Probate Properties for Sale: Quick Guide to Profitable Investments

Learn how to locate probate properties for sale and close deals quickly with practical strategies for high-equity, off-market real estate.

By James Le

Probate properties aren't just another listing category; they're homes sold through a court-supervised process after the owner has passed away. For the savvy investor, this often represents a significant, and overlooked, opportunity. The sales are usually driven by the estate's need to settle debts, which can lead to properties being priced well below what they're actually worth. It’s a unique niche for buyers who are willing to navigate a few legal hurdles.

The Untapped Goldmine of Probate Real Estate

So many real estate investors are chasing the same tired, over-saturated leads from the big national platforms. Probate properties, on the other hand, offer a much less crowded path to substantial returns. These aren't your typical MLS listings; they are opportunities born from legal necessity.

Here's how it works: when a homeowner dies, their estate enters probate. This is simply the court's process for managing their assets, paying off creditors, and distributing whatever is left to the heirs.

This legal framework is precisely what creates the opening for an investor. The person put in charge of the estate—known as the executor or personal representative—has a fiduciary duty to settle debts promptly. Very often, their primary goal isn't to squeeze every last dollar out of the home sale. It's to get a quick, clean transaction so they can close the estate and move on.

Why Probate Creates Motivated Sellers

The circumstances surrounding probate sales naturally create motivated sellers. Executors are frequently juggling personal grief with a mountain of complex legal and financial duties. This immense pressure can translate into several key advantages for an investor who knows what they're doing:

- Urgency to Sell: Estates run on a timeline, and creditors need to be paid. A fast, reliable cash offer can be a whole lot more appealing than waiting around for the highest possible bid that may or may not close.

- Built-In Equity: Between the need for a quick sale and the fact that many of these homes need some TLC, they are often listed at a serious discount.

- Less Competition: Let's be honest, sourcing these deals requires specialized knowledge. That alone means you’re up against far fewer buyers than you'll find fighting over traditional listings.

Probate properties represent a consistent source of off-market deals. When you understand the seller's unique motivations—settling debts and closing an estate—you can position yourself as a problem-solver, not just another buyer.

To really tap into this "goldmine," you need to know the difference between the types of assets an estate might hold. Understanding the distinction between probate and non-probate assets in Texas gives you a foundational knowledge that applies in most states.

This isn't a tiny niche, either. In the United States, probate properties are a significant market, with over 700,000 probate cases filed annually across major counties alone. This creates a steady stream of opportunities, many of which can be acquired at 20-30% discounts compared to their market value, simply because executors are so eager to liquidate the assets.

How to Source Probate Leads Before Anyone Else

To find the best deals on probate properties, you need to get there first. Most investors are just working from the same stale, syndicated lists. That means you’re fighting a crowd for every single property. The real advantage comes from sourcing your own leads directly, building a proprietary deal flow that puts you miles ahead of the competition.

Success in this niche isn't about luck; it's about creating a system to spot these opportunities before they hit the open market. You've got two main paths to do this: the traditional, hands-on approach of manual research and the modern, efficient method of using automated data platforms. Each has its place, but knowing both is key to building a robust pipeline.

