Using Public Records On Home Sales for Real Estate Growth

Unlock growth with public records on home sales. Learn to find, analyze, and use property data to connect with motivated sellers and close more deals.

By James Le

Public records are the bedrock of any real estate transaction. These are the official documents—deeds, tax assessments, sales histories—that detail every property deal. Managed at the county level, they provide the unfiltered truth about a property's history, from sale prices to ownership changes. For savvy investors and brokers, they're pure gold.

Why Public Records Are Your Untapped Goldmine

Forget fighting over stale, syndicated lists that have been sold to dozens of your competitors. The real competitive advantage in real estate lies in raw, direct-from-the-source data. The smartest people in the business are turning to public home sales records to uncover opportunities long before they ever sniff the open market.

This isn't just about looking up a single property. It's about building a strategic asset—an exclusive, predictable pipeline of off-market deals. By tapping into this unfiltered data, you can pinpoint distressed properties, identify motivated sellers, and get a real feel for market trends at the ground level.

The Strategic Value of Raw Data

Most real estate pros are stuck relying on the MLS or third-party data aggregators. Sure, it's convenient, but that data is often delayed, incomplete, or just plain wrong. It’s been filtered, repackaged, and resold so many times that its value is diluted, putting you in a crowded race to the bottom.

Public records, on the other hand, are the source of truth. They are filed directly with government bodies and contain the unvarnished details of every transaction.

Tapping into public records directly is like drinking from the source instead of a downstream tributary. You get the purest information first, giving you a critical timing advantage over competitors who are waiting for that same data to trickle down to them.

This direct access is non-negotiable for anyone serious about scaling their business in today's market.

Key Records and What They Reveal

Different records tell different stories. Understanding which documents to pull is the first step in building a powerful intelligence system. Each one offers a unique angle for spotting an opportunity.

Here’s a breakdown of the most valuable record types and the kind of actionable intelligence they provide.

Key Public Record Types and Their Strategic Value

| Record Type | What It Is | Strategic Insight |

|---|---|---|

| Deeds | The legal document proving ownership transfer from seller to buyer. | Track sales velocity, identify recent buyers who might be your next sellers, and spot out-of-state or corporate owners who could be motivated to sell. |

| Tax Assessments | The county's official valuation of a property for tax purposes. | Reveals owner info, property characteristics (sq. footage, year built), and value history. A sudden drop in assessed value could signal distress. |

| Sales Histories | A chronological list of every time a property has been sold and for how much. | The best way to estimate potential equity. Long-term owners (10+ years) are often prime candidates for selling. |

| Liens & Judgments | Records of financial claims against a property (tax liens, contractor liens, court judgments). | These are powerful indicators of financial distress and point directly to motivated sellers who might need a fast, off-market offer. |

By cross-referencing these documents, a clear picture of a property's story—and its owner's potential motivation—begins to emerge.

For a deeper dive, our guide on a comprehensive county property records search can show you exactly what to look for.

Understanding Broader Market Dynamics

Looking at these records in aggregate also paints a picture of the wider market. For instance, market data reveals that United States existing home sales reached an annualized rate of 4.35 million units in December 2025, a 5.1% monthly increase and the highest level in nearly three years.

This surge followed a major slump, with 2023 sales dipping below levels seen during the 2007-2010 subprime mortgage crisis. Trends like these, visible through public sales data, help you understand inventory, demand, and the timing of market recoveries. You can explore more data on existing home sales to see these patterns firsthand.

By interpreting these signals, you can move from being reactive to proactive, building a business that thrives in any market cycle.

How to Reliably Access Property Records

Sourcing public records on home sales can feel like chasing ghosts, but it's simpler than you think once you know where to look. The most reliable, up-to-the-minute information comes directly from the source. Your journey always begins at the county level.

These local government bodies are the official keepers of every single property transaction. They're the gold standard. Your first stop should almost always be the online portals for the county recorder (sometimes called the county clerk) and the tax assessor. Think of these websites as the digital front doors to the data you're after.

Navigating County Websites Like a Pro

Let's be honest, most government websites are clunky and feel like they were designed in another decade. Mastering them is a skill in itself. They often lack modern search features, so you have to know exactly what you're looking for and, more importantly, what to call it.

