How to Buy a House in Pre Foreclosure: A Complete Investor Playbook

Learn how to buy a house in pre foreclosure with this expert playbook. Discover how to find leads, negotiate deals, secure financing, and minimize risks.

By James Le

Buying a property in pre-foreclosure is one of the smartest ways to get a deal on a house before it ever sees the courthouse steps. You're not dealing with a bank or a faceless auctioneer; you’re stepping in to help a homeowner who has defaulted on their mortgage but hasn't lost their property... yet. This isn't like flipping a bank-owned home. It's a delicate dance that requires a good bit of empathy, a lot of patience, and some sharp negotiation skills.

The Pre-Foreclosure Playbook: Unlocking Off-Market Deals

Mastering how to buy a house in pre-foreclosure gives you a massive leg up on the competition. This is the very first stage of the whole foreclosure process—that golden window where a homeowner is behind on payments but still legally owns their home.

It’s your chance to craft a true win-win. The homeowner gets to sidestep a foreclosure torpedoing their credit, and you can lock down a property without getting into a bidding war at a public auction.

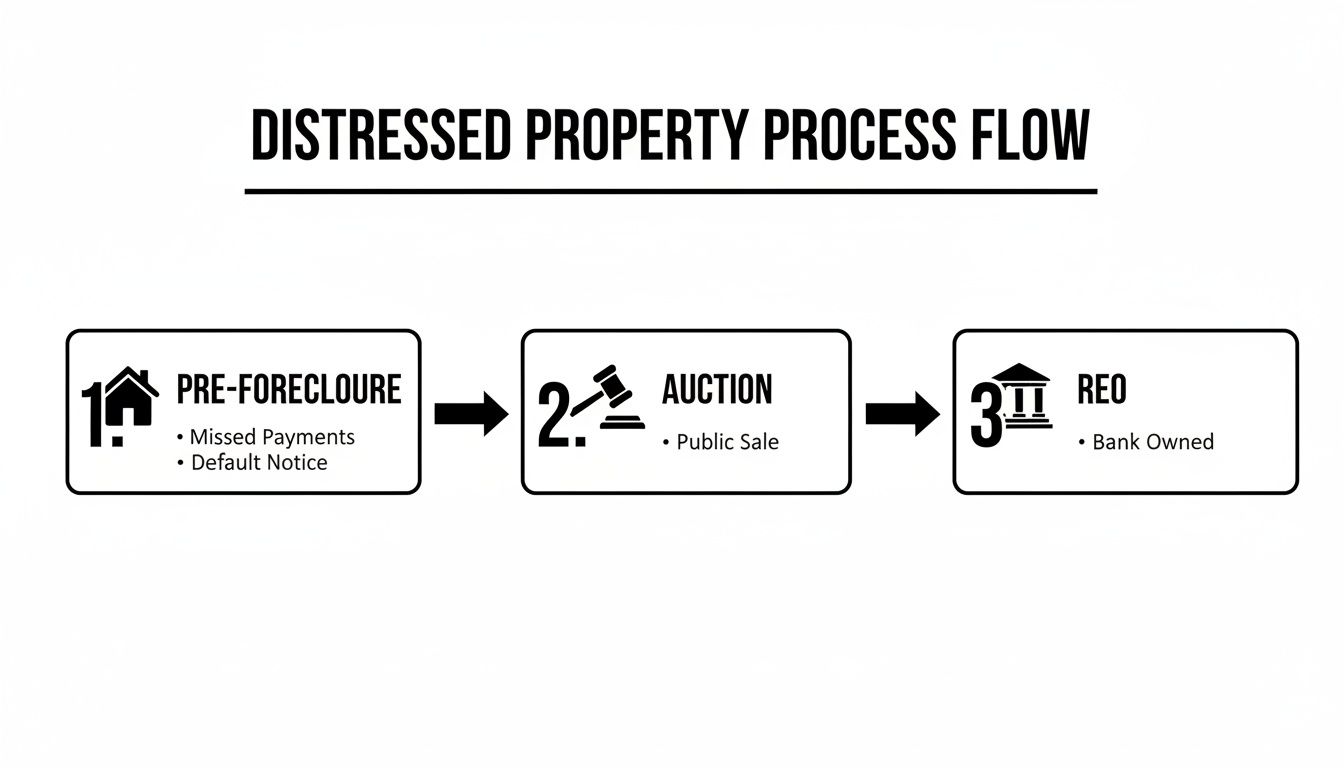

This flowchart lays out the typical journey of a distressed property, starting with pre-foreclosure and moving through to a potential bank-owned (REO) sale.

As you can see, jumping in during the pre-foreclosure stage is your earliest possible entry point. This is where you have the space for direct negotiation before things get messy and complicated.

Understanding the Landscape

The whole dynamic in a pre-foreclosure deal is completely different from a standard real estate transaction. The homeowner is buried under financial pressure and emotional stress, desperately looking for a lifeline. On the other side, the lender just wants to avoid the expensive headache of foreclosing. You get to be the problem-solver who can make everyone happy.

To pull this off, you have to get a handle on a few key things:

- Direct Negotiation: You're talking directly to the owner. This opens the door to creative solutions and deal structures you could never pull off at an auction.

- Less Competition: These deals are almost always off-market. That means you’re not fighting against a dozen other investors. We dig deeper into this in our guide on how to find off-market deals.

- Time is Ticking: There’s always a deadline. The homeowner has a very specific amount of time to fix their default before the bank officially schedules the auction.

A Quick Comparison: Pre-Foreclosure vs. Auction vs. REO

