Your Ultimate Tax Lien Investing Guide for Beginners

Discover how to profit from property tax liens with our comprehensive tax lien investing guide. Learn due diligence, bidding strategies, and risk management.

By James Le

Tax lien investing is a fascinating corner of the real estate world where you can buy a government-issued certificate for a property owner's unpaid taxes. It's a strategy that allows you to either collect a high interest rate when the homeowner settles their debt or, in some cases, end up owning the property itself. At its core, it’s a way for local governments to keep the cash flowing while giving investors a pretty secure opportunity to make a solid return.

What Is Tax Lien Investing and How It Works

Picture this: your local county needs money to pave roads, fund schools, and pay firefighters, but a homeowner has fallen behind on their property taxes. The county can't just wait around for the money. To get the cash they need now, they don't immediately seize the property. Instead, they sell a tax lien certificate to an investor.

Think of this certificate as a high-interest IOU that's backed by the real estate. When you buy one, you're essentially stepping in to pay that owner's overdue tax bill. In exchange, the county gives you the right to collect that money back from the property owner, plus a hefty, legally-mandated interest rate for your trouble.

The Lifecycle of a Tax Lien

The whole process is a clear, predictable dance between three main parties: the municipality, the property owner, and you, the investor.

- The Municipality: They need a steady stream of tax revenue to operate. When a tax bill goes unpaid, they sell a lien to get those funds into their coffers quickly.

- The Property Owner: They're legally required to pay property taxes. When they don't, a lien is placed on their property. This kicks off a specific timeframe (called the "redemption period") for them to pay back the investor—plus all that interest.

- The Investor: You're the one who shows up at a tax sale or online auction to buy the lien. Your primary goal is to earn that sweet, high interest rate, which you get when the property owner finally pays up and "redeems" the certificate.

A Simple Analogy: The Government-Guaranteed Loan

One of the easiest ways to wrap your head around tax lien investing is to think of it as providing a government-guaranteed loan. You're fronting the cash to cover someone's debt, and your investment is secured by a tangible, hard asset—the property itself. This is what makes it feel so much more stable than jumping into more volatile investments.

The system is really built to give property owners every chance to make things right. And most of them do. In fact, in over 95% of cases, the owner pays back the lien plus all the accrued interest within the redemption period. This makes redemption the most common—and profitable—outcome for an investor.

This isn't just some obscure strategy, either. It’s a huge part of the real estate investment world. We've seen some serious growth here, with tax lien sales climbing from $3.8 billion in 2021 to a whopping $5.02 billion in 2024. That’s a 32% jump in just three years, which tells you investors are increasingly hungry for these kinds of reliable, government-backed returns.

When it all works as planned, it’s a win-win-win. The government gets the money it needs to run, the property owner gets more time to sort out their finances, and you earn a passive, high-interest return. For a deeper look, you can learn more about what a tax lien property is and how the nuts and bolts work. Getting this foundation right is crucial before we jump into the more advanced stuff.

Navigating the Patchwork of Tax Lien Laws

Tax lien investing isn't a national sport with one set of rules. Think of it more like a local game, where every state—and often, every county—has its own unique playbook. A winning strategy in Florida could be a recipe for disaster in New Jersey, which makes understanding the local laws absolutely critical before you invest a single dollar.

This isn't just about minor differences in paperwork, either. The core mechanics of how you make money, how long you have to wait, and what happens if you don't get paid back can change dramatically as soon as you cross state lines.

