Best CRM For Real Estate Investors: Top 12 Platforms & Comparisons

Explore the best crm for real estate investors with an in-depth review of 12 top platforms. Compare features, pricing, and workflows to scale your deals.

By James Le

The right CRM is the central nervous system for any scaling real estate investment operation. It’s where raw leads become deals, follow-up turns into contracts, and data reveals your next best move. But with dozens of platforms, from all-in-one behemoths to nimble, specialized tools, choosing the best CRM for real estate investors can feel overwhelming. Many systems seem similar on the surface, making it difficult to determine which one truly aligns with your specific acquisition strategies, team size, and growth goals.

This guide cuts through the noise. We move beyond marketing hype to provide a comprehensive, data-driven breakdown of the top 12 CRMs designed for or adapted to the unique workflows of real estate investors. You won't find generic feature lists here. Instead, we offer an in-depth analysis of each platform's strengths, weaknesses, and ideal use cases, whether you're a solo investor, a growing team, or an established brokerage. While our focus is on investors, many principles of selecting a robust system apply broadly within the real estate sector, including when choosing a CRM for real estate agents.

This article is designed to be your definitive resource for making an informed decision. We'll explore everything from lead intake and deal pipelines to direct mail integrations and dialing capabilities. Each review includes screenshots, direct links, and clear recommendations to help you find the platform that will genuinely power your growth, streamline your acquisitions, and maximize your ROI. Let's find your business's next growth engine.

1. REsimpli

REsimpli positions itself as a true all-in-one platform, making it a strong contender for the title of best CRM for real estate investors who want to minimize tool sprawl. Its core value proposition is consolidating acquisitions marketing, lead management, and business operations under a single subscription. Instead of juggling separate services for a dialer, direct mail, skip tracing, and a CRM, REsimpli integrates these functions natively. This approach simplifies workflows and reduces the potential for data silos between disconnected applications.

The platform is designed with pre-built investor workflows, helping teams follow a structured process from lead intake to closing. Features like list stacking, free monthly skip tracing credits, and a Driving for Dollars app streamline the lead generation process significantly. Built-in KPI dashboards also provide a clear view of business performance without needing complex spreadsheet setups. You can dive deeper into its capabilities by exploring this detailed REsimpli investor CRM guide.

Key Features & Pricing

- Best For: Solo investors and small to mid-sized teams seeking an out-of-the-box, comprehensive solution.

- Unique Offerings: Combines dialer, SMS, direct mail, list stacking, and KPI tracking in one system.

- Pricing: Starts at $129/month for the Pro plan, with a 30-day free trial on annual plans.

- Pros: Dramatically reduces the need for third-party integrations; strong, pre-configured investor workflows.

- Cons: Higher entry price compared to basic CRMs; usage-based overages can apply for communications.

Website: https://resimpli.com/

2. FreedomSoft

FreedomSoft is one of the more established names in the REI software space, often considered a top-tier CRM for real estate investors focused on wholesaling and scaling their operations. It bundles a comprehensive suite of tools designed to manage the entire deal lifecycle, from lead generation to disposition. The platform's strength lies in its maturity and its deep understanding of investor-specific needs, offering ready-made workflows, follow-up automation sequences, and integrated marketing campaign management for direct mail, SMS, and ringless voicemail.

Unlike generic CRMs, FreedomSoft includes built-in phone numbers and lead-capture websites, allowing users to launch marketing efforts directly from the platform. This removes the friction of integrating multiple third-party services. The system is particularly well-suited for teams, as even lower-tier plans include access for multiple users and websites. Higher-tier plans provide dedicated account managers and larger lead download limits, catering to businesses with significant deal flow and marketing budgets.

Key Features & Pricing

- Best For: Wholesalers and established investor teams looking for a mature, all-in-one platform with robust marketing automation.

- Unique Offerings: Includes lead-capture websites, integrated direct mail tools, and phone systems even in base plans.

- Pricing: Starts at $197/month, with plans scaling up based on lead volume and feature access.

- Pros: Mature, REI-specific feature set; multiple users and sites included even on lower tiers; strong automation capabilities.

- Cons: Pricing rises quickly with scale; the platform can feel heavier and more complex than newer, CRM-only tools.

Website: https://freedomsoft.com/

3. REI BlackBook

REI BlackBook establishes itself as a marketing-centric powerhouse, making it a top choice for investors who prioritize automated lead generation and follow-up. Its core philosophy revolves around integrating a robust phone system, lead-capture websites, and marketing automation directly into its CRM. This design helps investors build and manage a predictable deal flow by capturing, nurturing, and converting leads through multiple channels from a single dashboard. Instead of piecing together separate tools for call tracking, websites, and email campaigns, REI BlackBook offers a unified solution.

The platform’s standout feature is its integrated Profit Dial phone system, which provides call tracking, routing, and recording to monitor marketing campaign effectiveness. Coupled with its property pipeline and deal analyzer, it supports the entire acquisition process from initial contact to closing. This focus on a cohesive marketing and sales stack makes it a strong contender for the title of best CRM for real estate investors who need to scale their outreach and streamline their follow-up systems efficiently.

