Your Guide to Buying a Property in Probate for Sale

Discover how to find and buy a property in probate for sale. This guide offers proven strategies for investors to navigate the process and close great deals.

By James Le

When a property owner passes away, their real estate often has to go through a court-supervised process called probate before it can be sold. This happens most frequently when the owner didn't have a will or a trust set up. For savvy investors and agents, this creates a unique window to find motivated sellers and deals that never even touch the open market.

How to Find Off-Market Probate Properties

The single biggest edge you can have in this niche is finding a probate property before it gets listed on the MLS. This is your ticket to sidestepping bidding wars and connecting directly with the estate's executor or administrator—people who often value a quick, no-fuss sale more than squeezing out every last dollar.

This isn't about getting lucky. It's about building a repeatable system to uncover these opportunities right at the source. Forget the generic advice; let's dig into the real-world methods that consistently generate these valuable leads. It comes down to knowing where to look in public records, building genuine relationships with key people in the probate world, and using the right data to stay ahead of everyone else.

Start at the Source: County Records

The most direct route is to go where the information is born: your local county courthouse or the county clerk's office. This is where every probate case is filed, creating a public record that's a goldmine of information. You'll find the name of the deceased, the personal representative handling the estate, and often the attorney involved.

A lot of counties are moving these records online, which is great. You can just log into a portal and search. But some old-school counties still make you show up in person. It can feel like a grind, but this manual effort gives you the absolute freshest data—often weeks or even months before it shows up on any third-party service. You're looking for new probate filings; this is the very beginning of every future probate sale.

