Finding an Off Market Listing Your Competitors Will Miss

Discover how to find an off market listing with proven strategies for investors and agents. Unlock hidden real estate opportunities and close better deals.

By James Le

Think of the real estate world as having two distinct arenas. There's the public stage—the MLS, Zillow, the big portals—where everyone can see what’s for sale. Then there’s the private, backstage area, where deals happen away from the crowd. An off market listing is a property for sale exclusively in that backstage area.

What Is an Off Market Listing and Why It Matters

An off-market property, also known in the industry as a "pocket listing," is sold without ever being publicly advertised on the Multiple Listing Service (MLS). Because consumer-facing sites like Zillow and Redfin get their data from the MLS, you won’t find these homes there, either. These are private transactions, typically handled through an agent’s personal network or directly between a buyer and seller.

If the MLS is the New York Stock Exchange—visible, transparent, and open to all—then an off-market deal is like a private equity placement. It's exclusive, direct, and usually crafted for a specific buyer or investor.

And this isn't some tiny, niche corner of the market. Data from a recent year showed that roughly 1.2 million homes were sold outside of the MLS, accounting for nearly 30% of all housing sales. That's a huge slice of the pie. But there’s a trade-off: one study revealed that homes sold on the MLS fetched prices that were, on average, 17.5% higher than comparable off-market sales. You can dig deeper into the numbers and what they mean on quickenloans.com.

To quickly see the differences, here's a simple breakdown:

On-Market vs Off-Market Properties at a Glance

| Characteristic | On-Market (MLS) Listing | Off-Market Listing |

|---|---|---|

| Visibility | Publicly advertised to everyone | Private, shared within a small network |

| Competition | High, often leads to bidding wars | Low, typically one-on-one negotiations |

| Sale Price | Tends to be higher due to competition | Often lower, with more room for negotiation |

| Process Speed | Can be slower due to marketing and showings | Can be much faster and more direct |

| Privacy | Low; sale details are public knowledge | High; terms and parties remain confidential |

This table just scratches the surface, but it highlights the core trade-offs at play. Sellers sacrifice maximum price for privacy and convenience, while buyers get a shot at a better deal by giving up the broad selection of the open market.

Why Do Sellers Choose the Off-Market Path

So, why would anyone willingly leave money on the table? Sellers who go the off-market route are usually optimizing for something other than the highest possible price. If you want to find these deals, you first need to understand their motivations.

Here are the main reasons a seller might keep their listing private:

- Privacy and Discretion: Think of high-profile individuals, celebrities, or even just people going through a tough divorce or financial hardship. They often want to keep their affairs out of the public eye. An off-market sale keeps things quiet.

- Testing the Waters: A seller might want to float a "what if" price to see if they get any bites, all without racking up "days on market" on the MLS. A property that sits on the MLS for too long starts to look stale, and this avoids that stigma.

- Cutting Down the Hassle: Let's be honest, selling a home is a pain. The constant stream of showings, open houses, and strangers traipsing through your personal space can be exhausting. A private sale offers a much more controlled, predictable, and frankly, easier process.

- A Specific Buyer is Already Lined Up: Sometimes the deal is practically done before it even starts. The seller or their agent might already have an interested party in their network, making a full-blown marketing campaign completely unnecessary.

The Strategic Advantage for Buyers and Investors

For buyers, investors, and agents who know where to look, the off-market world is a goldmine of opportunity. It's your ticket to escaping the frantic bidding wars and razor-thin margins that have come to define the public market.

By tapping into this hidden inventory, you gain access to properties that the general public doesn't even know are for sale. This creates a powerful edge in any real estate market.

The benefits are straightforward: you're up against far less competition, which almost always translates into better negotiation terms. Instead of just throwing a number at a faceless seller, you get to build a real relationship, understand their specific needs, and craft an offer that solves their problem—not just meets a price. Mastering this space means shifting from being a reactive buyer who waits for listings to a proactive deal-finder who creates them.