Key Features & Pricing

- Best For: Investor teams and businesses that rely heavily on multi-channel marketing and automated follow-up.

- Unique Offerings: The integrated Profit Dial phone system, lead-capture website builder, and advanced marketing automation workflows.

- Pricing: Starts at $97/month for the Basic plan, with higher tiers including more users and communication credits.

- Pros: Combines a strong marketing and telephony stack in one platform; tiered plans include usage credits for calls and SMS.

- Cons: Overages for communications can apply on the Basic plan; the extensive feature set may have a steeper learning curve for solo investors.

Website: https://www.reiblackbook.com/

4. InvestorFuse

InvestorFuse is a purpose-built lead conversion CRM that emphasizes rigorous follow-up and team accountability to prevent valuable leads from falling through the cracks. Its core philosophy is built around "Action-based" workflows, which force a next step for every lead, ensuring no opportunity is left idle. Rather than being a general-purpose tool, InvestorFuse is highly specialized, designed to unify all incoming lead sources and push them through a disciplined, systematic conversion process. This makes it an excellent choice for investors who struggle with inconsistent follow-up.

The platform stands out with its hands-on onboarding and accountability features, which are designed to help teams adopt and master the system quickly. With deep integrations for tools like smrtPhone and native KPI tracking, managers gain clear visibility into team performance and workload distribution. This focus on process and accountability makes it one of the best CRM for real estate investors aiming to scale their acquisitions team effectively without sacrificing lead quality or letting potential deals go cold.

Key Features & Pricing

- Best For: Solo investors and growing teams who need a structured system for lead follow-up and conversion.

- Unique Offerings: Action-based workflows that prevent lead slippage; concierge onboarding; strong team accountability and performance tracking.

- Pricing: Plans start at $197/month with a one-time, non-refundable setup fee.

- Pros: Laser-focused on follow-up discipline and accountability; clear, scalable pricing tiers for different team sizes.

- Cons: Not a general-purpose CRM, more specialized for lead conversion; requires a non-refundable setup fee.

