A Real Estate Pro's Guide to Probate Property For Sale

Discover how to find, market, and close probate property for sale. This guide offers proven strategies for real estate pros to tap into this hidden market.

By James Le

Probate properties are a steady, reliable source of motivated, off-market deals for any real estate pro who knows where to look. When a homeowner passes away, their property often has to be sold to settle the estate and distribute the assets. This process frequently creates opportunities to buy real estate well below its current market value.

The Untapped Goldmine in Probate Real Estate

For most agents and investors, the MLS is the main arena. It works, but it's also a gladiator pit—fierce competition, razor-thin margins. Probate properties are a completely different game, opening up a pipeline of deals that never even sniff the open market.

This isn't just about finding a bargain. It's about stepping in to provide real help to families during an incredibly tough time.

Here's the gist: when someone dies, their assets—including their house—go into a legal process called probate. A court appoints an executor (or "personal representative") to manage the estate. This person's job is to pay off the deceased's debts and hand out what's left to the heirs. It's a huge responsibility.

Why Probate Creates Motivated Sellers

The executor is often under a mountain of pressure. They're likely grieving while trying to untangle a web of legal and financial duties they’ve never seen before. This situation cooks up a unique kind of motivation you just don't find in a standard sale.

- The Clock is Ticking: Executors have a legal duty to settle the estate without unnecessary delays. A vacant house is a money pit, constantly draining the estate with taxes, insurance, and maintenance costs.

- No Sentimental Value: Heirs often live out of state or have no real connection to the house. Their focus is on a fast, clean transaction, not squeezing every last penny out of the sale.

- Cash is King: The estate needs liquid cash to cover everything from medical bills and legal fees to credit card debt. Selling the property quickly is the fastest way to get it.

This is where you come in. You're not just another investor looking to lowball an offer. You become a problem-solver, an expert guide for an executor who desperately needs one.

This niche is only getting more important. With global real estate investments hitting $380 billion in the first half of 2025, the market is stabilizing, but the best deals are found off the beaten path. Probate properties are a massive untapped opportunity for anyone targeting distressed assets.

These deals, typically found by digging through county records instead of browsing Zillow, can come on the market at a 20-30% discount simply because the sale needs to happen now. You can learn more about how these real estate investment trends are shaping the market for savvy operators.

How to Find Probate Leads Before Your Competition

The secret to winning with probate properties isn't complicated, but it does take some hustle: you have to get there first. While your competitors are busy buying the same tired, aggregated lists everyone else has, you can get a serious leg up by going straight to the source—the county courthouse.

This direct approach lets you build your own private pipeline of leads, often weeks or even months before they ever show up in a third-party database. It's the difference between proactively hunting for deals and reactively chasing scraps.

Sourcing Directly From County Records

Every single probate case kicks off with a public filing at the local courthouse. That's your goldmine. Instead of waiting for a data company to scrape, clean, and resell this information, you can get it yourself.

You'll want to keep an eye out for a few key documents that signal the start of the process:

- Petition for Probate: This is the first document filed to open an estate. It’s a treasure trove of information, naming the person who passed away, the potential executor, and often the known heirs.

- Letters Testamentary: Once the court officially appoints the executor, this document gives them the legal power to manage the estate. It confirms exactly who you need to be talking to.

- Inventory of Assets: This one isn't always filed right away, but it's pure gold when it is. It lists all the estate's assets, including the real estate you're looking for.

By keeping a regular eye on these filings, you're essentially creating your own real-time list of potential probate property for sale. If your county has digitized records, knowing the best real estate keywords can make searching a whole lot faster.

Qualifying Your Leads for Maximum Impact

Just collecting names isn't enough. The real work—and where the money is made—is in the qualifying process. This is where you separate the truly motivated sellers from the tire kickers by digging into property and tax data.

Your mission is to find properties that have clear signs of motivation or distress. This is where you connect the dots between the person in the probate filing and the actual house.

Here are the signals I always look for:

- Property Ownership: First, confirm the deceased was the sole owner. If there are other names on the deed or rights of survivorship, the property might not even go through probate, saving you a wasted call.

