A Modern Playbook for Real Estate Leads for Investors

Tired of stale lists? This guide reveals how to generate exclusive real estate leads for investors using county data, AI, and proven automation systems.

By James Le

If you’re a real estate investor, you know the feeling. Chasing the same stale leads as everyone else. The old model of buying lists from national data mills or fighting for scraps on Zillow is fundamentally broken. It’s a reactive game that keeps you permanently stuck in a sea of competition.

This whole approach is a race to the bottom.

By the time a lead from one of those generic services hits your inbox, it's already been sold to dozens of your competitors. That intense pressure immediately jacks up your acquisition costs and squeezes your potential profit margins before you’ve even made the first call.

Why Old-School Real Estate Leads No Longer Work

The problem goes way deeper than just a crowded market. Sticking with these overused sources creates some serious hidden costs that bleed your resources and kill your team's momentum. You aren't just paying for the list; you're paying with your time, effort, and morale.

Think about the hours your team wastes dialing numbers, talking to sellers who are either unmotivated or completely unqualified. Every minute spent on a dead-end call is a minute you could have dedicated to a real, viable deal. This isn't just inefficient; it's an operational drag that actively stops your business from scaling.

The real expense of a bad lead isn't the upfront cost—it's the opportunity cost. It's the high-potential deal you missed because your team was bogged down chasing prospects who were never going to sell.

Moving from Reactive to Proactive

At its core, the issue with old-school leads is that they force you to be reactive. You’re just waiting for opportunities to pop up on public platforms where they are visible to literally everyone. In any competitive market, that is a losing game.

A modern, proactive strategy flips this entire model on its head.

Instead of buying leads, you build a proprietary engine that uncovers exclusive opportunities before they ever hit the mainstream. This shift is what moves you from being just another investor in the crowd to the owner of a unique, powerful, and sustainable deal pipeline. It gives you a real advantage.

Building Your Pipeline from the Source with County Data

To consistently find the best off-market deals, you have to go straight to the source. Forget the national aggregators and those recycled lists everyone else is using. The real gold is buried in public records at the county level, where the first whispers of seller distress show up long before a property ever hits the mainstream market.

This is where you build an exclusive, proprietary pipeline. By tapping into raw, hyperlocal data, you get a powerful first-mover advantage, spotting opportunities your competition doesn't even know exists yet.

It’s a fundamental shift from being reactive to proactive. You stop chasing deals and start engineering a system that brings them to you.