It helps to see how these three stages stack up against each other. Each has its own pros, cons, and complexities. Understanding them is key to deciding where you want to focus your efforts as an investor.

| Attribute | Pre Foreclosure | Foreclosure Auction | REO (Bank-Owned) |

|---|---|---|---|

| Seller | Homeowner | Lender/Trustee | Bank/Lender |

| Competition | Low to medium | High | Medium to high |

| Price | Negotiable, often below market | Can be a great deal, but risk of bidding wars | Closer to market value, but still discounted |

| Condition | As-is, can be inspected pre-offer | As-is, sight unseen, no inspections | Often cleaned out, sometimes minor repairs done |

| Financing | Traditional, hard money, creative | Cash only, typically required on the spot | Traditional financing is usually an option |

| Title/Liens | Buyer's responsibility to clear | Buyer's responsibility, liens may be wiped | Usually clean title, guaranteed by the bank |

| Timeline | Can be fast, but depends on negotiation | Immediate | Standard 30-60 day closing |

While auctions can offer deep discounts, they're high-risk, cash-intensive affairs. REOs are more straightforward but offer smaller margins. Pre-foreclosure really hits that sweet spot of potential equity and negotiating power, as long as you're prepared for the complexities.

Current Market Opportunities

The latest numbers show a growing inventory for investors who know what they're doing. In the first half of 2025, there were 187,659 foreclosure filings in the U.S., which is a 5.8% increase from the same time last year.

This uptick is particularly noticeable in places like Florida and New Jersey. It signals that there are more opportunities out there, but without the chaos of a full-blown market crisis. These aren't crisis-level numbers, but they do point to a steady flow of potential deals for anyone who's ready to hunt them down.

Sourcing and Verifying Your Own Pre-Foreclosure Leads

If you want to consistently win in the pre-foreclosure space, you have to stop fighting over the same stale, over-fished lists everyone else is using. The real edge comes from building your own pipeline of exclusive leads—finding homeowners in the earliest stages of distress before your competition even knows a problem exists.

It’s about becoming a data detective. The goal is to create a predictable system for finding motivated sellers, not just tripping over random deals. This requires digging into unique data sources that flag financial hardship long before a formal Notice of Default ever hits the public record.