- Tax Records: Are the property taxes behind? Delinquent taxes are a massive red flag that the estate is short on cash and needs to sell something—fast.

- Code Violations or Liens: Check for any city code violations, overdue utility bills, or mechanic's liens. These problems add a ton of pressure on the executor to offload the property and settle the estate’s debts.

This qualification step is non-negotiable. It turns a raw list of court filings into a curated pipeline of sellers who need to sell, not just want to. You'll save yourself hundreds of hours and make sure every letter you send or call you make has the best possible chance of landing.

As the market finds its footing, these distress signals are more valuable than ever. We saw $193 billion in commercial deals in Q2 2025, showing there's plenty of activity. But the best residential deals are found off-market by spotting unique motivations. Probate filings tied to problems like code violations can give you a 15-25% discount edge, letting you lock up exclusive deals before the big national players even know they exist.

Automating and Scaling Your Sourcing

Look, manually pulling records from the courthouse and cross-referencing everything is a fantastic way to start. It works. But it’s a grind, and it’s not something you can scale as you grow. This is where you bring in the tech.

Platforms like Tab Tab Labs are designed to put this whole workflow on autopilot. They pull data from over nine different county-level sources—probates, tax liens, foreclosures, you name it—and surface those distress signals for you automatically. The system can then qualify the leads and even book appointments with motivated sellers right on your calendar. To get a better handle on building a targeted lead source, check out our guide on how to build a probate properties list.

This is how you shift from being a data miner to a deal closer. You get to focus your time and energy on what actually makes you money: building relationships and negotiating deals, all while the system keeps your pipeline full.

Building Trust and Rapport With Estate Executors

Once you’ve found a promising probate lead, you’re at the most critical—and delicate—part of the whole process: making contact. This isn't like cold-calling a standard For Sale By Owner. You're reaching out to someone who is likely drowning in grief, stress, and a mountain of legal paperwork they never asked for.

Forget the hard sell. Your real job here is to become a trusted resource, someone who can actually simplify their life during a chaotic time. The right approach positions you as a problem-solver, not just another agent or investor chasing a deal. Success hinges on genuine empathy, professionalism, and offering real value from that very first interaction.

The Mindset of an Executor

Before you even think about picking up the phone or writing a letter, you have to get inside the executor's head. They are not typical sellers. Their primary duty isn't always to squeeze every last penny out of the property; it's to settle the estate efficiently and fairly, following the letter of the law.

This responsibility is a massive weight. Executors are often completely overwhelmed with tasks they don't understand, from managing attorneys and court filings to dealing with the physical property itself. A vacant house can become a huge source of anxiety, racking up costs for taxes, insurance, and maintenance. They don't just want a sale—they need a solution. That’s where you come in.

Crafting Your Initial Outreach

Your first point of contact sets the tone for the entire relationship. A generic, sales-heavy postcard or a slick marketing email will go straight into the trash. Your communication has to be respectful, compassionate, and laser-focused on their needs, not yours.

