How To Find Property Owner Information A Practical Guide

A practical guide on how to find property owner information using public records, paid services, and advanced search tactics for complex ownership situations.

By James Le

Figuring out who owns a piece of property is usually more straightforward than people think. Most of this data is public record, after all. Your search will likely start with free resources at the county level and might eventually lead you to specialized paid services if things get complicated.

Your Starting Point For Finding Property Owner Information

Before you start digging, it helps to understand the landscape. The information you need is almost always out there; the trick is knowing where to look. The path you take—free public records versus a paid service—really boils down to your goals, your budget, and how complex the property's ownership might be.

For many situations, a quick search on the county assessor's website is all it takes. These government portals are the go-to source for property tax information and usually list the current owner's name and mailing address right there.

This direct approach is perfect for simple inquiries, like an investor doing some initial homework or just a curious neighbor. For example, if you're putting together a direct mail campaign, you can often pull a list of owners in a specific zip code directly from these public databases. It's a fundamental step in strategies like those we cover in our guide on how to drive for dollars effectively.

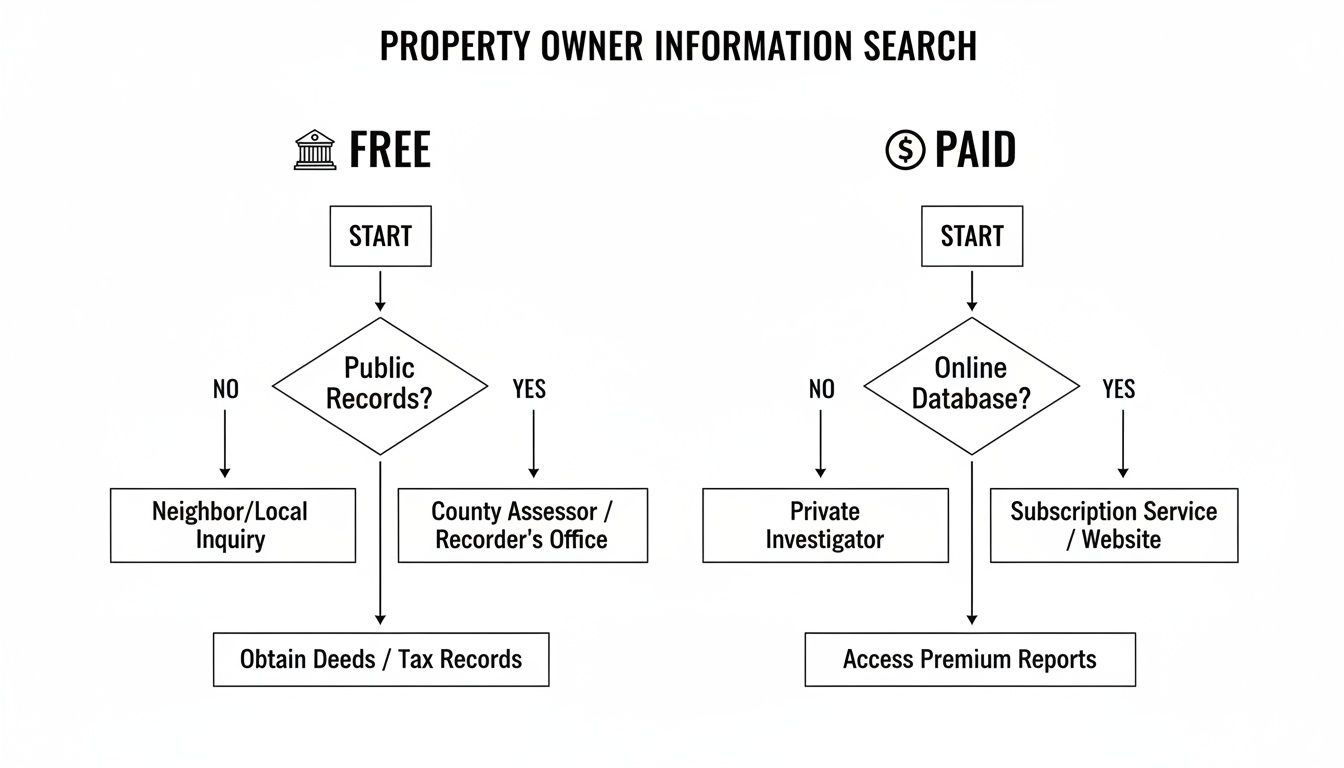

This flowchart maps out the two main routes you can take when you need to find out who owns a property: the free public records path or the paid data services path.

As you can see, it really comes down to a choice between the DIY route using county resources and the more streamlined (but pricier) option of using a dedicated service.