Website: https://www.investorfuse.com/

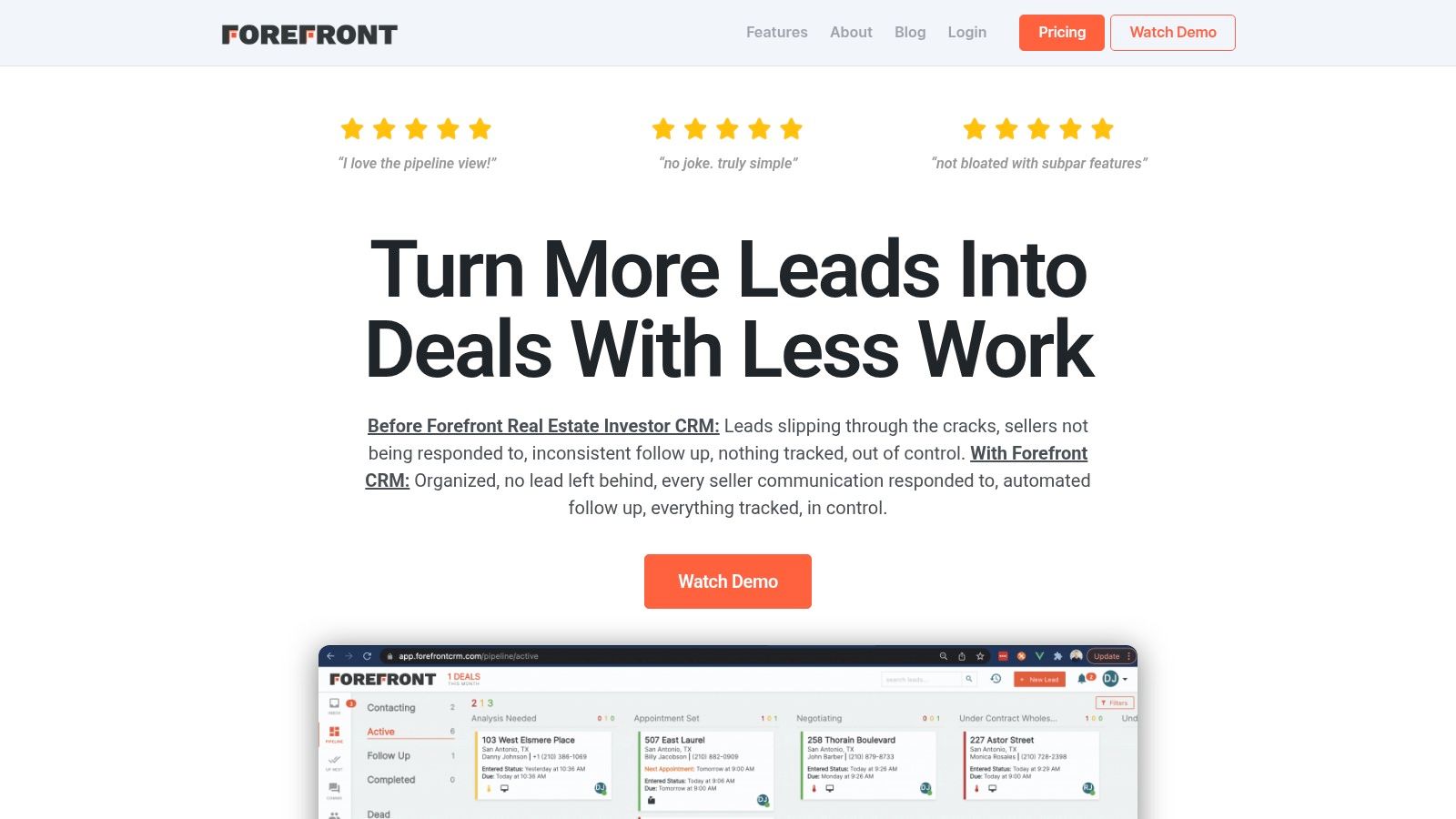

5. Forefront CRM

Forefront CRM targets real estate investors who prioritize lead conversion and team management over built-in prospecting tools. It distinguishes itself with a clean, intuitive interface focused on moving deals through a visual pipeline. Instead of trying to be an all-in-one system, Forefront excels at its core competency: managing and converting inbound leads generated from external marketing efforts. This makes it an ideal choice for teams that already have established lead generation systems, like a separate dialer or direct mail service, and need a powerful engine to manage the follow-up process.

The platform is built around simplicity and efficiency, providing proven follow-up sequence templates and clear KPI dashboards to track team performance. Its flexibility through Zapier and webhook integrations allows it to connect seamlessly with other best-in-class tools, creating a customized tech stack without the bloat of an overly complex system. This focus on conversion makes it a strong contender for the best CRM for real estate investors who want to optimize their acquisitions pipeline.

Key Features & Pricing

- Best For: Acquisitions teams and investors who want a dedicated, user-friendly CRM for lead management and conversion.

- Unique Offerings: A strong emphasis on a clean UI, visual pipelines, and pre-built follow-up templates designed for high conversion rates.

- Pricing: Pricing is not publicly listed; requires contacting the sales team for a quote. They offer a 30-day money-back guarantee.

- Pros: Exceptionally clean and focused user interface; the 30-day money-back guarantee removes risk for new users.

- Cons: Prospecting tools are intentionally limited, requiring external services; lacks transparent public pricing.

