Top 12 Real Estate Investor Lists & Sources for 2025

Discover the top 12 real estate investor lists and data sources for 2025. Unlock motivated seller leads and find cash buyers with our expert guide.

By James Le

Finding high-quality real estate investor lists is a critical step for agents, brokers, and marketers looking to connect with serious buyers. The right data can unlock off-market deals, build a robust buyer network, and accelerate sales cycles. However, navigating the crowded market of data providers can be overwhelming, with each platform offering different features, data sources, and pricing models. This guide eliminates the guesswork by providing a curated roundup of the top platforms and services available today. We dive deep into each option, analyzing its specific strengths, potential limitations, and ideal use cases.

To successfully acquire and leverage these lists, it's essential to understand the principles behind smarter list building, ensuring your outreach is both targeted and effective. This resource is designed to be your definitive guide, helping you pinpoint the exact tool that aligns with your specific business goals, whether you're targeting cash buyers, fix-and-flippers, or large-scale portfolio holders.

Instead of generic descriptions, you'll find a practical analysis of each service, complete with screenshots and direct links to help you make an informed decision quickly. We’ll compare industry giants like ListSource and PropStream with specialized tools and even unconventional sources, giving you a comprehensive overview of the best options for building powerful real estate investor lists. Let's get started.

1. Tab Tab Labs

Tab Tab Labs presents a sophisticated, all-in-one solution for serious real estate operators looking to move beyond generic, oversaturated real estate investor lists. It's positioned as an AI growth partner that builds a proprietary deal-finding engine for your business, focusing on early access to high-quality, distressed property leads before they hit the mainstream market.

The platform’s core strength is its Distressed Appointments Engine, which scrapes over nine county-level sources like probate filings, tax liens, and code violations. By stacking these distress signals, it identifies truly motivated sellers early. What truly sets it apart is the integrated, always-on AI ISA that immediately engages, qualifies, and books appointments directly into your calendar and CRM. This end-to-end automation handles follow-ups and reporting, freeing your team to focus exclusively on closing deals.

Built by operators with a track record of closing hundreds of deals and powering seven-figure direct mail campaigns, the system is grounded in real-world operational needs.

Key Features & Benefits

- Exclusive, Early-Access Data: By scraping county records directly, Tab Tab Labs surfaces distress signals weeks or even months before national data aggregators. This gives you a critical first-mover advantage.

- AI-Powered Lead Conversion: The AI ISA operates 24/7 to qualify leads and book meetings, ensuring no opportunity is missed and drastically reducing the manual labor of lead follow-up.

- Full-System Automation: Beyond lead generation, the platform automates reminders, status updates, and reporting, creating a predictable and scalable deal pipeline.

- Operator-Built Credibility: The system is designed by professionals who understand the nuances of high-volume investing, ensuring the workflows and data are practical and effective.

Practical Use & Implementation

Getting started involves a strategy call to design a custom system tailored to your market and scale. A significant advantage is the ability to request a no-commitment free sample list to validate data quality before investing. This is best for teams aiming for 15–20 pre-qualified seller appointments per month.

Pricing and Access

Tab Tab Labs does not offer public pricing. Costs are customized based on your specific market, integration needs, and operational scale, which requires a consultation. This tailored approach ensures the system is a precise fit for your business objectives.

| Feature | Description |

|---|---|

| Data Sources | 9+ county-level sources (probates, liens, foreclosures, etc.) |

| Lead Qualification | Always-on AI ISA for instant engagement & booking |

| Automation | Integrated workflows for follow-ups, reporting, and CRM updates |

| Best For | High-volume investors and teams scaling to 5–30+ deals/year |

Pros:

- Exclusive data that beats national aggregators

- End-to-end automation from lead to booked appointment

- Built by proven real estate operators

- Free sample list available to verify data quality

Cons:

- Not suitable for casual or low-volume investors

- Custom pricing requires a discovery call

- Requires setup and integration for full value

Website: Tab Tab Labs

2. ListSource (CoreLogic)

ListSource, a service from industry giant CoreLogic, is a foundational tool for agents and investors seeking to build hyper-specific real estate investor lists. It operates on a pay-per-record model, allowing you to create and purchase lists without long-term commitments, making it ideal for targeted direct mail or cold calling campaigns.

The platform’s primary strength lies in its granular filtering capabilities. You can segment properties by dozens of criteria, including homeowner equity, mortgage status, property type, and absentee owner status. This precision enables you to identify motivated sellers with a high degree of accuracy. For example, an agent could pull a list of all absentee owners in a specific zip code who have owned their property for over 10 years and have at least 50% equity.

Key Features & Considerations

- Pricing Model: Pay-per-record with a $50 minimum transaction. This is great for one-off campaigns but can become costly for large-scale lead generation. Custom subscription plans are available but require contacting a sales representative.

- Data Quality: The data is sourced directly from CoreLogic, a trusted provider of property information, ensuring high accuracy and frequent updates.