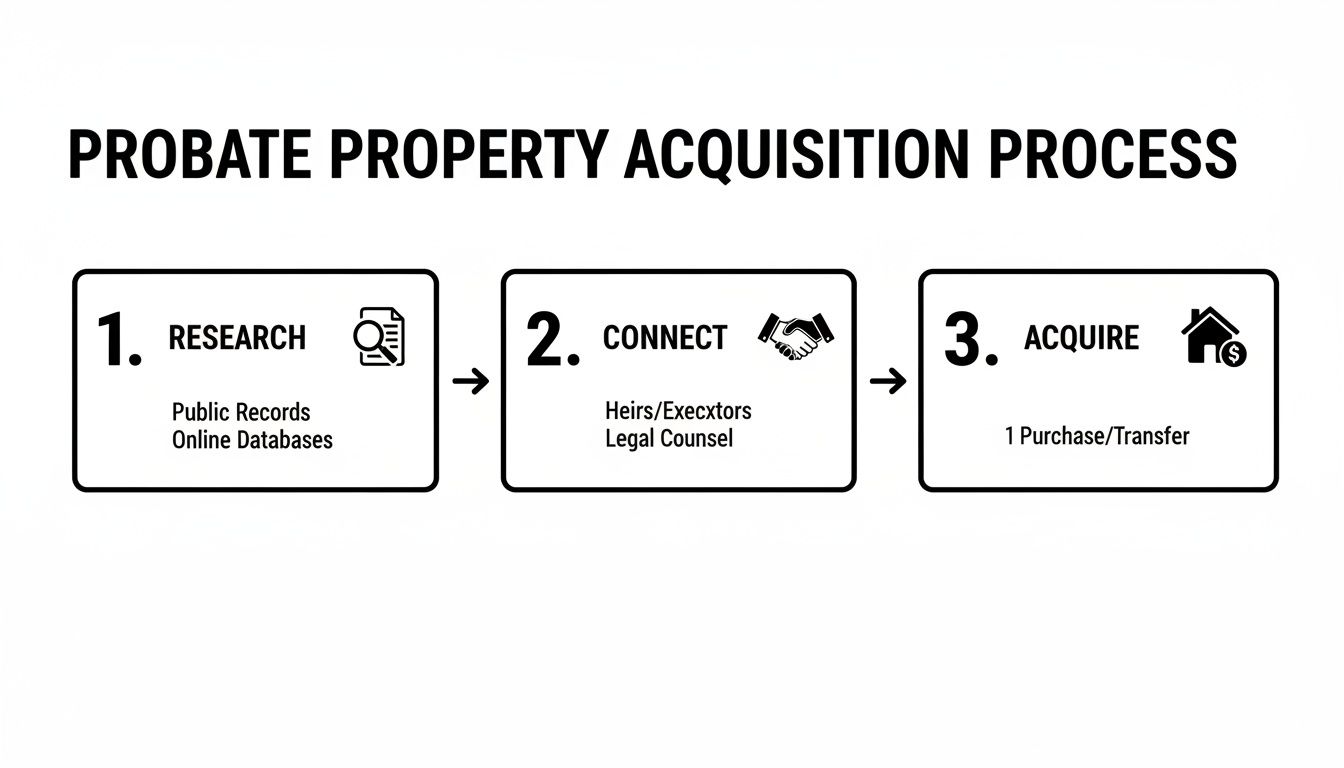

This simple flowchart breaks down the entire acquisition journey into three core phases.

Think of it as a clear roadmap: you start with research, then you connect with the decision-makers, and finally, you move to acquire the property.

Build Relationships With Probate Attorneys

Probate attorneys are the gatekeepers. They are on the front lines, advising executors who are usually overwhelmed and just want straightforward solutions. If you can position yourself as a reliable, fair, and fast-acting buyer, you can become their go-to person whenever a client needs to sell a property.

The trick is to be more than just another investor—be a problem-solver. Offer to provide free property valuations or connect them with your trusted clean-out crew, even for deals you know you won't get. When you lead with value, you build trust. That trust is what turns a cold contact into a warm referral pipeline.

Start by making a list of local attorneys who specialize in estate planning and probate. A quick Google search will get you started. From there, your outreach needs to be professional and laser-focused on how you can make their job easier and help their clients. This is a long game, for sure, but it can create a sustainable, exclusive source of off-market deals. If you want a deeper dive on this, check out our guide on how to build a probate properties list.

Utilize Targeted Data Services and Automation

Let's be real: digging through county records manually provides the freshest leads, but it's not a scalable strategy. This is where specialized data providers and automation tools become your best friend. These companies do the heavy lifting, scraping county records and compiling clean lists of probate filings, saving you dozens of hours.

This frees you up to focus on what actually moves the needle: outreach, follow-up, and negotiation.

Good data services don't just give you the case details; they cross-reference them with property records to pinpoint which estates actually include real estate. To truly tailor your pitch, it helps to understand how real estate investors can benefit from probate properties. Knowing this helps you speak directly to the seller's motivations, where speed and certainty often trump a slightly higher price.

Here’s a quick look at how the old-school manual approach stacks up against modern, automated systems.

Probate Property Sourcing Methods Compared

| Method | Speed & Efficiency | Data Freshness | Scalability | Key Advantage |

|---|---|---|---|---|

| Manual (Courthouse) | Slow, labor-intensive | The absolute freshest | Very low | Unbeatable data freshness; zero competition if you're first. |

| Automated (Data Service) | Fast, instant access | Updated daily/weekly | Very high | Massive time savings and ability to cover multiple markets. |

Ultimately, the most powerful system combines both. Use technology for scale and consistency, but don't be afraid to put in the manual work to get an edge on a hot lead. By blending direct research with smart automation, you create a robust process for consistently finding your next deal.

Navigating the Legal Side of Probate Real Estate

So you've found a promising probate property. Great. Now the real work begins. You’re shifting gears from discovery to due diligence, and this is where a small oversight can derail the entire deal.

This stage is all about understanding the specific legal framework that governs this particular sale. A misstep here won't just cost you time and money; it can kill the opportunity completely.

Your first move? Verify the exact status of the probate case. Your lead might just be an initial filing. You need to know, without a doubt, who holds the legal authority to act for the estate. This person is usually called the executor (if there's a will) or the administrator (if appointed by the court). Confirming their identity is non-negotiable. They are the only person who can legally sign a purchase agreement with you.