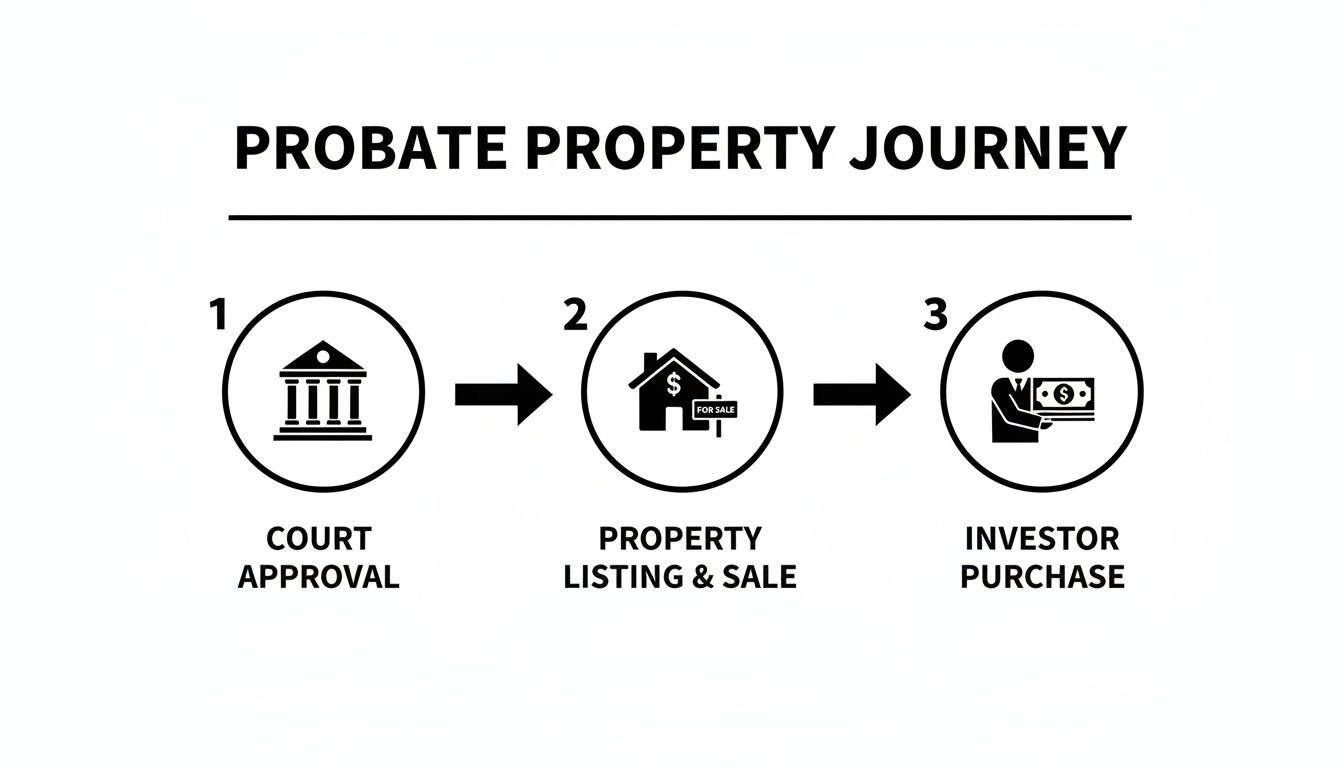

The graphic below shows the typical journey of a probate property, from the initial court filing to an investor's purchase.

As you can see, the critical window of opportunity for an investor opens the moment the case is filed with the court. It often slams shut once the property is publicly listed for sale.

The Old-School Method: County Courthouse Research

For decades, the most determined investors built their businesses by physically going to their local county courthouse. This boots-on-the-ground method means manually digging through public records to find newly filed probate cases. It’s a grind, no doubt, but it can be incredibly effective if you know what you're looking for.

When you're at the courthouse, you’re not just looking for a name. You need specific documents that signal a real estate opportunity is in play.

- Petition for Probate: This is the document that kicks off the whole process. It identifies the deceased person (the decedent) and names the person hoping to be appointed as the personal representative or executor.

- Letters Testamentary or Letters of Administration: This is the golden ticket. It’s the court order that officially gives the personal representative the legal authority to act on behalf of the estate—including selling property.

- Inventory of Assets: While not always filed right away, this document lists the estate's known assets. It will explicitly tell you if real estate is part of the estate.

This manual process is time-consuming and requires a solid understanding of local court procedures. You'll spend hours sifting through files, but the reward is finding leads that almost no one else has seen yet.

The Modern Approach: Automated Data Platforms

While courthouse runs still work, technology has created a much more efficient path. Modern data platforms like Tab Tab Labs have fundamentally changed the game for serious investors looking to source probate properties for sale.

These systems are built to do the heavy lifting for you. Instead of you going to the courthouse, they bring the courthouse data directly to your screen—often in near real-time.

Automated platforms don't just pull probate filings. They aggregate data from multiple public sources—like tax delinquencies, code violations, and other civil court records—to create a complete picture of distress. This allows you to identify the most motivated sellers with incredible precision.

This multi-layered data approach is what gives investors a true competitive edge. A probate filing on its own is a good lead. But a probate filing combined with a tax lien and a recent code violation? That's a lead with an extremely high probability of motivation.