- Usability: The interface is straightforward for building lists, and you can instantly download your data in a CSV format, ready for your CRM or marketing platform.

For a deeper dive into leveraging platforms like this, explore our guide on generating seller leads for real estate.

Website: https://www.listsource.com/

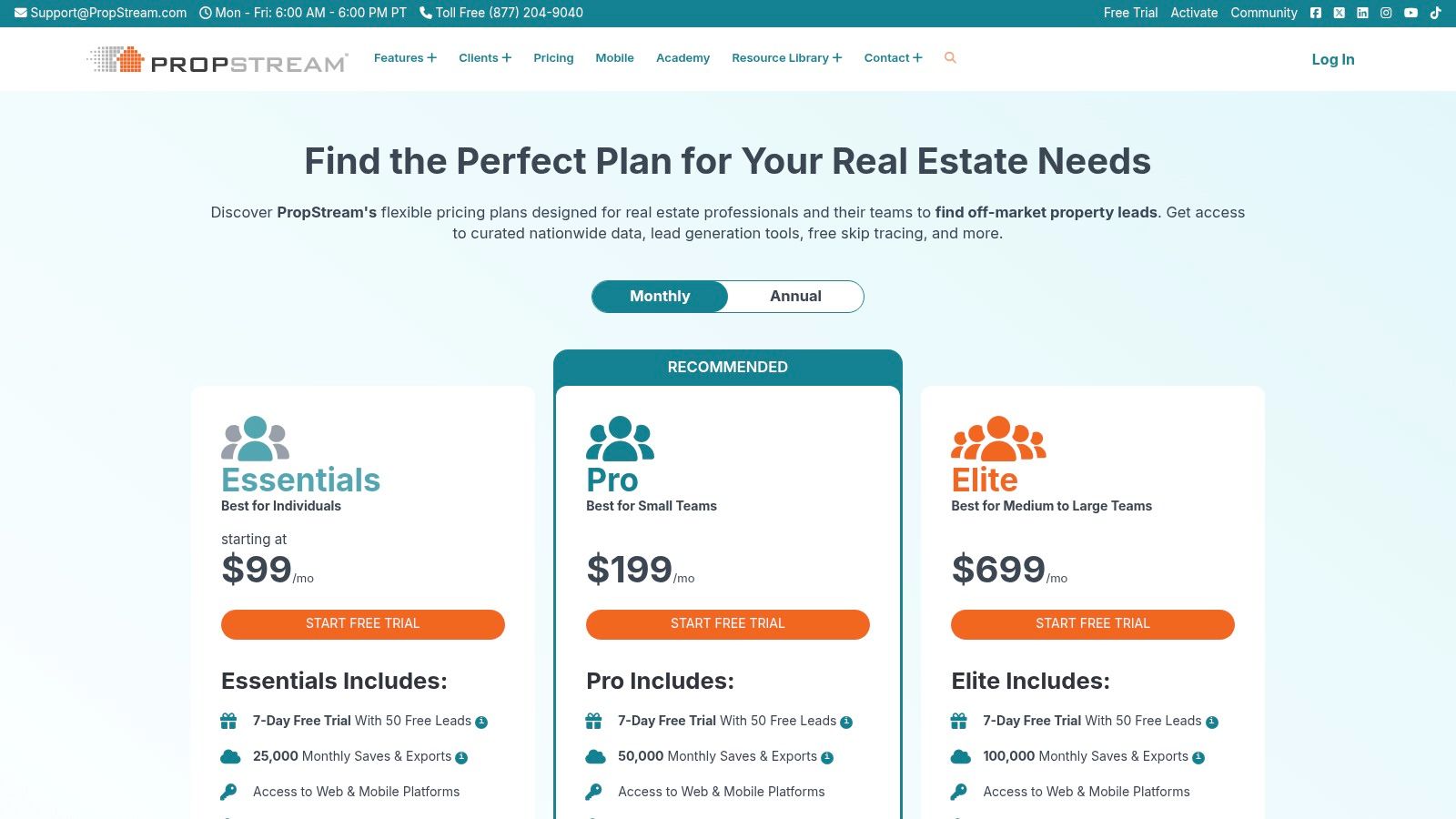

3. PropStream

PropStream is an all-in-one data platform widely recognized for helping users build highly targeted real estate investor lists. It moves beyond simple list-pulling by integrating nationwide property data with built-in marketing tools, comps, and lead automation, positioning it as a comprehensive lead generation engine. Its extensive investor-focused filters allow for precise targeting of specific seller motivations, such as pre-foreclosure, vacant properties, high equity, and even cash buyers.

The platform's strength is its combination of robust data with actionable follow-up tools. For instance, an agent can pull a list of all properties in a neighborhood with liens, instantly run comps to estimate value, skip trace the owners for contact information, and launch a direct mail or email campaign, all from within the same interface. This integrated workflow saves significant time and streamlines the entire outreach process.

