The Ultimate Guide to Off-Market Real Estate Deals

Unlock the secrets to finding and closing profitable off-market real estate deals. Learn proven strategies to build a competitive edge in any market.

By James Le

Think of the typical real estate market—the one powered by the Multiple Listing Service (MLS)—as a massive public auction. Every property for sale is on full display, attracting a stampede of bidders that inevitably drives up prices and creates a frenzy. It’s a transparent system, sure, but one where the best deals get swarmed in minutes.

Off-market real estate is a whole different ballgame.

Unlocking The Hidden Real Estate Market

This is the private gallery showing of the property world. These deals, sometimes called pocket or quiet listings, are sold discreetly through an agent's or investor's personal network.

You’re not fighting a crowd. Instead, you're negotiating directly, without the constant pressure of a bidding war breathing down your neck. That exclusivity is the core appeal and where the real advantage lies.

To get a clearer picture, let's break down the fundamental differences between the public and private markets.

On-Market vs Off-Market Properties at a Glance

This table offers a quick comparison, highlighting the key distinctions between properties you'd find on the MLS and those sourced through private channels.

| Attribute | On-Market (MLS) | Off-Market (Private) |

|---|---|---|

| Visibility | Publicly advertised to everyone | Privately shared within networks |

| Competition | High, often leads to bidding wars | Low, direct negotiation is common |

| Pricing | Set by market demand, often inflated | More flexible, potential for discounts |

| Speed of Sale | Can be slow due to financing, etc. | Typically faster, often cash deals |

| Access | Open to any buyer with an agent | Requires connections and proactive sourcing |

| Seller Motivation | Usually focused on maximizing price | Often values privacy, speed, or certainty |

As you can see, the path to acquiring an off-market property is fundamentally different. It requires a proactive, strategic approach rather than a reactive one.

Why Do Sellers Choose The Off-Market Route?

Understanding why a seller would skip the MLS is your key to finding these deals. Not every property owner wants the spotlight and headache of a traditional sale. For many, other factors are far more important than squeezing out every last dollar.

Here’s what often motivates them:

- Privacy and Discretion: Think of high-profile individuals or people in sensitive situations like a divorce or financial trouble. The last thing they want is their sale becoming public knowledge.

- Speed and Certainty: A private deal with a known investor or cash buyer can close in a fraction of the time. This eliminates the nail-biting uncertainty of a buyer's financing falling through or getting bogged down by inspections.

- Avoiding Hassle: Many sellers dread the thought of constant showings, open houses, and staging their home for months on end. An off-market sale is a straightforward, less disruptive alternative.

- Testing the Market: Sometimes, an owner just wants to float a specific price with a trusted agent to gauge interest before committing to a full-blown public listing.

This entire approach puts sellers in the driver's seat. They control who sees the property and the timeline for closing, which often creates a true win-win for both sides of the table.

The Growing Importance of Private Transactions

The buzz around off-market deals isn't just talk; it's a real, measurable trend. For years now, market reports have shown a steady climb in private real estate transactions as sellers and investors alike chase speed, certainty, and discretion.

What started as a niche tactic for ultra-luxury homes has now gone mainstream, popping up in residential and investment sales across major cities. You can dig into more insights on this off-market gold rush over at UnrealCRM.com.

This isn't just a minor blip—it's a fundamental market shift. By learning how to tap into this hidden inventory, you stop being just another reactive buyer duking it out for public listings. You become a proactive investor who creates their own exclusive deal flow. And in a crowded industry, that's the ultimate competitive edge.

How to Find Off-Market Properties Before Anyone Else

Finding great off-market real estate isn't about luck. It’s about creating a system to spot opportunities that everyone else is missing. While your competitors are stuck scrolling through the same public listings on the MLS, you can build your own private pipeline of deals by tapping into specific, often overlooked, data sources and human networks.

Think of it like being a detective. Instead of waiting for a case to be announced on the news (the MLS), you’re on the ground, piecing together clues that point to a deal long before it hits the mainstream. These clues are hidden in plain sight, tucked away in public records and within your professional relationships.