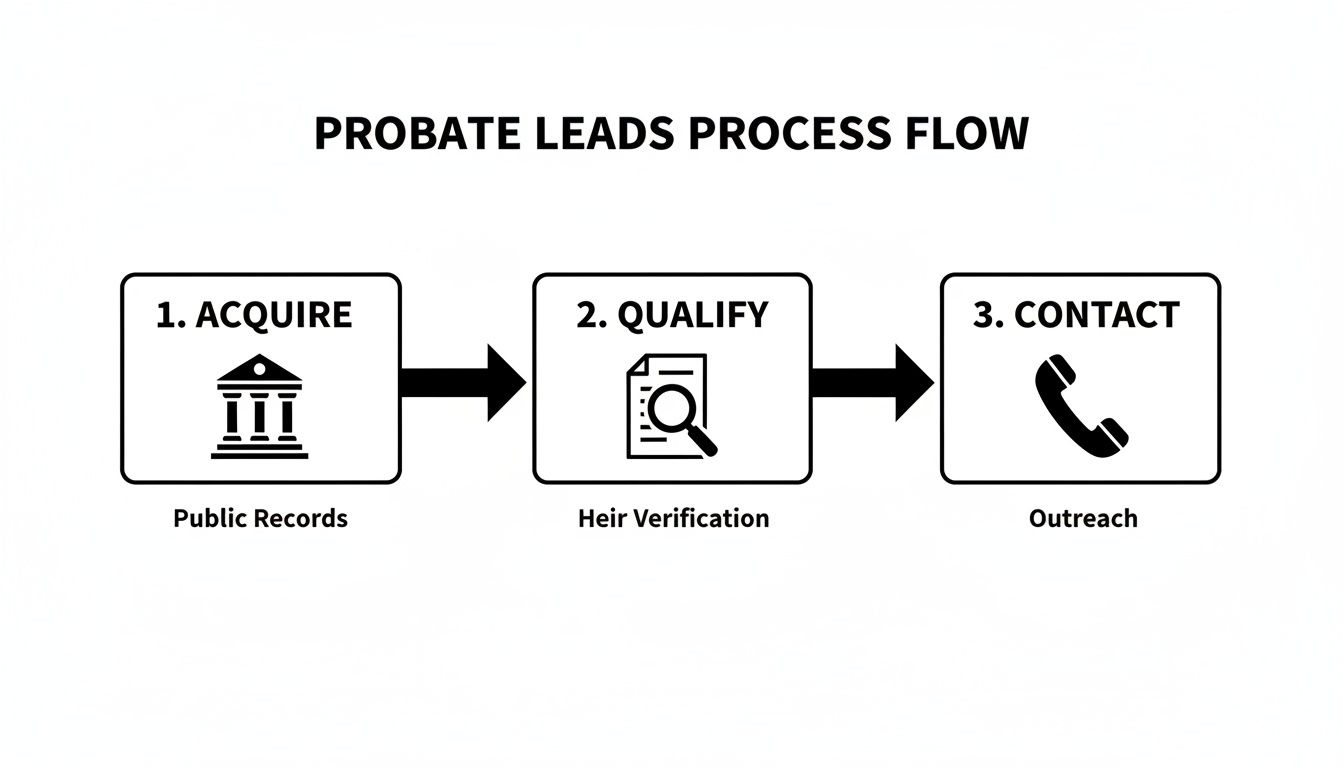

This simple flowchart breaks down how we turn raw public records into a real opportunity.

As the chart shows, your outreach is the final, crucial step after all the data work and qualification. It's the moment of truth, so you have to get it right.

Here are a few core principles I live by when crafting that first touchpoint, no matter the channel:

- Lead with Empathy: Acknowledge their situation right away. A simple line like, "I know this is a difficult time for your family," shows you see them as a person, not a prospect.

- Offer Concrete Help: Don't ask for the listing. Instead, offer solutions to their most pressing problems. Mention that you can help coordinate clean-outs, connect them with reputable estate sale services, or even provide a no-obligation cash offer if speed is a priority.

- Establish Credibility: Briefly touch on your experience with probate sales. This isn't about bragging; it’s about signaling that you understand the unique legal hurdles and can help them navigate the court requirements, which is a major stressor for most executors.

Your outreach should immediately answer the executor's unspoken question: "How can you make my life easier?" If your message doesn't give a clear, compelling answer, it's already failed.

Choosing Your Outreach Channel

So, what’s the best way to actually get your message in front of an executor? The truth is, it depends on your market, your budget, and what you’re comfortable with. When it comes to finding a probate property for sale, each channel has its own rhythm and rules.

I've seen agents succeed with different approaches, but the smart money is on a multi-channel strategy. A personal letter followed by a gentle phone call a week later can reinforce your message and show professional persistence without being pushy.

No matter which channels you choose, the goal is the same: build a foundation of trust. That's how you successfully close probate deals.