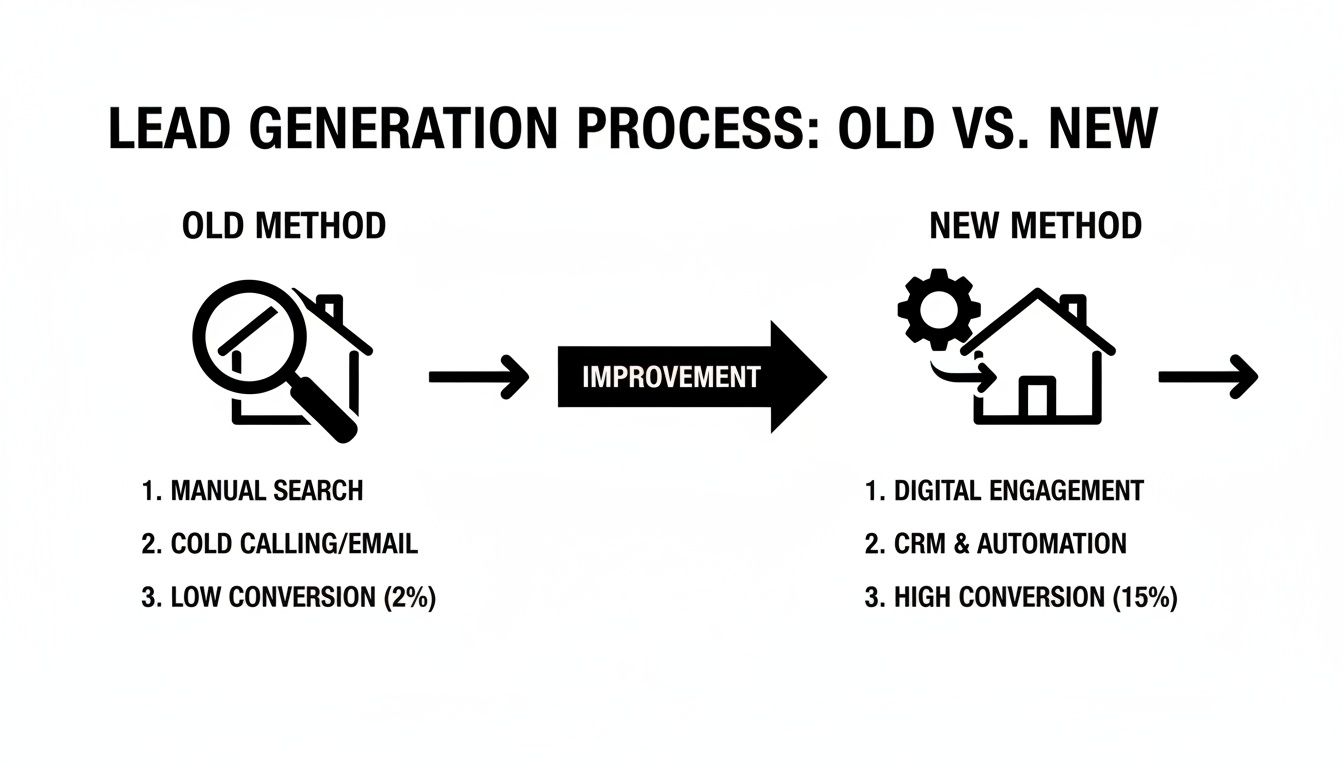

As you can see, the results speak for themselves. Building your own pipeline from source data isn't just a different method—it's a better one.

Understanding High-Value Distress Signals

Not all leads are created equal. The trick is knowing which county-level data points signal the highest seller motivation. These aren't just names on a list; they are blinking red lights for real-life situations that often require a quick, as-is property sale.

Below is a breakdown of the signals I’ve found to be the most potent. These are the situations where a motivated seller is most likely to welcome a fair cash offer that solves their problem.

| Data Source | What It Signals | Why It Matters for Investors |

|---|---|---|

| Probate Filings | A property owner has passed away, and the estate is in court. | Heirs are often out-of-state, emotionally drained, and eager to sell the property quickly to settle the estate. |

| Tax Liens & Delinquencies | The owner is behind on property taxes. | This is a classic sign of financial distress. The pressure to pay the debt before the county forecloses creates a highly motivated seller. |

| Code Violations | Citations for issues like structural problems or unpermitted work. | Mounting fines can force a sale, especially for landlords or homeowners who can't afford the repairs. Selling becomes the easiest path forward. |

| Pre-Foreclosures | The homeowner has defaulted on their mortgage but hasn't lost the property yet. | The ticking clock of an impending auction creates immense pressure to find an alternative, like a fast cash offer from an investor. |

Focusing on these specific data points moves you from a shotgun approach to a sniper rifle, targeting only the most likely-to-convert opportunities in your market.

Why Hyperlocal Data Wins Every Time

National lead providers are notorious for repackaging old, diluted data. County-level information, on the other hand, is as fresh as it gets—straight from the source. This hyperlocal focus gives you an unmatched competitive edge.

You’re not just getting a name and an address. You're getting insight into the specific circumstances driving a potential sale right in your backyard. This allows you to tailor your outreach with genuine empathy and a relevant solution, which dramatically increases your response rates. For a deeper dive, check out our guide on how to perform a county property records search.