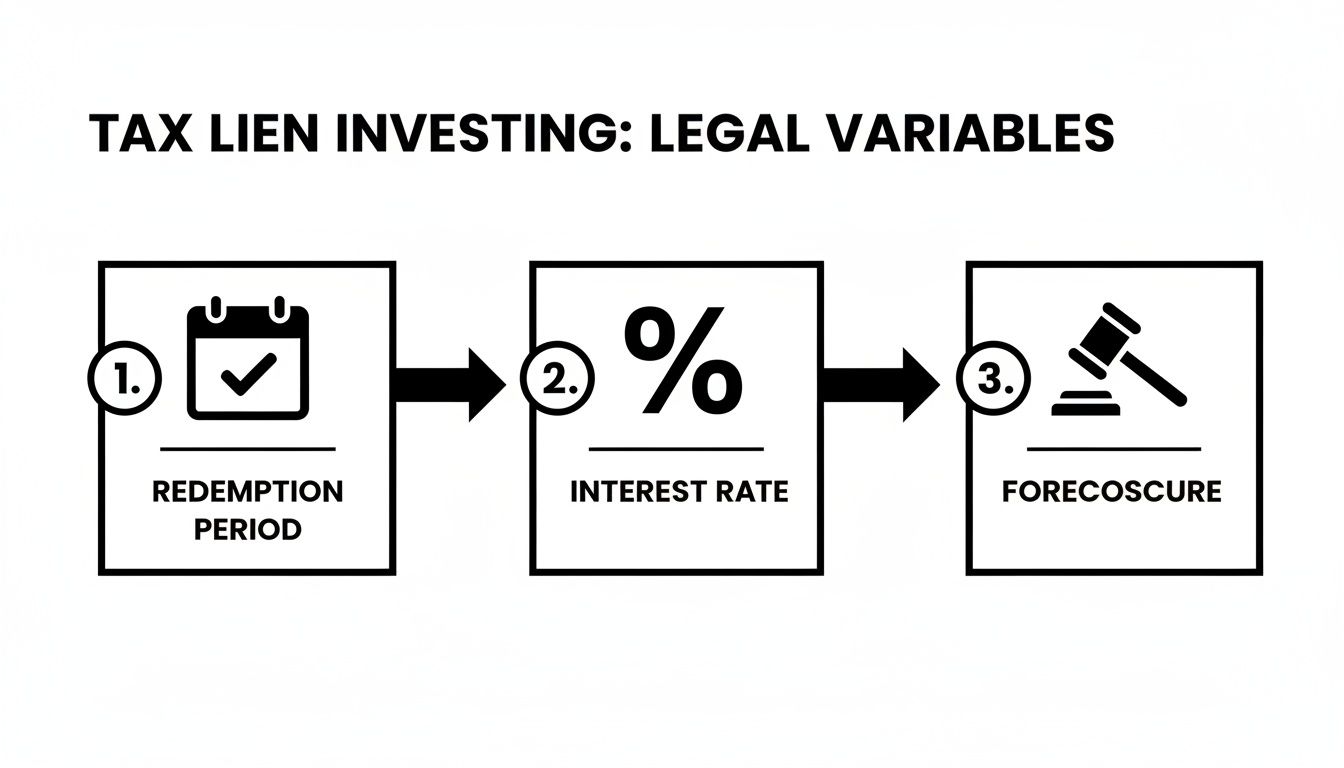

Key Legal Variables You Must Know

Three of the most important dials that get twisted from state to state are the redemption period, the interest rate, and the foreclosure process. Getting your head around these three is the first step to building a sound investment strategy in any market.

- Redemption Period: This is simply the window of time a property owner has to pay back the delinquent taxes, plus your interest. These periods can be as short as a few months or drag on for several years. A shorter period means a quicker potential return, but a longer one ties up your capital for a good while.

- Interest Rate Structure: States handle interest rates in wildly different ways. Some, like Arizona, offer a fixed statutory rate of up to 16%. Others, like Florida, use a "bid-down" system where investors compete by accepting a lower interest rate, which can seriously squeeze the final return.

- Foreclosure Process: If the property owner doesn't pay up within the redemption period, your path to taking ownership is dictated entirely by state law. Some states have a straightforward judicial foreclosure process, while others have far more complex hoops to jump through.

For instance, understanding the foreclosure process in North Carolina reveals specific nuances that directly impact how a tax lien investment plays out.

How State Laws Shape Your Strategy

Let's look at a couple of real-world examples. You'll quickly see how these legal differences create entirely different investment arenas.

Example 1: The Florida Model

Florida looks attractive on paper with its high statutory interest rate of up to 18%. But there's a catch: it operates on a competitive "bid-down" auction system. At these auctions, investors bid against each other by offering to accept a lower and lower interest rate. The investor willing to take the lowest rate wins the lien.

