A Guide to Finding Off Market Property For Sale

Discover how to find off market property for sale with this guide on data sourcing, automated outreach, and proven strategies for closing hidden deals.

By James Le

An off-market property is a home sold privately, completely bypassing a public listing on the Multiple Listing Service (MLS). This is how savvy investors and real estate operators get their hands on exclusive deals, often from motivated sellers, and sidestep the brutal bidding wars so common with publicly listed homes.

It's a strategy that hinges on proprietary data and smart, targeted outreach rather than fighting with the entire market over the same scraps.

Why Off-Market Deals Are Your New Competitive Edge

In today's market, relying only on the MLS is like fishing in a ridiculously overfished pond. Everyone's using the same bait, chasing the same few fish. Competition is insane, margins are razor-thin, and you're always playing catch-up.

The real advantage comes from building a pipeline of opportunities that no one else can even see. That's the power of focusing on finding an off-market property for sale.

This strategy isn't just some clever alternative; it’s fast becoming a necessity. The market is full of homeowners who need to sell but are terrified to list their homes publicly.

The Lock-In Effect and Hidden Inventory

A huge number of homeowners are sitting on mortgages with unbelievably low-interest rates, creating a powerful "lock-in effect." The thought of selling and taking on today's higher rates is a non-starter, which is strangling public inventory.

But life doesn't stop. Divorce, death, financial trouble, or a sudden job relocation—these events still happen. This creates a massive, growing pool of motivated sellers who desperately need a private, fast, and discreet way to sell their homes.

These sellers almost always fall into predictable categories you can spot long before they ever think about calling an agent:

- Financial Distress: Owners drowning in debt, facing pre-foreclosure, or buried under tax liens.

- Inherited Properties: Heirs going through probate who might live out-of-state and just want a quick, clean sale.

- Tired Landlords: Investors who are done dealing with deferred maintenance or problem tenants and want to cash out.

- Life Transitions: People who need to move now for personal reasons and can't deal with the stress and publicity of an MLS listing.

When you learn to identify these unique signals of distress, you stop buying the same stale, recycled lists as everyone else and start truly owning your market. You're not just finding leads; you're creating exclusive opportunities from scratch. And if you're looking to really get a leg up, exploring these powerful real estate lead ideas can seriously broaden your search.

Building Your First-Mover Advantage

The whole game is about building a proprietary data system that gives you a first-mover advantage. Forget waiting for data aggregators to sell you old, picked-over information. You need to tap directly into county-level records yourself. This is how you unearth deals that are completely invisible to your competition.

We’re seeing this trend explode right now. In the 2025 U.S. housing market, off-market deals have surged because over 80% of borrowers are so far out-of-the-money on their mortgages. This lock-in effect is funneling motivated sellers directly into private sales, fed by a steadily growing pre-foreclosure pipeline. For real estate operators, this is a gold rush—scraping county-level data from deeds, probates, and tax liens is the key to uncovering exclusive leads before anyone else knows they exist.

The table below breaks down just how different this approach is from the old way of doing things.

Comparing Public MLS vs Off-Market Deal Sourcing

| Attribute | Public MLS (On-Market) | Off-Market Sourcing |

|---|---|---|

| Competition | Extremely high; multiple offers are standard. | Very low; often a direct 1-on-1 negotiation. |

| Deal Visibility | Publicly accessible to every agent and buyer. | Private; known only to those with the data. |

| Seller Motivation | Typically testing the market, looking for top dollar. | Often distressed or need a fast, simple solution. |

| Purchase Price | Usually at or above market value due to bidding. | Typically below market value, reflecting the situation. |

| Process Speed | Slow and formal with standardized timelines. | Fast and flexible, can close in days. |

| Data Source | Centralized MLS database (recycled data). | Raw, proprietary data from county records. |

As you can see, the strategic upside of building your own off-market pipeline is massive. You control the process from start to finish.

By creating your own deal flow from raw, local data, you're not just participating in the market—you're making the market. You get to the seller first, build real rapport, and solve their problem before anyone else even knows a problem exists. This is how you turn brutal competition into pure, unadulterated opportunity.

Building Your Proprietary Data Engine

The real power in finding an off market property for sale comes from building your own private source of leads. Forget buying those recycled lists that every other investor in your area has already picked clean.

Your competitive edge is forged by creating a proprietary data engine, fueled by raw, local, and timely information. This is how you stop fighting over scraps and start owning your market.

