Finding Off Market Properties for Faster Deals

Discover how to find off market properties before they hit the MLS. Learn data-driven strategies, qualification tips, and how AI closes high-value deals.

By James Le

You’ve heard the term before, probably tossed around by seasoned investors or top-producing agents. But what exactly are off-market properties?

Think of them as a hidden inventory. They are real estate assets—homes, apartment buildings, commercial spaces—that are for sale but are not publicly listed on the Multiple Listing Service (MLS). This is a direct path to deals without the usual frenzy of public competition.

What Off-Market Properties Are and Why They Matter

Most real estate deals happen out in the open. A property hits the MLS, gets blasted out to sites like Zillow and Realtor.com, and is suddenly in front of thousands of potential buyers. This is the “on-market” world—a space where competition is fierce and bidding wars are just part of the game.

Off-market properties, on the other hand, operate in a parallel universe. These assets are for sale, but the transaction is kept intentionally private. Why? The owner might want to dodge the publicity and hassle of a traditional sale, test the market discreetly, or only engage with serious, pre-vetted buyers.

For investors and brokerages, this hidden inventory is a massive strategic advantage. Instead of just reacting to listings everyone else is already chasing, you get to proactively source opportunities directly from the owner, often before they've even thought about a public sale.

To put it simply, here’s a quick breakdown of how these two worlds compare.

On-Market vs. Off Market Properties At a Glance

| Feature | On-Market Properties (MLS) | Off-Market Properties |

|---|---|---|

| Visibility | Publicly listed and widely marketed | Private, unlisted, and shared selectively |

| Competition | High; multiple offers and bidding wars are common | Low to none; often a direct negotiation |

| Pricing | Often driven up by market competition | More room for negotiation; potential for below-market deals |

| Deal Terms | Typically standardized and less flexible | Highly flexible; creative terms like seller financing are possible |

| Access | Open to the general public and all agents | Requires proactive sourcing and relationships |

| Pace | Fast-paced with strict deadlines | Slower, more deliberate negotiation process |

Finding success in the off-market world requires a different playbook, but the rewards are well worth the effort.

The Strategic Edge of the Unlisted Deal

So, why does any of this really matter? Because getting access to off-market properties fundamentally changes how you acquire assets. It shifts you from being a passive searcher, waiting for opportunities to appear, to an active operator who creates them.

The benefits here aren't just theoretical; they hit your bottom line directly.

Here’s why the best operators are so focused on this space:

- Reduced Competition: You aren't fighting against dozens of other offers. In many cases, you’re the only one at the negotiating table, which gives you incredible leverage.

- Better Pricing: Without a bidding war inflating the price, you can often secure properties at or even below their true market value, protecting your margins.

- Flexible Negotiations: Sellers who go the off-market route usually have different motivations. They're often more open to creative terms, like seller financing or flexible closing dates.

- Exclusive Access: You’re tapping into a stream of deals your competitors don’t even know exist. This creates a proprietary deal flow that's almost impossible for others to replicate.

This isn't just a new tactic; it's a completely different operational model. Moving from the crowded MLS to direct sourcing lets you build a predictable, scalable pipeline of exclusive opportunities instead of just fighting for the scraps.

Why Off-Market Deals Are on the Rise

In today's tight housing market, the value of an off-market deal has never been higher. Global real estate investment turnover is expected to blow past $1 trillion by 2026, and much of that capital is chasing the same limited supply of publicly listed assets.

This intense competition is pushing more and more activity into private channels. In the U.S. alone, around 6% of sellers are pulling their listings off-market because of pricing sensitivity, creating a rich environment for those who know how to source deals directly. You can dig into more of these global real estate trends in this great report from Savills.

This dynamic makes proactive sourcing an essential skill for both survival and growth. Understanding how to find, validate, and engage with these hidden opportunities is the first step toward dominating your market—which is exactly what we’ll explore next.

How to Uncover Hidden Off-Market Deals

The start of a great off-market deal isn't usually some well-kept secret—it’s more like a breadcrumb trail of public records just waiting for someone to follow it.

While a lot of investors are stuck on networking, the real advantage comes from learning to read the data signals that point to a motivated seller long before they even think about listing. These aren't just names on a spreadsheet; they're stories of distress and opportunity unfolding in plain sight at the county courthouse.