Tapping into Early Distress Signals

The most valuable leads are hiding in plain sight within public records, but they aren't the obvious ones. While foreclosure filings are a decent starting point, the savviest investors are looking for the precursor events. These are the life circumstances and financial pressures that often send a homeowner down the path to mortgage default.

Here are the goldmines of data you should be digging into:

- Probate Records: When a homeowner passes away, the heirs are often highly motivated to sell the property. They need to settle the estate and want to avoid the carrying costs of a house they have no emotional attachment to. These deals can move quickly.

- Tax Liens: Unpaid property taxes are a massive red flag. If a homeowner is struggling to pay a few thousand dollars in taxes, you can bet they're having an even harder time with their much larger mortgage payment.

- Civil Court Filings: Life events like lawsuits and divorces create immense financial strain. A divorce filing, for example, frequently forces the sale of the family home as assets are divided.

- Code Violations: A property getting slapped with citations for an overgrown lawn, structural issues, or other municipal violations often points to an owner who can't afford the upkeep. This is another strong indicator of deeper financial trouble.

The market itself is signaling a growing opportunity for investors who know how to mine this data. Foreclosure filings were up 18% year-over-year through August 2025, and Q3 filings hit 72,317—a 16% jump from the previous year. The trend is clear. For operators, the key is using platforms that can turn these raw statistics into an actionable, exclusive lead list.

Key Takeaway: The best leads aren't on a list you can buy. They are signals you uncover by systematically piecing together different types of county-level public records. This multi-layered approach gives you a critical timing advantage.

Automating Your Lead Generation Engine

Let's be realistic: manually scraping data from hundreds of different county websites is an impossible task to do at scale. It’s a full-time job in itself. This is where technology becomes your unfair advantage.

Modern data platforms can completely automate the process of pulling, cleaning, and cross-referencing information from all these disparate sources. Imagine a system that pings you the moment a homeowner with significant equity gets hit with a tax lien or a code violation. This is how you become the very first person to reach out with a helpful, relevant solution. You shift from being a reactive investor waiting for deals to a proactive deal-maker who controls their own pipeline.

The Critical Verification Process

Once you've got a promising lead, the next step is to put on your skeptic's hat and start verifying everything. Never, ever assume the data you have is 100% accurate or up-to-date. Taking the time to double-check every detail upfront will save you from chasing dead ends and wasting a ton of time and money.

Your verification checklist needs to include these non-negotiables:

- Confirm Ownership: Pull official records to see exactly who is on the title. Ownership can get messy fast—it might be in a trust, split among multiple heirs, or recently transferred without you knowing. Knowing how to do a proper county property records search is a fundamental skill here.

- Identify All Liens and Encumbrances: A preliminary title search is absolutely crucial. You need to know the exact mortgage balance, but that's just the start. Look for second mortgages, HELOCs, tax liens, mechanic's liens, or HOA liens. Every single one represents another creditor you'll have to negotiate with.

- Determine the Foreclosure Stage: If a Notice of Default has been filed, find out the exact date. This is your clock. It tells you how much time you have to work with before a potential auction date gets set, which dictates the entire urgency and strategy of your negotiations.

Crafting Your Outreach and Negotiation Strategy

You’ve got a verified lead. Now for the hard part—and the most human part: making contact.

Reaching out to a homeowner in distress isn’t just a sales call. It’s a conversation about one of the most stressful situations a person can face. This requires a delicate balance of empathy, straightforward honesty, and a crystal-clear value proposition.

Remember, these folks are likely drowning in confusing lender notices and getting hammered with aggressive calls from other investors. Your entire approach has to cut through that noise. You need to position yourself as a genuine solution, not a predator.

Perfecting Your Initial Outreach

How you make that first contact sets the tone for everything. Knocking on the door can work, but it often feels invasive and puts people on the defensive. Two of the most reliable (and compliant) methods are direct mail and a well-thought-out phone call.