Success comes from using precise, official terminology. Searching for general terms like "home sale" or "foreclosure" will get you nowhere fast. You need to speak their language. Using the specific titles of the documents they file will cut through the noise and deliver exactly what you need.

Here are the keywords that will actually get you results:

- Grant Deed or Warranty Deed: Your go-to for recent sales and ownership transfers.

- Notice of Default (NOD) or Lis Pendens: These signal that a property is entering pre-foreclosure.

- Tax Lien: This points to properties with unpaid taxes, a classic sign of distress.

- Assessor Parcel Number (APN): Use this for laser-focused searches on a specific property.

Knowing these terms is the difference between a frustrating afternoon and a productive one. When you understand the system, you can filter through thousands of irrelevant documents to find truly actionable data.

When Digital Fails: The In-Person Approach

Believe it or not, not every county has its records fully online. In many rural or less-populated areas, you'll need to go old-school and physically visit the county clerk's or recorder's office. This might sound like a hassle, but it's often a goldmine. You'll gain access to records your digital-only competitors will never see.

Once you're there, you'll likely use a public access terminal—a dedicated computer for searching their internal database. The staff can be an incredible resource, so don't be shy about asking for guidance on how their system works. If you find a relevant document, you can usually request a copy for a small fee.

Going in person might seem inefficient, but it’s a powerful strategy for uncovering hidden gems. The records you find there are often completely untapped, giving you a significant first-mover advantage in less competitive markets.

The Role of Third-Party Data Aggregators

Of course, there are plenty of third-party data aggregators that package and sell public records. These services are convenient, offering cleaned-up data from multiple counties in one place. But that convenience comes at a price—both in dollars and in data freshness.

Aggregators pull their data from the same county sources you can access yourself. This means there's an inherent delay between when a record is filed and when it shows up in their database. For time-sensitive opportunities like pre-foreclosures, that lag can mean the difference between landing a deal and showing up too late.

While these services have their place, relying on them exclusively is a mistake. The real power lies in building your own data pipeline. This involves mastering the art of scraping real estate data efficiently and legally to build your own proprietary dataset. Finding the property owner is a critical part of this, and our guide on how to find a property owner for free offers more strategies.

When you go direct-to-source, you stop being a consumer of stale lists and become a creator of exclusive opportunities.

Turning Raw Data Into Intelligence You Can Actually Use

Getting your hands on public records is really just the starting line. The raw files you pull from a county clerk's website are almost always a complete mess—inconsistent, riddled with typos, and full of duplicates. The real work, where the actual value is created, is in turning that digital chaos into a clean, powerful asset.

Anyone can download a file. The pros are the ones who can make that data work for them. It’s about building a reliable, predictable engine that becomes the bedrock of your entire marketing and outreach system.

How to Get Data in Bulk Without Losing Your Mind

Pulling one record at a time is fine if you’re just checking on a single property, but it’s a hopeless strategy if you're trying to build a real pipeline. You need to get data at scale, and that usually means web scraping.

Think of a web scraper as a bot you program to visit a county recorder’s site, hunt down specific documents like deeds or tax liens, and copy all the important info into a spreadsheet. It can do in minutes what would take a person weeks of mind-numbing work. This is how you build a substantial list quickly.

But with great power comes great responsibility. You absolutely must respect a website's terms of service. Don't hammer their servers with a constant stream of requests; that's a quick way to get your IP address blocked. Good scraping is about efficiency, not exploitation.

The Legal and Ethical Guardrails You Can't Ignore

It's critical to know the rules of the road. While the information itself is public, the way you get it is subject to regulation. Running afoul of a site's terms of service or, worse, the Computer Fraud and Abuse Act (CFAA), can land you in serious trouble.

Always play the long game. The goal is to build a sustainable business, not to chase a short-term win that comes with massive legal risks. If a site offers an API for data access, use it. It's their sanctioned method. If not, scrape responsibly by making your bot behave like a human—slow down, take breaks, and don't be greedy.

The Only Data Fields That Really Matter

Once you've got a mountain of raw data, you need to decide what's signal and what's noise. Your first pass should be ruthless, focusing only on the data points that will actually drive outreach and help you make decisions.