Website: https://forefrontcrm.com/

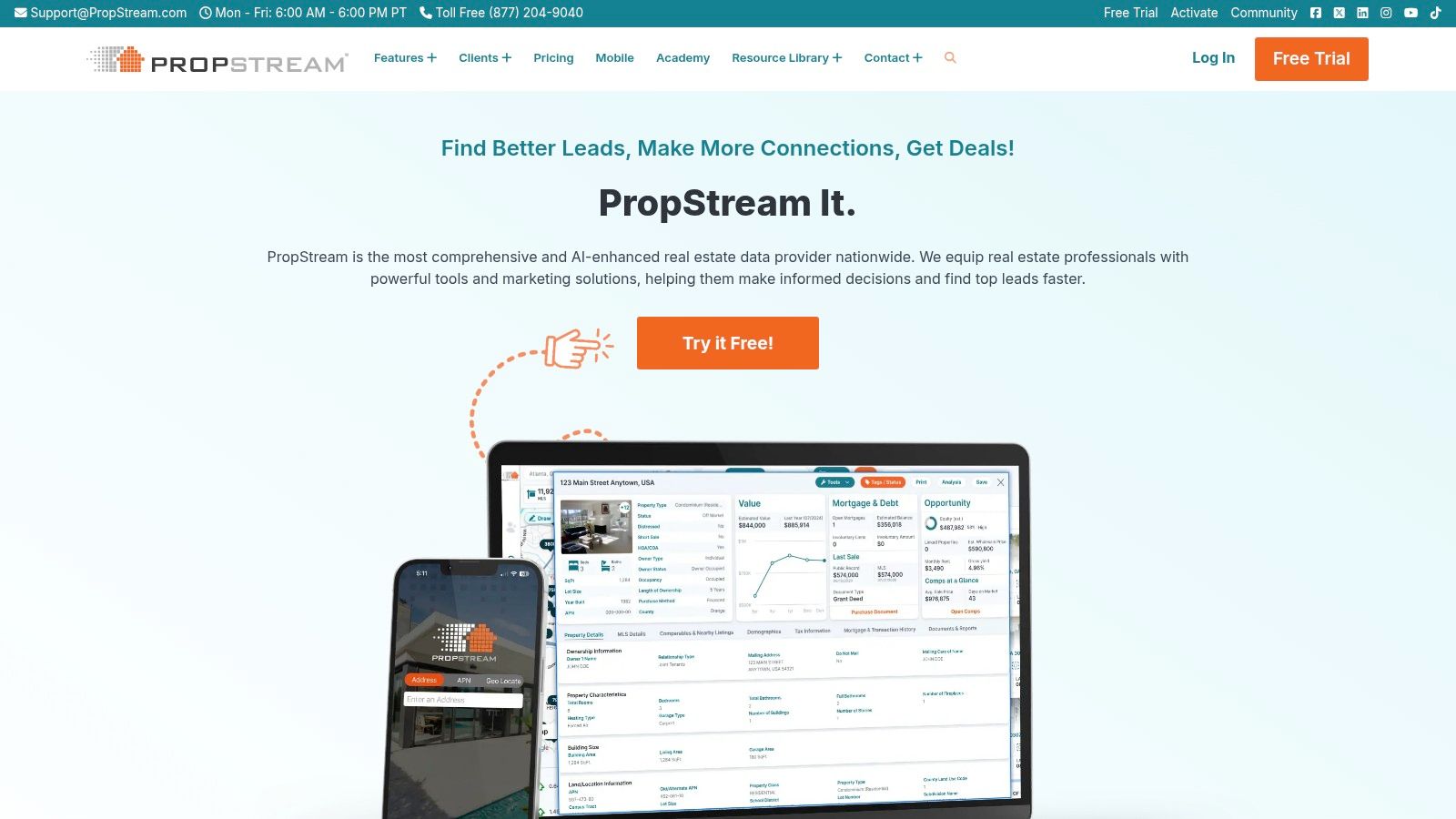

6. PropStream

PropStream is less a traditional CRM and more a powerful data engine with CRM-like capabilities built-in, earning its spot as an essential tool for investors focused on proactive lead generation. Its primary strength lies in providing nationwide property data, robust filtering options, and integrated marketing tools. Investors use it to build hyper-targeted lists of distressed properties, absentee owners, or pre-foreclosures, and then initiate outreach directly from the platform. While not a full-fledged sales pipeline manager, it serves as the foundational data source for many successful marketing campaigns.

The platform centralizes the process of identifying, researching, and contacting potential sellers. Features like built-in skip tracing, postcard marketing, and email campaigns allow users to move from list creation to outreach without exporting data to another service. This makes it an invaluable asset for investors who prioritize data-driven marketing and need a reliable, all-in-one tool for finding off-market deals. It is often the first step in an investor's tech stack, feeding leads into a more dedicated management system.

Key Features & Pricing

- Best For: Investors at all levels who need a primary tool for off-market lead generation and property data analysis.

- Unique Offerings: Comprehensive nationwide property database with over 153 million records, advanced filtering, and integrated skip tracing and marketing.

- Pricing: Starts at $99/month, which includes 10,000 property exports per month. Add-ons are available for team members and additional services.

- Pros: Unmatched data for building targeted marketing lists; combines research and outreach in one platform.

- Cons: Its CRM features are basic compared to dedicated systems; monthly export and save limits can be restrictive for high-volume users.