Key Features & Considerations

- Pricing Model: Subscription-based with tiered plans. A 7-day free trial is available, offering a chance to test its capabilities with sample leads before committing.

- Integrated Tools: Includes features like a "Lead Automator" that automatically refreshes saved lists with new leads, plus skip tracing and marketing outreach capabilities, making it a powerful end-to-end solution.

- Limitations: Export limits are tied to your subscription plan, which may require purchasing add-ons for larger campaigns. Some advanced features are also reserved for higher-tier plans.

Website: https://www.propstream.com/pricing

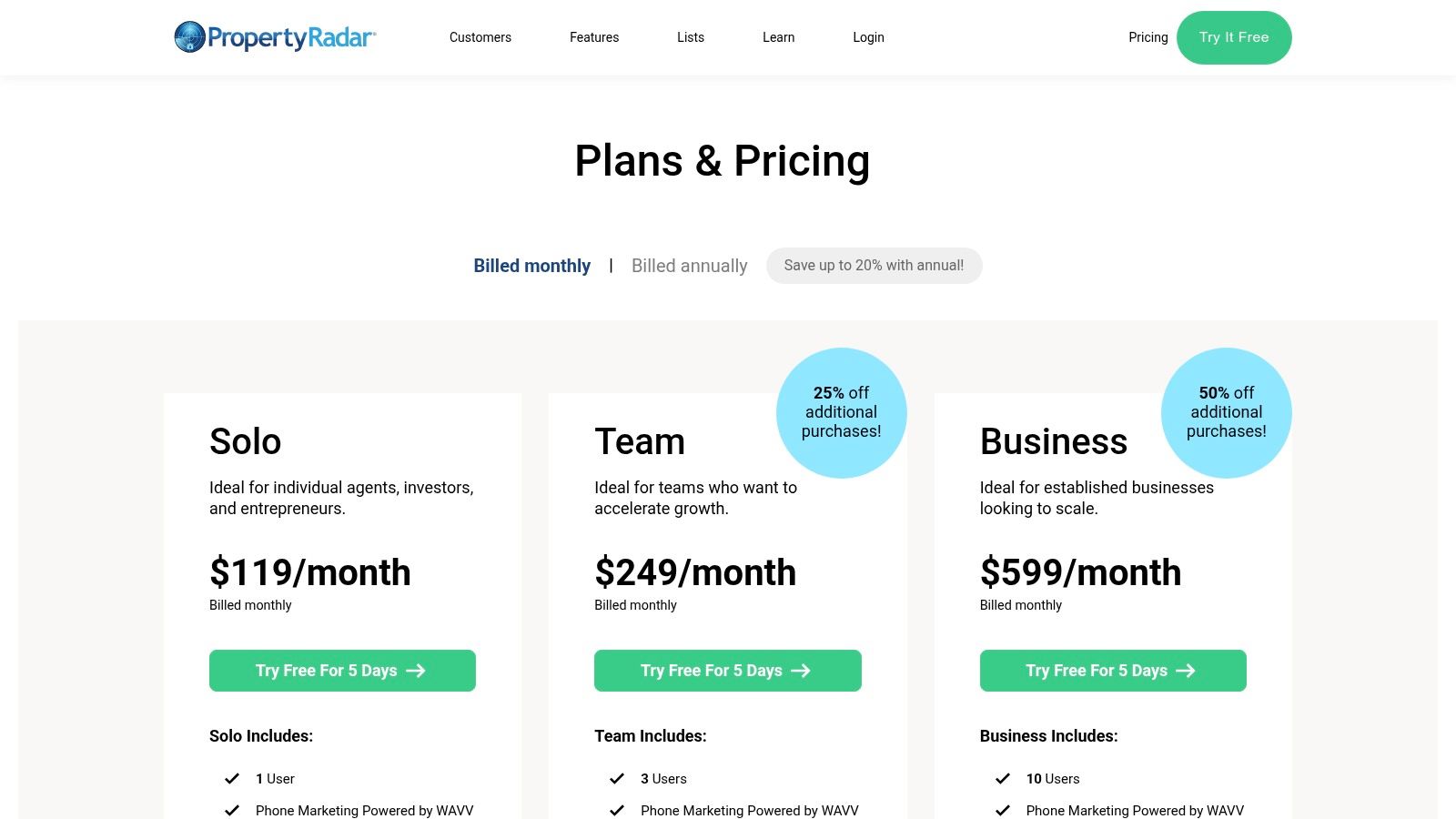

4. PropertyRadar

PropertyRadar is a powerful, data-driven platform designed for professionals seeking dynamic real estate investor lists. It moves beyond simple list-pulling by integrating list-building, monitoring, and direct marketing capabilities into one cohesive workflow. The platform’s strength is its depth, offering over 250 criteria to create hyper-targeted lists based on property, owner, and transactional data.