Platforms like Tab Tab Labs use sophisticated tech to scrape and cross-reference this information automatically. This means you can:

- Get Notified Instantly: Receive alerts as soon as new probate cases with real estate are filed.

- Access Enriched Data: See a full profile of the property and the estate, including potential liens or other issues.

- Save Dozens of Hours: Free up your time to focus on what actually matters—contacting sellers and making offers.

The difference between the two approaches is stark. Let's break it down.

Comparing Probate Lead Sourcing Methods

| Feature | Manual County Record Search | Automated Data Platforms (e.g., Tab Tab Labs) |

|---|---|---|

| Speed & Timeliness | Slow; data is as fresh as your last trip to the courthouse. | Near real-time; alerts are often sent within hours of filing. |

| Data Richness | Limited to what's in the probate file itself. | Enriched with property data, liens, and other motivation signals. |

| Time Investment | Extremely high; requires hours or days of physical research. | Minimal; data is delivered directly to your dashboard. |

| Scalability | Difficult; limited by geography and the number of hours in a day. | Highly scalable; can monitor multiple counties or states at once. |

| Accuracy | Prone to human error in data entry and interpretation. | High; automated systems reduce manual errors. |

| Cost | "Free" in dollars but very expensive in time and travel costs. | Subscription-based, offering a high return on investment. |

Ultimately, choosing a method comes down to how you value your time and how serious you are about scaling your business.

For a deeper dive into creating a targeted lead list, our guide on building a probate properties list offers actionable strategies you can implement right away. The efficiency gained through automation allows an investor to scale their operations from finding a few deals a month to building a predictable, high-volume pipeline. You move from being a prospector to becoming a true market operator.

Mastering Your Due Diligence on Probate Deals

So, you've found a promising probate lead. Great. Now the real work begins. This is the stage where you protect your capital and figure out if you've found a genuine opportunity or a potential money pit.

Due diligence on probate properties for sale is a different beast entirely. It’s way more than a standard home inspection. You're diving deep into the legal, financial, and physical details that can absolutely make or break your deal. The goal here is to build a complete, unvarnished picture of the property and the estate—verifying authority, uncovering debts, and assessing the home's true condition.

First Things First: Confirm Who Can Actually Sell the Property

Before you spend a single dime on inspections or a title search, you have to confirm one critical fact: does the personal representative actually have the legal authority to sell you the house? This isn't just a formality. A sale without proper authority is completely invalid, and just taking someone's word for it is a classic rookie mistake.

This authority comes from the court in a document called Letters Testamentary (if there’s a will) or Letters of Administration (if there isn't one). You need to see this document and verify it's legit. In some places, the representative might even need to petition the court for a specific "License to Sell," even with these letters in hand.

A verbal "I'm the executor" means nothing. Always, always request a copy of the court-issued Letters Testamentary or Letters of Administration. This piece of paper is your only proof that you're negotiating with the person legally empowered to sign on the dotted line.

Uncovering Hidden Liens and Estate Debts

Probate properties often come with financial baggage. The estate is legally on the hook to settle all the decedent's debts before any assets go to the heirs, and those debts often get attached to the real estate. This makes a thorough title search completely non-negotiable.

Here’s what you’re typically looking for:

- Mortgage Liens: The most obvious one—the outstanding home loan balance.

- Tax Liens: Unpaid property, state, or even federal taxes.

- Mechanic's Liens: Bills from contractors who did work but never got paid.

- HOA Liens: Missed dues or special assessments from a homeowners' association.

- Judgment Liens: Debts resulting from lawsuits the decedent lost.

Finding these early is key. It lets you build them into your offer. A property that seems like a steal on the surface can turn into a loser once you tack on thousands in hidden liens.

Getting Real About the Property's Physical Condition

It's common for probate properties to have a lot of deferred maintenance. The previous owner might have been elderly or ill and simply couldn't keep up with repairs. This is where you can find incredible value, but only if you know exactly what you’re walking into.

Your physical inspection has to be meticulous. These homes often need far more than a coat of paint and new carpet; you're hunting for major, systemic problems. Pay extra close attention to the "big five" expensive systems:

- Roof: Check its age, look for missing shingles, and scan for any signs of past or present leaks.