Tapping Into Public County Data

County records are an absolute goldmine. They offer a direct line of sight into property ownership and, more importantly, potential distress. Every record tells a story, and learning how to read between the lines is a game-changer for any serious investor. By focusing on these sources, you can find owners who have a powerful reason to sell quickly and without the hassle of a traditional listing.

Here are some of the most potent data points to zero in on:

- Probate Filings: When a property owner passes away, their estate often goes through probate court. The heirs might be out-of-state, emotionally detached from the home, and just want to sell quickly to settle the estate.

- Tax Liens and Delinquencies: Owners who are behind on property taxes are almost always dealing with financial hardship. A tax lien is a massive red flag signaling distress and a strong motivation to sell before the county forecloses.

- Code Violations: Properties slapped with multiple code violations—think overgrown lawns, structural problems, or unpermitted work—often belong to owners who can't afford the upkeep. This can be a prime opportunity for an investor who isn't afraid of a project.

- Pre-Foreclosures: These public notices (often called a Lis Pendens) mean a homeowner has defaulted on their mortgage. This opens a time-sensitive window where you can negotiate a purchase before the property is lost to a bank auction.

- Absentee Owners: These are people who own a property but don’t live in it. Our in-depth guide on creating absentee owner lists shows how these landlords, often tired of managing tenants from a distance, can turn into highly motivated sellers.

The image below gives you a sense of how modern platforms can pull all these different data points together into a single, actionable list of leads.

This dashboard shows how different distress signals—like tax liens, probate, and pre-foreclosures—are aggregated, letting an investor instantly spot and target the most promising off-market opportunities in a given area.

Building a Powerful Referral Network

While data gets you the leads, relationships get you the inside scoop. A solid professional network is like having your own team of eyes and ears on the ground, bringing you deals you’d never find in public records. These are the people who are often the first to know when a property owner is thinking about selling.

Your network is your most valuable asset in the off-market world. A single trusted referral can be worth more than a thousand cold leads because it comes with built-in credibility and context.

Start building real connections with these key professionals:

- Attorneys: Estate planning, probate, and divorce attorneys are constantly in front of clients who need to liquidate real estate, often quickly and without a lot of public fuss.

- Contractors and Tradespeople: Plumbers, roofers, and electricians are in and out of properties all day. They know which homes are vacant, falling apart, or owned by someone who's overwhelmed with maintenance.

- Property Managers: They have firsthand knowledge of "tired landlords"—investors who are just done with the headaches of management and ready to sell their rental portfolios.

- Wholesalers: Don't forget other investors. They can be a fantastic source for deals that don't quite fit their own buying criteria but might be a perfect match for you.

When you combine the analytical horsepower of county data with the on-the-ground intelligence from a trusted network, you create a truly formidable sourcing machine. This dual-pronged strategy ensures you’re not just finding leads, but finding the right leads—the exclusive off-market real estate deals that give your business a serious competitive edge.

Turning Raw Data Into Qualified Appointments

Sourcing a list of potential off-market leads is a huge first step, but it’s really only half the battle. Raw data—just a name, an address, maybe a sign of distress—is pretty much worthless until you turn it into a real conversation. This is where a repeatable process for qualifying and engaging potential sellers takes you from playing a guessing game to running a predictable appointment-setting machine.

The whole point is to move fast but smart, focusing your most valuable asset—your time—on the homeowners who are actually likely to sell. Let's be real: not every lead is created equal. A property with a few distress signals and a ton of equity is a much hotter prospect than one with a single, minor issue.