- Direct Mail: A well-written letter is a fantastic, non-invasive way to introduce yourself. It gives the homeowner a moment to breathe and process the information without feeling cornered. For a masterclass in this, check out our guide on direct mail marketing for real estate.

- Phone Calls: A call offers an immediate connection, but it demands a soft touch. Think of your script less as a script and more as a conversation guide.

Expert Tip: Your opening line should never be, "I want to buy your house cheap." Frame it as, "I specialize in helping homeowners understand all of their options when they're in a tough spot with their property." You're an advisor first, a buyer second.

Whatever method you choose, the core message is the same: You are a problem-solver. You can offer a fair, fast, all-cash solution that helps them dodge the credit-destroying bullet of a foreclosure auction.

The Art of Empathetic Negotiation

Once you have the homeowner on the phone or sitting across from you, the real negotiation starts. And at this stage, your ability to listen is far more valuable than your ability to talk. Your first job is to understand their real pain points.

- What are they truly afraid of? Is it the foreclosure hitting their credit? The public shame of an auction? Losing the home they raised their kids in?

- What is their most pressing need? Do they need quick cash to relocate? More time to figure out their next move? Or just a simple, fast closing to end the nightmare?

- What does their ideal outcome look like? If they had a magic wand, what would they wish for?

Knowing the answers to these questions lets you shape an offer that solves their problem, not just the one you think they have.

A classic example is the homeowner with a bit of equity but zero time to list the traditional way. They're frozen in place by the approaching auction date. Your offer can provide the speed and certainty they're desperate for.

Structuring a Win-Win Offer

A great pre-foreclosure deal is one where everybody leaves the table feeling like they won. Here’s how that looks in practice:

- For the Homeowner: They sell their house on their own schedule, avoid the foreclosure on their credit report, and often walk away with cash from whatever equity they had. You can even get creative and offer a "lease-back" option, letting them rent the home from you for a few months to make their transition smoother.

- For the Lender: The bank is thrilled. They get the defaulted loan paid off without enduring the expensive, drawn-out foreclosure process. It’s a clean and simple win for them.

- For You: You acquire a property, frequently below its market value, with immediate equity baked in. You solved a massive problem for someone and created a profitable investment for yourself.

Expect objections. They’re a natural part of the conversation. The homeowner might be suspicious of your motives or think your offer is too low. Don't get defensive. Validate their concerns. Walk them through your numbers with total transparency, showing them exactly how you calculated the offer after accounting for the mortgage payoff, other liens, and repair costs.

This isn’t about haggling; it’s about building trust. Turning this incredibly sensitive situation into a signed contract all comes down to being a compassionate, professional problem-solver from the first word to the last.

Financing Your Deal and Navigating the Closing Process

Once you get a signed purchase agreement, the real race begins. In the world of pre-foreclosures, you quickly learn that how you buy a house in pre foreclosure is just as critical as finding the deal in the first place. Your ability to close fast is everything.

Traditional mortgage lenders? Forget about them. They’re slow, cautious, and built for a 30- to 45-day world. That timeline just doesn’t work when a homeowner is days away from the auction block.

This is where your financing strategy becomes your biggest advantage. Showing up with a fast, reliable way to fund the deal isn’t just about logistics; it’s a powerful negotiating tool that can win over a stressed-out seller who needs a quick, clean exit.

Exploring Your Funding Options

You need to have your capital lined up and ready to go long before you even make an offer. In pre-foreclosure, the ability to fund a deal in days, not weeks, is what separates the pros from the amateurs.

Your main options boil down to three core strategies, each with its own pros and cons.

- All-Cash Offers: This is the undisputed king. Cash is clean, fast, and eliminates almost every financing contingency. It tells the seller you're serious and can close without any drama from a bank.

- Hard Money Loans: If you don't have a pile of cash sitting around, hard money is your next best bet. These private lenders focus on the property's potential value (the After-Repair Value or ARV), not your W-2. They can fund a deal in as little as 7-10 days, but that speed comes at a cost—namely, higher interest rates and fees.