This approach is especially powerful right now. We have a massive housing shortage—one Hines report estimates a gap of 6.5 million housing units. This supply-and-demand imbalance means that distress signals are converting into real investment opportunities at higher rates than ever before.

The goal is to stop buying leads and start manufacturing opportunities. When you build your pipeline from county data, you control the quality, volume, and exclusivity of your deal flow.

Tapping into the Source Data

So, how do you actually get your hands on this information? You have two main options, each with its own trade-offs.

The DIY Approach

You can physically go to the county courthouse or try to navigate their online portals to pull records yourself. This is the most direct method, but it's incredibly time-consuming and often involves wrestling with clunky, outdated government websites. To round out your research, a specialized Zillow.com data scraper can also help pull complementary property details from public-facing sites.

Partnering with a Data Service

A much more scalable solution is to work with a service that does the heavy lifting for you. These companies are experts at scraping, cleaning, and organizing messy county data from hundreds of sources. They can deliver a steady stream of pre-vetted, exclusive leads right into your CRM, freeing you up to focus on what you do best: talking to sellers and closing deals.

Whichever path you choose, the principle is the same. Owning your lead generation process by going directly to the source is the single most impactful shift you can make to grow your real estate investment business.

Using AI and ISAs to Qualify Leads at Scale

So, you've got a steady stream of exclusive, data-backed leads coming in. That's a huge win, but it quickly creates a new problem: volume. How in the world do you sift through hundreds of potential opportunities without completely burning out your team or letting great deals slip through the cracks?

The answer isn't to work harder; it's to build a smarter qualification machine. This is where you blend the raw power of artificial intelligence with the nuanced touch of a human expert.

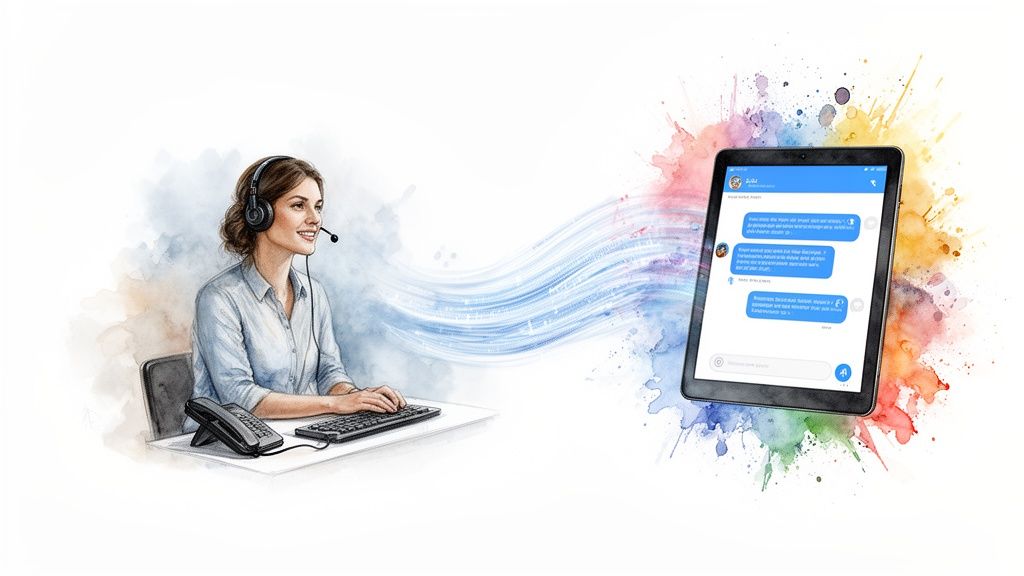

This hybrid approach lets you engage every single lead the second it hits your pipeline, while saving your most valuable resource—your time—for conversations with sellers who are actually motivated to make a deal. It's all about converting that raw data into booked appointments, efficiently.

This is the ideal handoff: automated systems tee up the opportunities, and your human experts knock them down.

