The Ultimate Real Estate Investor CRM Guide

Discover how a real estate investor CRM can streamline your deal flow, automate outreach, and scale your operations with proven, data-driven strategies.

By James Le

If you're a real estate investor, you know the game isn't about managing client relationships in the traditional sense. It's about finding the next deal. Your entire business lives and dies by your ability to consistently source, analyze, and close profitable opportunities, often before anyone else even knows they exist.

That's where a specialized tool, a real estate investor CRM, comes into play. Forget everything you know about the CRMs your agent friends use. An investor's platform is less of a contact database and more of a deal-finding machine, engineered from the ground up to track properties, automate outreach to motivated sellers, and build a predictable, scalable pipeline of assets.

What Is a Real Estate Investor CRM?

Think of it as the mission control center for your entire investment operation. While a traditional agent is focused on managing buyers and sellers for a commission, you're playing a completely different sport. You're hunting, analyzing, and acquiring assets for your portfolio.

This kind of tool is what takes you from a chaotic mess of spreadsheets, sticky notes, and missed opportunities to a finely-tuned system that closes deals with precision. It’s the engine that powers a scalable business by turning that chaos into a repeatable, almost boringly predictable, process.

The Shift From Spreadsheets to Systems

For years, the default for investors was a patchwork of Excel files, notebooks, and calendar reminders. We've all been there. But that manual approach isn't just inefficient; it's impossible to scale. A dedicated real estate investor CRM centralizes every single piece of information, from a seller's phone number to the estimated ARV on their property.

And the market is waking up to this. The real estate CRM software market is already a massive USD 10.81 billion industry, and it's projected to soar to USD 17.13 billion. This growth is fueled by savvy investors ditching manual methods for powerful platforms that can track leads from distressed properties, foreclosures, and tax liens automatically.

The payoff is huge. For those who make the switch, the numbers show an average ROI of $30.48 for every dollar invested. You can dig deeper into the real estate CRM software statistics to see the full impact.

Investor CRM vs Agent CRM At a Glance

It's easy to get the two confused, but their core purpose is fundamentally different. Here's a quick breakdown of where each type of platform puts its focus.

| Feature Focus | Real Estate Investor CRM | Standard Real Estate Agent CRM |

|---|---|---|

| Primary Goal | Deal & Property Acquisition | Client Relationship Management |

| Lead Type | Motivated sellers, distressed properties | Buyers, sellers, past clients |

| Key Workflow | Sourcing off-market deals, automated outreach | Nurturing leads, managing transactions |

| Data Focus | Property data, liens, equity, comps | Contact details, preferences, birthdays |

| Communication | High-volume, multi-channel (SMS, RVM) | Personalized, long-term follow-up |

As you can see, an investor CRM is a high-velocity workflow tool. It's built for the specific, aggressive task of finding and closing deals, not for sending "happy anniversary" emails to past clients.

Core Functions of an Investor CRM

A true investor CRM is defined by its ability to handle specific, deal-centric jobs. It's less about nurturing a lead for months and more about efficiently processing a high volume of property leads to find those hidden gems.

Its most critical functions usually include:

- Lead Sourcing: Plugging directly into data providers to pull lists of distressed properties, probates, or pre-foreclosures right into your system.

- Pipeline Management: Tracking deals through custom stages that actually make sense for an investor, like "Initial Research," "Offer Sent," and "Under Contract."

- Automated Outreach: Setting up and launching multi-channel campaigns (think SMS, email, and even direct mail) to connect with hundreds of property owners at once.

- Deal Analysis: Keeping all property details, running comps, and calculating potential returns right inside the deal record. No more jumping between five different apps.

An investor CRM is fundamentally a workflow machine. Its entire purpose is to create a predictable, automated process for finding and closing profitable deals. It allows you to stop competing for the same public listings everyone else is fighting over and start dominating your market by uncovering exclusive, off-market opportunities.

The Core Features of a Powerful Investor CRM

If you really want to get what makes a real estate investor CRM different, you have to look past the generic bullet points. This isn't about tacking on more features; it’s about having the right tools, all engineered for one single purpose: finding and closing off-market deals. These platforms are built around a handful of non-negotiable features that snap together to create a scalable, deal-finding machine.

Here’s an analogy I like: an agent's CRM is like a family sedan. It's built for comfort and nurturing long-term relationships. An investor's CRM? That's a high-performance race car, engineered for speed, precision, and aggressive acquisition. Every single component is there to get you to the finish line—a signed contract—faster than everyone else.