- Subject-To (Sub-To) Acquisitions: This is a more advanced move. You take over the title to the property "subject-to" the seller's existing mortgage. In short, you start making their payments without formally assuming the loan. It's an incredibly powerful technique if the homeowner has a great interest rate locked in, but it absolutely requires an ironclad legal structure to protect everyone involved.

Because sellers are in a tough spot, they're often open to unconventional solutions. This is the perfect environment to explore creative real estate financing options like a seller note, which can be a win-win for both parties.

To make it clearer, here’s a breakdown of how these funding methods stack up against each other.

Financing Options for Pre Foreclosure Properties

| Financing Method | Best For | Speed to Close | Key Considerations |

|---|---|---|---|

| All-Cash Offer | Investors with significant liquid capital looking for the strongest negotiating position. | Fastest (3-7 days) | Requires substantial cash reserves. The simplest and most attractive option for sellers. |

| Hard Money Loan | Fix-and-flip investors or those needing to close quickly without tying up all their cash. | Fast (7-14 days) | Higher interest rates (8-15%) and points (2-5%). Based on ARV, not personal income. |

| Subject-To | Deals where the existing mortgage has favorable terms (low interest rate, low balance). | Varies (10-30 days) | Requires sophisticated legal contracts. The "due on sale" clause is a potential risk. |

| Short Sale | Properties that are "underwater" (owe more than they are worth). | Slowest (3-12 months) | Entire process is contingent on lender approval, which is slow and unpredictable. |

Each path has its place, but the key is matching the right strategy to the specific deal and seller's situation.

Navigating a Short Sale with the Lender

What if the homeowner is "underwater," owing more than the house is worth? Welcome to the world of the short sale. This means you need the lender’s permission to buy the house for less than the total mortgage balance.

Be warned: getting a short sale approved is a bureaucratic marathon, not a sprint. The homeowner has to prove genuine financial hardship with a mountain of paperwork, and you need to submit your offer with solid proof of funds. The bank will then order its own appraisal to make sure your offer isn’t a lowball. Prepare for a long, often frustrating back-and-forth with the bank’s loss mitigation department.

Pro Tip: Your best weapon in a short sale is a perfectly organized submission package. Missing documents and sloppy paperwork are the number one cause of delays and denials. Partner with an agent or attorney who lives and breathes short sale negotiations.

The Critical Importance of a Meticulous Title Search

Regardless of how you fund the deal, there is one step you can never, ever skip: a thorough title search. This is non-negotiable.

The title search is what pulls back the curtain on the property's history, revealing any "clouds" on the title. These are the hidden liens, judgments, and ownership claims that can either kill your deal or become a massive headache for you after closing.

A good title search will uncover:

- The primary mortgage balance

- Any second mortgages or Home Equity Lines of Credit (HELOCs)

- Unpaid property tax liens

- Mechanic's liens filed by contractors who weren't paid

- HOA or condo association liens for unpaid dues

- Judgments against the homeowner from unrelated lawsuits

Every single one of these liens has to be settled and released at closing for you to get a clean title. This is where so many pre-foreclosure deals die. You might agree on a great price with the seller, only to find out there’s an extra $20,000 in liens tacked on, completely wiping out your profit.

Due diligence is even more critical in states with high distress rates. For example, in September 2025, Florida led the nation with 4,621 foreclosure filings, a 20% increase from the previous year. Markets with this kind of volume are often littered with properties that have complicated financial histories, making a flawless title search absolutely essential.

At the end of the day, your success comes down to two things: securing fast, flexible funding and mastering the nitty-gritty of the closing process, especially the title work. This is what separates the investors who consistently close profitable deals from those who just spin their wheels.

Mitigating Risks and Scaling Your Operations

Getting the keys to a pre-foreclosure property is a huge win, but your work is just getting started. Right after closing, two major challenges almost always pop up: dealing with the physical condition of the house and handling who—if anyone—is still living there.