This engine isn't built on national aggregator data; that stuff is often slow, stale, and incomplete. Instead, we're going straight to the source: county and municipal records. This is where you find the real stories of distress and motivation long before they ever become public knowledge.

Uncovering The Story Behind The Data

Each data point from a county source tells a human story, often one of pressure or transition. Understanding these narratives is the key to crafting outreach that is both empathetic and effective. As you build your system, exploring various real estate data processing use cases can spark some great ideas for interpreting this information effectively.

Here are the core data sources that form the foundation of a powerful distressed appointments engine:

- Probate Filings: These court records signal an inherited property. Heirs, who might live out-of-state and have zero emotional attachment to the house, are often incredibly motivated to sell quickly for a fair price to settle the estate.

- Pre-Foreclosure Notices: This is one of the clearest signals of financial distress you can find. The owner is behind on their mortgage, and the clock is ticking. A private sale can be a dignified way out, avoiding a damaging foreclosure on their record.

- Tax Liens: When a homeowner falls behind on property taxes, the county places a lien on the property. It’s a rock-solid indicator of financial strain and a powerful motivation to sell and clear the debt.

- Code Violations: Properties with a stack of code violations—for overgrown lawns, structural issues, or unpermitted work—often belong to overwhelmed landlords or owners who just can't afford the upkeep anymore.

- Civil Court Records: Things like lawsuits, divorces, or bankruptcy filings can all create an urgent need for cash, making a fast, private home sale a very attractive option.

The magic happens when you start combining these signals. An out-of-state owner of a property with a tax lien and a handful of code violations is a far more qualified lead than someone with just one issue. Layering data like this is what turns raw information into actionable intelligence. For a deeper dive, our guide on how to perform a https://tabtablabs.com/blog/county-property-records-search offers a tactical breakdown.

From Raw Data To A Predictable Pipeline

Look, the goal isn't just to collect data; it's to systematize the process of turning that data into appointments. A true proprietary data engine doesn't just find leads—it qualifies and prioritizes them for you, automatically.

The most successful real estate operators don't buy leads; they manufacture them. By tapping directly into courthouse records, you're not just finding opportunities—you're getting a six-month head start on the entire market.

This system works by setting up automated "scrapers" that constantly monitor these public county sources for new filings. The moment a new probate case or tax lien pops up, your system instantly flags it.

From there, the process should be seamless:

- Data Ingestion: The new record is automatically pulled into your system.

- Data Enrichment: The system then cross-references the property address with other databases to pull owner info, property equity, and other key details.