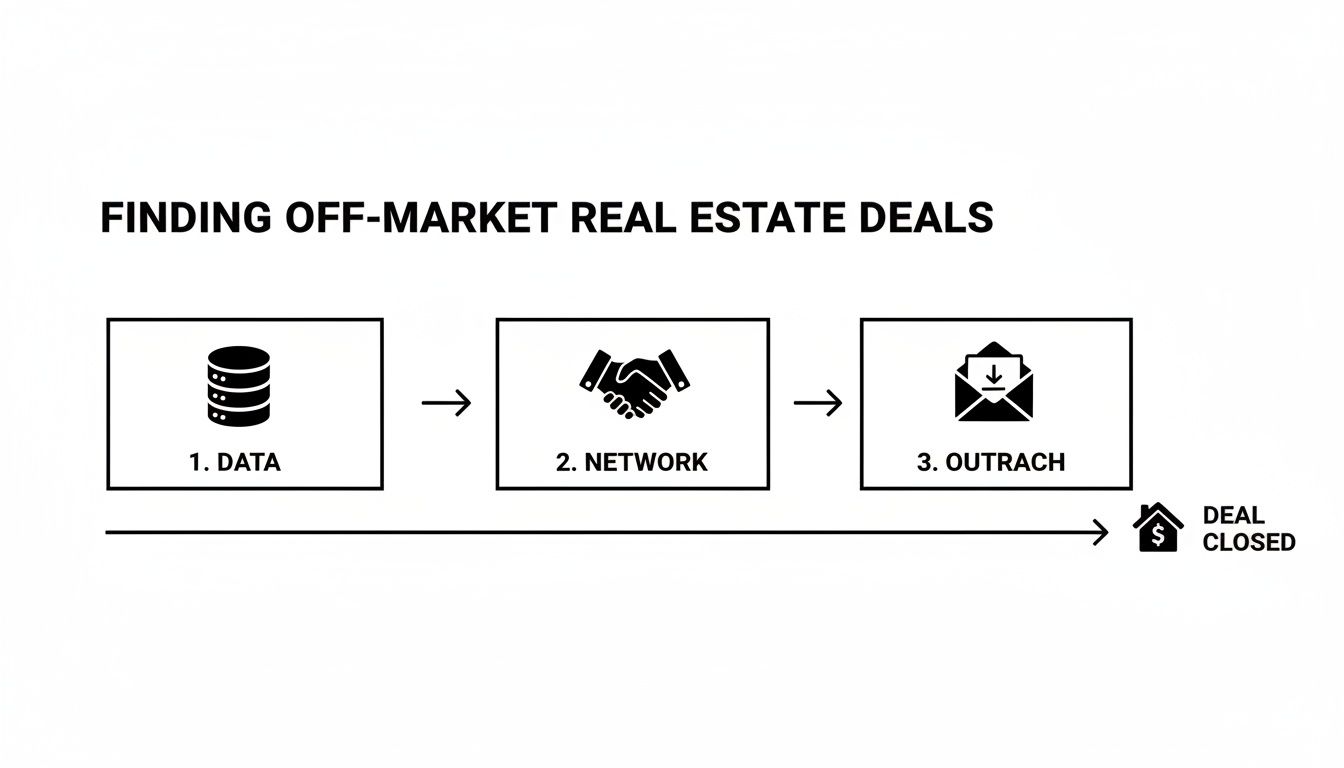

You can think of the whole off-market deal-finding process as a simple funnel: you start with data, enrich it through your network, and then kick off direct outreach.

This flow really drives home that data is just the starting point. It gets powerful when you layer in context before you ever pick up the phone, creating a consistent pipeline for new deals.

A Framework for Lead Qualification

Before you spend a single dollar on a stamp or a minute on a call, you need a quick way to score your leads. This is how you prioritize your outreach so you're not just spinning your wheels. A solid qualification process separates the signal from the noise, making sure you’re talking to genuinely motivated sellers.

I like to focus on three core pillars:

- Equity: Does the owner actually have significant equity in the place? A homeowner with little to no equity has their hands tied and is unlikely to sell at a price that makes sense for an investor. Tools that give you a loan-to-value (LTV) estimate are indispensable here.

- Motivation Level: How badly does the seller need to act now? A property in pre-foreclosure or probate signals a much higher motivation level than an absentee owner who's just tired of being a landlord. The more distress signals you see, the higher the motivation.

- Property Condition: Does the property look rough around the edges? Information from code violations or even a quick virtual "drive-by" on Google Street View can tell you if it needs a lot of work. That often lines up perfectly with a seller’s desire for a quick, as-is sale.

By layering these criteria, you can create a tiered list. Your "Tier A" leads—high equity, multiple distress signals, poor condition—should get your most intensive and personalized outreach right away.