Website: https://www.propstream.com/

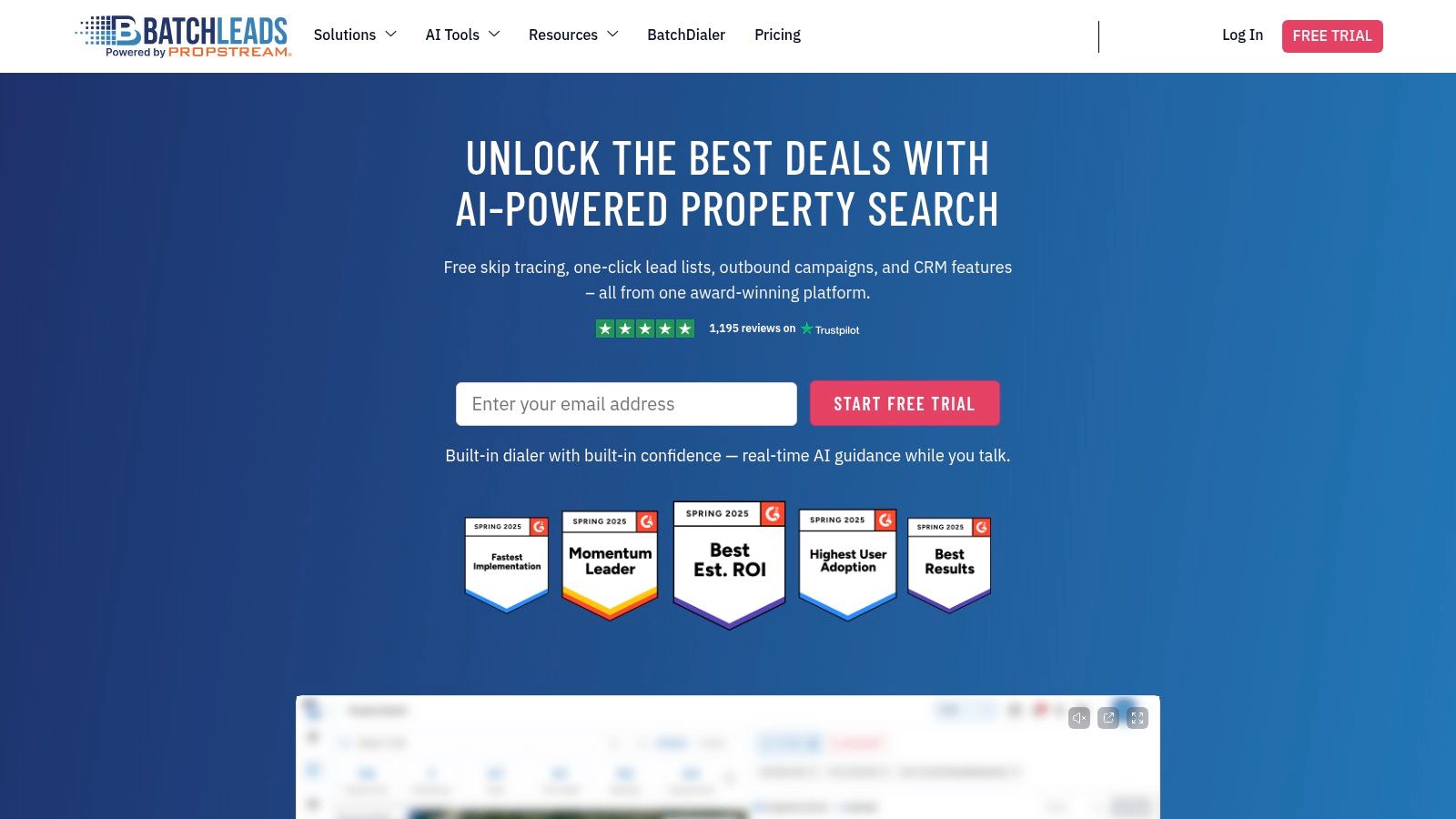

7. BatchLeads

BatchLeads positions itself as an all-in-one platform focused on combining deep property data with integrated marketing tools, making it a powerful choice for investors who prioritize high-quality list building and data enrichment. Its core strength lies in providing property lists with built-in contact information, significantly reducing the need for separate skip tracing services. This integrated approach helps investors move quickly from identifying potential properties to launching outbound marketing campaigns, all within a single environment.

The platform includes a CRM-style pipeline, a Driving for Dollars mobile app, and direct mail capabilities, creating a cohesive acquisitions workflow. For teams focused on cold calling, the AI Dialer add-on optimizes outreach efforts, while native Podio integration and Zapier connectors offer flexibility for custom setups. The generous inclusion of contact data makes it one of the best CRM for real estate investors looking to minimize their cost-per-lead on data. You can find more details in this guide to the best skip tracing services.

Key Features & Pricing

- Best For: Investors and teams who heavily rely on data-driven list building and outbound marketing.

- Unique Offerings: Generous inclusion of contact data and enrichment, AI Dialer add-on, and Reia AI assistant.

- Pricing: Starts at $99/month for the Personal Plus plan, with more features and lower per-lead costs on higher tiers.

- Pros: Combines lead generation and management effectively; strong data enrichment reduces the need for external tools.

- Cons: SMS marketing requires third-party integrations and compliance setups; export and lead quotas can lead to overage charges.