- HVAC: Test the heat and AC. Find out how old the units are.

- Plumbing: Look for active leaks, check the water pressure, and identify any outdated materials like galvanized pipes.

- Electrical: Keep an eye out for ancient knob-and-tube wiring or an undersized, outdated electrical panel.

- Foundation: Inspect for significant cracks, settling, or water intrusion in the basement or crawlspace.

A crucial part of this is spotting potential hazards. Older homes, in particular, can harbor dangerous materials. For instance, understanding the risks associated with asbestos and DIY home improvements is vital for both your safety and for budgeting the renovation accurately.

Calculating the True Potential of the Deal

Once you have the full picture—legal authority confirmed, financial liens tallied, and physical condition assessed—you can finally calculate the deal’s actual profitability. This means creating a detailed scope of work for all necessary repairs and estimating your after-repair value (ARV). Your potential profit is the difference between the ARV and your total costs (purchase price + repairs + holding + closing).

If you’re planning to keep the property as a rental, this is also when you run your numbers. You'll need to project your rental income and operating expenses with a sharp pencil. To make sure the investment hits your financial targets, check out our guide on calculating cap rate for a rental property. This kind of systematic framework is what turns probate investing from a gamble into a calculated business decision.

Connecting With Heirs and Negotiating With Empathy

Once you’ve identified a promising property and done your homework, you’re at the most delicate part of the entire process. This is where the human element takes center stage. You’re not just dealing with a seller; you’re reaching out to a grieving family. Standard real estate tactics simply won't work here.

This isn’t about just making an offer. It’s about building a sliver of trust with people who are navigating a truly difficult time, both emotionally and logistically. Your goal is to be seen as a problem-solver—someone who can provide a simple, clean solution when everything else feels complicated.

Crafting a Respectful First Contact

How you first reach out sets the tone for everything that follows. Come in too hot or too salesy, and you've lost before you even began. The key is to be considerate, patient, and genuinely helpful.

I've found that direct mail is still one of the most effective and least intrusive ways to make that first connection. Forget the generic postcards. A well-written, hand-addressed letter shows you took the time to be thoughtful, and that goes a long way.

Keep the message simple and direct, but soft.

- Acknowledge their situation gently. Something as simple as, "I understand this may be a difficult time," shows you're human.

- Introduce yourself clearly. Let them know who you are and why you're writing.

- Present your solution. Explain that you can offer a quick, hassle-free cash purchase for the property. Frame it as a way to avoid the stress of repairs, showings, and lengthy listings.

- Give them an easy out. Provide your contact info for a no-pressure conversation, emphasizing that they should only call if and when they're ready.

The real art here is removing all pressure. Your letter should feel like an offer to help, not a demand for a sale. You're offering to take one major item off their massive to-do list.

This is also where automation, used correctly, can be a game-changer. An AI-powered ISA, for instance, can handle initial inquiries with respect and compliance, making sure you only spend your time with personal representatives who have already signaled they're open to a conversation.

The Art of Empathetic Negotiation

When it comes to probate properties for sale, hardball negotiation tactics are a complete non-starter. This is about finding a solution that works for everyone. Often, the family is less concerned with squeezing every last penny out of the deal and more focused on speed, certainty, and simplicity.

Your offer has to reflect that reality.

Making a fair 'as-is' offer is absolutely critical. This approach shows you understand they don't have the time, money, or emotional energy for renovations. By taking on that burden yourself, you're providing massive value. When you present your offer, have your repair estimates ready. This allows you to transparently walk them through exactly how you landed on your number.

This isn't some tiny, niche strategy; it's a massive market. Opportunistic real estate funds, which heavily rely on distress signals like probate, captured 64.5% of $77.1 billion in fundraising in the first half of 2025. In major markets, probate leads can make up 15-20% of an investor's entire pipeline. If you want to grasp the scale, you can read more about these global real estate trends.

Building Trust Through Clear Communication

During the negotiation, your most powerful asset is clear, consistent, and honest communication. Be prepared to listen far more than you talk. Sometimes the personal representative just needs to vent their frustrations or share a memory about the home. Giving them that space is how you build genuine rapport.