This tool is exceptional for investors and agents who want to automate their prospecting. You can create a list, such as "out-of-state owners with high equity and no mortgage," and set up alerts to be notified whenever a new property meets your criteria. This transforms a static list into an active lead generation engine.

Key Features & Considerations

- Pricing Model: Monthly subscription plans with transparent pricing for included exports and contact unlocks. Overage fees apply for data pulled beyond your plan's allowance, which requires careful monitoring.

- Integrated Data: A key advantage is the built-in skip tracing, providing phone numbers and emails without needing a separate service. This streamlines the outreach process significantly.

- Usability & Automation: While there is a learning curve to master all 250+ criteria, its mobile apps and automation features make it invaluable for active investors who need leads on the go.

For those interested in how data-rich platforms are changing the industry, discover more about predictive analytics in real estate.

Website: https://www.propertyradar.com/pricing

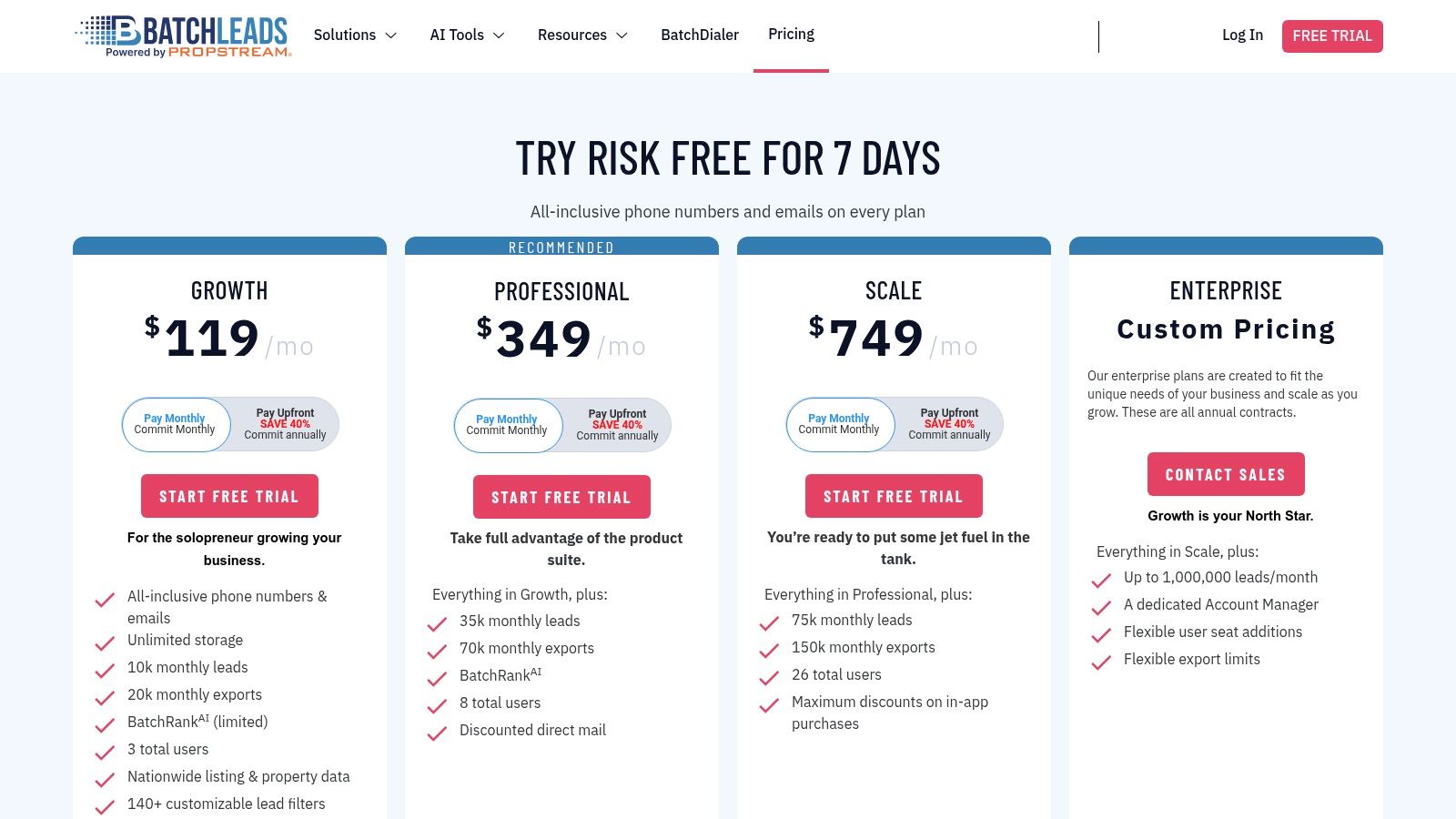

5. BatchLeads

BatchLeads is an integrated platform designed for investors and wholesalers who need a seamless workflow from list building to outreach. While it serves many lead types, its dedicated "Cash Buyers" filter makes it a powerful tool for agents and investors looking to build targeted real estate investor lists. This feature allows you to quickly identify active cash purchasers in any market nationwide.