Empathetic and Compliant Outreach Strategies

Once your qualified list is ready, your outreach has to be human-first and fully compliant. Remember, you're often reaching out to people during a tough chapter in their lives. A pushy, tone-deaf approach will get your call ended and your mail thrown in the trash. Applying some basic principles from business intelligence and reporting can help you structure these outreach campaigns so they’re both effective and respectful.

Your goal is to position yourself as a problem-solver, not just a buyer. This requires getting the right contact info, which is why finding the best skip tracing service is a non-negotiable step. You have to be sure you're reaching the actual owner.

Here’s a simple multi-channel outreach strategy that works:

- Direct Mail: This is often the perfect first touch. A handwritten letter or a personalized postcard stands out and feels far less intrusive than a cold call. Keep the message simple: "I'm interested in your property at [Address]. If you've ever considered selling, I'd love to chat."

- Cold Calling: After a mailer has landed, a follow-up call can be incredibly effective. Your script should be built around empathy and getting straight to the point. Reference the property address to show you've done your homework, then state your purpose. The key is to listen to their situation, not just barrel through a hard pitch.

- SMS Messaging: Texting can get great response rates, but you must follow compliance rules to the letter. Keep messages short, professional, and always give them an easy way to opt out. For example: "Hi [Name], this is [Your Name]. I sent a letter about your property on [Street]. Are you the owner?"

At the end of the day, the most successful investors mix and match these methods. They automate the first few steps of outreach and qualification, freeing themselves up to have genuine, high-quality conversations and build rapport with sellers who have already signaled interest. This systematic approach is the bridge that takes you from a spreadsheet of raw data to a calendar full of qualified appointments.

Using AI and Automation to Scale Your Deal Flow

Let's be honest: hunting for off-market deals the old-fashioned way is an absolute grind. It’s a messy process, full of operational bottlenecks that stop even the most driven investors in their tracks. We’re talking about endless hours scraping county websites, follow-up cadences that fall through the cracks, and far too many dead-end conversations with people who were never going to sell.

This manual approach puts a hard cap on your growth. You can only make so many calls, send so many letters, and knock on so many doors in a day. To really grow your business, you need a system that’s working for you around the clock—one that shifts your operation from chasing a handful of deals to managing a predictable, flowing pipeline of opportunities.

Building an Automated Deal-Finding Engine

What if you had a system that could automatically tap into proprietary data from county records—things like probate filings, tax liens, and code violations—and then kick off the qualification and outreach process without you lifting a finger? This isn't some far-off sci-fi concept; it's what's happening right now with the practical application of AI and automation in real estate.

An automated engine like this takes on the most grueling, time-sucking parts of the job. It finds the distressed properties, checks them against your specific criteria, and even makes the first move to start a conversation.

The change in your day-to-day is massive. Instead of spending 80% of your time digging for deals and just 20% of it actually closing them, you get to flip that ratio completely.

From Data Scraping to Booked Appointments

A truly smart system doesn't just dump a list of leads in your lap; it nurtures them. By bringing in AI-powered assistants—often called AI ISAs (Inside Sales Agents)—you can put the entire journey from lead discovery to a booked meeting on autopilot.

Here’s what that automated workflow looks like in practice:

- Proprietary Data Acquisition: The system is constantly scanning multiple county-level public records, pulling out fresh distress signals long before they show up on the big national data platforms.

- Instant Lead Qualification: As new leads pop up, AI analyzes them against your investment profile—like required equity levels or specific types of distress—to score and prioritize them in seconds.

- Automated Outreach: High-priority leads automatically trigger a multi-channel outreach sequence, sending personalized texts or emails to get the conversation started.

- AI-Powered Conversations: An AI ISA engages with homeowners who respond, asking smart qualifying questions to gauge their motivation and real interest in selling.

- Direct-to-Calendar Booking: Once the AI confirms you have a motivated seller, it books an appointment straight onto your calendar. All the relevant property and owner info gets pushed right into your CRM.