Here's the bare minimum you need to capture:

- Property Address: The physical location of the house.

- Owner's Full Name: You can't personalize anything without this.

- Owner's Mailing Address: This is the golden ticket. It's often different from the property address and is where your direct mail actually needs to land.

- Sale Date and Price: Essential for calculating equity and understanding the property's history.

- Document Type: Was it a Grant Deed? A Notice of Default? A Tax Lien? This context tells you the story behind the data point.

- Assessor Parcel Number (APN): This is the unique ID for a property and your best weapon against duplicate records.

Nail these down, and you have a solid foundation to build on. Now, the real fun begins: cleaning it all up.

Data Hygiene: A Checklist for a Clean List

Let's be blunt: raw public data is filthy. You'll find "St." and "Street" used interchangeably, names in ALL CAPS, and the same property listed five different ways. This junk will kill your marketing budget if you don't fix it. Data hygiene isn't just a nice-to-have; it's non-negotiable.

Here’s a practical checklist to get your data into fighting shape:

- Standardize Addresses: Pick one format and stick with it. Convert every 'St.', 'St', and 'Street' to 'Street'. Do the same for 'Apt' vs. 'Apartment' and 'Dr' vs. 'Drive'. Consistency is king.

- Kill the Duplicates: Use the APN (or a combination of owner name and property address) to find and merge duplicate records. You don't want to mail the same person three times for the same property.

- Fix the Names: Get names into proper case ('John Smith' instead of 'JOHN SMITH'). If you can, parse them into separate 'first name' and 'last name' columns for better personalization.

- Validate Mailing Addresses: Before you spend a dime on postage, run your list through an address validation service. It’s cheap and will stop you from mailing to vacant lots and bad addresses.

Enriching Your Data for a True Competitive Edge

A clean list is good. An enriched list is where you start printing money. Data enrichment is all about layering on new information from other sources to make your records more powerful.

The most valuable type of enrichment in this business is skip tracing. A good skip tracing service takes the owner's name and mailing address and finds their phone numbers and email addresses. Suddenly, you've unlocked entirely new ways to reach them—cold calls, text messages, even targeted social media ads.

By following this path—bulk acquisition, rigorous cleaning, and strategic enrichment—you take a messy pile of public records and forge it into a precision-guided marketing weapon. This is the engine that powers any serious automated lead generation system.

Building an Automated Lead Generation Machine

Clean, enriched public records aren't just a static asset; they are the fuel for a powerful, automated lead generation machine. This is where your data truly starts to work for you, shifting your process from manual and reactive to a proactive, always-on engine for growth.

Imagine a new probate filing or pre-foreclosure notice hitting the county records. Instead of you needing to hunt it down, clean it up, and then figure out what to do next, an automated system kicks in instantly. This is the fundamental shift from chasing deals to having qualified appointments simply show up on your calendar.

Designing Your Automated Workflow

The core concept here is to create a direct pipeline from your data source to your outreach channels. When a new record matching your specific criteria—say, a tax lien on a high-equity property—is identified, it triggers a pre-defined sequence of actions. And this happens in near real-time, giving you a critical first-mover advantage.