Reading the Tea Leaves of Public Data

Think of county-level data as the earliest possible warning system for a potential deal. These records get filed out of legal necessity, creating a factual, time-stamped log of events that often mean a property owner is feeling the pressure. Getting good at reading these "tea leaves" gives you a massive competitive edge.

You can jump way ahead of the market by zeroing in on these key signals:

- Tax Liens and Delinquencies: When an owner falls behind on property taxes, the county slaps a lien on their property. This is a crystal-clear sign of financial strain and a strong hint that the owner might need to sell fast.

- Probate Filings: After a homeowner passes away, their estate often has to go through probate court. The heirs might live out of state, have no emotional attachment to the house, and be highly motivated to sell quickly to settle the estate.

- Code Violations: A property racking up code violations—think overgrown yards, structural problems, or unpermitted work—often points to a neglected asset. The owner could be an overwhelmed landlord or an absentee owner who's ready to offload a headache.

- Pre-Foreclosures: A notice of default is one of the very first public steps in the foreclosure process. This opens up a critical window to connect with a homeowner who needs to sell to avoid losing their property to the bank.

These signals are the raw ingredients for building your own proprietary pipeline of exclusive leads. While other investors are buying the same stale, recycled lists, you can be the first one to reach out with a real solution.

Turning Raw Data into Actionable Leads

Just finding these signals is only step one. The real work is in consistently tracking, verifying, and then acting on this information. For instance, the classic "driving for dollars" method involves physically spotting distressed-looking properties and then digging into public records to find the owner. We break down how to modernize this old-school technique in our complete guide to driving for dollars.

But let's be honest—manually checking county websites, courthouses, and recorder offices is a huge time sink and simply doesn't scale. To turn this raw intelligence into a predictable flow of deals, you need a system. That means creating a process to not only gather the data but also enrich it with owner contact information (a process called skip tracing) and get it organized for outreach.

The goal isn't just to find a deal; it's to build a machine that consistently surfaces dozens of potential deals every single month. By focusing on the source data, you stop competing with the crowd and start creating your own market.

The Power of Distressed Scenarios

Off-market deals thrive in situations of distress. With the current U.S. housing deficit and a reported 42% drop in speculative construction, investors are hunting harder than ever for non-listed assets like foreclosures and probates. Tapping directly into county-level data for these signals can give you early access to opportunities at potential discounts of 20-30% below market value.

These motivated sellers often care more about a fast, certain closing than squeezing every last dollar out of the sale. This creates a win-win for investors who can offer a quick, no-hassle transaction. To really level up your strategy, exploring these powerful ways to generate real estate sales leads can be a great resource for expanding your outreach. When you combine data-driven sourcing with smart engagement, you build a pipeline that others simply can't access.

Building Your System to Source and Validate Data

Spotting signals like tax liens or probate filings is a great first step, but raw information is a long way from being an actionable lead. The real challenge—and where most investors get completely bogged down—is turning a messy spreadsheet of names and addresses into a clean, qualified list of potential sellers you can actually reach.

This is where you build your operational advantage. Finding the raw data is just the starting line; creating a system to process it is what separates the pros from the amateurs. Without a solid process, you're just hoarding data.

The Headaches of Raw Data

County data is a goldmine, but it's rarely served up in a neat little package. Every county, and sometimes every department within that county, has its own quirky way of recording and storing information. This creates some serious hurdles you have to clear to build a scalable system for finding off-market properties.

A few of the most common headaches include:

- Weird Formatting: One county might list owner names as "Last, First," while another uses "First Last." Addresses can be broken up into multiple columns, key property details might be missing, and the files themselves can be anything from messy PDFs to ancient text files.

- "Dirty" Data: Public records are notoriously full of errors. Typos, outdated information, and incomplete entries are the norm, not the exception. This "dirty" data has to be scrubbed and standardized before it’s even remotely usable.

- The Skip Tracing Problem: A property address is one thing, but it doesn't give you a way to actually contact the owner. Skip tracing—the process of finding an owner's phone number and email address—is the essential next step for any direct outreach campaign.

Just trying to manually clean and enrich this data for a single county can eat up dozens of hours a week. Attempting it for multiple sources isn't just inefficient; it’s a one-way ticket to burnout.