The Role of the AI ISA

Think of an AI-powered Inside Sales Agent (ISA) as your first line of defense. It’s an ‘always-on’ system that never sleeps, gets tired, or misses a text. The moment a new distress signal enters your system, your AI ISA should spring into action, making that first contact within seconds.

Speed is everything here. Study after study shows that the odds of actually qualifying a lead plummet after the first five minutes. An AI ensures you're always the first to reach out, giving you a massive leg up on the competition.

The AI's primary job is simple: handle the initial screening and filter out the noise. It can fire off a few foundational questions to quickly figure out if a lead is even worth a human's time. These quick filters are crucial for keeping your pipeline clean and your team focused.

A good AI ISA will handle these key screening tasks:

- Confirming Intent: A simple "Are you the owner and are you thinking about selling?" can weed out a surprising number of duds.

- Basic Property Details: It can gather the essentials, like confirming the property address and ownership.

- Initial Motivation Check: Asking simple, non-intrusive questions helps gauge if there's any real interest.

This automated first touch is a game-changer. It frees your human team from the soul-crushing, low-yield task of chasing down every single data point. Instead, they can focus entirely on leads that have already been warmed up and have confirmed they're open to a conversation.

Human ISAs for the High-Stakes Conversations

Once the AI has done the initial filtering, the truly promising leads get handed off—seamlessly—to a skilled human ISA. This is where empathy, intuition, and real negotiation skills come into play. While AI is fantastic for speed and scale, you need a human to navigate the complex emotions that often come with a distressed property sale.

A human ISA’s role is to dig deeper, to truly understand the seller’s motivation and situation. This is where you move beyond data points and get to the human story behind the distress signal. If you're new to the concept, we have a complete guide on what an ISA is in real estate that breaks it all down.

A great ISA doesn't just ask questions; they listen. They uncover the seller's core problem—the 'why' behind their need to sell—and then position your offer as the perfect solution.

This is the point where you properly vet a lead against the criteria that define a truly motivated seller.

- Timeline: How fast do they need to sell? Is there a foreclosure auction looming or a hard probate court date?

- Pain Points: What’s the real driver here? Financial hardship? An inherited property they can't manage? Overwhelming repair costs they just can't stomach?

- Property Condition: What's the real state of the house? Does it need a new roof, a foundation repair, or a full gut job that the owner simply can't afford?

- Price Expectation: Are they realistic? Do they have a solid understanding of their property's as-is value, or are they dreaming of a Zillow estimate?

By the time a human ISA hangs up the phone, they should have a complete picture of the opportunity. Then, they take the final step: turning that warm, qualified prospect into a pre-vetted appointment booked directly on your calendar (or your acquisitions manager's). This powerful one-two punch of AI and human expertise ensures you're only spending time on deals that actually have a high probability of closing.

Automating Outreach to Maximize Conversions

Getting a pipeline of high-quality real estate leads for investors flowing is a huge win, but honestly, it's only half the battle. A fantastic lead is completely worthless without timely, persistent, and effective follow-up. This is exactly where I see most investors drop the ball, letting golden opportunities die on the vine because their communication is all over the place.

The fix? Build an automated, multi-channel outreach system. This isn't about spamming people; it's about nurturing prospects from the very first touchpoint all the way to a signed contract. Forget the generic, one-size-fits-all templates. A winning strategy means creating automated sequences that feel personal, build trust, and ensure not a single lead ever falls through the cracks.

The whole point is to deliver the right message through the right channel at just the right time. Do that, and you'll stay top-of-mind when they're finally ready to make a move.

Designing a Multi-Channel Follow-Up Sequence

Relying on just one channel for your outreach is a recipe for failure. It's just not how people work. Some sellers live on text messages, others prefer email, and a surprising number—especially those in distress—are best reached through old-fashioned physical mail. A truly robust system combines all three to maximize your chances of making a real connection.

Your goal is to create a "surround sound" effect. You want your brand to pop up in multiple places, reinforcing your credibility and showing you're serious. This multi-pronged approach dramatically boosts response rates compared to just hammering a list with cold calls.