Comparing Outreach Methods for Probate Leads

Choosing the right mix of outreach channels is key. This table breaks down the three primary methods for contacting estate representatives so you can decide what works best for your business.

| Outreach Method | Pros | Cons | Best For |

|---|---|---|---|

| Direct Mail | • Non-intrusive, allows for thoughtful messaging. • Can feel more personal and professional. • High open rates if done correctly (e.g., plain envelopes). | • Slower response times. • Can be expensive to scale. • Easy to get lost in junk mail if not personalized. | Initial, gentle contact to introduce yourself as a resource without applying pressure. |

| Phone Calls | • Immediate feedback and personal connection. • Allows you to listen and adapt your pitch in real-time. • Can build rapport quickly if done with skill. | • Highly intrusive; requires extreme sensitivity and skill. • High chance of catching people at a bad time. • Can damage your reputation if you come off as pushy. | Following up after an initial letter has been sent, or for agents with exceptional phone skills and empathy. |

| Digital Outreach | • Cost-effective and highly scalable. • Easy to share links to resources (articles, vendor lists). • Allows for automated follow-up sequences. | • Hard to find accurate email/social media contact info. • Low open/response rates for initial cold contact. • Can feel impersonal and is easily ignored or marked as spam. | Follow-up communication after establishing initial contact through another channel. |

Ultimately, a blended approach often delivers the best results. A well-crafted letter can break the ice, a follow-up call can add a human touch, and email can keep the conversation going with helpful resources. The key is to be helpful and respectful at every step.

Navigating the Legal Side of a Probate Sale

A probate sale isn't your everyday real estate deal. It's really a legal process that just happens to involve selling a house, all under the watchful eye of the court system. For agents who aren't prepared, what looks like a great opportunity can quickly become a tangled mess of legal hurdles and frustrating delays.

To close a probate property for sale, you have to get comfortable with its unique legal framework from the very beginning. Your job goes way beyond just listing and showing; you become a guide for the executor, helping them navigate the confusing waters of the probate court. That means setting realistic timelines and managing everyone's expectations right from the start.

The first, most critical piece of information you need is the scope of the executor's power. This one detail will dictate how the entire sale unfolds.

Full Authority vs. Limited Authority

Not all executors are created equal. The authority they're granted by the court determines just how much supervision is needed for the sale, making it the single biggest factor that will influence your closing timeline.

-

Full Authority: This is what you hope for. Under the Independent Administration of Estates Act (IAEA), an executor with full authority can operate a lot like a traditional seller. They can list the property, accept an offer, and get things into escrow without running to the court for permission at every turn. They still have to give notice to the heirs, of course, but the whole process is worlds faster and more straightforward.

-

Limited Authority: This path means more court involvement and, you guessed it, more time. An executor with limited authority needs the court's stamp of approval on almost every major decision, including the final sale price. This triggers a formal court confirmation process that can easily tack on several extra months to the closing.

Figuring out this distinction immediately is non-negotiable. It lets you prep the executor and any potential buyers for what's ahead, which goes a long way in preventing deals from falling apart down the road.

The Court Confirmation Process Explained

When a sale is subject to court confirmation, it becomes a very public affair. Once the executor accepts an offer, the deal is far from done. That offer is really just the opening bid.

The accepted offer is then presented to the probate court at a scheduled hearing. Think of it as a live auction, right in the courtroom. Other qualified buyers can show up and try to outbid the person who originally got the offer accepted.

The court sets the rules for this auction. Typically, the first overbid must be 5% over the first $10,000 of the original offer, plus 10% of the remaining balance.

For the initial buyer, this can be an incredibly stressful experience—they could lose the property after weeks of due diligence. Your job is to make sure they know this is a possibility and walk them through the overbidding process if they want to stay in the game. It's a transparent system, but it's also one of the most unpredictable parts of handling certain probate sales. If you're just getting into this niche, truly understanding what is a probate listing is square one.

Anticipating and Handling Common Legal Hurdles

Beyond the court confirmation dance, plenty of other legal issues can pop up and derail a probate sale. Getting ahead of these potential problems is the key to keeping the transaction moving forward.

A smooth probate closing is almost never a matter of luck; it's the product of relentless due diligence. The biggest deal-killers—title clouds, heir disputes, and creditor claims—are almost always findable and manageable if you look for them early.