Manual Drudgery vs. Automated Efficiency

The old-school approach to this problem is pure, mind-numbing manual labor. It looks like an investor or a VA spending endless hours downloading files, painstakingly correcting formatting in Excel, and then running names through a separate skip-tracing service one by one. This method is slow, riddled with human error, and completely unscalable.

An automated system, on the other hand, treats data acquisition like a manufacturing pipeline.

By building an automated engine, you stop being a data janitor and become an operator. Your focus shifts from cleaning up messy spreadsheets to analyzing deals and talking to motivated sellers who are already pre-qualified.

Here’s a quick look at how a platform like Tab Tab Labs visualizes this automated data pipeline, turning raw county records into validated opportunities right before your eyes.

This kind of dashboard view shows how a system can pull together, clean, and serve up leads from multiple distress categories, giving you a clear, actionable overview of your entire pipeline.

Building Your Data Machine

The secret to generating a predictable flow of off-market properties is creating a repeatable, scalable system. The goal is to own your data acquisition process from the ground up, giving you a proprietary source of leads that your competitors can't just go out and buy. You can go deeper on the nuances of public records in our guide on the best ways to perform a county property records search.

This machine has a few core components:

- Automated Scraping: This is the tech that consistently pulls data from your target county sources (probate courts, tax assessors, etc.) the moment new records are filed.

- Data Cleansing and Standardization: A process that automatically fixes formatting errors, kicks out duplicate entries, and structures all the data into a uniform format.

- Automated Skip Tracing: An integrated service that appends accurate contact information—phone numbers and emails—to each and every property record.

- CRM Integration: A direct feed that pushes these cleaned, enriched leads straight into your CRM, all teed up and ready for outreach.

For finding and managing information on property owners, gleaning insights from the best B2B data providers can also be incredibly valuable as you build out your system.

When you build this engine, you stop fighting over the same stale, recycled lists everyone else is using and start creating your own exclusive deal flow. Once your data is clean and ready to go, the next step is to engage these potential sellers at scale.

Using AI to Automate Outreach and Qualification

Once you have a clean, validated list of potential off-market properties, the real work begins. The old way is a brutal grind: manual cold calls, endless follow-ups, and messy spreadsheets. This is where your best people burn out, sinking 80% of their time into low-value tasks instead of high-stakes negotiations.