Confirming Authority to Sell the Property

Here's something a lot of newcomers miss: not all executors have the same power. Their ability to sell real estate is dictated by the decedent's will and, ultimately, the court. This one detail will shape your entire strategy and timeline.

You'll typically run into one of two scenarios:

- Full Authority: In many states, an executor can be granted "full authority" under the Independent Administration of Estates Act (IAEA). This is the best-case scenario. It allows them to sell the property much like a traditional homeowner, often without needing the court to sign off on every little step. They can set the price, accept your offer, and move things along much, much faster.

- Limited Authority: If the executor has "limited authority," brace yourself for a more bureaucratic process. They can still market the property and accept an offer, but the final sale is subject to court confirmation. Your accepted offer is really just the starting point.

Knowing this difference upfront is everything. A sale with full authority might close in a standard 30-45 day window. A court-confirmed sale? That can easily drag on for several months.

The Court Confirmation Process

If the property in probate for sale you’re chasing requires court confirmation, get ready for a public showdown. Once the executor accepts your offer, their attorney petitions the court for approval. A hearing date is set, and your offer price becomes the opening bid in a live, in-court auction.

Yes, you read that right. Other buyers can literally show up in the courtroom and try to outbid you. The rules for this "overbid" process are very specific. For instance, the first overbid might need to be 5% higher than your offer on the first $10,000 and 10% more on the rest.

This process is designed to get the highest possible price for the estate, but it introduces a huge risk for you. You could do all the work to find and secure the deal, only to lose it at the last minute on the courthouse steps.

Key Takeaway: Before you invest serious time or money, find out if the executor has full or limited authority. This single fact dictates your timeline, negotiation strategy, and risk level.

Researching Title and Uncovering Liens

Beyond the probate court, every property has a past. A thorough title search isn't just a good idea; it's absolutely critical. The previous owner may have left behind debts that are now attached to the property as liens. To get a better handle on the basics, this overview of what probate is and how it works is a great starting point.

Here are some of the usual suspects you might uncover:

- Mortgage Liens: The outstanding home loan always has to be paid off.

- Tax Liens: Unpaid property, state, or even federal taxes can create a claim against the title.

- Creditor Claims: Medical bills and other personal debts can sometimes be secured against the estate's real estate.

- Mechanic's Liens: If a contractor did work on the house and never got paid, they may have filed a lien.

All these issues have to be cleared before the title can be cleanly transferred into your name. Usually, the sale proceeds are used to pay off these debts at closing. But knowing about them upfront gives you a clearer picture of the estate's financial health and can give you leverage in negotiations.

If you're looking for more detail, we break it all down in our guide answering the question, "What is a probate listing?". Getting this legal groundwork right from the start ensures you’re talking to the right person and building a deal that can actually make it to the finish line.

Connecting With Executors and Heirs Authentically

Alright, you've done the legwork. You’ve identified a potential property in probate for sale and have a decent handle on its legal status. Now comes the most delicate part of the whole dance: making first contact.

This isn't your typical sales call or marketing push. You're reaching out to people who are navigating a profound loss, and your entire approach has to reflect that reality.

Forget the generic, mass-produced templates you see floating around. Every piece of outreach needs to be built on a foundation of empathy, respect, and a genuine desire to solve a problem. The goal is to position yourself not as a vulture circling a property, but as a helpful resource offering a straightforward path through a complicated time. Success here is measured in trust, not just in closed deals.

The Power of Empathetic Direct Mail

In an age where everyone's inbox is a disaster, a thoughtfully crafted physical letter can actually cut through the digital noise. But it has to feel personal, or it's just junk mail. A generic "I want to buy your house" postcard is absolutely destined for the recycling bin.

Your letter has to be different.

Start by acknowledging the situation with sincerity. You don't need to be overly sentimental, but a simple, respectful opening line shows you're a human being. From there, immediately pivot to how you can help. Frame your value proposition as a solution to the biggest headaches of probate.