Here are the top three hurdles to keep on your radar:

-

Clouds on the Title: It's incredibly common for probate properties to come with title issues. These can be anything from old mechanics' liens to claims from heirs nobody knew existed. Ordering a preliminary title report the moment you can is an absolute must.

-

Disagreements Among Heirs: The executor may have the legal authority, but unhappy heirs can make the process miserable by filing objections with the court. Constant, transparent communication is your best tool for minimizing friction and keeping the focus on getting the property sold.

-

Creditor Claims: Before any heirs get paid, the estate’s debts have to be settled. If the estate owes a lot of money, the proceeds from the home sale will be used to pay those creditors. This can create tension over the sale price or timeline, especially if creditors are putting pressure on the executor.

Successfully managing this process requires more than just a real estate license; it demands a solid grasp of the legal side. Deepening your knowledge by understanding the intricacies of probate will better prepare you for these challenges. By working hand-in-glove with the probate attorney and staying proactive, you can guide the sale to a successful close and prove your worth as a true probate specialist.

Building a Scalable Probate Sourcing System

Finding a single probate property for sale is a solid win. But consistently generating qualified appointments with motivated executors isn't just a win—it's a business.

To really make a living in this niche, you have to move beyond manual, one-off efforts. You need a scalable system that feeds your pipeline predictably. That means putting technology and processes to work for you.

By building an integrated workflow, you can transform probate prospecting from a time-consuming grind into a reliable revenue stream. The whole point is to spend less time digging for data and more time negotiating deals.

Tailoring Your CRM for Probate Leads

Your CRM is the central nervous system of your operation, and a generic, out-of-the-box setup just won't cut it. For probate, you need to customize your CRM to track the specific data points that actually matter, allowing you to manage relationships and timelines with precision.

Think way beyond the standard name, phone, and email fields. Your probate CRM should be a specialized database built to organize the unique details of each and every case.

Start by creating custom fields for the essentials:

- Case Number: The unique identifier for the probate case at the courthouse.

- Deceased's Name: The name of the property owner who passed away.

- Executor/Administrator Details: Full name, address, phone, and email.

- Probate Attorney Information: Contact info for the estate's legal counsel.

- Key Court Dates: The filing date, hearing dates, and any other critical deadlines.

This level of detail gives you the entire landscape of a deal at a glance. It also sets the stage for some powerful automation, ensuring you never miss a critical follow-up or deadline.

Implementing Automated Follow-Up Sequences

Probate is a long game. Executors are often not ready to decide on your first, second, or even third contact. Without a system, it's dangerously easy for promising leads to fall through the cracks just because you got busy.

This is where automated follow-up sequences, or "drip campaigns," become your secret weapon. These are pre-written series of emails, texts, or even tasks for direct mail that are scheduled to go out over weeks or months. They nurture the relationship without you having to manually hit "send" every single time.

A well-designed automated sequence keeps you top-of-mind with every single executor in your pipeline. It delivers value consistently, positioning you as a helpful resource so that when they're finally ready to act, you are the first person they call.

For instance, your sequence could start with an empathetic intro email. A week later, it could send a helpful article on "5 Common Mistakes Executors Make." Two weeks after that, just a simple check-in message. This systematic approach ensures persistent, professional contact without ever feeling like you're harassing them.

Many of the same principles for finding a probate property for sale also apply when you're looking for general off-market property for sale, since both require a systematic and patient approach to lead nurturing.

Leveraging AI for Outreach and Qualification

If you really want to scale, you have to delegate the repetitive, top-of-funnel tasks. This is where AI-powered tools can be a game-changer. Modern AI assistants can handle the first touch and initial qualification, freeing you up to focus on high-value activities like building rapport with warm leads and negotiating contracts.

Here’s how an AI assistant could slot into your workflow:

- Initial Contact: The AI sends the first wave of emails or texts to new probate leads, using empathetic and personalized templates you've approved.

- Lead Qualification: When an executor replies, the AI can ask a series of qualifying questions about their motivation, timeline, and the property's condition.