This hands-off process is built to deliver a steady stream of pre-vetted opportunities right to your doorstep. For investors and agents trying to stay ahead, using advanced tools is no longer optional. You can even explore how AI solutions for real estate professionals to manage calls can plug leaks in your follow-up and make your operation more efficient.

The real game-changer here is turning your business into a scalable asset. You’re moving from a chaotic, hustle-driven model to a predictable system that reliably puts 15-20 pre-qualified seller appointments on your calendar every single month.

Gaining an Unbeatable Competitive Advantage

In the dog-eat-dog world of off-market real estate, speed and efficiency are your secret weapons. While your competitors are stuck manually pulling outdated lists and cold-calling numbers that go nowhere, your automated engine is already deep in meaningful conversations with motivated sellers.

This tech-driven edge is about more than just saving time. It lets you operate at a scale that’s simply impossible to achieve with manual labor alone. By putting these ideas into action, you turn the vague concept of "AI in real estate" into a real, tangible tool for building a dominant and predictable deal flow. To go a bit deeper, check out how AI is being used by real estate agents to get an edge.

Ultimately, automation isn't here to replace the human touch in real estate; it's here to amplify it. It frees you from the soul-crushing, repetitive tasks so you can pour your energy into what you do best: building rapport, negotiating creative solutions, and closing the deals that will truly move your business forward.

Measuring What Matters in Your Off-Market Funnel

You can't scale what you don't measure. It’s an old saying, but it’s the absolute truth in this business. To turn your off-market operation from a side hustle into a predictable, scalable machine, you have to stop relying on gut feelings and start making decisions based on cold, hard data.

Tracking the right Key Performance Indicators (KPIs) is like having a dashboard for your business. It tells you exactly where you’re winning, where you're leaking money, and where the hidden bottlenecks are choking your growth. Without these numbers, you're just flying blind, potentially burning thousands on a marketing channel that’s delivering junk leads or losing deals to a clunky follow-up process. Understanding your numbers is the only way to build a truly profitable off-market real estate machine.

The Three Core Metrics of Your Funnel

While you could track dozens of data points, the health of your entire operation really boils down to three critical metrics. Think of them as the vital signs of your business. Together, they paint a complete picture of your funnel’s efficiency, from the first touchpoint all the way to a closed deal.

- Cost Per Lead (CPL): This is your starting point, the most fundamental number you need to know. It answers a simple question: How much does it cost to get one potential seller to raise their hand? To get this number, just divide your total marketing spend on a campaign (like a specific direct mail drop) by the number of leads it brought in.

- Cost Per Appointment (CPA): This metric takes it a step further. It measures how much you're spending to turn those initial leads into a real, qualified appointment on your calendar. You calculate this by dividing your total marketing spend by the number of appointments you actually booked.

- Cost Per Acquisition (CPAc): This is the ultimate bottom-line metric—the one that really matters. It tells you the total, all-in cost to acquire a single property. To figure it out, divide your total marketing and sales expenses by the number of properties you’ve successfully closed on.

Tracking these three numbers gives you a clear view of your marketing dollar's entire journey. That visibility is what lets you stop guessing and start making strategic, informed decisions.

Using KPIs to Diagnose and Fix Problems

Knowing your numbers is one thing; using them to fix what's broken is where the real magic happens. Each KPI tells a story, and a significant gap between any two of them is a massive red flag that something in your process isn't working.

Think of your funnel metrics as a doctor's diagnostic tools. A high temperature (a bad KPI) doesn't tell you the illness, but it tells you exactly where to start looking for the cause.

Here’s how to read the signs and figure out what your numbers are telling you:

- If your CPL is too high: This almost always points to a problem at the very top of your funnel. Maybe your targeting is too broad, your data source is low-quality, or your marketing message just isn't hitting the mark. The fix: Get more specific. Refine your lead lists to focus on clearer signs of distress or A/B test different ad copy and mailer designs to see what resonates.

- If your CPA is much higher than your CPL: This is a classic sign of a breakdown between getting a lead and booking a meeting. You’ve got interested people, but you’re fumbling the handoff. The fix: Look at your follow-up. Is it too slow? Are your scripts weak? Does your team need better training on how to handle common objections? Speed and skill are everything here.

