a very specific date before you even think about listing.

The Magic of the One-Year Mark

When it comes to capital gains, the entire game hinges on a single question: how long did you own the property? The answer determines which of two tax buckets your profit falls into, and the rates are worlds apart.

- Short-Term Capital Gains: Sell the property in one year or less, and your profit gets taxed at your ordinary income rate. This is the same rate you pay on your day job's salary, which can climb as high as 37%. Ouch.

- Long-Term Capital Gains: Hold the property for more than one year, and your profit is taxed at the much friendlier long-term capital gains rates. We're talking 0%, 15%, or 20%, depending on your overall income.

This "one-year-and-a-day" holding period is the single most powerful lever an investor can pull to slash their tax bill on a flip. The difference isn't small—it's a complete game-changer.

A Tale of Two Timelines

Let's make this real with an example. Say you're an investor who flips a house and clears a $70,000 profit. Your regular income tax bracket is 24%, but your long-term capital gains rate is only 15%.

Now, look what happens depending on when you sell.

| Holding Period | Profit | Tax Rate | Tax Owed | Net Profit |

|---|---|---|---|---|

| 11 Months (Short-Term) | $70,000 | 24% | $16,800 | $53,200 |

| 13 Months (Long-Term) | $70,000 | 15% | $10,500 | $59,500 |

By just waiting two more months to cross that one-year threshold, you pocket an extra $6,300. This is exactly why obsessively tracking your purchase date and strategically planning your sale is so vital when it comes to taxes flipping houses.

Your holding period starts the day after you close on the purchase and ends on the day you close on the sale. Timing this right can literally translate into thousands of dollars saved.

Using Losses to Your Advantage

Let's face it, not every flip is a grand slam. In a tough market, you might even take a loss on a property. But here's the silver lining: as an investor, you can spin that disappointing outcome into a smart tax move through something called tax-loss harvesting.

Here’s the playbook:

- Offset Gains: You can use a capital loss from one project to cancel out a capital gain from another profitable flip in the same year.

- Deduct from Income: If your losses are bigger than your gains, you can deduct up to $3,000 of that leftover loss against your ordinary income (like your salary) each year.

- Carry Forward Losses: Got more than $3,000 in losses? No problem. You can carry the excess forward to future years to wipe out future gains or income.

For instance, if you score a $50,000 gain on Flip A but take a $20,000 loss on Flip B, you only owe capital gains tax on the net $30,000. This lets you manage your tax bill across your whole portfolio, not just on a deal-by-deal basis. This strategy becomes even more crucial in tightening markets where profit margins are shrinking. As recent data from ATTOM Data Solutions shows, making every tax strategy count is more valuable than ever.

Understanding Taxes for Full-Time Flippers

When flipping houses goes from a side hustle to your main gig, the tax rules change completely. The IRS stops seeing you as a casual investor cashing in on capital gains. Instead, you're now classified as a dealer—someone running a full-blown business.

This one distinction is a game-changer because it flips the script on how your profits are taxed.

For a dealer, the money you make on a flip isn't a capital gain. It’s treated as ordinary business income, just like the revenue from a coffee shop or a construction company. This means you're paying taxes at your standard income tax rate, which is almost always higher than the friendly rates investors get.

But that's not even the biggest surprise. The real kicker is something called self-employment tax.

The Self-Employment Tax Shock

If you’re new to full-time flipping, the 15.3% self-employment tax is probably the biggest financial gut punch you'll face. Think of it as the dealer's version of FICA taxes (Social Security and Medicare). When you work for someone else, your employer pays half and you pay half.

But now, you're the boss. That means you're on the hook for both halves. This 15.3% gets tacked on in addition to your regular federal and state income taxes. It's a hefty price for being your own boss and can absolutely demolish your take-home pay if you aren't ready for it.

Make no mistake: self-employment tax is the single biggest financial difference between flipping as an investor and as a dealer. Ignoring it is a recipe for a massive, unexpected tax bill and a year-end cash flow crisis.

A Tale of Two Tax Bills

Let's put some real numbers to this. Imagine you make a $50,000 profit on a flip. How does the IRS treat that money for an investor versus a dealer?

We'll assume both are in the 22% federal income tax bracket and the investor held the property long enough to qualify for the 15% long-term capital gains rate.

| Tax Calculation | Investor (Long-Term Gain) | Dealer (Business Income) |

|---|---|---|

| Profit | $50,000 | $50,000 |

| Capital Gains Tax (15%) | $7,500 | $0 |

| Income Tax (22%) | $0 | $11,000 |

| Self-Employment Tax (15.3%) | $0 | $7,650 |

| Total Tax Owed | $7,500 | $18,650 |

| Net Profit | $42,500 | $31,350 |

The difference is staggering. On the exact same $50,000 profit, the dealer pays $11,150 more in taxes. This is why getting your head around your IRS classification isn't just a suggestion—it's essential for survival when it comes to taxes flipping houses as a business.