Advanced Lead Sourcing Integrations

Deal flow is the lifeblood of any serious real estate investment business. A top-tier investor CRM doesn't just sit there waiting for you to dump leads into it; it actively helps you find them before they ever sniff the open market. The secret is direct integration with specialized data sources.

And no, I'm not talking about your typical MLS feed. I'm talking about a direct pipeline into county-level data that screams motivation and distress. This includes things like:

- Tax Liens and Delinquencies: Pinpointing property owners who are in a financial bind and likely need to sell fast.

- Probate Filings: Giving you a heads-up on inherited properties, which heirs often want to liquidate quickly without a lot of hassle.

- Code Violations: Highlighting neglected or run-down properties, which often signals an overwhelmed landlord or an absentee owner.

- Pre-Foreclosure Notices: Getting you in the door with homeowners who are at risk of losing their property and need a real solution.

This direct data access completely changes the game. It's not just about organization; it's about opportunity. Globally, 74% of CRM users report having better access to customer data, which leads to 46% higher client satisfaction and fewer lost leads. For an investor, that means turning raw data from deeds and probate courts into booked appointments before those properties even show up on national aggregator sites. You can get more details on how CRMs boost data accessibility over at llcbuddy.com.

Automated Lead Scoring and Segmentation

Once the leads start pouring in, your next problem is figuring out where to focus. How do you find the golden needles in the haystack? This is where automated lead scoring is a must-have. A powerful investor CRM uses custom rules and AI to instantly analyze and rank leads based on their likely motivation level.

For instance, a property that flags multiple distress signals—say, a tax delinquency and a code violation—would automatically get a higher score than a property with just one. This simple step lets you point your time, energy, and marketing dollars at the opportunities that are actually likely to close.

A great investor CRM doesn't just hold your data; it interprets it for you. It tells you exactly who to call first, making sure your most valuable resources are always aimed at your most promising targets.

Multi-Channel Outreach and Pipeline Visualization

With your best leads identified, the CRM then becomes your marketing engine. It can launch coordinated, multi-channel campaigns that practically run themselves. Imagine sending out targeted SMS messages, personalized emails, and even triggering direct mail campaigns, all from one dashboard.

Finally, all this activity gets tracked in a visual pipeline that actually makes sense for an investor. Forget generic stages like "Contacted" or "Follow-Up." You get a workflow that mirrors your actual business process:

- Researching

- Offer Made

- Negotiating

- Under Contract

- Closed

This kind of clarity ensures no deal ever falls through the cracks. More importantly, it gives you a real-time, at-a-glance dashboard of your entire business's health.

Automating Your Deal Flow From Lead to Close

A real estate investor CRM is what puts your deal flow on autopilot. It’s the critical difference between manually chasing every lead and building a predictable system that drops qualified appointments right onto your calendar. This isn't just theory; it's the exact workflow that separates amateur investors from the pros who consistently close deals.

Think about it this way: a new distressed property lead, maybe flagged for tax delinquency, automatically pops into your system. Instantly, a pre-built outreach sequence kicks off. It might start with a text, followed by a personalized email a day later, and another a few days after that. The system handles the relentless, structured follow-up that you know is key to getting a response but is so tedious to do by hand.

This entire process—from that first touchpoint all the way to securing a conversation with a motivated seller—is managed by interconnected workflows inside your CRM.