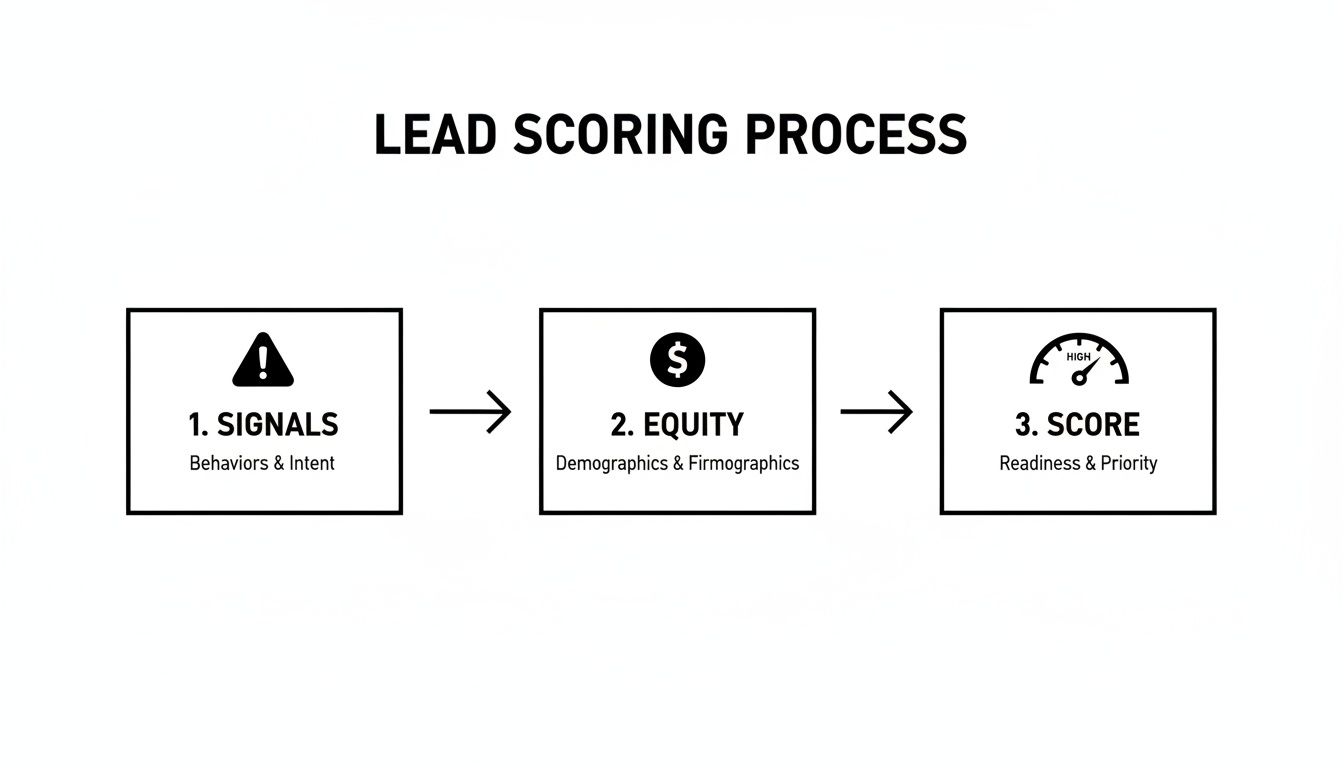

- Lead Scoring: The lead gets automatically scored based on the number and severity of distress signals.

- Automated Outreach: The highest-scoring leads are immediately pushed into a pre-built outreach campaign.

This automated workflow is the heart of your "Distressed Appointments Engine." It cuts out the manual grunt work and ensures you are the very first person to contact a motivated seller, often within hours of their information hitting the public record. This is how you consistently generate 15-20 pre-qualified seller appointments every single month.

Mastering Compliant Outreach That Converts

Having a killer data engine is just the entry ticket. The real magic happens when you turn all that raw information into actual conversations with homeowners. This is where the pros separate themselves from the amateurs—it's about mastering outreach that is compliant, empathetic, and, most importantly, effective.

Anyone can blast out a generic offer. But connecting with someone about an off market property for sale, especially when they're in a tough spot like probate or pre-foreclosure, requires a completely different playbook. Your entire approach has to be built around rapport and problem-solving, not just jamming a sale down their throat.

The secret is a multi-channel strategy. You need to meet homeowners where they are, using a mix of proven methods that you can tailor to their specific situation. It’s a delicate dance of being persistent without being a pest, all while proving you're a credible solution to whatever they're facing.

The Power Trio of Outreach Channels

To actually get through to motivated sellers, you need more than one tool in your belt. Just hammering one channel is a surefire way to leave a ton of money on the table. A smarter, blended approach that uses direct mail, intelligent calling, and old-school networking creates a "surround-sound" effect that builds trust and gets you a response.

Think of how these three work together to make sure your message lands:

- Direct Mail: In an inbox-cluttered world, something you can physically hold really stands out. It's tangible, feels less intrusive, and lets the homeowner digest your offer on their own time.

- AI-Powered Cold Calling: Let's be real, initial outreach is a grind. Modern AI ISAs (Inside Sales Agents) can handle this heavy lifting with insane efficiency, qualifying leads and setting appointments without burning out your actual sales team.

- Strategic Networking: Building real relationships with local attorneys, contractors, and even other agents can turn into a powerful referral pipeline that just keeps feeding you deals.

This trifecta ensures you’re covering all your bases, from a thoughtful letter that arrives in their mailbox to a perfectly timed phone call.

Crafting Direct Mail That Actually Gets Opened

Those generic, bright yellow "WE BUY HOUSES!" postcards are tired. They scream "lowball offer" and get tossed in the trash immediately. To be effective, your mail needs to feel personal, show empathy, and speak directly to the seller's probable pain point. The goal isn't to flash a number; it's to start a conversation.

Take a probate lead, for instance. The mailer needs to be respectful and genuinely helpful. Acknowledge the difficult situation they're in and position yourself as a resource, not a vulture. We get way more into the weeds on this in our guide to direct mail marketing for real estate.