The Different Faces of Off Market Real Estate

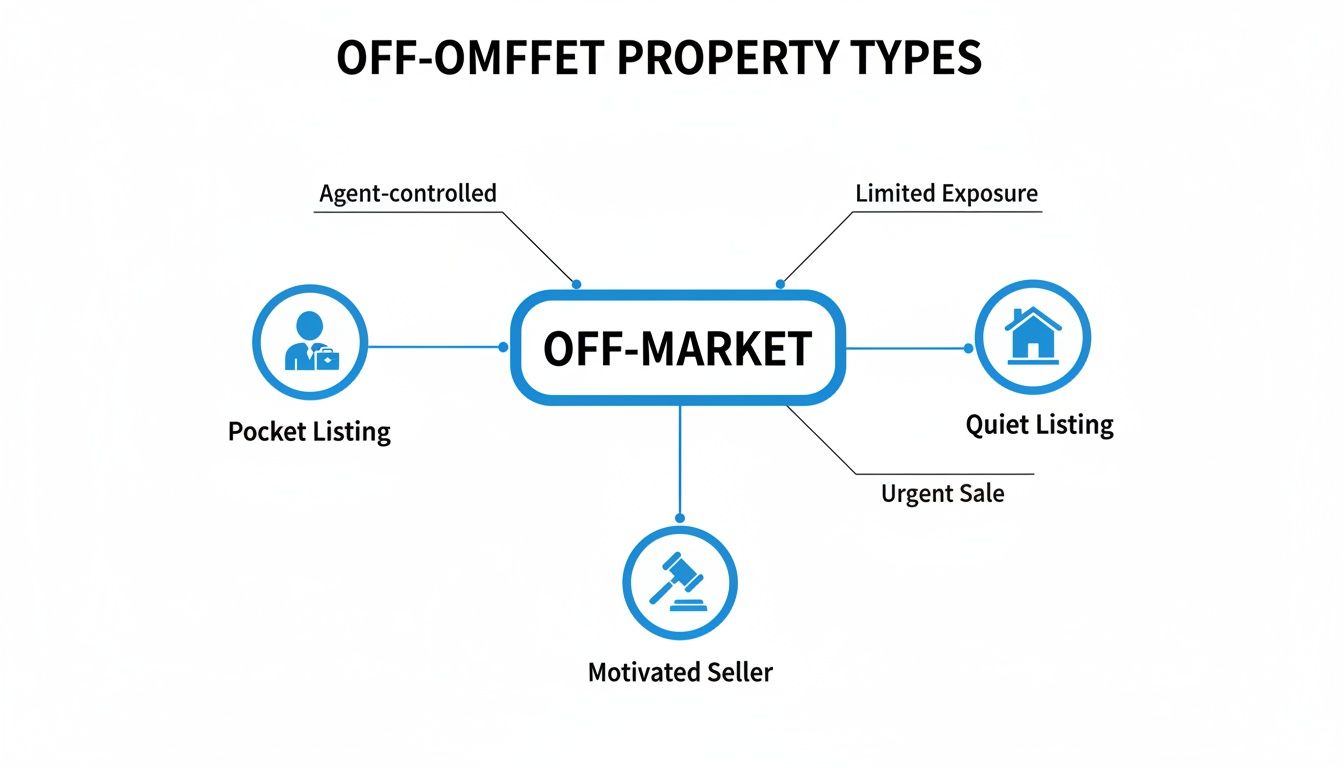

The term “off-market” gets thrown around a lot, but it isn't some monolithic category of secret deals. It’s better to think of it as an entire ecosystem of opportunities, each one driven by a completely different set of circumstances and motivations.

Getting a handle on these nuances is the first real step toward sourcing deals your competition doesn't even know exist.

Think of it like a collection of different fishing spots. Some are known to a handful of local pros, while others are totally hidden, forcing you to read the currents to find them. Each spot holds different kinds of fish and, naturally, requires a different kind of bait.