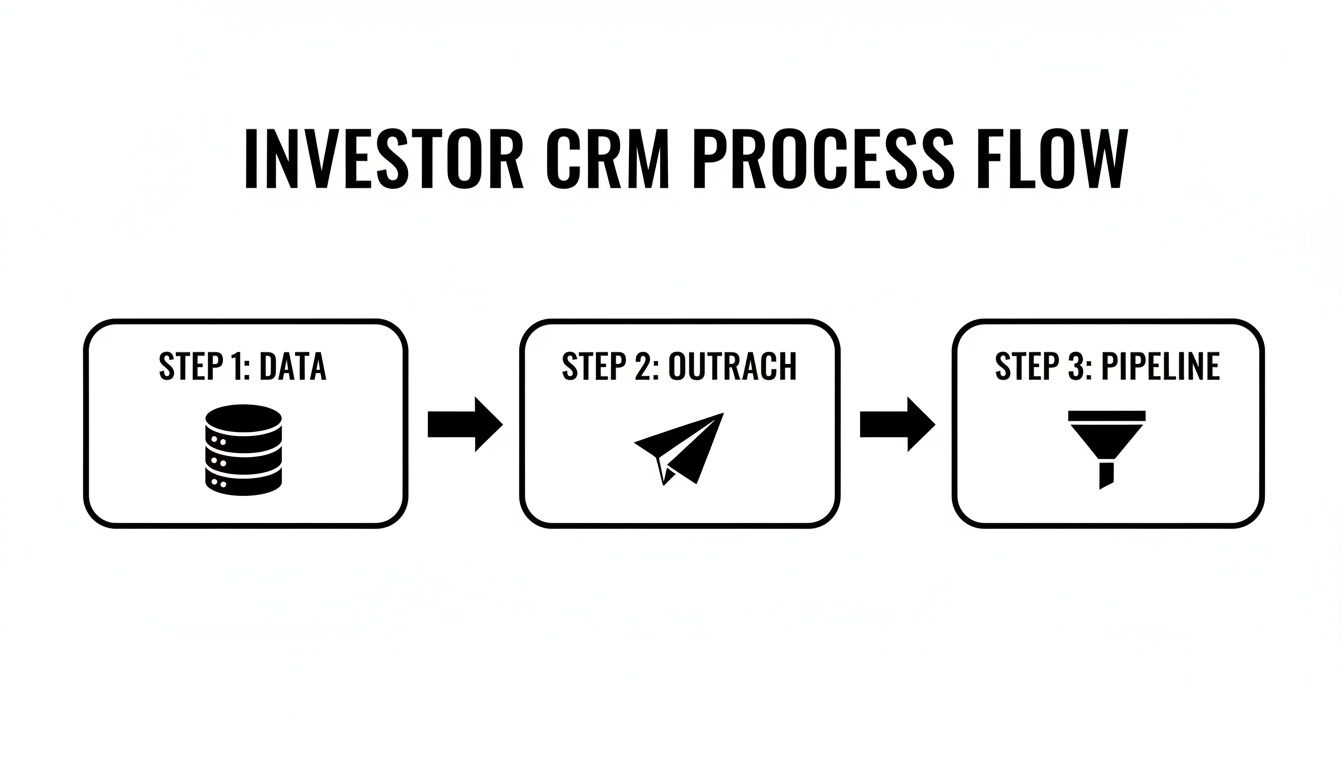

This is what that simple, powerful flow looks like:

As you can see, it all starts with high-quality data. That data feeds into your automated outreach, which in turn funnels genuinely qualified leads straight into your pipeline for you to work.

The AI-Powered Assistant Workflow

Now, let's take that automation a step further. When a seller finally replies to one of your automated messages, an AI-powered assistant (often called an ISA, or Inside Sales Agent) can immediately take over the conversation. This isn't just a simple chatbot; it can engage in a natural back-and-forth, ask sharp qualifying questions, and gauge the seller's motivation level—all without you lifting a finger.

If the lead checks out, the AI can even access your calendar and book an appointment directly. The moment that appointment is set, the CRM automatically shifts the deal stage from "Outreach" to "Appointment Booked," assigns you a task to prep for the call, and shoots confirmation messages to both you and the seller.

Building these kinds of repeatable, automated sequences is what really professionalizes an operation. It's how you can scale your efforts and get more consistent results. If you want to dive deeper, there's a lot to learn about marketing automation best practices.

Automation isn’t about replacing human interaction; it’s about eliminating the administrative friction that prevents it. It handles the 80% of repetitive work so your team can focus on the 20% that actually closes deals—building rapport, negotiating, and solving complex problems.

Freeing Your Team for High-Value Work

This automated deal flow takes the most time-consuming, soul-crushing parts of the investment process off your plate. Just think about all the hours you and your team burn on:

- Manual Follow-Ups: Sending dozens of texts and emails just to get a single "yes" or "no."

- Calendar Coordination: The endless back-and-forth trying to nail down a meeting time.

- Data Entry: Manually updating spreadsheets or CRM records after every single interaction.

When you delegate these tasks to your CRM, your people are freed up to focus on what really moves the needle: analyzing deals, crafting winning offers, and negotiating contracts. To take this even further, many investors bring on a CRM specialist virtual assistant to manage and fine-tune these systems, ensuring the machine is always running at peak efficiency.

Ultimately, a well-implemented real estate investor CRM doesn't just organize your business—it multiplies your output.