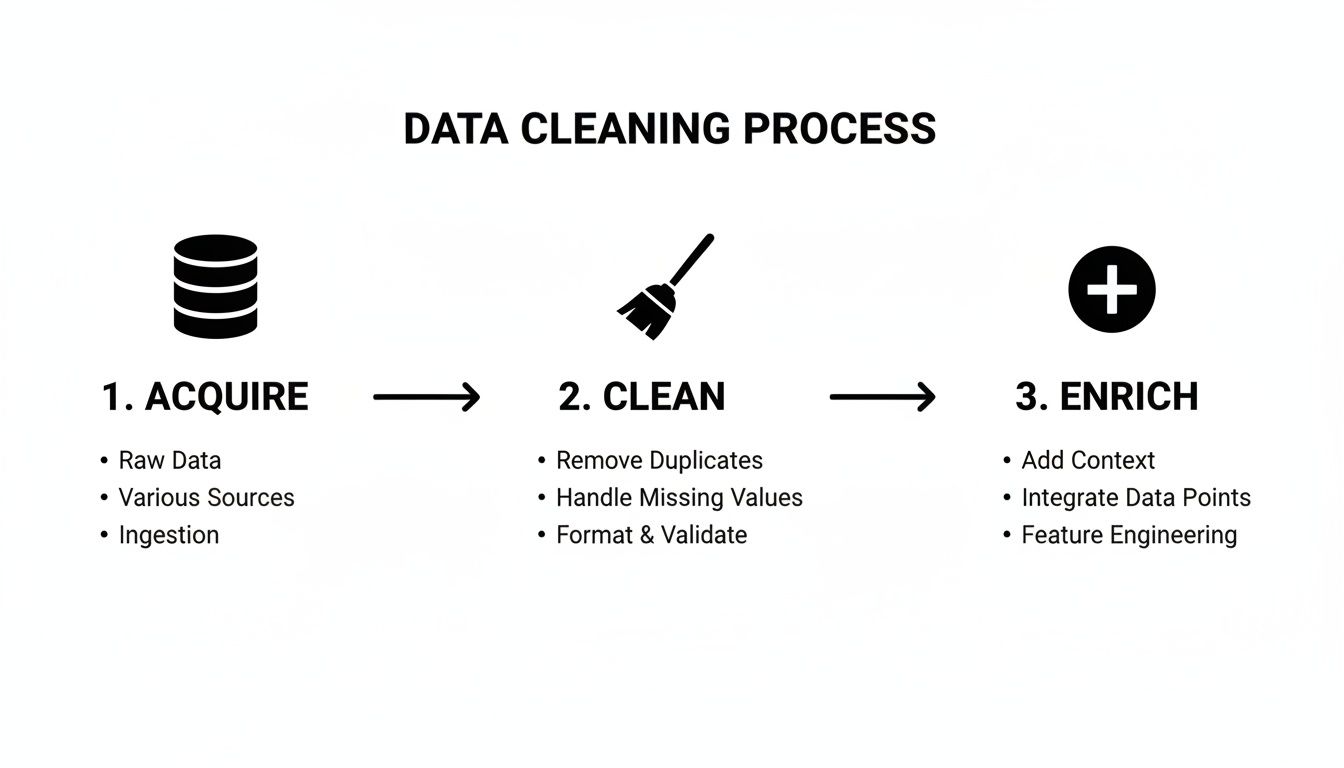

This diagram illustrates the basic flow for getting your data ready for this kind of automation.

This simple process—Acquire, Clean, and Enrich—is the foundational assembly line that feeds your entire marketing system with high-quality, actionable data.

This workflow ensures every lead is standardized and enhanced before any outreach begins, which dramatically boosts the effectiveness of your campaigns. The goal is a system that operates 24/7, engaging potential sellers at the perfect moment.

Real-World Automation in Action

Let’s walk through a tangible example. A new Notice of Default is filed at the county recorder's office. Your system, which is set up to scrape these records daily, immediately flags it.

From there, an automated sequence unfolds without you lifting a finger:

- CRM Integration: The new record, including the owner's name, property address, and mailing address, is instantly pushed into your CRM and tagged as a "New Pre-Foreclosure Lead."

- Direct Mail Trigger: This new entry automatically fires off a command to your direct mail provider. Within 24 hours, a pre-written, empathetic letter offering solutions is printed and in the mail.

- AI ISA Engagement: Three days later, an AI-powered Inside Sales Agent (ISA) sends a carefully worded, compliant text message to the homeowner's number (which you got from skip tracing), referencing the letter and asking if they're open to exploring their options.

This multi-channel approach happens entirely on its own. You're not dialing numbers or licking envelopes; you're just focusing on the high-value conversations that result. To really dial in your lead acquisition, it's worth checking out a comprehensive Automated Lead Generation Guide to see how these principles apply across different industries.

The Rise of the AI ISA

The true game-changer in modern real estate automation is the AI ISA. Think of it as a tireless assistant that can handle hundreds of initial conversations at the same time. Its job isn't to close the deal, but to engage, qualify, and book the appointment.

An AI ISA can screen leads for motivation with stunning efficiency. It asks the right qualifying questions, understands intent from the replies, and determines if a lead is warm enough for a human conversation. This frees up your team from spending 80% of their time chasing down dead-end leads.