Probate Direct Mail Example:

Subject: Regarding the property at [Property Address]

Dear [Heir's Name],

My name is [Your Name], and I'm a local property specialist. I know this is likely a difficult time, and I can only imagine how managing an inherited property adds to an already challenging situation.

I help families in our community navigate this process with a simple, private way to handle these properties. We offer a fair cash purchase that can close on your timeline, which often helps settle the estate quickly without the hassle of repairs, listings, or showings.

If this might be helpful, please feel free to call or text me anytime at [Your Phone Number].

Sincerely, [Your Name]

See the difference? This approach is consultative, not aggressive. It proves you've done your homework and are offering a real solution.

Deploying AI ISAs for Smart and Scalable Calling

Cold calling is a numbers game, but it doesn't have to be soul-crushing. This is exactly where AI-powered ISAs are changing everything. These systems can churn through hundreds of initial calls, get past gatekeepers, and use surprisingly human-like conversational AI to gauge interest.

The key is feeding the AI with smart scripts that are empathetic and solution-focused. For a pre-foreclosure lead, the script can't be pushy. It needs to focus on providing them with options and a way out.

Here’s a rough structure for an AI ISA script for a pre-foreclosure situation:

- Introduction & Verification: "Hi, may I speak with [Owner Name]? My name is [AI ISA Name] with [Your Company]. I'm calling about your property at [Property Address]. We specialize in helping homeowners explore all their options, and I just wanted to see if you might be open to hearing a no-obligation cash offer?"

- Acknowledge and Pivot: If they sound stressed or hesitant, the AI can respond with empathy. "I completely understand this can be a stressful time. Our goal is just to provide a simple alternative to the traditional listing process, which can help you avoid foreclosure and move forward."

- Qualify and Set Appointment: If there’s a flicker of interest, the AI smoothly transitions to booking a real call. "Great. One of our senior property specialists, [Your Name], would be happy to walk you through the details. Would tomorrow at 10 AM or 2 PM work for a brief, confidential call?"

This automated process frees you up to spend your time only with pre-qualified, motivated sellers. It’s a massive efficiency boost. The system handles the grunt work, turning cold data into warm, scheduled appointments that pop up right on your calendar.

How to Score and Prioritize Your Leads

Once your data engine starts humming, you’ll trade one problem for another: information overload. A flood of leads is great, but not every signal of distress points to a real opportunity. Chasing down every single one is a surefire way to burn out your team and waste a ton of money on homeowners who simply aren't ready to sell.

The key is to stop treating all leads as equal. You need to focus only on the ones most likely to convert, which means building a simple but powerful lead scoring system. This lets you automatically surface the most motivated sellers, so your team's time is spent on pre-qualified appointments, not dead-end pursuits.

A smart scoring system shifts you from being reactive to proactive, letting you concentrate your energy where it'll actually make a difference.

Defining Your Scoring Criteria

An effective scoring model for an off market property for sale really boils down to a few critical data points. The goal is to assign a number to each lead—a simple 1-10 scale works perfectly—based on how many motivating factors are present.

Here are the core pillars of a solid lead scoring system:

- Number of Distress Signals: This is the big one. A property with multiple red flags (say, a tax lien and a code violation) is a much stronger signal than a property with just one. Every additional signal should dramatically bump up the score.

- Property Equity: A homeowner with a good chunk of equity has more flexibility and is in a much better position to accept a fair offer. Low or negative equity just complicates the sale, making that lead a lower priority for now.

- Owner Location: An out-of-state owner is often less emotionally tied to a property and more interested in a convenient sale. This is especially true for tired landlords or heirs who just inherited a house they don't want.

These three elements are what I call the "motivation trifecta." When a lead scores high in all three categories, it needs to jump to the very top of your outreach list, no questions asked.

Real-World Scoring Examples

Let's walk through how this actually works. Your scoring system should be so clear that anyone on your team can instantly see why one lead is a top priority and another can wait.

Here’s how you might score two different leads:

Scenario A: High-Priority Lead (Score: 9/10)

- Signals: Vacant property, tax lien, multiple code violations (3 signals)

- Equity: Estimated 60% equity

- Owner: Lives out-of-state

This is a top-tier lead. The combination of vacancy, financial pressure, property neglect, and a distant owner absolutely screams motivation. This one should be fast-tracked for immediate, multi-channel outreach.