Using Data and AI to Find Off-Market Deals

In today's crowded market, the investors who win are the ones who see what others miss. The old way—buying the same generic, public data lists everyone else has—is a recipe for getting beat. The real edge comes from building your own private, off-market deal flow.

How? By creating your own intelligence engine. And a modern real estate investor crm is the perfect machine for the job. Instead of just managing contacts, it plugs directly into unique, county-level data sources, revealing the earliest whispers of seller motivation long before a property ever hits the market.

It's about connecting dots no one else can even see.

Tapping Into Proprietary County Data

The most successful investors don't wait for deals to come to them. They hunt for specific distress signals, often hiding in plain sight within public records. A sophisticated CRM can be set up to automatically pull and make sense of this raw information from sources like:

- Deeds and Title Transfers: Spotting recent ownership changes that could mean an inherited property or a quick flip opportunity.

- Civil Court Records: Uncovering situations like divorces or financial disputes that often force a property sale.

- Foreclosure Filings: Getting way ahead of the curve by identifying properties in the earliest stages of the foreclosure process.

- Code Violations: Pinpointing neglected properties where the owner might be overwhelmed and just wants out.

This hyper-local data gives you an almost unfair advantage. While other investors are waiting for a Zillow alert, you’re already having a conversation with the owner. To really grasp how this works, check out the power of predictive analytics for real estate. When you bring AI into the mix, specialized tools like an AI Real Estate Property Analyzer can dive even deeper.

The Power of an Always-On AI ISA

Once your CRM flags a high-potential lead, speed is everything. This is where an "Always-on AI ISA" (Inside Sales Agent) becomes your secret weapon. Think of it as a tireless team member who works 24/7 to engage and qualify leads the second they show interest.

An AI ISA can handle the initial back-and-forth, ask key qualifying questions, and book a qualified seller appointment right onto your calendar—all before your competitor has even had their morning coffee.

This immediate, intelligent engagement ensures you're always the first to connect. This isn't some futuristic fantasy; it's happening now. The broader real estate CRM market is projected to hit USD 14.97 billion by 2035, and it's no surprise that 78% of real estate firms are already using cloud-based CRMs. These systems are the perfect foundation for powering AI assistants, turning raw data from civil courts and code violations into booked meetings.

This one-two punch of proprietary data and AI-driven outreach is how top operators shift from a reactive, list-buying game to a proactive, data-driven strategy. The end goal isn't just to find a deal here and there. It's to build a predictable pipeline of 15–20 qualified seller appointments every single month, transforming your deal flow from a guessing game into a science.

How to Choose and Implement Your Investor CRM

Picking and launching a CRM is one of the biggest moves you can make in your real estate investing business. Let’s be clear: this isn't just about buying a piece of software. It’s about fundamentally rewiring your operations to handle more volume, more efficiently.

Get it right, and your new platform becomes the central nervous system for your entire deal flow. Get it wrong, and you've just introduced a massive source of friction that will frustrate your team and slow you down.

This blueprint will help you cut through the noise, pick a system that actually fits your goals, and roll it out without pulling your hair out. A good launch means your team actually wants to use it and you see the value right away, turning that software expense into a powerful engine for closing more deals.

Your Evaluation Checklist

Not all CRMs are built the same, especially when it comes to the unique needs of an investor. As you start looking at different options, use this checklist to ignore the flashy marketing and focus on what will actually move the needle for your team.

-

Data Integration Capabilities: This is non-negotiable. Can the CRM pull in proprietary, county-level data like tax liens, pre-foreclosures, probates, and code violations? Steer clear of any platform that only works with the same generic, over-fished public lists everyone else is using.

-

Workflow Customization: You need a system that bends to your will, not the other way around. Make sure you can build custom deal pipelines, automated outreach sequences (for both SMS and email), and task management rules that mirror your unique strategy for finding and closing deals.

-

Scalability and Performance: Think about where you want to be in two years. Will the system keep up? A solid investor CRM should handle tens of thousands of records and blast out high-volume marketing campaigns without grinding to a halt or feeling clunky.

-

Built-in Compliance Tools: Sending out a ton of texts and emails means you have to take compliance seriously. The platform absolutely must have integrated tools to manage TCPA regulations, like tracking opt-ins and automatically suppressing contacts who have opted out. Don't risk it.