The platform's main differentiator is its all-in-one approach. You can pull a list using over 140 filters, score the leads with its proprietary BatchRank AI to prioritize your efforts, and then immediately launch outreach campaigns. This integration saves significant time by eliminating the need to export and import data between different list-building, skip tracing, and marketing tools.

Key Features & Considerations

- Pricing Model: Tiered monthly subscriptions, with higher tiers offering more monthly lead exports and advanced features. The best rates and tools are reserved for premium plans, and marketing features like the dialer are paid add-ons.

- Integrated Workflow: The ability to build a list, score it, and execute SMS, direct mail, or dialer campaigns from one dashboard is a major advantage for high-volume outreach.

- Data & AI: The platform includes nationwide property data and uses its BatchRank AI to help you focus on the most promising leads first, improving campaign efficiency. It is also a well-regarded skip tracing service for finding contact information.

Website: https://batchleads.io/pricing

6. DataTree Lists (First American)

DataTree, the data arm of title insurance giant First American, offers an enterprise-grade solution for creating highly specific real estate investor lists. It taps into a vast national database of over 150 million properties, enriched with detailed ownership, deed, mortgage, and even HOA data. This makes it a powerful resource for agents or investors looking for comprehensive property and title-related information.

The platform is particularly strong for those needing deep, verified data. You can build marketing lists targeting absentee owners, high-equity homeowners, or properties showing signs of distress. For example, a user could pull a list of all non-owner-occupied properties in a county with an estimated equity above 60% and a mortgage originated before 2015.

Key Features & Considerations

- Pricing Model: Access typically requires contacting a sales representative for custom subscription or a la carte pricing. It is less of a self-serve platform, catering more to businesses than solo users needing a quick list.

- Data Quality: The data lineage from First American ensures exceptional accuracy, with robust document image coverage providing an extra layer of verification for serious due diligence.

- Usability: The interface and product options can feel complex and enterprise-focused. However, the flexible delivery options, including reports and CSV exports, make it adaptable once a list is generated.

Website: https://dna.firstam.com/lists

7. Prospect by Buildout

Prospect by Buildout is a modern prospecting tool (the successor to ProspectNow) designed for investors and brokers seeking to build detailed real estate investor lists. It merges property data with owner contact information and predictive analytics, allowing users to identify not just who owns a property, but who is most likely to sell it soon. This makes it a powerful asset for uncovering off-market opportunities.

The platform stands out by offering both residential and commercial property data, complete with AI-driven "likely to sell" scores. This predictive modeling analyzes transaction history, market trends, and property characteristics to flag assets ripe for acquisition. An investor can target a specific county, filter for multi-family properties, and then sort by the owners most likely to sell in the next 12 months, creating a highly targeted outreach list.

Key Features & Considerations

- Pricing Model: Offers transparent regional (3- or 5-county) and nationwide subscription plans with a free trial available. Plans include a monthly quota of "owner unlocks" to reveal contact details.

- Data & Analytics: Combines property, mortgage, and transaction data with AI-powered modeling to predict likely sellers, giving you a competitive edge in your prospecting.

- Usability & Limits: The platform allows easy contact exports, but the monthly unlock quotas can be a limitation for high-volume campaigns. Users should leverage the free trial to assess if the interface and data meet their specific needs.