- Appointment Setting: Once a lead is qualified as motivated, the AI can access your calendar and book a call or meeting directly, killing the endless back-and-forth of scheduling.

This kind of automation acts as a force multiplier for your business. It lets you engage with a much larger volume of potential deals while ensuring you only spend your personal time on the opportunities most likely to convert. This is how you go from closing one or two probate deals a year to building a machine that closes them every single month.

Common Questions About Buying Probate Property

Diving into the world of probate real estate is bound to kick up a few questions. It’s a specialized corner of the market with its own set of rules, timelines, and headaches. Getting straight answers is the only way to build the confidence you need to close these complex but often rewarding deals.

Let’s tackle some of the most common questions agents and investors have when they first get into this niche.

How Long Does It Take to Sell a Probate Property?

This is the million-dollar question, and the honest answer is: it depends. A probate sale can wrap up in a few months or drag on for more than a year. There’s no standard timeline because the whole process is dictated by the legal machinery of the estate settlement.

A few key things really set the pace:

- Estate Complexity: If the estate is a tangled mess of debts, multiple properties, or family squabbles, things will naturally take longer to sort out.

- Executor's Authority: As we've covered, an executor with full authority can move almost like a traditional seller. This is the fast track.

- Court Confirmation: If the executor has limited authority, every major step needs a judge's approval. The court confirmation process alone, with all its required notices and hearings, can easily tack on several months.

Your job is to help the executor see what's coming, manage their expectations, and steer them around the administrative logjams that create frustrating delays. You're their guide through a legally mandated maze.

Can I Buy a Probate Property With a Mortgage?

Yes, you absolutely can finance a probate property purchase. The key is to work with a lender who actually gets it. Not every loan officer is prepared for the potential delays and extra paperwork that come standard with a probate sale.

The biggest hurdle for any buyer using a loan is the timeline uncertainty. Court schedules are rigid and have a mind of their own, which can wreck a standard rate lock or loan commitment deadline.

Have a very direct conversation with your lender before you even think about writing an offer. Make sure they’re okay with potential extensions and understand that the closing date isn't completely in your or the seller's control.

And since many probate homes are sold "as-is," get ready for a tougher underwriting process, especially if the place needs work. A thorough home inspection isn't just a good idea here; it's non-negotiable.

What Are the Biggest Risks With Probate Properties?

While the opportunities are huge, probate deals come with their own unique flavor of risk. You need to go in with your eyes wide open. The main dangers fall into three buckets: title issues, frustrating delays, and emotional landmines.

A comprehensive title search is your single most important risk-management tool. It’s not uncommon to unearth nasty surprises that can cloud the title, such as:

- Surprise heirs who have a legitimate claim to the property.

- Unpaid creditor liens from old medical bills or credit card debt.

- Sloppy errors in past deeds or property records.

Transactional delays, as we just discussed, are a constant threat, especially for buyers juggling financing or the sale of their own home.

Finally, remember who you're dealing with—people navigating grief and stress. Managing the relationship with the executor and the heirs demands a ton of patience and empathy. One communication breakdown can torpedo the whole deal.

Should I Work Directly With Heirs or the Probate Attorney?

Your main point of contact—the person who calls the shots—is the court-appointed executor or personal representative. They hold the legal authority to list the property, negotiate offers, and sign the closing documents on behalf of the estate. Building a solid, trusting relationship with them should be your number one priority.

While the executor is your client, the probate attorney is your indispensable partner. You'll be coordinating with the attorney on all the legal paperwork, court filings, and closing procedures. Their job is to make sure the sale is legally sound and meets every court requirement. Respect their role and keep the lines of communication wide open.

Whatever you do, don't try to go around the executor to deal with other heirs unless you are explicitly told to. This almost always creates confusion and conflict, undermining the executor’s authority and putting the entire sale at risk.

At Tab Tab Labs, we turn the grueling hunt for probate leads into a simple, automated system. Our AI-powered engine delivers pre-qualified seller appointments straight to your calendar, so you can spend your time closing deals, not digging for them. Schedule a free strategy call to see how it works.