A Step-by-Step Implementation Guide

Once you've picked your winner, you need a rock-solid implementation plan. Rushing this stage is the #1 reason CRM rollouts fail. A structured approach is the only way to sidestep the common traps and get your team excited instead of overwhelmed.

The biggest mistake investors make is a half-hearted commitment. Trying to run your new CRM alongside old spreadsheets is a recipe for data chaos and kills all momentum. A successful launch requires a full, decisive switch—everyone manages every lead in the new system from day one.

Follow these steps for a much smoother transition:

-

Data Migration: First things first, get your existing lead lists and contacts cleaned up and imported. This is a critical first step. You can't build a strong house on a cracked foundation, and you can't build a powerful deal machine on messy data.

-

Customize Your Workflows: Before anyone on your team even logs in, get your core deal pipelines and automated outreach campaigns set up. A well-configured system gives them immediate structure and shows them exactly what to do.

-

Team Training and Onboarding: Don't just show them how to click the buttons; show them why this new system is going to make their lives easier and help them close more deals. Focus on the benefits, not just the features. For a deeper dive, our guide on a modern real estate investing crm covers more advanced strategies.

-

Launch and Monitor: Go live, but don't just walk away. For the first 30 days, keep a close eye on how your team is using the system. Get their feedback, fix any hiccups right away, and make sure to celebrate the early wins to build that positive momentum.

Got Questions? We've Got Answers

Jumping into any kind of new software, especially one that sits at the very heart of your business, is going to bring up some questions. It's smart to be skeptical. Let's tackle some of the most common ones we hear from investors so you can move forward with confidence.

How Is an Investor CRM Different From a Generic CRM?

Think of a generic CRM as a powerful but completely empty toolbox. You could, in theory, build a house with it, but you'd have to go out and buy every single specialized tool first. A real estate investor CRM, on the other hand, comes pre-loaded with the hammers, saws, and measuring tapes designed specifically for flipping, wholesaling, or holding properties.

It comes out of the box with fields for property details, pre-built pipelines that match how you actually work a deal (think "Due Diligence" and "Under Contract"), and direct lines to pull property data and run comps. That specificity alone saves you months of banging your head against a wall and thousands of dollars in customization fees you'd burn just trying to force a generic system to speak your language.

Can a Solo Investor Really Benefit From a CRM?

Absolutely. In fact, you could argue it's even more critical for a solo operator. A good CRM becomes your always-on virtual assistant, the one who handles all the boring, repetitive tasks that would otherwise eat up your entire day.

It's the system that automates your follow-up, keeps your deals from falling through the cracks, and makes sure you never forget to call a motivated seller back—even when you're out walking a property. By putting a system in place from day one, you're building a foundation that lets you handle a much higher volume of deals without completely burning out. It’s how you scale from one deal to ten without hiring a team.

A lot of people think CRMs are just for big teams. That's a huge misconception. For a solo investor, a CRM isn't about managing people—it's about creating leverage. It automates the grunt work so you can spend your time on the only things that actually make you money.

What's the Biggest Mistake People Make When Implementing a New CRM?

The single biggest killer of a new CRM is a lack of commitment. So many investors try to play it safe, keeping one foot in their new system and the other in their old mess of spreadsheets. This halfway approach is a recipe for disaster. It just creates confusion, pollutes your data, and guarantees no one on your team will actually use the new tool.

For a successful launch, you have to make a clean break. Draw a line in the sand and commit 100% to the new system for every single lead from that day forward. The second biggest mistake? Rushing the setup. Take the time upfront to really dial in your pipelines and automations. That initial investment is what makes the system feel indispensable from the get-go.

How Does an Investor CRM Help with Outreach Compliance?

In today's world of high-volume outreach, a modern investor CRM is your first line of defense against a compliance nightmare. This is especially true with regulations like the Telephone Consumer Protection Act (TCPA) for SMS marketing.

A good system automatically manages your opt-in and opt-out lists, physically preventing you from texting someone who has asked you to stop. It also creates a bulletproof audit trail of every single touchpoint with a potential seller, which is invaluable if you ever face a legal challenge. For any serious investor doing direct mail, texting, or cold calling at scale, this isn't a "nice-to-have"—it's a non-negotiable tool for managing massive financial and legal risk.

Ready to stop fighting over the same stale public lists and start building a predictable pipeline of off-market deals? At Tab Tab Labs, we provide the proprietary data, AI-powered automation, and expert support that serious real estate operators use to dominate their markets. Schedule your free strategy call today and see exactly how we can help you close more deals.