Unlocking Deals With a County Property Records Search

Discover how a county property records search can uncover off-market deals. Our guide shows investors how to find and interpret data for a competitive edge.

By James Le

Forget scrolling through generic MLS listings. If you want a real competitive edge in real estate investing, you need to go where the competition isn't: public records. This is where the true stories of properties and their owners are hidden in plain sight.

Your Foundation for Finding Off-Market Deals

The big real estate websites give you surface-level information, but they almost always miss the critical indicators of a motivated seller.

Those golden nuggets—things like tax delinquencies, probate filings, or code violations—are buried deep in county databases. Getting your hands on this information is how you build a reliable pipeline of deals that most investors don't even know exist. It completely flips the script, moving you from reacting to the market to getting way ahead of it.

Where to Find the Most Valuable Data

So, where do you actually start digging? The first step is knowing which county office holds which piece of the puzzle. Getting this right saves a massive amount of time and is a cornerstone of learning how to find off market deals consistently.

Each department tracks different information, and combining data from multiple sources is where the magic happens. Here's a quick breakdown of the key offices you'll be dealing with and what you can expect to find in each one.

Key County Offices and the Data They Hold

| County Office | Types of Records Available | Strategic Value for Investors |

|---|---|---|

| County Assessor | Property characteristics, assessed value, ownership information, and parcel maps. | Establishes baseline property details and identifies the current owners. Your starting point for any search. |

| County Recorder/Clerk | Deeds, mortgages, liens, judgments, and other recorded legal documents. | Reveals a property's complete transaction history and uncovers financial distress signals like liens. |

| Tax Collector/Treasurer | Property tax payment history, delinquencies, and upcoming tax sales. | Identifies owners under financial pressure who may be highly motivated to sell quickly and avoid foreclosure. |

| Court System (Probate, Civil) | Probate filings, divorce decrees, and foreclosure proceedings. | Uncovers properties tied to estates, legal disputes, or foreclosures, often leading to motivated sellers. |

Think of it like putting together a profile. On its own, a single data point is just information. But when you start connecting the dots, a clear picture of opportunity emerges.

A tax delinquency from the Collector's office combined with a probate filing from the court system? That's not just a lead; it's a powerful signal of a highly motivated seller who likely needs to liquidate an asset quickly.

This guide is your roadmap for not just finding this data but actually understanding what it means. We'll go way beyond basic definitions and get into actionable strategies for turning raw public records into a consistent, exclusive source of investment opportunities. The goal is to build a system for spotting distress and motivation long before a "For Sale" sign ever hits the lawn.

Where to Find the Gold: A Guide to County Data Sources

A successful county property records search isn't just about aimlessly clicking through government websites. It’s about knowing which digital doors to knock on. Each county office holds a different piece of the property's story, and knowing their roles is the first step in turning raw data into a real lead.

Think of it this way: you're not just collecting files. You're learning to recognize what a specific document from a specific office signals about a potential opportunity.

Your hunt almost always starts with the County Assessor. This office is the keeper of the basic, foundational data. We're talking square footage, bed/bath count, lot size, and most importantly, the current owner's name and the property's assessed value.

This is your baseline. It confirms who owns the place and gives you the all-important Assessor's Parcel Number (APN). That APN is the key you'll use to unlock records across every other county department.

The County Recorder and the Property's Financial Story

With the basics from the assessor in hand, your next stop is the County Recorder (sometimes called the Clerk of Court). This is where the property's financial and legal history unfolds. You'll find every recorded deed, mortgage, and lien right here.

This is where the real story often emerges. Spotting a recently recorded Lis Pendens or a Notice of Default, for instance, is a clear signal that foreclosure proceedings have started. That's a huge indicator of a motivated seller. To really make sense of this, you'll need a solid grasp of understanding foreclosure processes.

Uncovering Distress in Tax and Court Records

Next up, head over to the Tax Collector's (or Treasurer's) portal. This search is straightforward but incredibly powerful. You're looking for one thing: tax delinquencies. A property owner falling behind on taxes is often facing bigger financial problems and might be very open to a quick sale.

For an even deeper layer of insight, you need to check court records, especially probate court filings. When a property owner passes away, the estate often goes through probate. This process frequently leaves heirs—who might live out of state with no attachment to the property—needing to sell it to settle the estate. These are some of the absolute best off-market deals you can find.

A probate filing for a property that also has deferred maintenance noted in the assessor's photos and a tax delinquency is a trifecta of motivation signals. This is the kind of detail that turns a generic property search into a targeted, high-potential lead.

This kind of focused research is what separates the pros from the amateurs, especially in competitive areas. The real estate market varies wildly by region, and top emerging markets are seeing explosive growth. For example, Richmond, Virginia is leading the pack with an 11.8% growth rate, followed by Atlanta at 10.8% and Phoenix at 10.6%. In these hot spots, a meticulous county property records search is the only way to find deals before they hit the MLS.