Agent-Controlled Listings

These are probably the most well-known type of off-market properties—the ones real estate agents control but intentionally keep off the public MLS. They generally fall into two camps.

- Pocket Listings: This is the classic example. An agent has a signed listing agreement with a seller but keeps the property "in their pocket." They'll only market it to their private network of proven buyers and trusted agents. Sellers often go this route for privacy or to test a certain price without racking up public "days on market."

- Quiet Listings (or Office Exclusives): This opens the circle of exposure just a little wider. A quiet listing is only shared with the other agents inside the listing agent's brokerage. It gives the brokerage's team the first crack at finding a buyer in-house before the property ever hits the open market.

These deals are all about who you know. Getting access is almost entirely dependent on the strength of your network and your reputation among the top-producing agents in your market.

Motivated Seller Scenarios

Once you get past the agent-controlled world, you find a vast landscape of properties that aren't for sale in any traditional sense. Instead, the owner is under some kind of pressure that makes selling a very attractive option. These are the truly hidden gems.

These aren't just properties; they're situations. The key is to recognize that you're not just buying a house—you're providing a solution to a homeowner's complex problem, often at a critical moment.

This category is full of distinct situations:

- Pre-Foreclosures: The homeowner has fallen behind on their mortgage, and the lender has started the legal process to take back the property. These owners are racing against the clock to sell before the bank forecloses, which makes them incredibly motivated to hear a fast, fair cash offer.

- Probate Properties: When someone passes away without a clear will or trust, their real estate has to go through a court-supervised process called probate. The heirs or the estate administrator are usually just looking to liquidate the asset to pay off debts and distribute what's left. This creates a clear path for a straightforward sale.

- Tax Liens and Delinquencies: If an owner stops paying their property taxes, the county can put a lien on the home. These owners are often dealing with financial hardship and may be very open to selling the house to clear their tax debt and walk away clean.

Other Hidden Opportunities

Finally, you have owners who are open to selling but haven't made a single move to list their property. They aren't in distress, but they have a personal reason for wanting to sell without the circus of a public listing.

Two classic examples here are:

- Unlisted For Sale By Owner (FSBO): These are the homeowners who plan to sell the house themselves but just haven't gotten around to advertising it yet. A well-timed, direct inquiry can catch them at the perfect moment before they put up a sign or post it online.

- Tired Landlords: This group owns rental properties but has simply had enough. They're worn out from dealing with tenants, toilets, and turnover. They are often incredibly receptive to an offer that lets them cash out of their investment without any more headaches.

Actionable Strategies for Sourcing Off Market Deals

Finding an off-market listing isn't about luck; it's about shifting your mindset from passively waiting for deals to actively hunting for them. This is where the real work begins—blending smart, data-driven research with the kind of human connection that uncovers opportunities no one else sees. Nail this, and you'll build a pipeline of exclusive deals that your competition can only dream about.

The diagram below breaks down the main flavors of off-market properties you'll come across, from listings quietly held by agents to properties owned by highly motivated sellers.

Knowing the difference helps you focus your energy. Are you building relationships with top agents, or are you reaching out directly to someone who needs to sell now?

Mining Public Records for Motivated Sellers

Often, the best off-market opportunities come from sellers facing some kind of distress. The good news? Their situations are usually a matter of public record. County courthouses and city offices are absolute goldmines of data, packed with clear signals of motivation. The trick is knowing which records to pull and how to read the tea leaves.

Here are the bread-and-butter sources to hit first:

- Pre-Foreclosures (Lis Pendens): The moment a lender starts the foreclosure process, they file a public notice called a lis pendens. This document is your earliest warning flare that a homeowner is in deep financial trouble and likely needs a fast exit.

- Probate Court Filings: When someone passes away, their property often lands in probate court. These records will point you straight to the estate's representative, who is almost always motivated to liquidate assets like real estate to pay off debts and distribute the cash to heirs.

- Tax Liens and Delinquencies: The county tax assessor keeps a running list of homeowners who are behind on their property taxes. These folks are feeling the financial squeeze and are often incredibly open to an offer that makes their tax headache disappear.