- No Repairs Needed: Make it clear you buy properties "as-is." This alone can lift a massive weight, removing the burden of finding contractors and funding costly repairs.

- No Clean-Outs Required: Offer to handle the contents of the home. For many families, this is the most emotionally and physically draining task of all.

- A Simple, Fast Process: Emphasize the certainty of a cash offer and a quick, predictable closing. This is a powerful contrast to the drawn-out, uncertain nature of listing on the open market.

Keep the letter brief and easy to scan. Use quality paper—it makes a difference. I highly recommend hand-signing each one and using a real stamp. These small details signal that a real person, not some automated mailing service, is behind the communication.

Your first point of contact sets the entire tone. Lead with empathy and a problem-solving mindset. The offer comes much later. Your only goal right now is to start a conversation and build a tiny foundation of trust.

Navigating the First Phone Conversation

If you decide to pick up the phone, your script—or rather, your talking points—must be rooted in the same principles. This is absolutely not the time for high-pressure sales tactics. Your tone should be calm, patient, and genuinely understanding.

The first 15 seconds are everything. You need to immediately state who you are and why you're calling, but do it in a way that’s respectful of their situation. For example, you might try something like, "My name is [Your Name], and I'm reaching out about the estate of [Deceased's Name]. I specialize in helping families with properties in probate and just wanted to see if I could be a resource for you."

Be ready for anything. Some executors will be all business, ready to talk details. Others might be emotional or simply not ready to engage at all. The key is to listen far more than you speak. Let them guide the conversation. Your objective is simply to understand their needs and see if your solution—a fast, as-is sale—is even a good fit for them. For more specific guidance, our article on effective real estate cold calling scripts offers some valuable frameworks to adapt.

Ultimately, your success in connecting with executors and heirs comes down to authenticity. They need to believe you're there to help lift a burden, not just to snag a deal. When you consistently lead with compassion and provide real value, you build a reputation that opens doors others will find permanently closed.

How to Craft an Offer an Estate Can't Refuse

Putting an offer on a probate home isn't like your typical real estate deal. You're not just trying to meet a seller's financial hopes; you're presenting a solution to a legal entity—the estate. And that estate is run by an executor who has a fiduciary duty to the heirs. This changes the game completely. Your offer has to be strong in more ways than just the price.

For an executor, the primary goal often isn't just the highest price, but the highest certainty of closing. They're already navigating a thorny legal process, often while grieving. An offer that promises a smooth, predictable, and quick resolution can easily beat out a slightly higher but riskier bid.

Valuing the Property in Its "As-Is" State

Probate homes are almost always sold "as-is." You need to bake this reality into your valuation from the very beginning. The term "as-is" means the estate won't be making repairs, offering credits, or getting tangled in negotiations after an inspection.

When you're running the numbers, you absolutely must account for:

- Deferred Maintenance: What are the immediate, big-ticket items? We're talking roof, HVAC, foundation, and plumbing. These aren't points to negotiate later; they are line items in your calculation now.

- Clean-Out Costs: These homes are often packed with a lifetime of personal belongings. Don't forget to factor in the cost and sheer labor required for a full property clean-out.

- Market Comps: Pull recent sales of similar homes, but get specific. Filter for properties that were also sold in "as-is" or distressed condition. Comparing a probate property to a fully staged, renovated home will throw your numbers way off.

Getting a professional inspection before you offer can give you real clarity. But even a detailed walk-through with a contractor you trust can help you build a realistic repair budget to subtract from the property's after-repair value (ARV).

Structuring an Offer That Solves the Estate's Problems

Once you've landed on your price, the next move is to package it in the most appealing way possible. For an executor, a clean and simple offer is music to their ears. The objective is to slash contingencies and remove any potential roadblock that could complicate or delay the close.

An executor’s job is to settle the estate efficiently and responsibly. An offer with minimal contingencies and a quick close date isn't just convenient—it demonstrates that you are a serious, capable buyer who will help them fulfill their legal obligations without adding more stress.