Methods For Finding Property Owners At a Glance

To make the choice clearer, let's break down the pros and cons of free public records searches versus paid data services. This table gives you a quick comparison to help you decide which approach fits your needs best.

| Method | Cost | Information Provided | Best For |

|---|---|---|---|

| Free Public Search | Free | Owner name, mailing address, tax data, sales history | Simple lookups, budget-conscious investors, verifying basic information. |

| Paid Data Service | Subscription or per-report fee | Owner name, contact info, property details, mortgage data | Bulk searches, finding hard-to-reach owners, complex ownership (LLCs). |

Ultimately, both paths can get you the information you need. Free methods require more hands-on effort but cost nothing, while paid services save you time and often provide richer data, especially for tough cases.

The Foundation Of Public Records

The fact that these records are public isn't some new internet-age phenomenon. The U.S. has a long-standing system for documenting land ownership, which is what makes today's property searches possible in the first place.

While there are still global challenges in land registration—experts estimate only 30% of the world's population holds a legally registered title—the United States has a pretty robust system.

Back in 1795, Congress mandated the creation of county recorder's offices to ensure deeds and mortgages were publicly accessible. That same principle holds true today for the 65.1% of American households that own their homes, with much of that information now available online.

Using Free Public Records To Uncover Ownership Details

When you need to find out who owns a piece of real estate, your first move should always be to tap into free public records. These government databases, typically managed at the county level, are the bedrock of property ownership in the U.S. and often have exactly what you need without costing a dime.

This whole system of public documentation has a long history. The tradition of publicly recording land transfers goes back centuries, eventually making its way to the United States where a federal law in 1795 mandated that counties set up recorder’s offices. This legacy is why today we can pull up most of this information online. You can read more about this history of land records on geospatialworld.net.

Learning to navigate these resources is a core skill for any real estate pro. Let's walk through exactly where you need to look.

Start With The County Assessor Website

The county assessor’s office is your ground zero. Their main job is to figure out a property's value for tax purposes, which means they maintain a meticulous, up-to-date record of every single parcel in their jurisdiction.

Almost every county now has an online portal where you can search their database. The two most common ways to search are by the property's street address or, if you have it, the Assessor’s Parcel Number (APN).

A quick search will usually give you a goldmine of information:

- Current Owner's Name: The person, LLC, or trust that's on the hook for the tax bill.

- Owner's Mailing Address: This is often different from the actual property address and is absolutely critical for things like direct mail campaigns.

- Recent Sales History: You can typically see the last sale date and price, which gives you a ton of context.

- Property Characteristics: Details like square footage, the year it was built, and lot size are almost always included.

My personal tip: Don't get thrown off by clunky, outdated government websites. They can be slow and far from intuitive, but the data is golden. Just be patient, try a few different ways of searching, and remember this is the most reliable free source you're going to find.

For those looking to gather this data at scale, it's worth understanding the tools of the trade. Learning about things like Proxies for Web Scraping Data can make a huge difference in your efficiency.

Dig Deeper At The County Recorder Or Clerk

So, the assessor tells you who pays the taxes, but the county recorder (sometimes called the county clerk) tells you who legally owns the property through official documents. Think of this office as the official library for all real estate paperwork.

This is where you can find and review copies of critical documents:

- Deeds: These are the legal instruments that prove an ownership transfer. A recent "Grant Deed" or "Quitclaim Deed" will name the current legal owner.

- Mortgages and Liens: These documents show any debts or claims against the property, which helps you paint a much clearer picture of its financial situation.

- Title History: By tracing deeds backward in time, you can build a complete ownership history for the property, which is an essential part of any real due diligence.

Leverage County GIS Mapping Systems

This is one of my favorite tools. Many counties now offer a Geographic Information System (GIS) map, which is basically an interactive, data-rich map of every parcel in the county.

Instead of typing in an address, you can just visually click on a property right on the map. A little pop-up or sidebar will usually appear, packed with information pulled directly from the assessor and recorder databases. This is a lifesaver when you know a property's location but don't have its exact address.

When Paid Services And Skip Tracing Are Worth It

While free public records are a fantastic starting point, you'll inevitably hit a wall. This usually happens when a property is held by an LLC or trust, hiding the individual owner behind a corporate veil. In these moments, investing in a paid service isn't just a convenience—it's a necessity.

These services are built to cut through the noise and deliver actionable contact info, fast. They go way beyond what you'll find on a county assessor’s site, saving you hours of frustrating detective work.

Distinguishing Data Providers From Skip Tracing

It’s important to get the lingo right because the two main types of paid services serve very different purposes.