This technology isn't just about sending robotic texts. It's about having intelligent, two-way conversations.

Here's a quick look at how that might play out:

- AI ISA: "Hi John, I'm reaching out about your property on 123 Main St. We help homeowners explore all their options, even difficult ones. Are you open to a brief, no-pressure chat about your situation?"

- Homeowner: "Maybe, what are you offering?"

- AI ISA: "We can make a fair cash offer to close quickly, which can be a simple solution for some. Are you the owner of the property?"

- Homeowner: "Yes."

- AI ISA: "Great. Would you be available for a 15-minute call tomorrow at 4 PM to discuss the details with our specialist?"

Once the homeowner agrees, the AI books the appointment directly on your calendar and syncs the entire conversation history into your CRM. All you have to do is show up to the call with a fully qualified, motivated seller. This is how you transform public records from a simple list into a predictable stream of appointments.

Proven Strategies for Investors and Brokerages

Okay, we've walked through the mechanics of getting your hands on public records and even automating the process. But raw data is just that—raw. It doesn't become valuable until you have a solid strategy to put it to work. The real art is knowing precisely which records to chase down and how to shape your outreach to connect with a homeowner's specific situation.

For investors and brokerages, this isn't about buying a generic list and hitting "send." It’s about surgical precision. It’s about understanding someone's circumstances before you ever make contact, which allows you to connect on a much more human level.

The Investor Playbook: Finding Off-Market Deals

Investors live and die by their ability to find motivated sellers before the rest of the market catches on. Public records are the only truly reliable way to get a jump on these exclusive leads. By zeroing in on signals of distress, you can build a pipeline that is virtually free of competition.

The trick is to look beyond simple deed searches. You need to hunt for the kinds of records that point to a problem that a quick, clean cash offer can solve.

Here are the records that separate the pros from the amateurs:

- Probate Filings: When a homeowner passes away, the heirs often inherit a property they either don't want or can't manage. This almost always creates an immediate need for a simple, fast sale.

- Tax Liens: Nothing screams financial hardship louder than unpaid property taxes. Homeowners facing this are typically very motivated to sell to avoid a looming tax sale.

- Code Violations: A string of code violations—think overgrown lawns, peeling paint, or structural issues—often signals a neglected property. This could be an overwhelmed owner or an absentee landlord who's just tired of the headaches. Our guide on creating effective absentee owner lists dives much deeper into this specific niche.

The secret to great outreach isn't just about making an offer; it's about offering a genuine solution. Your message needs to be empathetic and helpful, not predatory. Acknowledge the tough spot they're in and position yourself as a problem-solver.

Think about a pre-foreclosure mailer. Instead of a blunt "I want to buy your house," try something like this: "My name is [Your Name], and I'm a local property owner. I know that dealing with the bank can be incredibly stressful, and I help homeowners find better solutions. If you're open to it, I can make a fair cash offer and we can close quickly, which might help you move forward." This approach builds trust from the get-go and generates far better responses.

The Brokerage Blueprint: Uncovering Listing Opportunities

For brokerages, the playbook is different but just as powerful. Your aim isn't necessarily to find distressed sellers, but to identify homeowners who are perfectly positioned to list their property on the open market. This is where deed records and sales histories become your best friends.

A smart brokerage can use public sales data to tap into two incredibly valuable client pools.

Identifying High-Equity Homeowners

By digging into sales histories, you can easily find homeowners who have been in their property for 10, 15, or even 20+ years. These folks are often sitting on a mountain of equity. They could be empty-nesters ready to downsize or maybe they just haven't realized how much their home is now worth.

Your outreach can be purely educational. Offer a complimentary home equity report. This provides instant value, positions you as a market expert, and opens the door for a natural conversation about listing. It's a soft, data-backed approach that works wonders.

Targeting Move-Up Buyers

Here’s another killer strategy: keep a close watch on recent deed transfers. When a home sells, you know the previous owner is now a "move-up buyer." They have a pocket full of cash from their sale and an immediate need for a new place.