Here are a few key elements that will make your offer pop:

- A Strong Earnest Money Deposit: Putting down a significant deposit is a powerful signal of your commitment and financial stability. It tells the executor you have real skin in the game.

- No Financing Contingency: This is the gold standard for probate offers. An all-cash deal, or at least one without a financing contingency, eliminates the risk of a loan falling through. That's a huge point of anxiety for any seller, but especially for an estate.

- A Quick Inspection Period: You still need to do your due diligence, of course. But offering a short, decisive inspection window (or waiving it entirely if you've already done a deep dive) adds to that feeling of certainty the executor is looking for.

- A Fast Closing Date: Proposing to close in 21-30 days can be incredibly attractive. The sooner the property is sold, the sooner the estate can be settled and the assets distributed to the heirs.

Understanding these dynamics is critical. To stay ahead of the curve, it's also smart to keep an eye on broader market forces that influence local competition and pricing. You can get a feel for what's coming by exploring expert analysis on global residential real estate market trends and investment outlook.

By focusing on certainty, speed, and simplicity, you align your offer perfectly with the executor’s duties. This approach shows you get the unique nature of a probate sale and positions you as the best possible solution for the estate.

Ensuring a Smooth and Successful Closing

You’ve navigated the legal maze, built a rapport with the executor, and put together a winning offer. Now for the final stretch: bringing the deal home.

Closing on a property in probate for sale definitely has a few more moving parts than your typical transaction. The secret to crossing the finish line without any drama is a systematic, proactive approach. Once that purchase agreement is signed, the clock starts ticking, and this final stage is all about meticulous coordination and clear communication.

Your Most Important Partner: The Title Company

In any real estate deal, a good title company is your best friend. In a probate sale, they're your lifeline. You simply can't afford to work with just any title or escrow company; you need a team that has a dedicated department or deep, specific expertise in handling probate and estate transactions.

An experienced probate title officer knows exactly what they're looking for. They can anticipate the need for documents like the Letters of Testamentary or Letters of Administration and know how to clear up the title issues common to estates, like old liens or stubborn creditor claims. This kind of experience is what prevents the painful delays that can completely derail a closing.

Choosing a title company without probate experience is one of the most common and costly mistakes an investor can make. Their unfamiliarity with court procedures and required documents can stall the process for weeks, frustrating the executor and putting the entire deal at risk.

Before you commit, vet them with some direct questions:

- How many probate sales have you closed this year?

- Do you have a dedicated probate specialist on staff?

- What’s your process for clearing heirship and creditor claims?

Their answers will tell you everything you need to know about whether they're equipped to handle the job.

Managing the Closing Timeline and Milestones

A successful closing really boils down to managing expectations and sticking to a clear timeline. While every probate sale has its own quirks, the core milestones are pretty consistent.

It all kicks off once the purchase agreement is fully signed. Your title company will open escrow and immediately start their title search. This is when any hidden clouds on the title—unpaid taxes, old mortgages, mechanics' liens—will come to light.

At the same time, you'll be wrapping up your own due diligence if you included an inspection period. It's crucial to get this done quickly to maintain momentum.

Now, if the sale requires court confirmation, that adds a major step to your timeline. The executor's attorney has to petition the court, a hearing date is set, and everyone waits for the judge’s final stamp of approval before you can officially close. This can easily add 30 to 90 days to the process, so you have to factor that potential delay into your plans from the get-go.

From Final Approval to Funding

Once all the contingencies are cleared and you've got court approval (if you needed it), you're in the home stretch. This is where you sign the final closing documents, wire your funds to escrow, and get ready for the keys. The title company handles the grand finale, making sure all the estate’s debts are paid from the proceeds before transferring the remaining balance into the estate's account.

Here's an interesting quirk of our niche: specific market data on probate sales, like average closing times or deal volumes, isn't really tracked by the big real estate research firms. While you can find broad market analysis, like these global real estate outlooks from PwC, they don't drill down into distressed property metrics.