Website: https://batchleads.io/

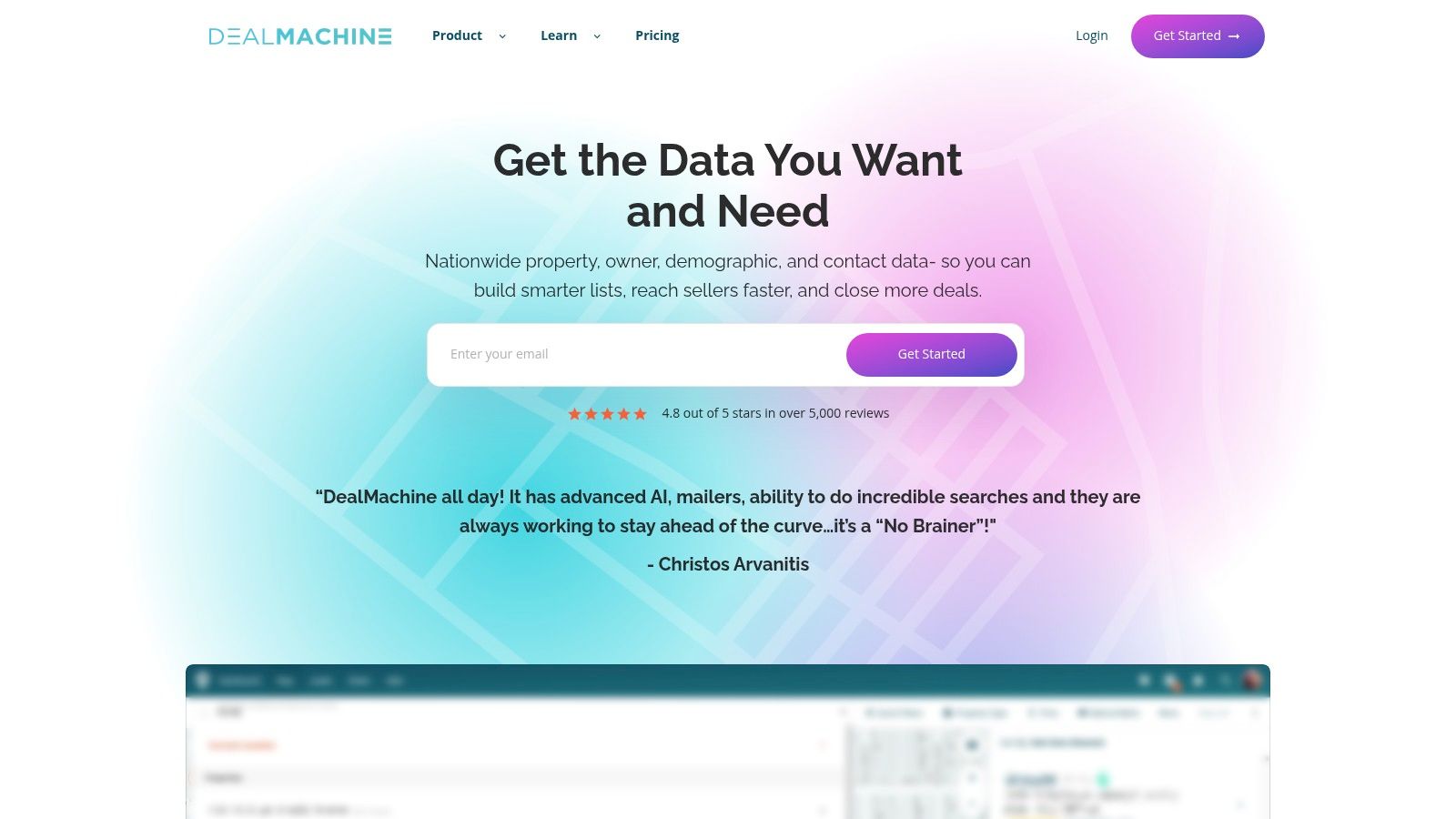

8. DealMachine

DealMachine is a powerful lead generation platform celebrated for its industry-leading Driving for Dollars (D4D) functionality. While not a traditional, deep-featured CRM, it provides essential lead and deal management pipelines tailored specifically for investors who source off-market properties in the field. Its core strength lies in empowering solo investors and field teams to identify distressed properties, access owner data in real-time, and launch marketing campaigns directly from their mobile devices. This makes it an exceptional tool for building a high-quality, proprietary lead list.

The platform integrates key acquisition tools like skip tracing, direct mail, and an AI-powered dialer and voicemail system to streamline outreach. Users can create custom driving routes, track properties, and manage their lead pipeline from a single, mobile-first interface. For investors whose strategy is heavily reliant on D4D, DealMachine serves as an indispensable front-end system and can be a strong contender for the best CRM for real estate investors focused on field acquisitions. It centralizes the most critical steps of in-person lead generation and initial marketing follow-up.

Key Features & Pricing

- Best For: Solo investors and teams whose primary lead generation strategy is Driving for Dollars.

- Unique Offerings: Best-in-class mobile D4D app with route planning, real-time property data, integrated direct mail, and an AI dialer.

- Pricing: Starts at $59/month for the Starter plan; team and enterprise plans offer more features and users.

- Pros: Unmatched mobile experience for field acquisitions; clear, tiered plans for different team sizes and lead volumes.

- Cons: The CRM functionality is lighter compared to dedicated, all-in-one systems; many features require add-on licenses or usage-based credits.

Website: https://www.dealmachine.com/

9. Realeflow (Leadflow)

Realeflow functions more as a lead generation engine with CRM capabilities rather than a dedicated, management-first platform. Its primary strength lies in providing direct access to a wide variety of motivated seller and cash buyer leads, which can be stacked and filtered directly within the system. This makes it an excellent starting point for investors who prioritize filling their pipeline with quality data before focusing heavily on complex follow-up sequences and team management. The platform is built around finding opportunities first and managing them second.

The user experience centers on its list-stacking and parcel-mapping tools, allowing for highly targeted marketing campaigns. While it includes CRM-style pipelines and marketing tools for direct mail and email, these features are less robust than those found in more specialized systems. For investors needing a powerful tool to identify and segment potential deals, Realeflow serves as a strong foundation, though it might require integration with a more advanced CRM as an operation scales. It’s a solid choice for those who want their lead source and initial management tool in one place.

Key Features & Pricing

- Best For: New and experienced investors focused on lead generation and list management.

- Unique Offerings: Extensive built-in lead types (pre-foreclosure, probate, etc.), advanced parcel mapping, and integrated list stacking.

- Pricing: Plans typically start around $125/month, with tiers based on lead download credits and feature access.

- Pros: Broad lead types available in one subscription; helpful mapping and list-management tools for targeted outreach.

- Cons: CRM features are secondary to lead generation tools; download and skip tracing credits are capped per plan.

Website: https://realeflow.com/

10. Left Main REI (Salesforce-based)

Left Main REI leverages the power of the Salesforce platform to deliver an enterprise-grade solution tailored specifically for real estate investors. It stands out by deploying pre-built REI workflows directly onto the world's most robust CRM, offering unparalleled scalability, security, and customization. This approach is ideal for sophisticated, multi-market teams that require a system capable of growing with their operations and integrating into a broader tech ecosystem.