- Code Violations: Local municipalities track properties with violations—think overgrown yards, sketchy structural issues, or unpermitted additions. These are often signs of a neglected property and an overwhelmed owner who's ready to throw in the towel.

Let’s be honest, digging through these records by hand is a soul-crushing grind. Thankfully, modern platforms can automate this for you, scraping county data to serve up curated lists of distressed properties and saving you hundreds of hours.

Building a Powerful Referral Network

While data gets you the leads, relationships get you the inside scoop. A truly effective off-market strategy is built on a network of professionals who become your eyes and ears on the ground. These are the people who meet motivated sellers long before any public record ever gets filed.

Your must-have network should include:

- Attorneys: Estate planning, probate, and divorce lawyers are invaluable. They’re on the front lines with clients who need to sell a property because of a major life event.

- Contractors and Tradespeople: Plumbers, roofers, and general contractors are often the first to know when a homeowner is staring down a massive repair bill they simply can't afford.

- Property Managers: These pros have a direct line to "tired landlords"—investors who are sick of the headaches and ready to offload their entire rental portfolio.

Building these connections takes time and effort. It's all about providing value first, whether that means sending referrals their way or just being a reliable resource they can count on. A strong network will feed you a steady diet of high-quality, exclusive leads.

Executing Direct Outreach Campaigns

Once you've got your list of potential leads from data or referrals, it's time for outreach. This is a numbers game, and it demands a systematic approach that combines personalized messaging with relentless follow-up. Hyper-targeted direct mail, for instance, lets you send personal-feeling letters to specific groups, like out-of-state owners or people in pre-foreclosure. You can learn more about how to effectively target and use absentee owner lists in our detailed guide.

And yes, cold calling still works wonders when you're starting with good data. The key is to lead with empathy. You’re not just trying to buy a house; you're trying to solve a problem for someone. This direct, human approach cuts through the marketing noise and gets you talking directly to the person who can say "yes."

This move toward private sales is blowing up in the luxury market. The off-market segment has grown so much that over half of UK homes valued above £2 million now sell without ever hitting the open market. In just one recent year, one-third of all £1 million-plus properties there were sold this way. It gets even crazier at the top: 54% of properties valued above £5 million found buyers privately.

This isn't just a UK trend, either. The National Association of Realtors estimated that roughly 1 in 5 U.S. luxury homes were sold privately off-MLS. To help you manage this process, you might want to check out solutions tailored for agents that can simplify finding and tracking these unique properties.

Turning Cold Leads into Qualified Conversations

Finding a potential off-market listing is just like discovering a trailhead. It’s a great start, but the real journey—turning that raw lead into a real conversation—is still ahead. The operators who consistently close these deals have mastered the art of outreach. They don't just wing it; they build a repeatable process that turns data points into qualified appointments.

This isn’t about high-pressure sales calls or slick scripts. Forget all that. Effective outreach is built on empathy, genuine problem-solving, and building a sliver of trust right from the first interaction. Whether you're sending a letter, an email, or making a phone call, your goal is to connect as a human who can offer a solution, not just another investor trying to lowball them on their house.

Crafting a Message That Actually Connects

Your initial message has to cut through an incredible amount of noise. A homeowner in a tough spot, like pre-foreclosure, is probably getting bombarded with generic, low-effort postcards and robocalls. To stand out, your communication has to be personal, respectful, and laser-focused on their needs.

Think of it this way: you’re not selling anything. You're trying to start a conversation about their problem. Your message needs to quickly establish that you're a credible, serious person and communicate a clear, simple way you might be able to help. For example, a direct mail piece to a probate lead should be compassionate and direct, acknowledging their difficult situation and offering a simple, no-hassle way to handle the property.

The golden rule of outreach is to lead with value and empathy. Your first contact should answer the seller's unspoken question: "How can you help me solve my problem?" This approach shifts the dynamic from a sales pitch to a consultation.