By tracking these sales, you can reach out to these recent sellers with a perfectly timed, tailored message. Offer to help them navigate a competitive market to find their next property. Just like that, one public record has the potential to turn into two commissions—one from the home they need to buy, and a future one when they sell again. This is how the top brokerages use public sales data to really dominate their local markets.

The right public records strategy looks different depending on your role in the real estate world. Whether you're hunting for off-market flips or stocking your pipeline with high-quality listings, the data provides a clear path forward.

Public Records Strategy by Professional Role

| Professional Role | Target Record Types | Primary Goal | Example Tactic |

|---|---|---|---|

| Investor | Probate, Pre-foreclosure, Tax Liens, Code Violations | Find motivated sellers for off-market deals | Send empathetic, solution-oriented direct mail to homeowners in probate, offering a fast cash close. |

| Real Estate Agent | Deed Transfers, Sales History (10+ years), Expired Listings | Generate new listing leads and find move-up buyers | Offer a free home equity report to long-term homeowners to start a conversation about their property's value. |

| Brokerage | All sales data, new construction permits, MLS data | Market analysis, agent recruitment, and lead generation | Track recent sales to identify move-up buyers, then route those leads to agents specializing in that area. |

| Wholesaler | Same as Investors, plus Divorce Decrees and Bankruptcy filings | Secure properties under contract to assign to other investors | Build a highly targeted list of properties with multiple distress signals (e.g., tax lien + code violations). |

Ultimately, success comes down to interpreting the story behind the data. Each record represents a person with unique needs, and the professionals who understand this are the ones who consistently win.

A Few Common Questions About Using Public Records

If you're new to the world of public records for home sales, you probably have a few questions. That's a good thing. Before you commit time and money, you need to be crystal clear on the legality, timing, and strategy.

Let's walk through the most common concerns I hear so you can move forward with confidence.

Is It Legal to Use Public Records for Marketing?

Yes, it's absolutely legal. But there's a huge "but" here: you have to do it the right way. While the information itself is in the public domain, your outreach methods are governed by some pretty strict regulations, like the Telephone Consumer Protection Act (TCPA). This is exactly where a lot of investors and agents trip up.

The records themselves aren't the problem; it's how you use them. The TCPA has iron-clad rules about automated dialing and texting. This is why having a compliant, well-thought-out approach is non-negotiable if you plan to use those channels.

To stay on the right side of the law, many pros stick to safer, yet still highly effective, channels like direct mail. If you're set on using text or phone outreach, the smartest move is to partner with a service that lives and breathes compliance. They'll use carefully designed AI scripts and processes to keep you out of very expensive legal trouble.

How Often Should I Pull New Records?

This really depends on what kind of opportunities you're hunting for. Not all data has the same shelf life, and in a competitive market, timing is everything. A one-size-fits-all schedule will either leave you buried in useless data or a step behind everyone else.

- Daily or Weekly: If you're chasing the most time-sensitive leads—think pre-foreclosures, probates, or fresh tax liens—you need data this fresh. These situations evolve fast, and being the first person to reach out is a massive advantage.

- Monthly or Quarterly: For broader strategies, like finding high-equity homeowners or doing general market analysis, pulling records less often is perfectly fine. This helps you spot trends without getting lost in the day-to-day noise.

The key is to lock in a consistent acquisition schedule that actually supports your specific investment or brokerage strategy.

Should I Do This Myself or Use a Service?

Ah, the classic build-versus-buy dilemma. The right answer for you boils down to three things: your time, your technical skills, and your budget.

Going the DIY route gives you total control. You pick the sources, you build the scrapers, and you handle all the data hygiene yourself. But make no mistake, this demands a serious investment in time and requires a decent amount of technical know-how to pull off effectively.

The alternative is a dedicated service that automates the whole pipeline. These services handle everything from acquisition and cleaning to data enrichment and even that first outreach. It saves you an incredible amount of time and ensures you're working with quality data, but it does come at a cost. Think of it as an investment in efficiency and speed—it frees you up to focus on what you're best at: closing deals, not managing data.

If you're ready to stop fighting over stale lists and start filling your pipeline with exclusive, pre-qualified appointments, Tab Tab Labs can help. We combine proprietary data acquisition with intelligent automation to power your growth. Schedule a free strategy call today and get a sample list to see the quality of our data for yourself.