This lack of public data just underscores why having a well-defined internal process is so important. By carefully tracking your own deals and building a network of experienced professionals, you can create a predictable and efficient closing system that gives you a serious edge.

Common Questions About Buying Probate Properties

Even after you get the hang of the probate process, a few nagging questions always seem to pop up. It makes sense—these deals aren't your typical transaction, and the unique quirks can create some uncertainty. Let's tackle some of the most common questions I hear from investors and agents to give you the clarity you need to move forward.

How Long Does It Take to Buy a Property in Probate for Sale?

This is the classic "it depends" answer, but it really boils down to one thing: whether the executor has full or limited authority.

If the executor has full authority, you're in luck. The sale can move almost as fast as a traditional deal. Once they accept your offer, you could be looking at a standard 30-45 day closing, assuming the title is clean. This is the best-case scenario and what you're always hoping for.

But if the sale requires court confirmation, you need to pump the brakes and adjust your timeline. Big time. This step introduces some serious delays. The court has to formally approve your offer, and just getting a hearing on the calendar can take weeks, sometimes months. Worse yet, your "accepted" offer can kick off an overbidding circus right there in the courtroom, which adds a whole new layer of time and stress. Throw in potential title defects or squabbling heirs, and you can see why it’s critical to know the sale's requirements from day one.

Can I Get a Loan for a Probate Property?

Technically, yes, you can get a loan for a probate property. But in the real world of these deals, cash is almost always king. The reason is simple: most probate homes are sold strictly "as-is," which is often a nice way of saying they need a lot of work.

Deferred maintenance, outdated systems, maybe even a leaky roof—these kinds of issues can make it tough for a property to pass a lender's strict appraisal and condition requirements. An all-cash offer that waives the financing contingency is a breath of fresh air for an executor. It screams certainty and eliminates the risk of a loan falling through, which is a huge headache for an estate that just wants to settle up and close out.

The probate process is already a minefield of legal hurdles. An executor’s main goal is usually a clean, predictable closing. A cash offer is the path of least resistance and often wins out, even if a financed offer comes in a little higher.

If you absolutely must use a loan, be completely transparent with your lender from the start. Make sure they understand you're dealing with a probate sale and that the timeline could get stretched out, especially if court confirmation is in the picture.

What Are the Biggest Risks When Buying a Probate Home?

The two monsters hiding in the closet are title issues and the property's physical condition. You're dealing with a property coming out of an estate, so it's not uncommon to uncover hidden liens from creditors, lingering tax problems, or even nasty disputes between heirs that can cloud the title and completely derail the deal.

And since these homes are almost always sold as-is, you have to go in expecting deferred maintenance. The previous owner may have been elderly or ill and unable to keep up with repairs. You could be facing anything from peeling paint to a cracked foundation. The other big risk? Getting outbid in court. You could sink a ton of time, effort, and money into due diligence, only to lose the property to someone who shows up at the hearing with a cashier's check.

Your best defense is an ironclad due diligence process. That means a professional home inspection and a comprehensive title search from a company that knows the ins and outs of probate.

Do I Need a Real Estate Agent Who Specializes in Probate?

While it’s not a legal requirement, I can't recommend it enough. Working with an agent who has verifiable experience in probate sales is one of the smartest moves you can make. This isn't their first rodeo.

The probate process is a different beast, with its own legal procedures, unique paperwork (hello, "Notice of Proposed Action"), and timelines that don't look anything like a normal transaction.

A specialist knows how to navigate the court system, how to write an offer that an executor and their attorney will love, and how to spot potential roadblocks before you crash into them. They'll also have a network of other pros, like probate-savvy title officers and attorneys, who can make your life a whole lot easier. Their expertise is invaluable and can be the difference between a smooth closing and a costly disaster.

At Tab Tab Labs, we live and breathe the complexities of finding and closing distressed property deals. Our Distressed Appointments Engine is built to give you a serious advantage, identifying exclusive opportunities like probate sales before they ever hit the MLS and filling your calendar with pre-qualified seller appointments. Book a free strategy call today to see how we can help you dominate your market.