When you do this right, you position yourself as a helpful resource, not a predator. That’s the foundation of trust you need to move the conversation forward.

The Art of the Qualification Call

The moment you get a response, the qualification process kicks into gear. This isn't just a casual chat; it's a structured conversation designed to uncover the seller's true situation and figure out if an off-market deal is a viable path for both of you. A good qualification call is a fact-finding mission, not an interrogation.

The secret is asking open-ended questions that encourage the seller to tell their story. Ditch the simple "yes" or "no" questions. Instead of asking, "Do you want to sell?" try something like, "What has you thinking about selling the property at this time?" This simple shift opens the door to understanding their real motivations.

Your goal on this call is to gather critical information across four key areas, which you can remember with the acronym M.A.P.S.

- Motivation: Why are they really considering a sale? Are they facing foreclosure, dealing with a messy inheritance, or just plain tired of being a landlord? The stronger the motivation, the more likely a deal is to materialize.

- Asking Price: What number do they have in their head? This is a crucial data point, but don't get hung up on the initial figure. A seller's first "ask" is often flexible if you can offer other valuable terms, like a lightning-fast closing or an all-cash offer with no contingencies.

- Property Condition: What’s the real state of the home? Does it need a new roof, a full gut job, or just a coat of paint? Getting a clear picture of the property's condition helps you formulate a realistic offer and shows the seller you’re serious and know what you're doing.

- Seller's Timeline: How quickly do they need to move? A seller facing an impending auction has a radically different timeline than a burned-out landlord who's just casually exploring their options.

Before hopping on a call, it's a good idea to have a checklist of questions ready. This ensures you cover all your bases and can compare opportunities consistently.

Essential Seller Qualification Questions

| Category | Key Question | What You're Trying to Uncover |

|---|---|---|

| Motivation | "What has you thinking about selling at this time?" | The core reason for the sale (e.g., financial distress, inheritance, relocation). Is it a "need to sell" or a "want to sell"? |

| Price & Equity | "If you were to sell, what's a price you'd be happy with?" | Their initial price expectation. You're also listening for clues about their mortgage balance and overall equity. |

| Timeline | "Ideally, how quickly would you like to have this property sold?" | Their sense of urgency. This helps you gauge how flexible they might be on price and terms. |

| Property Condition | "Tell me a bit about the property. Has it had any major updates recently?" | The physical state of the asset. You're listening for big-ticket items like roof, HVAC, foundation issues, or major cosmetic needs. |

| Decision-Making | "Are there any other owners on the title or people you'd need to consult with?" | Who the actual decision-makers are. A deal can stall if you're not talking to everyone who needs to sign. |

By systematically gathering this information using the M.A.P.S. framework, you can quickly assess whether a lead is a genuine opportunity or a dead end. This structured process allows you to focus your time and energy where they'll have the biggest impact, creating a much more efficient and predictable pipeline for your off-market strategy.

Navigating the Legal and Ethical Landscape

Let's get one thing straight: operating in the off-market space isn't the Wild West. It's a field with its own specific set of rules, and every serious investor or agent needs to master them. Understanding this legal and ethical framework isn't just a good idea—it's non-negotiable.

This stuff protects you from massive fines, keeps your license safe, and most importantly, builds the trust you need to create a sustainable business.

Think of it like driving a high-performance car. You can go incredibly fast and get where you're going, but only if you know the rules of the road. Ignoring them doesn't just risk a ticket; it can lead to a spectacular crash. The same principle applies here. Chasing off-market deals means knowing the regulations that touch everything from how agents can market a property to how you're allowed to contact potential sellers.

Understanding NAR’s Clear Cooperation Policy

For real estate agents, the big one is the National Association of Realtors' (NAR) Clear Cooperation Policy, also known as Rule 8.0. This policy was put in place to promote fair housing and keep the marketplace transparent for everyone.

In simple terms, the policy says that if a real estate agent publicly markets a property, they have to submit it to the Multiple Listing Service (MLS) within one business day. And "publicly marketing" is defined broadly. We're talking yard signs, social media posts, email blasts, features on a brokerage website—you name it.