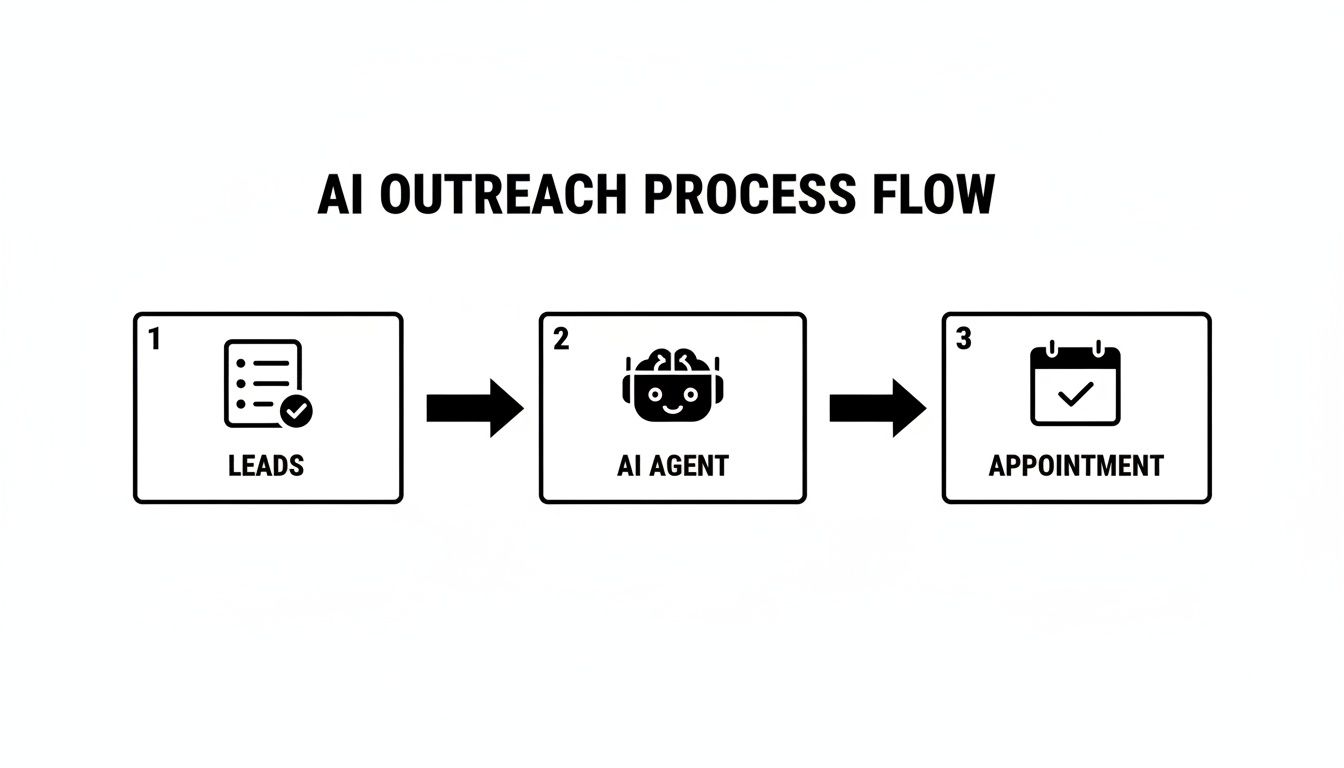

But what if you could just skip that whole part? That's where automating the top of your funnel with an AI Inside Sales Agent (ISA) comes in. This isn't just another chatbot; it’s a system built specifically to engage, qualify, and book appointments at a scale a human team could never dream of matching.

What Is an AI ISA and How Does It Work?

Picture your most tireless team member, one that can have hundreds of personalized, two-way conversations with potential sellers at the exact same time, all via text message. It works 24/7, never gets tired, and it absolutely never misses a follow-up.

Here’s how this automated engine completely changes your outreach:

- Instant Engagement: The second a new lead hits your CRM from your data system, the AI ISA fires off a compliant, initial text to get the ball rolling.

- Natural Conversation: It's not robotic. It uses conversational AI to understand what a seller is saying, ask the right qualifying questions, and figure out their motivation, timeline, and the property’s condition.

- Real-Time Qualification: The AI knows in seconds if it's talking to a motivated seller ready to move or just a tire-kicker, saving your team from countless dead-end calls.

- Automated Appointment Setting: Once a lead is qualified, the AI ISA seamlessly books an appointment right on your acquisitions manager's calendar.

This whole sequence—from the first touchpoint to a booked meeting—can happen in minutes without a single human getting involved. It frees up your top talent to focus on what they do best: building rapport with motivated sellers and closing deals.

An AI ISA doesn't replace your acquisitions team; it supercharges them. It acts as a perfect, always-on filter, making sure your team only spends their precious time talking with pre-vetted, high-intent sellers ready to have a serious conversation.

Staying Compliant While Scaling Outreach

Reaching out to homeowners directly, especially with texts, means you have to play by the rules. Regulations like the Telephone Consumer Protection Act (TCPA) are no joke, and breaking them can lead to massive fines and legal nightmares. A properly built AI outreach system has compliance baked right into its DNA.

It automatically manages consent, handles opt-out requests instantly, and makes sure every message follows legal guidelines. This lets you scale up your outreach aggressively while keeping risk low—a balance that's nearly impossible to pull off with manual methods. To learn more about how tech is shifting the industry, check out our guide to using AI for real estate agents, which dives deeper into these modern tools.

Seamless CRM Integration for a Unified Pipeline

Automation without organization is just another word for chaos. That's why a critical piece of any AI-driven system is how it connects directly with your Customer Relationship Management (CRM) platform. This creates a single source of truth for your entire pipeline.

Here’s what that looks like day-to-day:

- The AI ISA starts a conversation with a lead via text.

- The entire conversation history is automatically saved in the CRM.

- The lead's status updates in real time (e.g., from "New Lead" to "Qualified" to "Appointment Set").

- A new calendar event is created for your team with all the seller and property info attached.