-

Property Data Providers: Think of these as massive databases that pull public records from all over the country into one searchable platform. They are brilliant for pulling lists and getting basic ownership data in bulk, but they typically stop short of providing direct contact information like phone numbers.

-

Skip-Tracing Services: This is the next level up. Skip tracing is the art of finding someone who is tough to locate. These services take an owner's name and mailing address, then cross-reference it against private databases to dig up phone numbers and email addresses.

If the free public records aren't cutting it, it’s worth seeing what’s out there. You can even find good comparisons of alternatives to contact information services like Lusha to figure out what might slot into your workflow.

A real-world example: I once targeted an off-market property owned by an out-of-state LLC. The county records only gave me a registered agent's address in another state—a dead end. A quality skip-tracing service, however, coughed up the cell phone number of the actual managing member in under a minute. That led to a productive conversation that would have been completely impossible otherwise.

When To Make The Investment

So, when should you pull out your credit card? It all boils down to return on investment. If the time you'd spend digging through records costs you more than the price of a report, it's time to pay up.

Consider a paid service when you run into these classic roadblocks:

- The property is owned by an LLC, corporation, or trust.

- You have a large list of properties and need to gather data efficiently.

- The owner's mailing address is just a P.O. Box or a registered agent.

- You've tried all the free methods and still have no clear contact person.

Choosing the best skip tracing service is crucial for getting accurate data that actually leads to conversations. The cost is easily justified when it connects you with a motivated seller you couldn't otherwise reach, potentially unlocking a deal worth thousands. Just weigh the small upfront cost against the massive potential value of a successful transaction.

Dealing With Complex Ownership And Common Roadblocks

Finding the real owner isn't always as simple as looking up a name. You're going to hit frustrating roadblocks, especially when properties are held by a corporation, an LLC, or a trust. These structures are specifically designed to create a layer of privacy and liability protection, but that doesn't mean it's a dead end.

You just have to know where to look next.

This is where your inner detective comes out to play. Instead of throwing your hands up, it's just a matter of shifting your search to a different set of public records.

Unmasking Corporate And LLC Ownership

So, the county assessor’s site shows the owner is "123 Main Street Holdings, LLC." What now? Your next stop is the Secretary of State (SOS) website for whatever state the property is in. Every legitimate business entity has to register with the SOS, and lucky for us, this information is public.

Fire up the SOS business search portal and look up the LLC or corporation by its name. The results will usually give you some gold:

- Registered Agent: This is the official point of contact for the business. Sometimes it's a third-party service, but other times it's a person's name—jackpot.

- Principal Office Address: The official mailing address for the company.

- Officers or Members: This is often the key that unlocks everything. Many states list the names of the company’s managers, officers, or members.

Once you pull a real person's name from these records, you're back in business. You can take that name and run it through your other search methods or a skip-tracing service to nail down their direct contact info.

Peeling Back The Layers Of a Trust

Trusts are a tougher nut to crack. They are built for privacy, so the property deed might just say something vague like "The Smith Family Trust." Unlike an LLC, trusts aren't typically registered with the Secretary of State.

Your best shot here is to pull the actual deed from the county recorder's office. The document that transferred the property into the trust might name the trustee—that's the person who manages the trust's assets. The trustee is the individual you'll want to get in touch with.

This can get especially tricky with inherited properties. For a deeper dive into that world, check out our guide on how to handle a probate properties list.

Handling Outdated And Conflicting Records

Let's be real: public records are not always perfect. You'll find a name on the tax record that doesn't match the most recent deed, or a mailing address that's ten years old. This is why you can't rely on a single source.

My process is simple: trust, but verify. I always pull data from at least two sources—like the county assessor and the county recorder—to look for consistency. If the names and dates line up, I feel good about it. If they don't, the most recently filed document (which is almost always a deed) is your most reliable source of truth.

The global picture shows just how messy record-keeping can be. The biennial JLL Global Real Estate Transparency Index looked at 100 countries and found massive variations. For instance, even within the EU, where the average homeownership rate is 68.4%, you see rates as low as 47.2% in Germany or as high as 91.6% in Hungary. Each country, and even each state, has its own quirks. You can dig into more global home ownership rates on tradingeconomics.com.

Staying Ethical And Compliant With Owner Data

Finding a property owner’s information is just one piece of the puzzle. What you do with that information is a whole different ballgame—and it's a lot more critical to get right. Once you have a name, a phone number, or an email, you're stepping into territory governed by some pretty strict legal and ethical lines. You absolutely cannot cross them.

This isn't just about being professional. It's about protecting yourself and your business from some serious legal heat.