Website: https://www.prospect-by-buildout.com/pricing

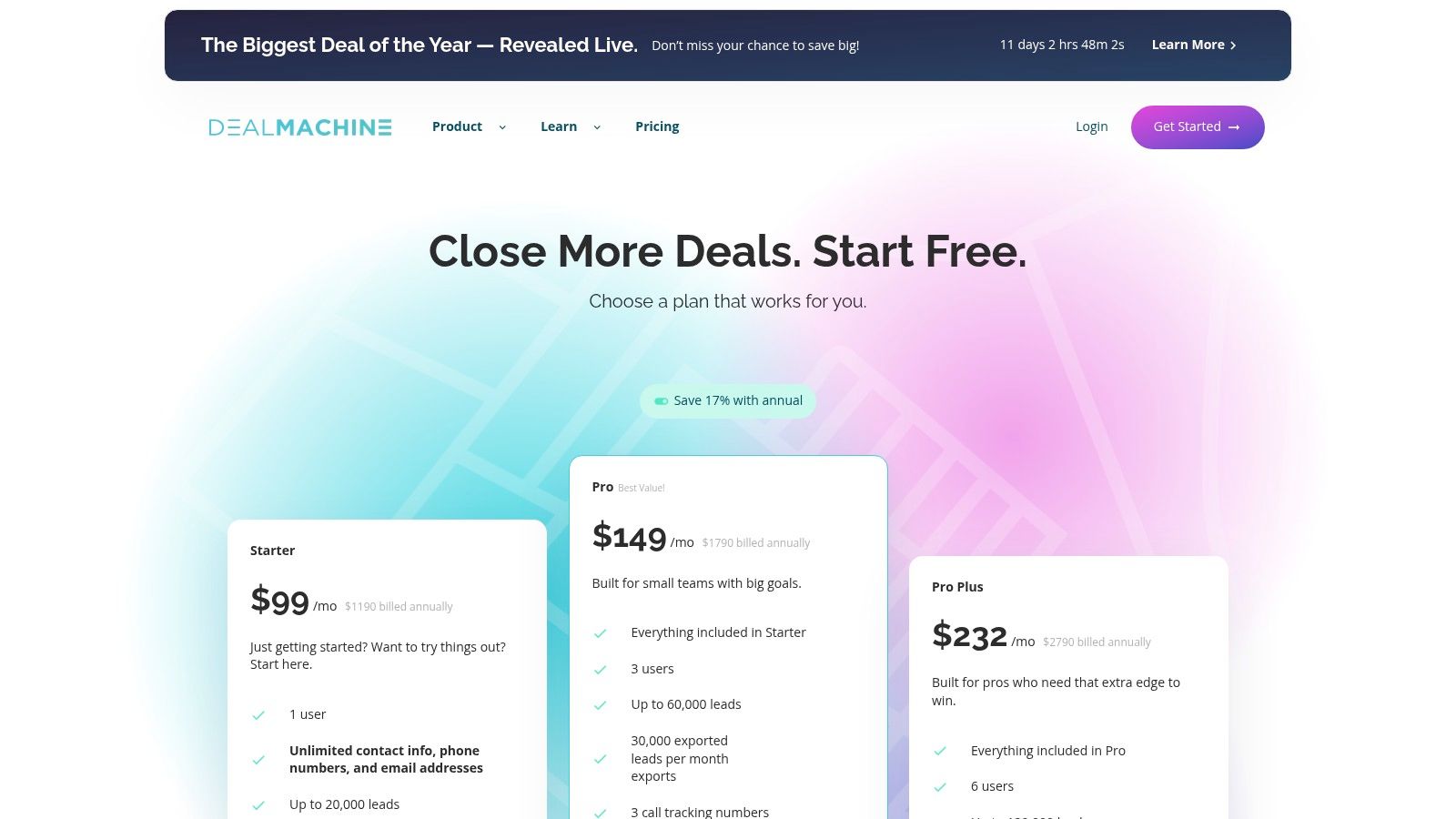

8. DealMachine

DealMachine is an investor-centric platform designed for active lead generation, particularly the “driving for dollars” strategy. It excels at helping users build unique real estate investor lists directly from the field, combining a powerful mobile app with robust desktop list-building capabilities. This approach allows agents and investors to discover off-market properties that competitors using traditional databases might miss.

The platform’s strength is its seamless integration of field and data work. While driving, a user can pin a distressed property, and the app instantly pulls up property details. From there, you can skip trace the owner, add them to a list, and immediately launch a direct mail or cold calling campaign, making it an all-in-one tool for proactive acquisition. Its List Builder also features over 700 data points, enabling deep dives into specific market segments.

Key Features & Considerations

- Pricing Model: Tiered monthly subscriptions (from "Starter" to "Team") that include a set number of lookups and exports. Integrated marketing tools like direct mail and the AI dialer are add-on costs.

- Data Quality: Data is aggregated from multiple public and private sources, offering comprehensive property details. The mobile-first workflow is excellent for verifying property conditions in real-time.

- Usability: The mobile user experience is a major highlight, with intuitive route planning and property tagging. The desktop interface is also straightforward for managing lists and launching campaigns.

Website: https://www.dealmachine.com/pricing

9. Data Axle USA (formerly InfoUSA)

Data Axle USA, formerly known as InfoUSA, is a major U.S. list broker that provides access to massive consumer and business databases. While not exclusively a real estate platform, its strength lies in building highly targeted real estate investor lists by using consumer demographics as a proxy. This allows you to find potential investors based on criteria like income, net worth, and other financial indicators.

The platform is particularly useful for identifying high-net-worth individuals or homeowners with specific financial profiles who might be looking to invest in property. For example, you can create a list of homeowners in a specific zip code with an estimated income over $250,000 and a home value exceeding $1 million. This approach helps you find potential private lenders or cash buyers who may not appear on traditional investor databases.

Key Features & Considerations

- Pricing Model: Pricing is quote-based and depends on the list size and selected filters. You can run counts for free to see the potential list size before committing to a purchase.

- Data Scope: Offers extensive consumer and business data, which is great for broad targeting but requires users to intelligently combine filters to identify likely investors.

- Usability: The online list-building tool is straightforward, providing instant counts and fast delivery of data files. They also offer data appending services to enrich your existing contact lists.