The platform comes equipped with specialized modules for dispositions and transaction coordination, alongside integrated calling, SMS, and mailing functionalities. Unique features like "DealSignals" and "Property Sales AI" provide data-driven insights to help teams identify and prioritize the most promising opportunities. By building on Salesforce, Left Main REI offers a level of reporting, automation, and extensibility that generic CRMs cannot match, making it a powerful choice for high-volume investment firms that are serious about data and process optimization. It is easily one of the best CRM for real estate investors who are already familiar with or planning to scale into the Salesforce ecosystem.

Key Features & Pricing

- Best For: Scaling, multi-market investment teams and high-volume operations that need enterprise-level reliability and customization.

- Unique Offerings: Built on the Salesforce platform, offering pre-configured REI workflows, advanced AI-driven seller signals, and extensive reporting capabilities.

- Pricing: Custom pricing based on team size and implementation needs; generally a higher-tier investment.

- Pros: Enterprise-level security, reliability, and virtually limitless customization; excellent for scaling complex operations.

- Cons: Higher price point with significant implementation and onboarding requirements; may be overly complex for solo investors or small teams.

Website: https://leftmainrei.co/

11. REI Reply

REI Reply makes a compelling case as the best CRM for real estate investors on a tight budget who still need powerful marketing automation. Its primary appeal lies in a low monthly subscription that unlocks a vast suite of features, including a phone dialer, SMS campaigns, and advanced AI-driven communication tools like voice cloning and automated voicemail drops. The platform is built to handle unlimited contacts, which is a significant advantage for investors scaling their lead generation efforts without wanting to hit a contact-based pricing ceiling.

Unlike all-inclusive platforms, REI Reply separates its software fee from communication costs. It leverages a direct Twilio integration, meaning you pay for calls and texts on a usage basis. While this requires managing a separate Twilio account, it offers transparent, pay-as-you-go pricing that can be more cost-effective for users with fluctuating marketing volumes. This model provides enterprise-level marketing tools without the enterprise-level monthly commitment.

Key Features & Pricing

- Best For: Budget-conscious investors and small teams who need robust marketing automation and are comfortable with a pay-as-you-go telecom model.

- Unique Offerings: AI contact center features, voice cloning, unlimited contacts, and a low flat-rate subscription fee.

- Pricing: Starts at a low monthly fee (typically around $49/month) with a 14-day free trial. Telecom usage is billed separately via a connected Twilio account.

- Pros: Extremely low subscription cost for the feature set; unlimited contacts and users are a major value add.

- Cons: Telecom costs are variable and billed separately, which can be confusing for new users; the website and documentation can feel more sales-focused than instructional.

Website: https://reireply.com/

12. Podio

Podio isn't a dedicated real estate investor CRM out of the box; instead, it's a highly flexible work management platform that has become a foundation for countless custom REI systems. Its core strength lies in its app and workspace builder, which allows investors to construct a CRM that perfectly mirrors their unique processes. This makes it an ideal choice for hands-on entrepreneurs who want total control over their workflows, from lead intake and follow-up sequences to deal management and reporting.

Many investors leverage pre-built real estate templates from the Podio App Market or work with third-party consultants to deploy sophisticated, turnkey systems on the platform. With its built-in automation engine, you can create intricate workflows for tasks like lead assignment and follow-up reminders. Mastering its automation capabilities is key, and you can get started by reviewing some fundamental marketing automation best practices that apply directly to customizing Podio. While it requires more initial setup, the end result is a system tailored precisely to your business needs.

Key Features & Pricing

- Best For: Tech-savvy investors or teams who want a completely custom CRM without the cost of ground-up development.

- Unique Offerings: A massive marketplace of REI-specific app packs and third-party integrations (like GlobiFlow for advanced automation).

- Pricing: Offers a free plan for up to 5 users; paid plans start at $11/user/month (billed annually).

- Pros: Extremely affordable per-user pricing and unparalleled customization to fit unique business processes.

- Cons: Requires significant configuration or partner templates to be investor-ready; the user interface can feel dated compared to modern CRMs.

Website: https://www.podio.com/

Top 12 CRMs For Real Estate Investors — Feature Comparison

| Product | Core features | UX / Quality ★ | Value / Price 💰 | Target audience 👥 | Unique selling points ✨ / 🏆 |

|---|---|---|---|---|---|

| REsimpli | Dialer/SMS/email, direct mail, list stacking, skip trace | ★★★★ — polished investor workflows | 💰 Mid (trial available) | 👥 Investors wanting an all‑in‑one stack | ✨ Out‑of‑box investor workflows; 🏆 reduces tool sprawl |

| FreedomSoft | Workflows, phone numbers, websites, direct mail | ★★★★ — mature REI feature set | 💰 Mid‑High (scales with use) | 👥 Wholesalers & nationwide teams | ✨ REI‑specific maturity; 🏆 multi‑site support |

| REI BlackBook | Marketing automation, Profit Dial, pipelines | ★★★ — marketing‑heavy | 💰 Mid (usage overages on basic) | 👥 Teams focused on multi‑channel marketing | ✨ Strong marketing + telephony stack |

| InvestorFuse | Action workflows, team KPIs, dialer integrations | ★★★★ — conversion focused | 💰 Mid (setup fee) | 👥 Teams needing accountability & follow‑up | ✨ Action‑based lead discipline; 🏆 concierge onboarding |