Scenario B: Medium-Priority Lead (Score: 6/10)

- Signals: Single pre-foreclosure notice (1 signal)

- Equity: Estimated 30% equity

- Owner: Lives in the property

Still a solid lead, but it doesn't have the same layers of motivation as the first one. The owner is local and is probably looking at other options to sort out their situation. This lead goes into a standard outreach cadence, not the urgent pile.

By applying simple rules like these, you create a clear hierarchy. This is how you can use predictive analytics in real estate to focus your efforts where they'll count.

Automating The Prioritization Process

The real magic happens when you automate this whole process. Manually scoring hundreds of leads just isn't scalable. A system like the one we've built at Tab Tab Labs can apply these scoring rules instantly as new data is pulled from county records.

This kind of automation is more important than ever as the market shifts. We're seeing a boom in these types of deals, fueled by recent demographic pressures and investors pulling back. Small landlords, getting crushed by soaring insurance and tax costs, are increasingly looking for quick, private exits to get out from under the carrying costs. As one PwC report on real estate trends highlights, this wave of liquidation is creating a deep pool of distressed sellers who have equity but can't wait for a traditional sale. You can discover more insights about these real estate trends from PwC.

Your automated system can spot these high-potential sellers the moment they appear. The second a lead hits a certain score (say, 8/10 or higher), it can kick off an entire workflow. An AI ISA can place the first call, a high-priority direct mail piece gets sent out, and the lead is flagged in your CRM for personal follow-up. This ensures your best opportunities get immediate attention, which dramatically increases your chances of being the first—and only—person they talk to.

Automating Your Off Market Acquisitions Funnel

You've built the data engine and you've mastered the outreach playbook. So, what's next? It's time to connect all the pieces and put your acquisitions on autopilot. A manual process, no matter how slick, will always hit a ceiling. To really scale and consistently find that next off market property for sale, you have to build a seamless, automated workflow that grinds away for you, 24/7.

The whole point is to engineer a system where you are no longer the bottleneck. The ideal acquisitions funnel does all the heavy lifting—from flagging a new lead to getting a qualified appointment on your calendar—without you lifting a finger. This frees you and your team to focus only on the stuff that actually matters: building real rapport with motivated sellers, negotiating contracts, and, of course, closing more deals.

Mapping The Automated Workflow

Imagine a machine that turns raw, messy data into scheduled meetings. This isn't some far-off fantasy; it's what's possible right now with the right tools working together. A truly integrated workflow connects your data sources, enrichment services, outreach channels, and CRM into one cohesive system.

Here's a blow-by-blow of what that looks like in the real world:

- Signal Detected: Your system's scrapers pick up a new tax lien filed at the county courthouse.

- Instant Enrichment: The property address is automatically pulled into your database. Within seconds, it's layered with property details, owner information, and an estimated equity figure.

- Automatic Scoring: Your preset rules instantly score the lead. A tax lien plus high equity? That's an 8/10, flagging it as a hot opportunity.

- Workflow Triggered: This high score kicks off a multi-channel outreach sequence. An AI-powered ISA places the first call while a personalized direct mail piece gets queued up.

- Engagement & Qualification: The AI ISA gets the homeowner on the phone, confirms they'd consider a private offer, and qualifies their motivation.

- Appointment Booked: The seller agrees to a call. The AI books it directly on your calendar and pushes all the lead data straight into your CRM.

This entire sequence can unfold in just a few hours—often before the homeowner has even thought about talking to anyone else. It's about combining raw speed with surgical precision to make sure you're always the first one in the door.

This flowchart gives you a simplified look at how different signals and equity data feed into a lead score.

This visual shows how raw distress signals and property equity are the two fundamental inputs for an effective, automated scoring system.

The Core Technology Stack

Building this kind of machine means getting the right tools to play nicely together. While you can swap out specific platforms, the core components are pretty consistent. You need systems that can talk to each other, passing data from one stage to the next without a hitch.

- Data Scrapers: Custom scripts or platforms like Tab Tab Labs that monitor and pull data directly from county-level sources.

- CRM (Customer Relationship Manager): A central hub like Podio or Salesforce to manage your pipeline, track every interaction, and store property information.

- AI ISAs: Conversational AI platforms that handle the initial cold calls and text message follow-ups at a scale no human team could match.

- Integration Tools: Services like Zapier or Make are the digital duct tape, connecting your different apps and automating data transfers between them.

The real magic isn't in any one tool—it's in the integration. A new lead popping up in your data system should instantly create a contact in your CRM and trigger a call from your AI ISA, all without a single click or copy-paste.