Website: https://www.dataaxleusa.com/

10. Exact Data

Exact Data is a specialty list broker that provides pre-built real estate investor lists, allowing for the quick acquisition of targeted contact information. Unlike platforms where you build lists from scratch, Exact Data offers ready-made segments by city or state, streamlining the process for agents who need to launch email or direct mail campaigns without delay.

The platform is designed for speed and convenience. You can select a geographical area, see the number of available investor contacts, and get a quote instantly. This direct approach makes it a valuable resource for agents or marketers looking to supplement their existing lead sources or test new markets with a dedicated list of potential investor clients or partners.

Key Features & Considerations

- Pricing Model: Transparent per-record pricing is visible during the online quoting process. You pay for the specific list you order, which is then delivered as a CSV or Excel file.

- Data Quality: As with many list brokers, data quality and email deliverability can vary. It's crucial for users to perform their own data hygiene and ensure all outreach complies with CAN-SPAM and other regulations.

- Usability: The website offers a straightforward online ordering system. The primary advantage is its simplicity and the speed at which you can acquire a pre-segmented list for immediate use.

Website: https://www.exactdata.com/real-estate-mailing-lists.html

11. Connected Investors (Cash Buyers tool)

Connected Investors is an all-in-one real estate investing platform that offers a powerful tool specifically for building real estate investor lists of cash buyers. Its "Cash Buyers" feature is purpose-built for wholesalers and investors looking to identify and connect with verified individuals and companies actively purchasing properties with cash.

The platform stands out by combining a nationwide map-based search with detailed buyer profiles. Users can view a buyer's recent activity, portfolio snapshots, and typical purchase criteria, which aids in vetting and outreach. This integrated approach, blending data tools with a community and educational resources, provides a more holistic environment than typical list-building services. To further enhance your reach to this specific segment, specialized Cash Buyer Lead Generation Services can be a valuable resource.

Key Features & Considerations

- Data & Profiles: The platform provides detailed profiles of cash buyers, including their purchasing history and portfolio, allowing for more targeted and informed outreach.

- Integrated Tools: It includes built-in skip tracing and team collaboration features, streamlining the process from list creation to deal-making within a single system.

- Pricing Model: Pricing details are not fully public, as features vary between different plans. It's recommended to explore their offerings or request a demo to understand costs.

- Data Variation: The depth and recency of cash buyer data can vary by market, so testing its effectiveness in your specific area is a wise first step.

Website: https://connectedinvestors.com/

12. Fiverr (freelance marketplace for custom investor lists)

For those needing a fast and inexpensive way to seed real estate investor lists, the freelance marketplace Fiverr offers a unique, done-for-you solution. Instead of subscribing to a platform, you hire freelancers who specialize in building custom lists of cash buyers or investors based on your specific geographical targets, such as a city, state, or even a set of zip codes. This approach is ideal for quickly acquiring a foundational list without the complexity of navigating a database yourself.

The primary advantage is its flexibility and speed, with many sellers offering turnarounds of 24 to 72 hours. However, the quality and data collection methods are highly variable. It's crucial to vet sellers by carefully reading gig descriptions, checking reviews and ratings, and requesting a sample before purchasing. The platform's buyer protections, like revision policies, provide a safety net, but diligence is key to a successful outcome.

Key Features & Considerations

- Pricing Model: Gig-based pricing, often tiered by the number of leads. This is a cost-effective method for acquiring starter lists without a recurring subscription.

- Data Quality: Quality is inconsistent and depends entirely on the seller. Many sellers offer add-ons like skip-tracing for phone numbers and emails, but accuracy can vary. Always review seller ratings and recent feedback.

- Usability: The process is straightforward: find a gig, provide your criteria, and receive a CSV/Excel file upon completion. Communication with the seller is handled directly through the platform.

Website: https://www.fiverr.com/

Top 12 Real Estate Investor List Providers — Comparison

| Solution | Core features ✨ | Quality / Results ★ | Pricing / Value 💰 | Target audience & USP 👥 |

|---|---|---|---|---|

| 🏆 Tab Tab Labs | ✨ County-first 9+ sources, Always-on AI ISAs, automated workflows, calendar/CRM push | ★★★★★ Predictable pipeline; target 15–20 pre-qualified appts/mo; users report +3–4 deals/mo | 💰 Custom pricing; free strategy call + no-commit sample list | 👥 Serious investors/teams/brokerages — exclusive county signals & operator-built systems |

| ListSource (CoreLogic) | ✨ Nationwide property/owner filters, instant CSVs | ★★★★ Trusted decades; frequent updates | 💰 Pay-per-record ($50 min) or subscription via sales | 👥 Investors & direct-mail marketers — broad coverage & granular filters |

| PropStream | ✨ Nationwide data, comps, marketing tools, Lead Automator | ★★★★ Widely adopted; balanced features | 💰 Tiered subscription; free 7-day trial | 👥 Investors wanting list-building + outreach automation |