The Upside of Being a Dealer

Okay, so the tax rates are higher. It's not all doom and gloom, though. Being classified as a business unlocks a much bigger toolbox of deductible expenses.

While investors have to "capitalize" most costs (rolling them into the property's cost basis), dealers get to deduct ordinary and necessary business expenses right away. This is a huge advantage.

Suddenly, you can write off things an investor could only dream of:

- Home office expenses, including a slice of your mortgage interest, utilities, and insurance.

- Marketing costs, like flyers, online ads, or website hosting to find deals and buyers.

- Business mileage for all that driving to properties, hardware stores, and city hall.

- Education and training, such as seminars or courses on real estate investing.

- Professional fees for your accountant, lawyer, or real estate agent.

Every single one of these deductions lowers your net profit, which in turn cuts both your income tax and your self-employment tax bill. The secret is keeping meticulous records. Every dollar you can legitimately deduct is a dollar fighting back against those higher tax rates. This ability to write off expenses is the silver lining of being a dealer, and it’s the key to keeping more of your hard-earned cash.

Strategic Tax Deductions to Maximize Your Flip Profits

Knowing your tax classification is the first step, but the real magic happens when you hunt down every single deductible expense. This is where you actively slash your taxable income and pump up your net profit.

Think of your flip as a business. Every single dollar you spend to buy, fix, hold, and sell that property is a potential deduction that shrinks your final tax bill. Forgetting to track even the small stuff is just leaving cash on the table.

This goes way beyond just stuffing receipts in a drawer. You need a system to categorize and document every cost tied to the project, from the first property inspection all the way to the final closing costs. Meticulous records are the bedrock of a smart tax strategy, turning what feels like boring bookkeeping into a powerful profit machine.

Categorizing Your Deductible Expenses

To make sure nothing slips through the cracks, it’s best to break down your deductions into the four main phases of a flip. This structure makes it a hell of a lot easier to track costs as they happen and ensures you claim everything you're entitled to.

Here’s how I like to group them:

- Purchasing Costs: These are the upfront expenses just to get the keys in your hand. We're talking attorney fees, title insurance, inspection costs, and appraisal fees.

- Renovation and Repair Costs: For most flips, this is the big one. It covers all materials—lumber, paint, fixtures—and all your labor costs for plumbers, electricians, and contractors.

- Holding Costs: These are the bills you pay just to own the property while you're working on it. Think mortgage interest, property taxes, insurance premiums, HOA dues, and utilities.

- Selling Costs: These are the final costs to get the deal done. Common deductions here include realtor commissions, staging fees, closing costs, and any money you spent on advertising.

Documenting these correctly is critical. While the gross profit on a flip looks great on paper, these deductions are what turn that number into actual money in your pocket. In early 2025, the average gross profit per flip was floating around $66,000—a figure that can get eaten up fast without obsessive expense tracking.

The Power of Meticulous Record-Keeping

A shoebox overflowing with crumpled receipts isn't going to fly. If you want to stand up to IRS scrutiny and truly maximize your deductions, you need a solid system. Digital tools like accounting software or even a well-organized spreadsheet are non-negotiable.

The golden rule is simple: If you can't prove it, you can't deduct it. Every single expense needs a paper or digital trail—an invoice, a receipt, or a bank statement.

That $400 trip to the hardware store for new light fixtures? That's a direct deduction. But without the receipt, it's just a $400 hit to your profit. Over the course of a single project, dozens of these "minor" untracked expenses can easily add up to thousands in lost deductions, which means a much bigger tax bill.

Pro tip: Open a separate bank account for each flip. It simplifies tracking immensely.

Don't Overlook These Common Deductions

Beyond the obvious stuff like lumber and realtor fees, a lot of flippers completely forget about the smaller, indirect expenses that are 100% deductible. These often-missed write-offs can make a real difference.

Run through this checklist:

- Business Mileage: Driving to the property? To the hardware store? To the bank for the project? Track those miles. They add up.

- Professional Fees: Did you pay an accountant, a lawyer, or other consultants? Deductible.

- Financing Costs: Loan origination fees, points, and the interest payments on your financing are all fair game.

- Insurance: Don't forget the premiums for that builder's risk or liability insurance you carried during the reno.

- Marketing and Advertising: Any cash you spent on flyers, online ads, or professional photography to sell the home is a business expense.

Even the costs of finding deals can be deductible. If you're using specialized software for finding motivated sellers, for example, you should look into whether the https://tabtablabs.com/outrank/best-skip-tracing-service you use qualifies as a business expense. Remember, every dollar you deduct is a dollar that goes straight to your bottom line.

Advanced Tax Planning for Serious Flippers

Once you’ve got a few flips under your belt, just filing your taxes once a year isn't going to cut it. To really scale a house-flipping business, protect your assets, and actually keep more of what you earn, you have to get proactive. This means shifting your mindset from simply paying taxes to strategically managing them for long-term growth.