This tight integration ensures no lead ever falls through the cracks. Your team gets a clear, up-to-the-minute view of the pipeline without ever having to manually update a spreadsheet or copy-paste notes. It turns a scattered, reactive process into a streamlined, predictable deal-generation machine, setting you up for real, scalable growth.

Theory is one thing, but seeing how this stuff works in the real world is where the rubber meets the road. Let's look at a real-world example of a mid-sized investment team, we'll call them "Keystone Acquisitions," as they completely overhauled how they found off-market properties. Their journey is a perfect blueprint for moving from sporadic, manual effort to a predictable, automated deal machine.

Originally, Keystone's strategy was as old-school as it gets. One person on their team spent about 15 hours a week, just pulling probate lists from a single county's website. The data was a mess, needing hours of painful cleanup before they could even think about skip tracing it—which was another tedious, manual task.

This old way of doing things was riddled with problems. It was slow, full of human error, and the leads were often stale by the time they got to the acquisitions team. Their pipeline was a rollercoaster, lurching from a few decent leads one month to a dead end the next. You can't build a business on that kind of inconsistency.

The Shift to a Data-Driven System

Keystone knew they couldn't scale by just working harder. They had to work smarter. So, they decided to build an automated system, partnering with a data and automation provider to create an engine that would transform the very top of their funnel.

Instead of relying on one source, the new system started pulling from nine different county-level sources at once. This gave them a much richer picture of potential distress, including:

- Probate Filings

- Tax Liens and Delinquencies

- Pre-Foreclosures

- Code Violations

- Civil Court Records (like divorces)

All this data was automatically cleaned up, standardized, skip-traced, and then fed directly into their CRM in almost real-time. This completely removed the data entry bottleneck and gave them a huge first-mover advantage.

Integrating AI for Scalable Outreach

Now that Keystone had a firehose of clean data, they hit their next wall: outreach. Their small team couldn't possibly call hundreds of new leads every single week. This is where they brought in an AI Inside Sales Agent (ISA) to handle the first touch and qualification at a massive scale.

This flow chart shows just how simple and powerful their new process became.

The system seamlessly moves from a raw lead to a fully qualified appointment booked on the calendar, with zero human touch. The AI ISA would text new leads within minutes, strike up a natural conversation to gauge their motivation, and then book the truly interested sellers right onto an acquisitions manager's calendar.

The change was immediate and staggering. The team stopped wasting hours on dead-end cold calls and started walking into warm conversations with sellers who were already pre-vetted and ready to talk.

Quantifying the Results

The real proof, as always, was in the numbers. When we look at the KPIs, they tell a story of explosive growth and efficiency. By automating how they sourced and qualified off-market properties, Keystone fundamentally changed the economics of their business.

Let's look at a side-by-side comparison of the key metrics before and after they made the switch.

Performance Metrics Traditional vs. Automated Off-Market Sourcing

| Metric | Traditional Method (Manual) | Automated System (Data + AI) |

|---|---|---|

| Leads Sourced per Month | ~150 (from 1 source) | ~1,200 (from 9 sources) |

| Hours Spent on Data Entry | 60 hours/month | 0 hours/month |

| Qualified Appointments Set | 4-5 per month | 18-22 per month |

| Cost Per Appointment | ~$450 | ~$175 |

| Lead-to-Appointment Rate | ~3% | ~1.7% (but from a much larger pool) |

| Pipeline Predictability | Low (inconsistent) | High (consistent flow) |

Keystone's transformation proves that scaling your off-market operation isn't about hustle and grind. It's about building a better system. By combining direct-from-source data with AI-powered automation, they built a predictable pipeline of exclusive deals. This freed up their best people to do what they do best: negotiate and close.

Common Questions About Off Market Properties

Diving into the world of off market properties can feel like you're learning a whole new language. It’s totally normal to have questions. This whole game shifts the focus from passively waiting for listings to hit the market to proactively creating your own opportunities, and that takes a different mindset—and a different set of tools.

To help clear things up, we’ve put together answers to the most common questions we hear from investors and agents who are just starting to build out a direct-sourcing pipeline. Think of this as your field guide for when you move past the theory and start getting your hands dirty.

Is It Legal to Contact Homeowners Who Aren’t Selling?