| PropertyRadar | ✨ 250+ criteria, list monitoring, phone/email unlocks, mobile apps | ★★★★ Transparent plans; strong monitoring | 💰 Clear plans; per-record overages | 👥 Local & national investors — built-in contacts, monitoring automation |

| BatchLeads | ✨ 140+ filters, BatchRank AI, dialer/SMS/mail integrations | ★★★ Good list-to-outreach workflow; AI scoring | 💰 Tiered plans; dialer/outreach add-ons | 👥 Wholesalers & volume investors — list→outreach pipeline |

| DataTree Lists (First American) | ✨ 150M+ properties, deeds/mortgages, document images | ★★★★ Enterprise-grade data & title coverage | 💰 Enterprise pricing; contact sales | 👥 Enterprises & title teams — robust document lineage |

| Prospect by Buildout | ✨ Regional or nationwide plans, owner unlocks, likely-seller modeling | ★★★★ Clear public pricing; modeling included | 💰 Public pricing; regional or national tiers | 👥 Brokers & investors — modeling + owner unlocks |

| DealMachine | ✨ Driving-for-dollars app, 700+ data points, integrated skip-trace & dialer | ★★★★ Strong mobile UX for field acquisition | 💰 Transparent plans; add costs for mail/dialer at scale | 👥 Field investors/wholesalers — mobile-first, route planning |

| Data Axle USA | ✨ Consumer & business lists, demographic/firmographic filters | ★★★ Trusted national list broker; fast delivery | 💰 Quote-based pricing after counts | 👥 Marketers seeking broad homeowner/affluence targeting |

| Exact Data | ✨ Prebuilt investor segments (city/state), email/postal/phone | ★★★ Variable quality by segment | 💰 Per-record pricing visible during selection | 👥 Marketers needing ready-made investor lists fast |

| Connected Investors (Cash Buyers) | ✨ Map-based cash-buyer search, profiles, skip-trace, collaboration | ★★★ Useful buyer profiles + community | 💰 Feature-based plans; limited public pricing | 👥 Wholesalers — grow vetted cash-buyer lists & team tools |

| Fiverr (freelance lists) | ✨ Custom DFY lists, optional skip-trace, fast turnaround | ★★–★★★ Quality varies by seller | 💰 Low-cost gigs; pay-per-project | 👥 Budget users needing quick, custom lists — vet sellers carefully |

Final Thoughts

The journey to finding and connecting with qualified real estate investors is no longer a search in the dark. As we've explored, the modern landscape is rich with powerful tools and data sources, each offering a unique pathway to building high-quality real estate investor lists. From comprehensive, all-in-one platforms like PropStream and BatchLeads to hyper-targeted, data-driven solutions like ListSource and PropertyRadar, the resources at your disposal are more sophisticated than ever.

We've seen that success isn't about finding a single "magic" list. Instead, it's about developing a strategic, multi-faceted approach. Your ideal toolkit might involve a primary subscription service for broad-stroke data pulling, supplemented by specialized platforms or even freelance support from marketplaces like Fiverr for niche, hard-to-find investor segments. The key is to align your chosen tools with your specific business goals, budget, and target market.

Key Takeaways for Building Your Investor Network

As you move forward, keep these core principles in mind:

- Define Your Ideal Investor: Before you spend a dime, create a detailed profile of the investor you want to work with. Are they a fix-and-flipper, a buy-and-hold landlord, a commercial developer, or a wholesaler? Your answer will dictate which platforms and search filters are most relevant to you.

- Layer Your Data: The most effective strategies often combine data from multiple sources. You might identify potential investors using public records or a tool like DataTree, then enrich that information with contact details and property portfolio insights from another platform.

- Prioritize Data Quality and Freshness: Stale data leads to wasted time and effort. When evaluating platforms, pay close attention to how often their databases are updated. Tools that pull directly from county records or MLS data in near real-time often have a significant advantage.

- Think Beyond the List: The list is just the starting point. Your success ultimately depends on your outreach, follow-up, and relationship-building strategy. A highly targeted list of 50 genuinely qualified investors is far more valuable than a generic list of 5,000.

Your Next Steps

Building a robust pipeline of investor clients is a marathon, not a sprint. Start by selecting one or two tools from this guide that best match your immediate needs and budget. Take full advantage of free trials to test their user interface, data accuracy, and filtering capabilities.

Remember that the ultimate goal is to transform raw data into meaningful conversations and, eventually, profitable partnerships. By strategically leveraging the right real estate investor lists, you can significantly accelerate your growth, close more deals, and establish yourself as a go-to agent for serious investors in your market.

Ready to turn your investor data into actionable marketing? A powerful CRM is the crucial next step. Tab Tab Labs provides an intuitive, real estate-specific CRM designed to help you organize your investor contacts, manage outreach campaigns, and track your deal pipeline effectively. Learn how Tab Tab Labs can supercharge your investor relationships.