Here’s what a typical multi-channel sequence might look like in the real world:

- Day 1: An initial, personalized SMS message goes out moments after a lead is qualified.

- Day 2: A compelling direct mail piece, like a professional postcard or even a handwritten-style letter, gets dropped in the mail.

- Day 4: A follow-up email lands in their inbox, referencing both the text and the mailer, maybe offering a bit of extra value or a soft call-to-action.

- Day 7: A second, slightly different SMS message is sent just to check in.

This layered approach makes sure your message gets through, even if one or two channels get ignored.

Crafting Messaging That Connects

The absolute key to effective outreach is empathy. Your messaging has to acknowledge the seller's likely situation without being pushy or aggressive. Generic scripts that scream "I want to buy your house for cheap!" will get you deleted and blocked. Fast.

Instead, you need to tailor your communication to the specific distress signal you identified.

A probate lead requires a message of condolence and patient assistance. A code violation lead needs a message that offers a fast solution to a frustrating problem. Personalization is what separates a welcome solution from unwanted spam.

Here are a few messaging angles that actually work:

- For Probate Leads: "My condolences for your family's loss. I specialize in helping families handle inherited properties with a simple, no-hassle process, allowing you to focus on what's most important right now."

- For Tax Lien Leads: "I saw the public notice regarding the taxes on [Property Address]. These situations can be stressful, and I may be able to provide a quick cash solution that resolves the debt and puts money in your pocket."

- For Code Violation Leads: "Dealing with city violations and repairs can be a major headache. We buy properties in as-is condition, meaning you wouldn't have to fix a single thing. We can close quickly and take care of the issues for you."

This kind of tailored approach shows you’ve done your homework and you’re offering a genuine solution to their specific problem.

Integrating Your CRM for Flawless Execution

This whole outreach system needs to be anchored by your Customer Relationship Management (CRM) platform. Think of it as the central brain of your operation—it automates tasks and makes sure nothing gets missed. When your lead sources, AI qualifier, and outreach channels are all talking to your CRM, that’s when the magic happens.

A proper integration lets you build workflows that trigger automatically based on a lead's status. For example, when an ISA qualifies a lead and flips their status to "Warm" in the CRM, it can instantly:

- Enroll the lead into the right multi-channel follow-up sequence.

- Create a task for an acquisitions manager to personally call the lead in 48 hours.

- Set a reminder to check in a week later if there's been no response.

Trying to manage this level of organization manually is impossible once you start to scale. By connecting your systems, you build a machine that executes your follow-up strategy perfectly, every single time. To get a better handle on setting up these kinds of workflows, check out these marketing automation best practices for a deeper dive into the mechanics.

This systematic approach builds trust through sheer professionalism and persistence, which will dramatically increase your conversion rate from lead to deal.

How to Track the KPIs That Actually Matter

Having a steady stream of qualified real estate leads for investors is a great start, but it's just raw material. If you want to transform your lead generation from a series of hopeful campaigns into a predictable, scalable business machine, you have to live and breathe your data.

That means obsessing over the right Key Performance Indicators (KPIs).

Tracking the right numbers gives you a crystal-clear map of your entire pipeline, from the moment a lead enters your system to the day you close the deal. It’s how you stop guessing and start making data-driven decisions to optimize your outreach, sharpen your qualification scripts, and accurately forecast your deal flow.

This isn’t just about staring at spreadsheets; it’s about building the confidence to pour gas on the fire and scale your operation.

The current market makes this more critical than ever. Investor demand for real estate leads is rebounding right alongside transaction volumes, creating one of the strongest environments for systematic lead generation in years. Over the last year, global real estate transaction volume hit $739 billion, a 19% year‑over‑year jump as investors jumped back into the market.

This flood of capital means more active sellers and a much higher density of actionable leads. Efficient tracking is the only way to capitalize on it.