What does this mean for you? While the potential return is high, fierce competition can drive the actual return down into the single digits. A winning strategy in Florida requires razor-sharp due diligence so you know your absolute maximum bid and, more importantly, when to walk away from an auction that’s gotten too hot.

Example 2: The New Jersey System

New Jersey presents a more complex but potentially more rewarding landscape. It also boasts a high statutory interest rate of 18%. But here, investors can also charge penalties. Plus, if you pay subsequent taxes on the property, you can earn interest on those payments, too, compounding your return.

The foreclosure process in New Jersey is a strict judicial one that requires significant legal oversight. This complexity often scares off less experienced investors, creating real opportunities for those who take the time to truly master the local rules of the game.

These two states alone show you can't just apply one generic strategy across the country. Your success hinges on your ability to read the local rulebook, avoid costly legal missteps, and tailor your approach to the specific market you're in. Your returns are directly tied to how well you understand and adapt to this legal patchwork.

The Due Diligence Playbook for Smart Investors

In tax lien investing, the real money is made long before you ever place a bid. Sure, winning at auction is a rush, but profit is secured through meticulous preparation. This is your playbook for conducting rock-solid due diligence, turning you from a hopeful bidder into a strategic investor who knows a property’s story before committing a single dollar.

A lot of newcomers make the fatal mistake of getting mesmerized by a high interest rate or the dream of scooping up a cheap property. But you have to burn this rule into your brain: you are buying a debt instrument, not a house. Your primary goal is to purchase a secure debt that is highly likely to be paid back with interest. Foreclosure is the rare, complex, and often costly exception, not the main event.

Beyond the Property Address

Your investigation has to go way beyond a simple address lookup. Effective due diligence means becoming a detective, piecing together clues from various sources to build a complete picture of the asset securing your potential investment. This is what protects your capital from being tied up in worthless liens on properties nobody wants.

Your initial checklist should look something like this:

- Virtual Property Inspection: Fire up tools like Google Street View and satellite imagery for a first look. Is the property in a state of obvious disrepair? Look for a collapsed roof, fire damage, or other major liabilities that would turn a foreclosure into a financial nightmare.

- Neighborhood Analysis: What’s the surrounding area like? Are neighboring homes well-maintained, or is this property sitting in a declining block? The health of the neighborhood directly impacts the property's value and how likely the owner is to pay off the lien.

- Zoning and Land Use: Dig into local county records to confirm the property's zoning. A lien on a sliver of unusable land or a property with severe zoning restrictions is a fast way to lose money.

This initial digital fly-by helps you quickly toss out the obvious duds, letting you focus your real research energy on properties with genuine potential.

Uncovering Hidden Risks in Public Records

The most critical phase of due diligence is digging into official records. This is where you uncover the financial and legal baggage that could completely wipe out your investment. Skipping this step is just not an option.

A huge piece of this is the title search. You need to identify any "superior" liens that would get paid before yours in a foreclosure. An IRS lien, for example, jumps to the front of the line, taking priority over almost everything else. If a property is saddled with a significant federal tax lien, your investment could become totally worthless. For a more detailed walkthrough, our guide on how to conduct a county property records search can provide deeper insights.

While those high interest rates are the main attraction of tax lien investing—with statutory maximums like 18% in Florida and 16% in Arizona—the on-the-ground reality is quite different. Intense competition at auctions, especially from institutional players like hedge funds, often crushes the actual winning bids down to a national average of 3-7%. These big firms are perfectly happy with a 6-9% return, which is far better than government bonds, leaving individual investors outgunned unless they have an edge. You can discover more insights about tax lien risks on Bankrate.com.

Valuing the Asset Correctly

Finally, you have to figure out the property's approximate market value. This isn't about getting a formal appraisal; it's about establishing a reasonable estimate to weigh against the total lien amount. Use online valuation tools, check recent sales of comparable properties ("comps") in the area, and review the county assessor’s valuation.