Yes, it’s absolutely legal, but only if you approach it with a laser focus on compliance. This isn’t about dialing for dollars at random. It’s about respectfully reaching out to people who, based on public data, might be in a situation where selling their home could be a genuine solution to a problem.

The key is following all the rules to the letter.

- Stick to the Telephone Consumer Protection Act (TCPA): This is the big one. It’s a federal law that governs telemarketing, but more importantly for modern outreach, it covers text messages. It lays out crystal-clear rules around consent and how you can communicate.

- Scrub Against the National Do Not Call Registry: Before any calling campaign kicks off, you have to run your list against the DNC registry. Skipping this step can lead to massive fines and legal headaches you just don't want.

- Honor Opt-Outs Immediately: If a homeowner asks you to stop contacting them, your system needs to process that request instantly. No excuses.

Of course, direct mail is still a widely used and compliant way to get the ball rolling. But the automated, data-driven strategies we’ve been talking about are built with compliance baked in from the start, letting you scale up your efforts without taking on dumb risks. A professional, ethical, and fully compliant approach isn't just the best path—it's the only one for long-term success.

How Is This Different from Buying National Lists?

This is probably one of the most critical distinctions to get your head around, because it’s where your real competitive edge comes from. The difference boils down to two things: exclusivity and timing.

When you buy a list from one of the big national data providers, you're buying a product. It's been aggregated, cleaned up, and then sold to dozens, maybe even hundreds, of other investors looking in your exact same market. By the time that list lands in your inbox, those leads are already getting hammered with calls, texts, and mailers. The element of surprise is gone, and you’re right back in the middle of a bidding war.

Sourcing data directly from county-level records gives you a powerful first-mover advantage. You are accessing the raw distress signals—like a brand-new probate filing or a freshly recorded tax lien—the moment they become public record. This is often weeks or even months before they ever show up on a national aggregator's list.

What this really means is you’re very likely the first person to reach out to a potentially motivated seller with a thoughtful offer. Making that first contact, free from the noise of all your competitors, dramatically increases your odds of building rapport and locking down the deal. You're no longer competing; you're creating your own exclusive opportunities from scratch.

Can a Small Team or Solo Investor Implement This System?

Absolutely. In fact, you could argue that this kind of automated system is more impactful for a smaller operation. A solo investor or a tiny team just doesn't have the bandwidth to manually scrape data from multiple counties, clean up thousands of records, and then make hundreds of qualifying calls every single week. That's a one-way ticket to burnout.

Automation is the great equalizer here. It lets a small, nimble team punch way above its weight, achieving the kind of output that used to be possible only for huge organizations with dedicated call centers.

Here’s how it levels the playing field:

- It swaps manual labor for efficient technology, freeing you from the soul-crushing grind of data entry and admin work.

- The AI ISA handles the entire top-of-funnel qualification process, making sure you only spend your precious time on revenue-generating activities.

- It builds a predictable and consistent deal flow, finally putting an end to that "feast or famine" cycle that plagues so many smaller investors.

Instead of getting bogged down in the process, a solo operator can focus their energy on what really matters: talking to pre-vetted, motivated sellers, analyzing deals, and crafting winning offers.

What Is the Typical Cost for an Automated System?

The cost can vary, but it's crucial to think of it as an investment in a predictable lead-generation engine, not just another business expense. The real question isn't "what does it cost?" but rather "what is the return on that investment?" You measure the ROI in the high-equity, exclusive deals you would have otherwise completely missed out on.

Platforms like Tab Tab Labs usually work on a partnership model. It often starts with a strategy call to really dig into your goals, followed by the design of a custom system built for your specific market and criteria. The monthly investment is typically a fraction of what a brokerage might spend on traditional, hyper-competitive marketing channels like Zillow leads or pay-per-click ads.

Many providers will also give you a sample data list from your target market before you commit to anything. This lets you see the quality and accuracy of the information for yourself, which really cuts down on the initial risk. By investing in a system that generates exclusive off market properties, you're not just buying leads—you're building a durable asset for your business that will pay dividends for years to come.

Ready to stop fighting over stale leads and start creating your own exclusive deal flow? Tab Tab Labs builds automated engines that turn raw county data into pre-qualified seller appointments, delivered directly to your calendar.

Book a free strategy call today to see how we can build a predictable pipeline for your business.