This rule directly torpedoed the traditional "pocket listing." An agent can't just quietly advertise a listing to a small circle of buyers while keeping it off the MLS anymore. The second it's public, it has to be available to all agents and their buyers through the MLS. It levels the playing field so every buyer gets a fair shot.

Federal Rules for Direct Outreach

When your strategy involves reaching out directly to homeowners, you're stepping onto turf governed by federal communication laws. The most critical one you need to know is the Telephone Consumer Protection Act (TCPA).

The TCPA puts some very strict limits on telemarketing calls and texts, especially if you're using any kind of automated tech. The key things you absolutely have to follow are:

- Do Not Call Registry: You must scrub your call lists against the National Do Not Call Registry. Calling someone on this list can rack up fines of over $40,000 per violation. Yes, you read that right.

- Time Restrictions: You are not allowed to make solicitation calls before 8 a.m. or after 9 p.m. in the recipient's local time zone.

- Express Consent for Texts: To send marketing text messages, especially with an auto-dialer, you need to have prior express written consent.

Ignoring the TCPA is a fast track to incredibly expensive lawsuits and regulatory heat. Compliance isn't a suggestion; it's a fundamental cost of doing business this way.

State Regulations and Disclosure Duties

Beyond the federal rules, real estate is heavily regulated at the state level. These laws can vary wildly from one state to the next, covering everything from licensing requirements to the exact language you need in a purchase contract. It's on you to know the specific rules for the state you're operating in.

At the heart of any transaction, ethically and legally, is the obligation for full and honest disclosure. This becomes even more critical when you're dealing with distressed sellers who might be vulnerable or just don't know the process.

You have a duty to be transparent about your intentions, the property's condition as you see it, and any material facts that could sway the seller's decision. For instance, when working with pre-foreclosures, you have to understand documents like a lis pendens and what they mean. Hiding information or using high-pressure sales tactics isn't just shady—it can get a contract thrown out and land you in serious legal trouble.

Building Your Scalable Off Market Deal Engine

Finding a few off-market deals here and there is one thing. Building a predictable system that spits them out consistently is how you build a real business.

The goal is to stop being an opportunistic deal-hunter and become a system-builder. We want a reliable engine that generates qualified appointments, where smart processes and technology do most of the heavy lifting for you.

At the heart of this machine is a well-oiled Customer Relationship Management (CRM) system. Forget thinking of a CRM as just a digital rolodex. It's the central nervous system of your entire operation—the single place where every lead, phone call, email, and follow-up note lives. It ensures a hot lead never goes cold just because you forgot to call back.

The Central Role of Your CRM

To successfully run an off-market strategy, you have to manage a high volume of leads. A powerful CRM is non-negotiable. It becomes your single source of truth, letting you track every prospect’s journey from a name on a list to a signed contract. Without it, you're flying blind, juggling messy spreadsheets and relying on memory, which is a recipe for disaster.

This is especially true because the path from first contact to a closed deal can take months, sometimes even years. A solid CRM automates the long game of nurturing leads. It can remind you exactly when to follow up and with what message, keeping you top-of-mind without you having to manually track every single interaction. For a deeper dive, check out our guide on selecting the best real estate investor CRM.

Automating Your Workflow for Maximum Efficiency

Once your CRM is set up, it's time for the fun part: automation. This is where you take all those manual, repetitive tasks and turn them into a smooth, hands-off process. The result? You're freed up to focus on the things that actually make you money—negotiating and closing deals.

Automation is the glue that connects your data sources, your outreach, and your CRM into one seamless workflow.

Here are a few game-changing automation plays:

- Automated Data Ingestion: New leads from sources like probate or pre-foreclosure lists are automatically piped into your CRM and tagged for you. No more manual data entry.

- Triggered Follow-Up Sequences: When a new lead hits the system, it can instantly kick off a multi-step outreach campaign. Think an initial letter, a follow-up email a week later, and a text message after that—all without you lifting a finger.