The key is to connect the dots. An out-of-state owner you found in the assessor's records becomes a much hotter lead when you also find a probate filing linked to them. You can learn more about how to strategically target these individuals in our guide to building effective absentee owner lists. Cross-referencing these data points is how you build a compelling narrative of seller motivation.

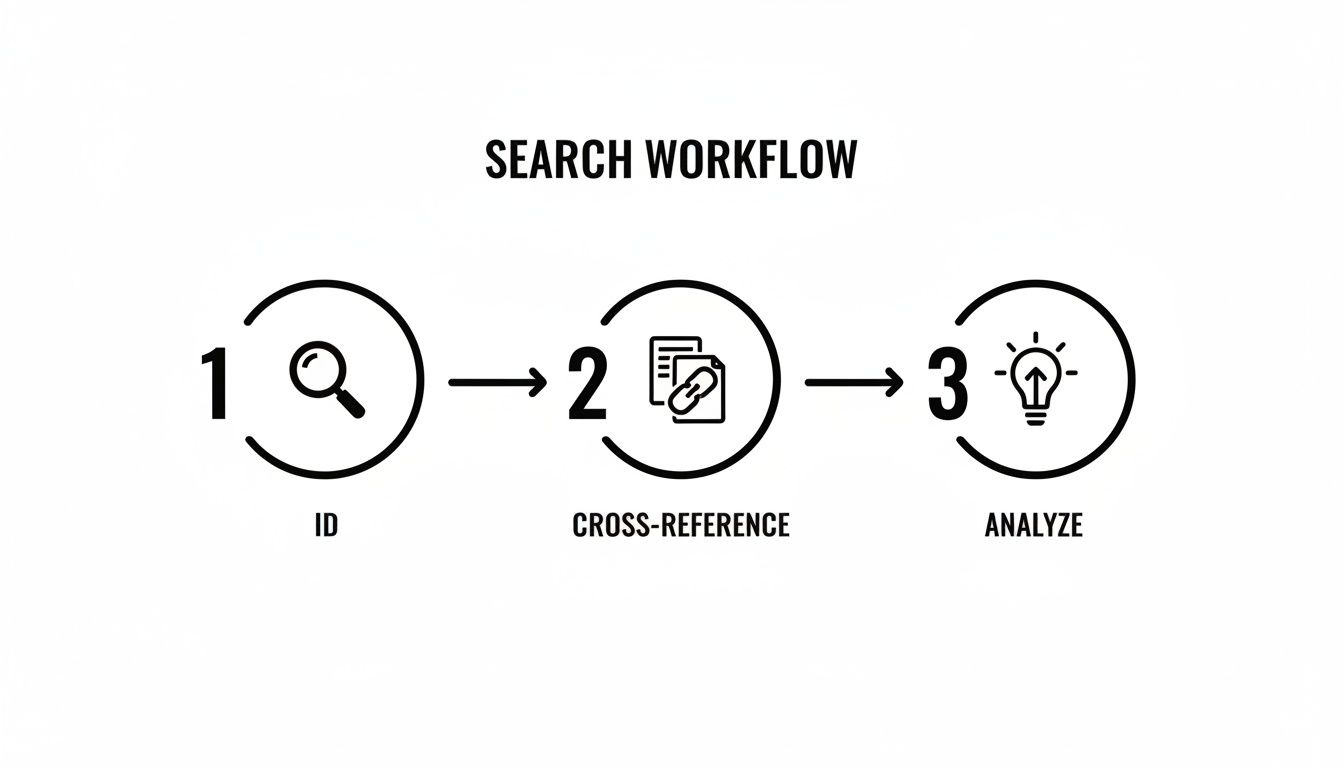

Building An Effective Search Workflow

Knowing where to look for property records is half the battle. The other half—the part that really separates the pros from the amateurs—is knowing how to look. A solid, repeatable search workflow is what transforms random bits of data into a crystal-clear picture of a property's past, present, and future potential.

The trick is to master three core search methods and, more importantly, to know when to use each one. Every approach serves a different purpose, whether you're zeroing in on one specific house or trying to uncover an owner's entire portfolio. Starting the right way saves a ton of time and can reveal opportunities you'd otherwise completely miss.

Searching by Property Address

This is almost always your ground zero. When you have a specific property in your sights, heading to the County Assessor's website and plugging in the address is your first move. This simple step confirms the basics like who owns it and what it's valued at, but its most critical function is to give you the Assessor's Parcel Number (APN).

Think of the APN as the property's social security number. It's the one unique identifier that all county departments use.