The most profitable real estate operators aren’t just better at finding deals; they are masters of systemization. They build machines that manufacture opportunities, allowing them to focus their human capital on the one thing that can't be automated: rapport and negotiation.

This level of automation creates something every investor craves: a predictable and scalable deal pipeline. Instead of wondering where your next deal is coming from, you have a system that reliably generates 15-20 pre-qualified seller appointments every single month. It turns the chaotic, unpredictable hunt for off-market properties into a reliable, measurable process, letting you grow your business with confidence.

Tracking KPIs to Optimize Your System

Building an automated acquisitions funnel is a massive step forward, but it's not a "set it and forget it" machine. Any system without metrics is just a guess. To truly build a predictable deal-finding engine for an off market property for sale, you have to measure what matters, test your assumptions, and constantly optimize.

This final piece of the puzzle is all about tracking the right Key Performance Indicators (KPIs). These numbers tell the real story of your system's health, showing you exactly where you're winning and where you're leaking money. Without them, you’re just flying blind. You'll have no idea if that new mailer design or a tweaked AI script is actually improving your bottom line.

Defining Your Core Funnel Metrics

You don't need some massive, complicated dashboard to get started. Just a handful of core metrics will give you 80% of the insight you need to make smart decisions. These KPIs track a lead’s journey from initial contact all the way to a signed contract, shining a light on the efficiency of each step.

Here are the essential KPIs every off-market operator should have on lockdown:

- Cost Per Lead (CPL): This is your most basic metric. Just take the total cost of a marketing campaign (like a direct mail drop) and divide it by the number of responses it generated. It tells you exactly how much you're paying to get someone to raise their hand.

- Cost Per Qualified Appointment (CPA): This is where the rubber really meets the road. It measures the total campaign cost divided by the number of actual appointments booked with motivated sellers. A low CPL is useless if none of those leads turn into real conversations.

- Appointment-to-Contract Ratio: This KPI gets right to the effectiveness of your sales process. Of all the qualified appointments you go on, what percentage of them result in a signed purchase agreement? This number tells you if your appointments are truly qualified and if your acquisitions team is closing.

Tracking these three metrics gives you a clear, top-to-bottom view of your funnel's performance. You can see how efficiently you're generating interest, how well you're qualifying that interest, and how effectively you're turning it into deals.

Benchmarks For A Healthy Off-Market Funnel

Knowing your numbers is one thing; knowing what they mean is another. While every market is different, there are some general benchmarks you can aim for to know if your system is on the right track.

A healthy, well-oiled off-market acquisitions machine should consistently produce 15-20 pre-qualified seller appointments every single month. This is the output that signals your data sourcing, lead scoring, and outreach are all working in harmony. If you’re falling short, it’s a clear sign that one part of your system needs attention.

A predictable pipeline isn’t built on hope; it’s built on data. When you can confidently say, "For every $X I spend on this campaign, I get Y qualified appointments," you’ve moved from just finding deals to manufacturing them on demand.

A Practical Guide To Optimization

Once you have your baseline KPIs, the real work begins. The goal is continuous improvement, making small, data-driven tweaks to your process that add up to big gains over time. This is where you refine your machine into a true competitive advantage.

Start by A/B testing one variable at a time so you can clearly attribute any changes in performance.

- Test Your Mailers: Send out two versions of a direct mail piece to a similar list. Change only one thing—the headline, the letter copy, or even the color of the envelope. Track the CPL for both to see which one pulls better.

- Refine Your AI Scripts: Tweak the opening line or the main value proposition in your AI ISA's script. Monitor your CPA to see if the new script is more effective at turning initial contacts into booked appointments.

- Adjust Your Lead Scoring: Are your highest-scoring leads consistently turning into contracts? If not, your scoring criteria might be off. Try adjusting the weight you give certain distress signals (e.g., giving more points for a tax lien than a code violation) and track your Appointment-to-Contract Ratio to see if lead quality improves.

This cycle of measuring, testing, and refining is what separates the operators who build sustainable businesses from those who just get lucky once in a while. By paying close attention to your KPIs, you can systematically lower your acquisition costs and build a deal-finding machine that fuels your growth for years to come.

Ready to stop guessing and start building a predictable pipeline of off-market deals? At Tab Tab Labs, we build proprietary data engines and automated outreach systems that deliver 15-20 pre-qualified seller appointments to your calendar every month. Schedule your free strategy call today to see how it works.