Your goal is to ensure the property's value significantly exceeds the cost of the lien plus any potential foreclosure expenses. A healthy equity cushion is your safety net, making it more likely the owner will redeem the lien to avoid losing a valuable asset.

This visual below lays out the key variables you'll be dealing with, from the redemption period all the way to foreclosure—all of which are shaped by the quality of your due diligence.

This flow shows that each stage is a distinct legal step governed by state law, which hammers home why thorough, upfront research is non-negotiable. By following this due diligence playbook, you build the confidence to vet every opportunity, dodge costly mistakes, and strategically put your capital to work for the best possible returns.

How to Acquire Tax Liens at Auction

Okay, you’ve done your homework. Your due diligence is complete, and you've got a list of promising opportunities. Now it’s time to step into the ring.

This is where the action happens, and understanding the practical mechanics of acquiring a tax lien certificate is what separates the pros from the spectators. Whether you're facing the traditional gavel of an in-person auction or the click of a mouse on a digital platform, knowing the rules of engagement is everything.

The main arenas for this are county auctions, which happen either in person or, more and more, online. But there's also a backdoor route for picking up the liens nobody wanted at the main event. Let's break down how you get in on the action and the bidding strategies that will make or break your success.

Understanding Different Auction Environments

First things first, you have to find the sales. Every county plays by its own rules and sets its own schedule. Your starting point is always the local tax collector’s website, where you’ll find lists of available liens, auction dates, and all the registration requirements.

- In-Person Auctions: The classic method, usually held at the county courthouse. These can feel a little intimidating if you're new, but they give you a chance to feel the energy in the room and see your competition face-to-face.

- Online Auctions: The modern, far more accessible approach. Dozens of counties now use specialized third-party websites to host their tax sales, which means you can bid from anywhere. The tradeoff? That convenience usually brings a lot more competition.

- Over-the-Counter (OTC) Sales: What happens to the liens that don't sell at auction? They often become available for purchase directly from the county. This is a great way to snag liens without getting into a bidding war, but you have to be extra careful—these are the properties everyone else passed on for a reason, making your due diligence even more critical.

Mastering Core Bidding Strategies

How you bid is dictated entirely by the rules of the state and county. There are two dominant methods that determine how a winner is decided, and you absolutely must know which game you're playing before you show up.

Bid Down the Interest Rate: In this format, the auction starts at the maximum statutory interest rate. Investors then bid against each other, offering to accept a lower rate of return. The winner is the person willing to take the lowest interest rate. This is common in states like Florida and forces you to know your minimum acceptable return before the first bid is even placed.

Premium Bidding: This one is simpler. You’re bidding an amount above the total lien value (the back taxes plus any associated fees). The investor willing to pay the highest premium wins the certificate. It’s a straightforward battle of who has the most capital, but be warned: paying a high premium can seriously chew into your profit margin. You need to run your numbers carefully.

Tips for Auction Day Success

Winning at an auction isn't just about having the deepest pockets; it's about executing your strategy with discipline. The environment can be fast-paced and emotional—a dangerous cocktail for any investor.

- Set Your Maximum Bid in Advance: Based on your research, decide the absolute highest premium you will pay or the lowest interest rate you will accept. Write it down. Stick to it. No exceptions.

- Understand the Rules of Engagement: Read every word of the county’s auction rules. Are payments due on the spot? What forms of payment are accepted? A simple logistical mistake can get your winning bid thrown out.

- Manage Your Funds: Make sure you have the required funds available and ready to go. Some auctions even require a hefty deposit just to let you in the door.

The auction floor is a competitive space. One statistic really drives this home: around 80% of all certificates are bought by members of the National Tax Lien Association (NTLA), showing just how much the pros dominate this $5 billion-plus annual market. These aren't just small-time investors; they are institutional heavyweights like hedge funds that flooded the market in the 2010s. You can read more about these critical tax lien investing facts on Amerisave.com.

This just underscores the need to be prepared, disciplined, and strategic. If you want to compete, you have to bid with confidence.

Managing Your Portfolio and Exit Strategies

Nailing down a tax lien certificate at auction feels like a huge win, and it is. But it’s the starting gun, not the finish line. The real art of making money in this game comes down to what you do next: how you manage your portfolio and, most importantly, how you plan to get paid.