Investing in pre-foreclosures is anything but a risk-free game. But if you have a solid framework in place, you can not only protect your investment but also start building a scalable business from that first deal.

The first potential bombshell is that most pre-foreclosures are sold "as-is," which means every single problem is now your problem. The second is that the former homeowner might not have moved out yet. How you navigate these situations is what separates seasoned investors from the ones who get burned.

Handling Occupied Properties After Closing

It's a classic scenario: you've officially closed, but the previous owner or their tenants are still on the property. This is an incredibly delicate situation that calls for a strategic, but humane, approach. Your first instinct might be to start a formal eviction, but that can quickly become a costly, time-consuming, and emotionally draining nightmare.

A far better first move is to negotiate a cash-for-keys agreement. It’s simple: you offer the occupants a cash payout in exchange for vacating by a specific date and leaving the property in decent, broom-swept condition.

Key Insight: A cash-for-keys offer is a business transaction, not a handout. It saves you a ton of time, legal fees, and the risk of the property being damaged on the way out. Offering $1,500 to $3,000 can feel like a lot, but it's a bargain compared to an eviction process that can drag on for months and easily cost you $5,000 or more in legal bills.

If a friendly agreement just isn't in the cards, you'll have to proceed with a formal eviction. This is a legal process with strict rules that vary by state and even city, so you have to follow them to the letter. It's highly recommended you hire an attorney who specializes in landlord-tenant law to handle this. Don't try to wing it.

Due Diligence on "As-Is" Properties

In real estate, "as-is" is one of the most loaded phrases you'll hear. It means the seller isn’t fixing a thing, and the responsibility is entirely on you to uncover every potential issue before you're legally locked in. When you're learning how to buy a house in pre foreclosure, mastering property due diligence becomes a non-negotiable skill.

You often have limited access to the property before making an offer, so you need to get good—really good—at spotting red flags from the outside and through preliminary research.

Your "as-is" due diligence should always include:

- Exterior Walk-Around: Look for the obvious signs of neglect. Is the roof sagging? Are there cracks in the foundation? Peeling paint can signal a lead paint hazard in older homes, and poor grading could mean water issues.

- Neighborhood Vibe Check: Drive the area at different times of the day. Are the neighboring homes well-kept? This directly impacts your after-repair value (ARV).

- Permit History: A quick check with the local building department can reveal a history of permits. A lack of permits for a big addition or renovation is a massive red flag for unapproved, shoddy work.

- Inspection Contingency: This is your get-out-of-jail-free card. Whenever you can, write an inspection contingency into your offer. It gives you a critical window to bring in a professional home inspector and walk away if you find a deal-breaker.

To make sure you don't miss a critical step in assessing a property's condition and potential liabilities, especially with distressed properties, use a comprehensive real estate due diligence checklist.

Building a Scalable Pre-Foreclosure Operation

If you want to turn pre-foreclosure investing from a side hustle into a predictable business, you need systems. You can't just rely on luck or stumbling into deals. Scaling is all about creating a repeatable workflow for every single stage of the process.

The goal is to systematize and automate as much as possible, building an engine that consistently brings you opportunities. This frees you up to focus on the high-value tasks that actually make you money, like negotiating and analyzing deals.

Here’s what a scalable system looks like in practice:

- Automated Lead Generation: You need to get ahead of the competition. Use tech to automatically pull county-level data for early distress signals—think tax liens, code violations, or probate filings. This lets you build your own proprietary pipeline of leads before they ever hit the MLS.

- Systemized Follow-Up: Not every homeowner is ready to sell the first time you reach out. Implement a CRM with automated follow-up sequences using email, text, and direct mail. This keeps you top-of-mind without you having to manually do the work.

- AI-Powered Qualification: Use AI assistants to handle the initial outreach and qualification. These tools can engage with potential sellers, ask the right qualifying questions, and book appointments directly on your calendar. You end up spending your time only with motivated, pre-vetted homeowners.