- Task Generation: If a seller replies with interest, the system can automatically create a task for you to call them and drop it right onto your calendar.

This kind of automation brings a level of consistency and speed that's impossible to achieve manually. In the off-market world, where timing is everything, that's a massive advantage.

Tracking the Metrics That Matter

You can't improve what you don't measure. A truly scalable engine requires an obsessive focus on Key Performance Indicators (KPIs) to diagnose the health of your pipeline. These metrics are your dashboard—they tell you what’s working, what’s not, and where to put your time and money.

The most successful operators treat their deal flow like a science. They know their numbers cold, allowing them to make data-driven decisions instead of relying on gut feelings.

Here are the essential metrics you need to be watching:

- Cost Per Lead (CPL): How much are you spending to get one potential seller lead in the door?

- Contact Rate: Of all the leads you generate, what percentage are you actually able to have a conversation with?

- Appointment Set Rate: Of those conversations, how many turn into a qualified appointment?

- Cost Per Appointment (CPA): What’s your all-in marketing cost to get one face-to-face meeting?

- Conversion Rate (Appointment to Contract): When you go on an appointment, how many result in a signed deal?

Tracking these numbers shines a light on bottlenecks and opportunities, letting you constantly fine-tune your machine for maximum output. For example, a recent trend has seen a spike in delistings, where sellers pull their homes from the MLS instead of chasing the market down with price cuts. Last September, delistings hit 5.5% of active inventory—a decade-high. This creates a whole new pool of motivated sellers for savvy operators to go after. Knowing your numbers helps you pivot to opportunities like this one fast.

Your Off-Market Questions, Answered

Jumping into the world of private real estate deals always brings up a few questions. Let's clear up some of the most common ones I hear from investors and agents.

Is Buying Off-Market Actually Legal?

Yes, absolutely. Buying a property that isn't listed on the MLS is 100% legal.

Most of the legal chatter you hear, like the NAR's Clear Cooperation Policy, is really about rules for licensed agents and how they are allowed to market properties. For a buyer, the actual purchase process isn't all that different from a standard deal—you'll still have a purchase agreement, title search, and a formal closing.

The real key is making sure everyone is on the same page with disclosures and that both sides are represented fairly. This is why having a good real estate attorney in your corner to look over the paperwork is always a smart move.

How Can I Find These Deals for Free?

Finding these properties without paying for data comes down to one thing: sweat equity. The classic method is what we call "driving for dollars."

This means you're literally driving through neighborhoods you're interested in, looking for tell-tale signs of a distressed property—think overgrown yards, boarded-up windows, or mail piling up. Once you spot one, you'll have to dig into public records to find the owner's information. You can also go straight to the source by spending time at your county courthouse, sifting through records for pre-foreclosures, probates, or tax liens.

Networking is another huge part of the free game. Building relationships with local probate attorneys, contractors, and even mail carriers can turn up leads you'd never find otherwise. Just know that while these methods don't cost you money, they cost you time—a lot of it. They're far less efficient than tapping into specialized data services.

What's the Difference Between a Pocket Listing and an Off-Market Listing?

People throw these terms around interchangeably, but there's a subtle yet crucial difference.

"Off-Market Listing" is the big umbrella. It covers any property for sale that isn’t publicly advertised on the MLS. A "Pocket Listing" is a specific type of off-market deal where a real estate agent has a signed listing agreement but chooses to market it privately to their own network instead of putting it on the MLS.

So, think of it this way: every pocket listing is an off-market deal, but not every off-market deal is a pocket listing. A For Sale By Owner (FSBO) or a pre-foreclosure property found through public records are off-market, but they aren't pocket listings.

Ready to build a scalable engine that consistently delivers exclusive, pre-qualified seller appointments? Tab Tab Labs combines proprietary county-level data with powerful automation to fill your pipeline with motivated sellers your competition will never see. Stop fighting over stale lists and start owning your market.