| Forefront CRM | Visual pipelines, KPI dashboards, templates | ★★★★ — clean, focused UI | 💰 Contact for pricing | 👥 Acquisitions teams wanting simplicity | ✨ Focused conversion tool; 30‑day guarantee |

| PropStream | Nationwide property data, comps, list exports | ★★★★ — data‑first platform | 💰 Mid (caps on exports) | 👥 Data‑driven investors sourcing off‑market leads | ✨ Best data coverage; 🏆 list building & comps |

| BatchLeads | Contact data, AI dialer add‑ons, D4D app | ★★★ — enrichment + outreach | 💰 Mid (quotas/overages) | 👥 Teams wanting built‑in contact enrichment | ✨ Generous contact data; flexible add‑ons |

| DealMachine | Driving for Dollars, mobile D4D, AI dialer | ★★★★ — strong field UX | 💰 Low‑Mid (add‑ons may apply) | 👥 Field teams & solo D4D operators | ✨ Best mobile D4D stack; route planning |

| Realeflow (Leadflow) | Lead types, list stacking, parcel mapping | ★★★ — lead generation + mapping | 💰 Mid (download/credit caps) | 👥 Investors needing varied motivated‑seller lists | ✨ Mapping & multi‑lead types in one tool |

| Left Main REI (Salesforce) | Salesforce workflows, DealSignals, dispos | ★★★★★ — enterprise grade | 💰 High (implementation heavy) | 👥 Scaling multi‑market teams & brokerages | ✨ Enterprise reliability & extensibility; 🏆 Salesforce ecosystem |

| REI Reply | AI calling/voicemail, dialer, calendars | ★★★ — budget AI telecom features | 💰 Low subscription (Twilio usage extra) | 👥 Cost‑conscious investors seeking AI calling | ✨ Very low subscription; AI voice features |

| Podio | App/workspace builder, automations, templates | ★★★ — highly customizable | 💰 Low per‑user | 👥 Teams that want custom CRMs & templates | ✨ Highly customizable; large REI marketplace |

From Platform to Profit: Integrating Your CRM For Maximum Deal Flow

Navigating the landscape of real estate investor technology can be overwhelming. We've dissected twelve of the industry's leading platforms, from all-in-one powerhouses like REsimpli and FreedomSoft to specialized tools like PropStream and REI Reply. Each system offers a unique combination of features, strengths, and ideal user profiles. The central takeaway is clear: there is no single "best" CRM, only the one that is best for your specific business model, scale, and strategy.

Choosing your platform is a critical first step, but it’s only half the battle. The true power of a CRM is unleashed not by its features alone, but by the quality of the data and the efficiency of the workflows you build around it. A sophisticated tool without a consistent flow of motivated seller leads is like a high-performance engine without fuel. It looks impressive but ultimately goes nowhere.

Making Your Final Decision

As you finalize your choice, move beyond the feature checklists and consider the operational reality of your business. The best CRM for real estate investors will align with your day-to-day processes and growth ambitions.

- For the Solo Investor: Prioritize simplicity, automation, and cost-effectiveness. Tools like REI Reply or a well-configured Podio setup can provide immense value without the complexity and overhead of larger systems. The goal is to automate follow-up and manage leads efficiently so you can focus on negotiating and closing.

- For Growing Teams: Scalability, collaboration, and clear pipeline visibility are paramount. Platforms like InvestorFuse or Left Main REI (built on Salesforce) are designed for team environments, offering features like task assignment, lead routing, and advanced reporting to keep everyone aligned.

- For High-Volume Operations: You need an end-to-end solution that handles everything from lead generation and marketing to deal analysis and disposition. Comprehensive systems like REsimpli and FreedomSoft are built to manage this complexity, consolidating multiple functions into a single, cohesive platform.

Implementation: The Key to Unlocking Value

Once you've selected your CRM, a thoughtful implementation strategy is essential for maximizing your return on investment. Simply signing up is not enough; you must integrate the tool deeply into your business operations. This involves migrating your existing data, customizing pipelines to match your deal stages, and, most importantly, training yourself and your team to use the platform consistently.

For many investors, connecting disparate systems like your lead sources, dialers, and marketing platforms can be a significant technical hurdle. To truly maximize your deal flow and ensure seamless operations, consider leveraging expert software integration services to build a custom, automated ecosystem. This investment ensures your CRM talks to all your other tools, eliminating manual data entry and creating a truly efficient deal machine. The goal is to make your CRM the central, undisputed source of truth for your entire operation.

Ultimately, the best CRM for real estate investors is the one that gets used every single day. It should feel less like a database and more like a trusted co-pilot, guiding your decisions and automating the repetitive tasks that drain your time. By choosing a platform that fits your current needs and future goals, and by committing to a strategic implementation, you transform a simple software subscription into a powerful engine for consistent, predictable deal flow and sustainable business growth.

Tired of manually feeding leads into your new CRM? Tab Tab Labs connects directly to your chosen platform, filling your pipeline with exclusive, pre-qualified motivated seller appointments so you can focus on closing deals, not finding them. Schedule a free strategy call at Tab Tab Labs to see how our Distressed Appointments Engine can transform your CRM into an automated profit center.