It's time to level up. This next stage is all about structuring your operations, digging into powerful deferral tools, and staying one step ahead of the IRS. These are the strategies that separate the seasoned pros from the amateurs who leave thousands of dollars on the table every single year.

Should You Form an LLC or S-Corp?

As your flipping volume grows, so does your personal risk. Flying solo as a sole proprietor means there's zero legal separation between your business and your personal life. If a deal goes south or someone gets hurt on-site, your personal savings, car, and even your family home could be fair game in a lawsuit.

This is where forming a business entity like a Limited Liability Company (LLC) or an S Corporation (S-Corp) becomes non-negotiable.

- LLC: For most flippers, an LLC is the perfect starting point. It creates a legal shield, separating your business liabilities from your personal assets. For tax purposes, it’s usually a "pass-through" entity—profits and losses flow directly to your personal tax return, which keeps you from getting taxed twice.

- S-Corp: An S-Corp offers the same liability protection but can unlock some serious tax advantages for high-earning flippers. It lets you pay yourself a "reasonable salary" and take the rest of the profits as distributions. Those distributions aren't subject to the hefty 15.3% self-employment tax, which can add up to massive savings.

Choosing the right entity is a foundational move for any serious flipper. It’s not just about saving on taxes; it's about protecting everything you've worked for. Make sure to chat with a legal and tax pro to figure out the best fit for your specific situation.

Using a 1031 Exchange to Defer Taxes

The 1031 Exchange, also known as a like-kind exchange, is one of the most powerful wealth-building tools in real estate, period. It lets you sell an investment property and roll all the profits into a new, "like-kind" property without paying a dime in capital gains tax at that moment.

But here’s the big catch for flippers: this strategy is generally off-limits for anyone the IRS classifies as a dealer. Since dealers hold property with the primary goal of reselling it quickly, their flips usually don't qualify. If, however, you hold some properties as long-term investments, a 1031 exchange can be a game-changer for growing your portfolio tax-free.

To get a better handle on ways to lower your tax bill, you should explore the full range of real estate investment tax strategies available.

The Necessity of Quarterly Estimated Taxes

When you're self-employed, you don't have a boss withholding taxes from your paycheck. You're the boss, and that means you're responsible for paying your income and self-employment taxes directly to the IRS throughout the year.

These payments are called quarterly estimated tax payments, and they aren't optional. If you skip them, you'll get hit with some pretty nasty underpayment penalties and interest charges when you finally file your annual return. It's way better to think of it as paying your taxes in installments to avoid a massive—and expensive—surprise in April.

Governments are also getting more aggressive about taxing short-term real estate profits. For example, a new house-flipping tax in British Columbia, Canada, set to take effect in 2025, will slap a 20% tax on profits from homes sold within a year. This is part of a growing trend, making smart, proactive tax planning more critical than ever before. You can read more about how this policy impacts homeowners in BC and see just how quickly the rules of the game can change.

Common Questions About House Flipping Taxes

When you're knee-deep in drywall dust and paint swatches, tax rules are probably the last thing on your mind. But understanding a few key concepts upfront can save you a world of headaches later. Let's tackle some of the most common questions flippers ask.

Can I Use the Primary Residence Exclusion on a Flip?

This is a big one, and the short answer is almost always no.

The IRS is pretty clear on this: to qualify for the big capital gains tax break, you have to own and live in the home for at least two of the five years leading up to the sale. Since the whole point of a flip is to get in and out quickly, you'll almost never meet that "use test."

That means you should plan for the profits to be fully taxable. Don't bank on a tax-free payday.

What Happens If My Flip Loses Money?

It happens. Not every project is a home run, and sometimes the market turns or you uncover a nasty surprise behind a wall. How the IRS lets you handle that loss depends on how you're classified.

- If you're an investor: You can use a capital loss to cancel out other capital gains. If you still have losses left over after that, you can deduct up to $3,000 per year against your regular income (like your W-2 job).

- If you're a dealer: This is where being classified as a business pays off. You can typically deduct the entire loss against your other income in the same year. It’s a much faster way to get tax relief from a project that went south.

Do I Need an LLC to Start Flipping Houses?

Legally, no, you don't need one to get started. But should you have one? Absolutely, especially once you start doing this regularly.

Think of an LLC as a firewall. It creates a legal separation between your business assets (the flip properties, your business bank account) and your personal assets (your family home, your car, your savings). If a deal goes wrong and you get sued, that liability shield can be a financial lifesaver.

Beyond the legal protection, an LLC also gives you a ton of tax flexibility. Getting advice from a good lawyer and a tax pro is the best first step to figure out the right structure for you.

Ready to grow your real estate business with the right technology? Tab Tab Labs is your go-to directory for discovering the best AI tools and automation strategies designed for real estate professionals. Explore our platform to find solutions that will help you work smarter.