Every single certificate you own is an active investment. It needs to be tracked, watched over, and guided toward a profitable exit. Without a system, it’s frighteningly easy to blow past a critical deadline or fail to secure your position, turning what looked like a sure thing into a total loss. The goal is to make sure every lien you buy follows a clear path to one of two outcomes.

The Most Common Exit: Redemption

The vast majority of tax liens—we're talking 95% or more—end in redemption. This is your bread and butter, the ideal scenario you're aiming for every time. Redemption is simple: the property owner finally pays their overdue tax bill, plus all the interest and penalties that you, the investor, are owed.

When this happens, the county tax office handles everything. They collect the money from the owner and then cut you a check for your original investment plus all the interest you’ve earned. It’s clean, it's mostly passive, and it’s profitable. Your main job during the redemption period is to sit back, keep tabs on your investment, and make sure all the i's are dotted and t's are crossed legally. This hands-off process is exactly why redemption is the go-to exit for investors who want reliable returns without the headaches of actually owning property.

When Redemption Fails: The Foreclosure Path

So what happens in that rare case when the redemption period ends and the property owner is still nowhere to be found? Your exit strategy pivots to foreclosure. This is the legal process that allows you, as the lienholder, to take ownership of the property to settle the debt.

But let's be crystal clear: foreclosure isn't some simple "congratulations, you get the house" moment. It’s a messy, expensive, and time-consuming legal battle.

If you head down this road, be ready for a few major steps:

- Sending Legal Notices: States have ironclad rules about notifying the property owner and anyone else with a stake in the property (like a mortgage company) that you're starting foreclosure. One wrong move here can get your entire claim thrown out.

- Hiring an Attorney: You absolutely need a real estate attorney who specializes in this niche. Don't even think about winging it. Legal fees can easily tack on thousands of dollars to your costs.

- Covering Additional Costs: You’ll be on the hook for court filing fees, the cost of a title search, and a bunch of other administrative expenses that pop up along the way.

Think of foreclosure as the nuclear option, not the prize. The real goal is always to get your investment and your interest back. Suddenly owning a property throws a whole new set of problems at you—repairs, maintenance, other potential liens, and the entire circus of trying to sell it.

Essential Portfolio Management Tasks

To keep your investments safe and on track for a profitable exit, you have to actively manage your portfolio. There's no way around it. For every single lien you hold, you've got a few key responsibilities.

- Tracking Deadlines: Get obsessive about this. You need to know the exact expiration date of the redemption period for every lien. If you miss it, you could lose your right to foreclose, and your certificate becomes a worthless piece of paper.

- Paying Subsequent Taxes: In many places, you can (and should) pay the property taxes for the years after your initial lien purchase. This is a smart move. The county adds these payments to the total amount the owner has to pay you back, and you usually earn interest on them at the same high rate as your original lien. It protects your first-in-line position and juices your returns.

- Legal Communication: Any and all contact with the property owner has to follow state and local laws to the letter. Trying to play hardball or harassing them will land you in serious legal trouble and put your entire investment at risk.

A well-run portfolio is the foundation of a successful tax lien business. When you treat each certificate as its own unique asset with its own timeline and needs, you put yourself in the best possible position to cash in on redemptions while being fully prepared for those rare times you have to take the foreclosure route.

Scaling Your Investments with AI and Automation

If you're looking to grow beyond buying one-off liens, you'll hit a wall pretty fast. Manual research and chasing down leads becomes a massive bottleneck, and it's the single biggest thing that separates the hobbyists from the serious operators. The pros have figured this out: building a scalable system is everything, and technology is how you do it. This is where the smart money is creating a huge gap between themselves and the competition.

Modern data engines are completely changing the game. Think about platforms that scrape millions of county records every single day, sniffing out not just tax liens, but probates, foreclosures, and other distress signals. They spot these opportunities long before they ever land on some mainstream list, giving you a massive head start.