By building this operational backbone, you shift from chasing individual deals to managing a consistent flow of opportunities. That's how you go from closing one or two properties a year to doing it every single month.

Diving Into the Weeds: Common Pre-Foreclosure Investing Questions

Once you start digging into pre-foreclosure, a lot of questions pop up. It's a world filled with nuance, and getting straight answers is the only way to build the confidence you need to turn someone else's difficult situation into a winning deal for everyone involved. Let's tackle some of the most common questions I hear from investors.

Think of this as your field guide for clarifying your strategy and bracing for the challenges—and opportunities—that lie ahead.

How Much Below Market Value Can You Realistically Buy a Pre-Foreclosure Home?

Everyone loves a good story about buying a house for pennies on the dollar, but let's get real. A realistic target for most pre-foreclosure deals is 10-25% below current market value. Are there unicorn deals at 30-40% off? Sure, but they're incredibly rare and usually come with a mountain of deferred maintenance or a rat's nest of legal problems.

The final price is always a balancing act. It hinges on a few key variables:

- The homeowner's equity: More equity gives the seller more wiggle room to accept a lower offer.

- The lender's balance: What's owed to the bank sets the absolute floor for your offer.

- Property condition: A trashed house with a leaky roof and a dead furnace is naturally going to command a lower price.

- Local market dynamics: In a blistering seller's market, discounts shrink. In a buyer's market, you have more leverage.

Your job is to find that sweet spot—a number that nets you a solid return while giving the homeowner a dignified and effective way out.

What Happens If There Are Multiple Liens on the Property?

Finding multiple liens on a property is more the rule than the exception. It's not just the primary mortgage. You'll often uncover second mortgages, IRS tax liens, unpaid property taxes, or even a mechanic's lien from a contractor who never got paid.

When this happens, your title company instantly becomes your best friend. The game plan is to negotiate with each lienholder individually to release their claim. This almost always means offering them a settlement—a fraction of what they're actually owed—to make them go away.

Here's the critical thing to remember: seniority rules. The first mortgage gets paid first from the sale. Any junior lienholders only get paid from what's left over. This gives you leverage, as they'll often take a smaller payoff now rather than risk getting wiped out completely at a foreclosure auction.

Is a Short Sale the Only Way to Buy a Pre-Foreclosure Property?

Not at all. A short sale is a very specific tool for a very specific problem: when the homeowner is "underwater" (they owe more than the house is worth). This process is a grind because you need the lender's permission to accept less than the full mortgage balance.

But if the homeowner has equity? The path is much, much simpler. You can buy the home directly from them, just like a traditional sale. The closing proceeds pay off the mortgage and any other liens, and the seller walks away with the rest of the cash.

For more advanced investors, there's also the "Subject-To" strategy, where you essentially take over the seller's existing mortgage payments. Every deal is different, which is why a deep dive into the homeowner's financial picture is non-negotiable.

What Are the Biggest Legal Risks I Should Be Aware Of?

The legal landmines in this business generally fall into two buckets: title issues and compliance with homeowner protection laws. Mess up either one, and your deal is dead in the water.

Unexpected title defects are a classic deal-killer. Think hidden liens, ownership squabbles from a nasty divorce, or a last-minute bankruptcy filing that freezes everything. This is precisely why you never skimp on an experienced real estate attorney and a top-notch title company. They are your shield.

On the compliance side, you have to be militant about following all federal and state laws governing how you communicate with distressed homeowners. These rules exist to shut down predatory practices. The solution is simple: lead with empathy, be transparent, and document every single conversation. It's not just good business; it's your legal protection.

Ready to stop fighting over stale lists and start owning your pipeline? Tab Tab Labs uses proprietary county-level data and AI automation to deliver exclusive, pre-qualified seller appointments directly to your calendar. Build your scalable pre-foreclosure operation today. Learn more at https://tabtablabs.com.