The words you choose matter. Ditch the cold, transactional jargon for a more personal tone. If you're on the phone, having a communication framework helps. You might find it useful to check out some effective real estate cold calling scripts and adapt them for a more empathetic, probate-focused conversation.

Finally, remember to explain every single step of the process, from the purchase agreement to the closing timeline. For most people, the probate world is a confusing maze of legalities. When you act as a knowledgeable and patient guide, you stop being just a buyer and become a trusted partner. That’s how you get the deal done.

You’ve done the heavy lifting—finding the property, vetting the details, and striking a deal with the personal representative. Now you're in the home stretch, but this is where many promising probate deals fall apart.

Securing financing and navigating the close on a probate property isn't like your average real estate transaction. This final leg of the journey demands speed, flexibility, and a deep understanding of the unique hurdles that pop up with estate sales.

Choosing the Right Financing Strategy

Unlike a typical home purchase, you can’t just walk into any bank and expect a smooth ride. Many probate homes have years of deferred maintenance, making them ineligible for the strict appraisal requirements of a conventional loan. A leaky roof, a shot water heater, or an ancient electrical panel will send a traditional appraiser running for the hills, killing your deal at the eleventh hour.

This is exactly why seasoned probate investors have a different playbook.

- All-Cash Offers: This is the undisputed champion in the probate world. Cash is king because it’s fast, certain, and completely removes the risk of a lender backing out. For an executor who just wants to close the estate and move on, a cash offer is the cleanest and most attractive option on the table.

- Hard Money Loans: Think of these as short-term, asset-based loans from private lenders who get it. They're far more interested in the property's potential after-repair value (ARV) than your FICO score, which makes them a perfect fit for homes that need a total overhaul.

- Private Money Lenders: This is where you borrow from an individual or a small group of investors. The beauty here is the flexibility. Terms are highly negotiable, giving you leeway on everything from interest rates to the loan's duration.

- Conventional Renovation Loans: Options like an FHA 203(k) loan exist, but they are slow and buried in paperwork. In a competitive situation where the executor values speed above all else, a 203(k) loan just can't keep up.

Your choice here directly impacts your negotiating power. Showing up with a cash or hard money offer tells the executor you're a serious buyer who can close quickly and without drama.

Understanding the Closing Process for Probate Sales

Closing on a probate property is more than just a trip to the title company. It’s a legal process that often involves direct oversight from the probate court, adding layers of complexity and time that you don't see in a standard sale.

Your best move is to assemble a team of pros who live and breathe estate transactions. A sharp real estate attorney and an experienced title agent are your most valuable allies here. They'll make sure every legal 'i' is dotted and 't' is crossed so the sale is locked down tight.

Here’s a quick look at how the closing phase usually unfolds.

| Stage | Key Actions & Considerations | Why It's Critical |

|---|---|---|

| Court Approval | The personal representative might need to file a "Petition to Confirm Sale." This can trigger a court hearing where, in some states, other buyers can show up and try to outbid you. | This is a legal safeguard to ensure the executor gets the best price for the estate. A sale that skips this step could be invalidated later on. |

| Title and Escrow | Your title company will perform a deep dive to clear any liens or claims against the property. They'll work hand-in-glove with the estate’s attorney to round up all necessary paperwork. | This is what guarantees you get a clean, marketable title. It protects you from future claims by creditors, unknown heirs, or the IRS. |

| Document Assembly | The executor must produce critical legal documents like the court-issued Letters Testamentary (or Letters of Administration), the death certificate, and the official License to Sell. | These documents are the legal proof that the person you're dealing with actually has the authority to sell the property. No letters, no deal. |

| Final Closing | Once the court signs off and the title is clear, the closing looks more like a traditional transaction. Funds are wired, and the deed is recorded in your name. | This is the finish line where ownership officially changes hands. The proceeds go into the estate's account to pay off debts and get distributed to the heirs. |

Navigating the closing on a probate property is a team sport. Your success hinges on having an experienced title company and real estate attorney who understand the specific requirements and timelines set by the local probate court.

The process will feel slower, and it demands patience. But by understanding the financing game and knowing the legal roadmap for closing, you can confidently turn that negotiated deal into a tangible asset, ready for its next chapter.