Building a Predictable Deal Pipeline

But the real magic happens when you pair that firehose of data with AI-powered tools. Instead of burning weeks sifting through spreadsheets and public records, these systems can qualify thousands of potential leads against your exact investment criteria—instantly. What you get is a predictable, automated pipeline of high-potential deals flowing your way.

This approach completely flips your business model on its head. You stop hunting for individual deals and instead build a machine that consistently brings pre-vetted, distressed property opportunities right to your doorstep.

This frees you up to spend your time and energy on what actually makes you money: analyzing the good deals, making offers, and closing contracts. Not the endless, soul-crushing prospecting.

From Data to Deals

So how does this work in practice? It's a multi-step process that would be impossible to replicate manually if you're trying to operate at any kind of scale.

- Signal Detection: The AI is smart. It looks for properties showing multiple signs of distress, like a tax lien plus a code violation. That combination screams "motivated seller."

- Instant Qualification: Leads are automatically checked against property data, current market values, and any other liens to make sure they're a perfect fit for your strategy. No more wasting time on duds.

- Automated Outreach: Once a lead is qualified, the system can kick off compliant outreach campaigns, contacting property owners to see if they're interested and even booking appointments straight to your calendar.

These principles of automation aren't new, but their application in real estate is a game-changer. For a broader look at the mechanics, understanding the fundamentals of service automation and AI can provide a solid foundation.

To see these workflows in action specifically within our industry, check out our guide on AI for real estate agents. The tools and strategies are remarkably similar and just as powerful.

Answering Your Lingering Questions

Even with a roadmap in hand, it’s natural to have questions when you’re exploring a new investment landscape. Let’s tackle some of the most common ones that come up for aspiring tax lien investors.

Can I Really Snag a Property for Just the Cost of Back Taxes?

This is one of the biggest myths in the business. While you technically can get a property through foreclosure if the owner doesn't pay up, it's incredibly rare. We're talking less than 5% of the time.

The real goal, and the most common outcome, is earning a nice return from the interest and penalties the property owner pays to clear their debt. Think of foreclosure as your nuclear option, not the grand prize. It’s a messy, expensive, and time-consuming legal battle that requires lawyers and a lot of extra cash. The savviest investors focus on liens that are almost certain to be paid off (redeemed), not the ones that might lead to a foreclosure fight.

What Happens If a Property Has an Existing Mortgage?

Here’s the good news: a tax lien is a superior lien. That’s a fancy way of saying it jumps to the front of the line, ahead of almost every other debt, including the mortgage. If you were forced to foreclose, the mortgage would get wiped out along with the owner's equity.

Because of this, the bank or mortgage lender has a massive incentive to make sure that doesn't happen. To protect their own multi-hundred-thousand-dollar investment, lenders will often step in and pay the delinquent taxes themselves. When they do, your lien gets redeemed, and you walk away with your principal plus all that juicy interest. It’s another built-in safety net that makes redemption the most likely scenario.

Is Tax Lien Investing Actually a Source of Passive Income?

It’s definitely more passive than flipping a house or being a landlord, but don’t mistake it for a set-it-and-forget-it investment. The initial due diligence is very hands-on, demanding hours of active research into properties, title histories, and auction rules.

And once you’ve bought a tax lien certificate, the work isn’t over. You still have to stay on top of things.

- Track Redemption Deadlines: This is non-negotiable. If you miss a key date, you could lose your entire investment.

- Pay Subsequent Taxes: In many states, you’re required to pay the ongoing property taxes to keep your lien in first position.

- Manage Foreclosure: On the off chance a lien isn't redeemed, you have to be the one to kick off and manage the entire legal foreclosure process.

This isn’t just busywork; it's the essential management needed to protect your capital and lock in your profits.

Ready to stop fighting over stale lists and start filling your pipeline with exclusive, pre-qualified appointments? Tab Tab Labs uses an AI-powered Distressed Appointments Engine to find motivated sellers before anyone else. We scrape county-level data for tax liens, probates, and foreclosures, then use AI to qualify leads and book appointments directly to your calendar. Discover how top operators are scaling to 15-20 deals a month. Get your free strategy call and a sample list to see the data quality for yourself at https://tabtablabs.com.