Defining Your Core Funnel Metrics

To really get a grip on your business, you need to track metrics that follow a lead through its entire lifecycle. Forget vanity metrics like website visits or social media likes. Focus on the numbers that directly hit your bottom line.

These are the core KPIs that the most successful investors are obsessed with:

- Cost Per Lead (CPL): This one's simple: your total marketing and data spend divided by the number of raw leads you generated. It tells you exactly how much it costs to get a potential deal into the top of your funnel.

- Cost Per Qualified Appointment (CPA): This measures what it costs to turn those raw leads into actual, pre-vetted appointments on your calendar. It’s a vital sign for the health and efficiency of your qualification engine.

- Cost Per Acquisition (CAC): The holy grail. This is your total spend divided by the number of closed deals. Knowing your CAC is the only way to know if your entire operation is truly profitable.

Keeping a close eye on these three metrics gives you the complete financial picture of your lead generation machine.

Building an Integrated Data Dashboard

The only way to track these KPIs effectively is to get your systems talking to each other. Your data sources, AI qualifiers, and CRM need to be fully integrated. Once they are, you can build a dashboard that gives you a real-time, bird's-eye view of your whole pipeline.

A well-designed dashboard should immediately answer your most important questions:

- Which lead sources are giving me the cheapest appointments?

- What’s our average lead-to-appointment conversion rate?

- How long does it take, on average, to turn a lead into a closed deal?

Having a single source of truth for your data is non-negotiable for scaling. It rips the guesswork and emotion out of your decision-making, letting you double down on what’s working and mercilessly cut what’s not.

For instance, you might see that your CPL from probate leads is high, but your CPA is incredibly low. That's a clear signal that those leads are high-quality and well worth the initial investment. On the flip side, if a direct mail campaign has a low CPL but almost never converts to an appointment, you know it’s time to rethink your messaging or targeting for that channel.

Optimizing Based on Performance Data

Once your tracking is dialed in, you can start making surgical improvements. The data will shine a spotlight on bottlenecks and opportunities you would have completely missed otherwise.

Start by looking at your funnel conversion rates, step by step:

- Lead to Contact Rate: What percentage of raw leads does your AI or ISA team actually engage with? If this is low, your initial outreach (your SMS or email copy) might need a rewrite.

- Contact to Appointment Rate: Of the leads you connect with, how many become qualified appointments? A low number here could mean your ISAs need better training or your qualification scripts are off.

- Appointment to Offer Rate: How many of your appointments result in an offer being made? This metric tells you a lot about the quality of your appointments and the effectiveness of your acquisitions team.

- Offer to Contract Rate: The final hurdle. This shows how well your offers are landing with sellers and how strong your team's negotiation skills are.

While you're zeroing in on lead gen KPIs, don't lose sight of what happens after you acquire a property. Efficient property management can massively impact your overall performance and free up capital for new deals. Using one of the best property management apps, for example, lets you track your existing portfolio's performance with the same data-driven rigor.

This holistic view—from lead to leased property—is what separates the amateurs from the professional operators.

Common Questions About Building a Lead Engine

As you start thinking about moving from theory to actually building this thing, you're going to have questions. It's totally normal. Setting up your own lead engine is a big shift in how you operate, and the small details are what make the difference between a frustrating money pit and a profitable machine.

Let's tackle the most common questions I hear from investors.

Is Scraping County Data for Real Estate Leads Legal?

This is usually the first question people ask, and for good reason. The short answer is yes, it's completely legal to access and use this data.

All of that information you find in county records—probate filings, tax liens, code violations, you name it—is public record. By law, governments have to make it accessible. That's why you can walk into a courthouse or browse a clunky government website and pull this information yourself.

But here's the critical part that most people miss: there’s a huge difference between getting the data and using the data to contact people.

The data itself is public. How you contact the people behind that data is heavily regulated. You have to play by the rules, like the Telephone Consumer Protection Act (TCPA) for texts and calls, or CAN-SPAM for emails.