Scaling Your Business With Probate Automation

If you're still chasing deals one by one, you know the drill. It's a grind that leads to feast-or-famine income cycles and, eventually, burnout. To truly win in the probate niche, you have to stop thinking like a deal hunter and start acting like a system builder.

This is where automation comes in, transforming your probate efforts from a side hustle into a predictable, scalable business. Modern platforms are built to take on the repetitive, high-volume work that consumes most of an investor's day. By handing off lead generation, data analysis, and initial outreach to technology, you build an engine that consistently fills your pipeline.

Suddenly, your time is freed up for the things that actually matter: building rapport with sellers, analyzing deals, and writing offers.

Building a High-Volume Pipeline With Technology

Automation isn’t just about moving faster; it’s about operating with a level of precision and efficiency that's impossible to match by hand. Systems like Tab Tab Labs' Distressed Appointments Engine are designed specifically to give serious investors a real competitive edge.

Instead of you spending hours digging through county records, the platform does the heavy lifting. It doesn't just pull probate filings; it cross-references them with other key distress signals—things like tax liens, code violations, and civil court data—to zero in on the most motivated sellers.

This multi-layered approach delivers a steady stream of highly qualified leads right to your dashboard, packaged with all the data you need to act quickly.

The real power of automation is that it shifts you from reacting to the market to proactively creating your own opportunities. You’re no longer fighting over the same public lists everyone else has. You’re building a private, exclusive flow of off-market probate properties.

The demand for these properties has exploded, particularly as the U.S. housing market grapples with historically low inventory. Probate sales now make up 8-10% of all distressed transactions, a market worth over $50 billion. More importantly, investors who use AI to qualify these leads are seeing 2.5x higher close rates with sellers. You can dig into the data yourself and learn more about the U.S. housing market outlook here.

Freeing Your Team to Close More Deals

The whole point of scaling is to get your team focused on their highest-value activities. By bringing technology into your workflow, you can offload the critical but time-sucking tasks and let your people concentrate on what brings in revenue.

Here's what that looks like in the real world:

- AI-Powered Qualification: An AI-driven ISA can handle the initial conversations, making sure every touchpoint is compliant and respectful while filtering for genuine seller motivation.

- Automated Follow-Up: The system can run sophisticated follow-up campaigns, keeping your name top-of-mind with personal representatives without you lifting a finger.

- Seamless CRM Integration: Once a lead is qualified, an appointment is booked directly onto your calendar and pushed to your CRM, complete with all the property details and contact info you need.

This is the kind of operational efficiency that separates the top 1% of investors from everyone else. When your pipeline is always full and your follow-up runs on its own, your team can pour all their energy into what they do best: negotiating with empathy and closing more profitable deals.

Got Questions About Probate Properties? We've Got Answers.

We get these questions all the time from investors diving into the probate space. Let's clear up a few common points of confusion.

How Long Does It Take to Buy a Probate Property?

This is the million-dollar question, and the honest answer is: it depends. The timeline can swing wildly from just a few months to well over a year.

What's the holdup? It really boils down to two things: state law and how complicated the estate is. A sale that needs court confirmation will always take longer. The efficiency of the executor plays a huge role, too. Our best tip? Come in with a clean, strong offer from the get-go. It can seriously speed things up.

Are All Probate Properties Sold As-Is?

You should pretty much always assume a probate property is being sold 'as-is'. It's the standard for a reason.

Think about it from the seller's perspective. The executor or the heirs probably haven't lived there, don't know the property's quirks, and definitely don't want to get into the repair business. To protect themselves, they sell it as-is. For you, this just means a thorough inspection isn't optional—it's essential to know exactly what you're buying.

Can I Use Traditional Financing for Probate Properties?

Technically, yes, but it can be tricky. The property has to meet the lender's standards for appraisal and condition, and that's often where things fall apart.

Many probate homes have years of deferred maintenance, which can make them a no-go for standard conventional or FHA loans. This is why cash offers, hard money loans, or specific renovation loans are so common in this niche. They give you the flexibility to close and the capital to handle any needed repairs.

Ready to stop fighting over stale lists and start building a predictable pipeline of exclusive probate deals? Tab Tab Labs combines proprietary county-level data with powerful automation to deliver pre-qualified seller appointments directly to your calendar. Schedule your free strategy call today.