Once you have that APN, you can pivot. Take that number and plug it into the portals for the County Recorder and the Tax Collector. This is how you connect the dots. In just a few clicks, you can go from a simple address to pulling the entire deed history, seeing any outstanding mortgages, and checking for liens at the Recorder's office.

Searching by Owner Name

This is where things get interesting. A name-based search is a powerful strategic tool, especially when you have a hunch an owner might have more than one property. Let's say you spot a distressed property. You find the owner's name, then run that name through the Assessor's and Recorder's databases. Suddenly, you might uncover their entire local portfolio.

This is a game-changer. You could discover an investor who is behind on taxes for several properties, which signals much bigger financial trouble and, therefore, a much higher motivation to sell. This technique takes you from thinking about a single asset to seeing a portfolio-level opportunity.

A single tax delinquency is a lead. Finding out the same owner is delinquent on five other properties through a name search? That's a high-priority target who might be ready to talk about a bulk deal.

Searching by Assessor's Parcel Number (APN)

If you already have the APN—maybe from a list you bought or a previous search—it's the most direct and foolproof way to get records. Addresses can be tricky; databases might list "Street" as "St." or "St," causing your search to fail. The APN, however, is always the same. It cuts through any ambiguity and takes you straight to the file you need.

By building a simple workflow—start with an address or owner, grab the APN, then use that APN across different county departments—you create a comprehensive research machine. It’s a systematic approach that ensures you don't miss the crucial details that link tax status, ownership history, and legal issues together to pinpoint the best off-market deals.

How to Read Between the Lines and Find Real Opportunities

Pulling up the records is just the starting line. The real magic happens when you know how to read the story hidden in the dense, legal language of these documents. This is how you turn a routine county property records search from a simple data-pull into a strategic, opportunity-finding mission.

Going beyond just noting a document's existence is critical. You need to understand what it signals. A Deed of Trust, for instance, isn't just a record of a loan. It tells you the lender, the loan amount, and the date it was issued—all clues that help you estimate the owner's equity and get a feel for their financial situation.

Likewise, a tax lien certificate says a lot more than just "unpaid taxes." It shows you the exact amount of the delinquency and, more importantly, how long it's been sitting there. A small, recent delinquency might just be an oversight. A large, aging one? That often points to deeper financial distress and a highly motivated seller.

This simple workflow shows how we move from just identifying records to analyzing them for actionable insights.

Each step builds on the last, turning raw data into a clear picture of what's really going on with a property.

Decoding Foreclosure and Probate Signals

Foreclosure documents follow a predictable path, and knowing where you are on that timeline is everything. A Notice of Default or Lis Pendens is an early warning flare, giving you a chance to reach out before things escalate to a public auction. A Notice of Trustee's Sale, on the other hand, means the clock is ticking loudly, and the window for a pre-foreclosure deal is slamming shut.

Probate records present a totally different type of opportunity. These court filings mean a property owner has passed away, and the asset is now tied up in an estate. But the real gold is buried in the details.

A probate case with an out-of-state heir is one of the strongest indicators of seller motivation you'll ever find. The heir often has no emotional attachment to the property, lives hundreds of miles away, and is far more interested in a quick, clean sale to liquidate the asset and close the estate.

This is the kind of pattern recognition that turns public data into private leads. Our guide on how to find property owner information can help you track down these key people and start a conversation.

Connecting the Dots for a 360-Degree View

No single document ever tells the whole story. The real skill lies in piecing together information from different county departments to build a complete profile of a property and its owner.

- Tax Delinquency + Code Violations: This combo is a classic sign of an owner who can't afford basic upkeep and taxes. It screams deferred maintenance and a strong need to sell.

- Probate Filing + Reverse Mortgage: This scenario means the heirs have inherited a property with a loan that's now due. They have to either pay off the mortgage or sell the house—creating immense pressure for a fast deal.

- Divorce Decree + Quitclaim Deed: When you see a quitclaim deed filed right after a divorce, it almost always means one spouse is being taken off the title. This often creates a motivated seller who needs to offload the property to finalize the asset split.

The sheer volume of these records is mind-boggling. With 4.13 million existing home sales and over 1.3 million housing starts each year, a constant river of new data flows into county databases. This massive scale is exactly why learning to interpret these records effectively is so crucial. It’s how you stop competing for the same old public listings and start creating your own pipeline of exclusive, off-market deals.

Automating Your Search to Scale Your Business

Doing a few manual searches is fine when you're just starting out. You can find some solid one-off deals that way. But let's be honest, it's a huge bottleneck. If you're serious about growing your operation, you can't scale your business by clicking through county websites one by one.

Every hour you spend on those manual lookups is an hour you're not spending on outreach, negotiating, and actually closing deals. This is the point where automation stops being a "nice to have" and becomes absolutely essential.