This is where working with an expert service is a game-changer. They don't just do the heavy lifting of gathering and cleaning up messy county data. They make sure every bit of outreach done on your behalf is compliant. That protects you from the massive legal headaches and fines that come with sloppy marketing, letting you focus on what you do best: closing deals.

What Does It Cost to Build a System Like This?

The investment can vary wildly depending on whether you go it alone or bring in a partner. Let's look at both paths.

The DIY Approach

Trying to build this from scratch is a massive undertaking, and the costs add up faster than you'd think.

- Data Scraping: You're looking at hiring developers or data scientists to build and—more importantly—maintain scrapers for dozens, if not hundreds, of different county websites. Each one is a unique, buggy mess.

- Team Building: You’ll have to recruit, hire, and train your own team of Inside Sales Agents (ISAs) to actually call and qualify the leads your scrapers find.

- The Tech Stack: You'll need to pay for a solid CRM, a platform for sending SMS, emails, and direct mail, plus all the custom software to make them talk to each other.

This route gives you total control, but don't be surprised if it runs you tens of thousands of dollars a month just to keep the lights on.

The Managed Service Approach

This is the path most successful investors take. You partner with a specialized company that has already sunk the capital into building the technology and training the talent. You're essentially paying a monthly fee to plug into their proven, fine-tuned system.

It's easy to get sticker shock, but you have to think in terms of ROI. The right partner isn't selling you a service; they're delivering a result. The conversation shifts from "How much does this cost?" to "What's my cost per qualified appointment and my cost per acquisition?" When you nail those numbers, the monthly fee becomes an investment that pays for itself many times over by eliminating wasted ad spend and boosting your bottom line.

How Many Raw Leads Does It Take to Get One Deal?

This is the classic "it depends" scenario, but I can give you a realistic breakdown of what a healthy funnel looks like. The most important thing to remember is that quality crushes quantity, every single time. I'd rather have a hundred fresh, high-intent distress signals from local county data than a thousand stale leads from some national list broker.

Here's a sample of what the numbers might look like in practice:

- Top of Funnel: Start with 100 high-quality, pre-vetted distress signals pulled directly from county records.

- Qualification Stage: Out of those 100 signals, your team might successfully engage and qualify 15-20 homeowners, booking them as actual appointments on your calendar.

- Offer Stage: From those appointments, you'll probably find that 5-7 properties are worth making a serious offer on.

- Closing Stage: And from those offers, you can realistically expect to close 1-2 deals.

Of course, these numbers can swing based on your market, how sharp your team is, and how relentless your follow-up is. But it clearly shows why having a killer pre-qualification process is non-negotiable. It’s how you sift through the noise to find the handful of truly motivated sellers ready to talk, saving you an incredible amount of time.

Can This System Find Buyer Leads Too?

Absolutely. While this guide has been all about finding motivated sellers, you can use the exact same data-driven approach to find the other crucial players in your market: cash buyers.

You just flip the script. Instead of looking for signs of distress, you start hunting for signs of activity. By digging into public records, you can pinpoint the people and companies actively scooping up properties for cash in your backyard.

- Deed Records Analysis: You can filter property deeds to find buyers who purchased without a mortgage. That's a dead giveaway for a cash deal.

- LLC Ownership Data: Serious investors often buy through LLCs. Tracing the ownership of these companies uncovers the real power players in your market.

- Assignment of Contracts: You can also spot investors who are actively wholesaling deals by looking at assignment records, making them perfect potential partners or buyers for your properties.

Suddenly, your lead engine isn't just for finding deals—it's a tool for total market domination. You can use it to source off-market opportunities and build a private, high-quality list of cash buyers ready to take them off your hands.

Ready to stop fighting over stale lists and start owning your deal flow? At Tab Tab Labs, we build proprietary lead engines that deliver exclusive, pre-qualified appointments directly to your calendar. Schedule a free strategy call today to see how we can build a predictable pipeline for your business.