There’s a world of difference between public information, like a name on a deed, and private data, like a personal cell number you pulled from a skip tracing service. Just because you can find the data doesn't give you a blank check to use it however you want.

Key Regulations For Outreach

When you switch from research mode to outreach, you've got to know the laws of the land. Two of the big ones you need to burn into your brain are the TCPA and the CAN-SPAM Act. Ignoring them can lead to fines that could sink your business.

-

Telephone Consumer Protection Act (TCPA): This law puts heavy restrictions on telemarketing calls and texts. A huge piece of this is the National Do Not Call Registry. Before you even think about dialing, you must scrub your list against this registry. Fines for messing this up can be thousands of dollars per call. Ouch.

-

CAN-SPAM Act: This federal law lays down the rules for commercial email. It demands you be honest in your messaging, give people a crystal-clear way to opt-out, and include your physical mailing address in every single email. No exceptions.

The core principle here is simple: respect people's privacy. Your goal is to start a business conversation, not to harass someone. An aggressive, unwelcome approach is the fastest way to kill a lead and torpedo your reputation.

The Dos And Don'ts Of Contacting Owners

You need a clear set of guidelines to navigate this ethically. Building a professional reputation means doing things the right way, every single time.

Do This:

- Be Transparent: Right out of the gate, state who you are and why you're reaching out. No mystery.

- Provide Value: Give them a clear, compelling reason for your call or email that could actually benefit them.

- Respect "No": If someone tells you to stop contacting them, that’s it. Honor the request immediately and permanently.

- Keep Records: Log your outreach attempts and, most importantly, any opt-out requests.

Not This:

- Never Misrepresent Yourself: Don't ever pretend to be a government official or someone you’re not. It's illegal and just plain wrong.

- Don't Share Their Data: You worked to find this private contact info. Never sell it or share it with others.

- Don't Be a Nuisance: This should be common sense. Avoid calling at weird hours or hammering someone with calls after they've made it clear they're not interested.

Ultimately, your long-term success is built on trust. A compliant and respectful outreach strategy isn't just about dodging legal bullets; it’s the bedrock of a sustainable business.

Common Questions (And Roadblocks) In Property Searches

When you're digging for property owner information, a few challenges pop up time and time again. Getting straight answers can save you a world of frustration. Let's tackle the most common hurdles you'll likely face out in the wild.

These are the practical, no-fluff answers to keep you moving forward when you hit a wall.

What If I Only Find An LLC's Name?

This is probably the most common roadblock of them all. You pull the county records and the owner is listed as something like "123 Main Street Holdings, LLC." Now what?

This is your cue to pivot from county records to state-level business filings. Head straight to the Secretary of State (SOS) website for whatever state the property is in.

Every legally registered company, including an LLC, has to file paperwork with the state. A quick search on the SOS business portal is a goldmine. It can reveal:

- The registered agent—the person designated to receive legal documents.

- The company’s official mailing address.

- And the real prize: the names of the LLC's managers or members.

Once you have an actual person's name, you can circle right back to your skip-tracing tools to hunt down their direct contact info. Just like that, you've bypassed the corporate shield.

Is It Legal To Contact An Owner I Find?

Short answer: yes. It's generally legal to contact a property owner using information you found through public records or paid services. But—and this is a big but—you must do it compliantly. The data isn't the problem; it's how you use it that matters.

You absolutely have to follow federal and state rules like the TCPA (Telephone Consumer Protection Act) and the CAN-SPAM Act. This means scrubbing your calling lists against the National Do Not Call Registry and always including a clear opt-out link in your emails.

Don't skip this step. Ignoring these regulations can bring on some seriously painful financial penalties. The goal is professional, targeted outreach—not spammy harassment.

How Do I Handle Outdated Or Incorrect Records?

Let's be real: public records are not always perfect. You’ll pull a tax record that conflicts with the most recent deed, or find a mailing address that's clearly a decade old. It happens.

The key is to never trust a single source of data. You have to cross-reference.

Always compare information from at least two different databases. For instance, pit the owner's name on the county assessor’s site against the name on the latest deed from the county recorder. If you see a mismatch, the most recently filed legal document—usually a deed or maybe a Transfer on Death Deed (TODD)—is your source of truth. A TODD, for example, is a legal instrument that transfers ownership upon death and its filing is the most current record.

This verification process is what separates the pros from the amateurs. It ensures you're chasing the right lead and not burning daylight on bad information. By layering multiple sources, you build a much clearer, more reliable picture of who actually owns the property.

At Tab Tab Labs, we eliminate these headaches by providing real estate operators with pre-qualified, motivated seller appointments sourced from exclusive county-level data. Stop chasing dead ends and start closing more deals. Book a free strategy call today.