The top-performing teams I know have moved past this manual grind. They've built their own proprietary, always-on deal engine. They're not fighting over the same stale public lists everyone else is using. Instead, they’ve created a consistent flow of fresh, qualified leads pulled directly from the source.

Building Your Automated Deal Engine

The big shift here is mental. You have to stop thinking in terms of one-off searches and start thinking about automated data acquisition. This means setting up systems that continuously pull information from multiple county sources—the assessor, recorder, and tax collector—and feed it right to you.

What you're really creating is a live feed of opportunities as they happen.

This approach is so powerful because it catches distress signals the moment they appear on record. A new tax lien, a probate filing, or a pre-foreclosure notice gets flagged and sent your way automatically. This gives you a massive head start before anyone else even knows that property is in play.

By building an automated system, you're not just finding leads; you're creating a proprietary pipeline. This is your exclusive source of opportunities that your competitors, who are still searching manually, won't see for weeks or even months.

Integrating Data for Maximum Impact

Just getting the data is only half the battle. The real magic happens when you integrate it directly into your CRM. As soon as a new distressed property record pops up, your system should automatically create a new lead, complete with all the crucial details.

From there, you can kick off a whole chain of automated actions:

- Assign a lead score so you can prioritize the hottest opportunities first.

- Drop the lead into a direct mail or email sequence for immediate outreach.

- Create a task for someone on your team to make a follow-up call.

As you build out these systems, you can get even smarter by incorporating predictive lead scoring models to refine your outreach even further. This ensures your team is always focused on the prospects most likely to convert, not just the newest ones.

County-level property records and digital tools have completely changed how homes are marketed and sold. Just look at the data: 97% of homebuyers now use the internet to search for properties. This massive shift makes automated county records aggregation more valuable than ever for pros who want to stay ahead of the curve. You can discover more insights about real estate statistics to see just how much the industry has evolved.

A final, crucial point: always put compliance and data privacy first. Make sure your outreach methods respect all regulations, like Do Not Call lists, and that you're managing the data you collect responsibly. Automation at scale comes with a serious commitment to ethical practices.

Got Questions? We've Got Answers.

Even the most dialed-in workflow hits a snag now and then. When you're deep in a county property records search, a few questions always seem to pop up. Let's tackle some of the most common ones I hear from investors so you can keep your research moving without getting bogged down.

One of the biggest frustrations? Hitting a wall when you can't find what you need online. This happens more than you'd think, especially once you start digging in smaller or more rural counties that haven't exactly prioritized digitizing their archives.

Are All County Property Records Available Online?

Definitely not. While you'll find that most major urban and suburban counties have pretty slick online portals, a surprising number of smaller counties are still running on paper and snail mail.

For certain documents, especially older deeds, specific court filings, or probate records, you might have no choice but to physically visit the county office or mail in a formal request. It's a huge time sink. This digital divide is where automated data providers really shine—they've already built the bridges to access both online databases and offline records, giving you the full story without the legwork.

What Is the Difference Between Assessed Value and Market Value?

This one trips up a ton of people, and getting it wrong can wreck your numbers.

The assessed value is purely for the county's tax purposes. It's a number calculated using a government formula, and it might only get updated every few years. Because of that, it often lags way behind what's actually happening in the market.

Market value, on the other hand, is the real-world price a property would likely sell for today. It's a dynamic number based on recent comps, local demand, and the property's condition. It's the only number you should be using to figure out what a property is truly worth.

Key Takeaway: Think of assessed value as a stale, tax-related number. Market value is your real-time, decision-making number. Never, ever confuse the two when you're running ARV calculations or putting together an offer.

How Can I Find Out if a Property Has Liens?

This is a big one. Liens are almost always filed with the County Recorder or Clerk's office. You can usually search their records portal by the owner's name, the property address, or—best of all—the APN.

Keep an eye out for all kinds of liens:

- Mechanic's liens (from unpaid contractors)

- Tax liens (from unpaid property or income taxes)

- Judgment liens (resulting from lawsuits)

While a direct search is a great start, the only way to be 100% sure a title is clean is to order a full, professional title search.

Is It Legal to Use Public Records for Marketing?

Yes, in general, it's perfectly legal to use public records for commercial purposes like sending direct mail. After all, the information is publicly available for a reason.

That said, you absolutely have to play by the rules. If you're doing any phone outreach, for example, you must scrub your lists against the National Do Not Call Registry. When in doubt, it’s always smart to have a quick chat with a legal pro to make sure your marketing campaigns are fully compliant.

A manual county property records search can only get you so far before it starts eating up your entire day.

Tab Tab Labs automates this whole mess, scraping over nine different county sources to put exclusive, pre-qualified seller appointments directly on your calendar. Stop fighting over the same stale lists everyone else has and start owning your market.