- If your CPAc is disproportionately high: This hurts the most. It means you’re great at getting in the door but terrible at walking away with a signed contract. The fix: This is usually a problem with your in-person game. You might need to sharpen your negotiation skills, rethink your offer structure, or work on building better rapport and trust with sellers during the appointment itself.

To really get a handle on this, you need to track your funnel’s performance from top to bottom. Here are the essential metrics that will give you that complete view.

Essential Metrics for Your Off-Market Funnel

| KPI | What It Measures | Why It Matters |

|---|---|---|

| Cost Per Lead (CPL) | The average cost to generate a single seller lead. | Tells you the efficiency of your marketing channels and campaigns. |

| Lead-to-Appointment Rate | The percentage of leads that convert into a booked appointment. | Reveals the effectiveness of your follow-up process and sales scripts. |

| Cost Per Appointment (CPA) | The average cost to secure one qualified seller appointment. | Combines marketing cost and follow-up efficiency into a single number. |

| Appointment-to-Offer Rate | The percentage of appointments that result in you making an offer. | Shows whether your appointments are with truly qualified and motivated sellers. |

| Offer-to-Contract Rate | The percentage of offers that get accepted and turn into a contract. | Measures the strength of your offers, negotiation skills, and closing ability. |

| Cost Per Acquisition (CPAc) | The total cost to acquire one property (marketing + sales costs). | This is your true bottom-line metric for determining profitability. |

By consistently monitoring these KPIs, you can move from guesswork to a system. It allows you to surgically identify and fix the weakest links in your funnel, building a business that's engineered for sustainable, profitable growth.

Staying Compliant in Your Seller Outreach

Jumping into off-market real estate is about more than just finding good data and writing a killer script. It demands a serious respect for the legal and ethical lines you can't cross. Direct-to-seller marketing is an incredibly powerful strategy, but it exists inside a tight framework of rules designed to protect people's privacy.

Let's be clear: ignoring these rules isn't just a bad idea—it's a fast track to crippling fines, a ruined reputation, and putting the future of your entire business at risk. If you want to build something that lasts, you have to bake compliance into your workflow from the very first day. It's non-negotiable.

Getting a Handle on The Key Regulations

This isn't a substitute for legal advice, but you absolutely have to understand the main pillars of regulation before you send a single mailer or make one phone call. These laws dictate how, when, and why you're allowed to contact potential sellers.

- Telephone Consumer Protection Act (TCPA): This is the big one for anyone calling or texting. The TCPA has strict rules about using autodialers and sending texts people didn't ask for. Getting this wrong is expensive, with fines running from $500 to $1,500 per violation.

- National Do Not Call Registry: You are legally required to scrub your calling lists against the National Do Not Call (DNC) Registry. Calling someone on this list can lead to massive penalties, and playing dumb is not a defense that will work.

- Direct Mail Best Practices: While direct mail is less regulated than calls or texts, it's not the wild west. Everything you send must be truthful and can't be deceptive. Making misleading claims about what a property is worth or what your intentions are will land you in legal hot water.

Think of compliance as the foundation of your business. A shaky foundation might hold up for a bit, but sooner or later, the whole thing comes crashing down. Operating by the book isn't a roadblock; it's a competitive edge that builds trust and ensures you're still in business years from now.

Why Compliant Platforms Are a Must-Have

Trying to manage all this compliance manually is a recipe for disaster. Juggling DNC lists, staying on top of TCPA rule changes, and navigating state-specific laws is a full-time job where one mistake can cost you dearly. This is exactly why working with professional platforms that build compliance into their DNA is so critical.

A good service automates these vital safety checks for you, acting as your first line of defense. These platforms will automatically scrub your outreach lists against the National Do Not Call Registry and other suppression files, making sure you don't accidentally contact someone you shouldn't. This kind of built-in protection is indispensable for any serious investor who wants to scale their off-market real estate operation without taking on unnecessary risk.

When you make compliance a priority, you're not just dodging legal bullets. You're building a more ethical, trustworthy, and effective outreach engine. Sellers are far more willing to listen to a professional who respects their privacy, which turns a potential legal nightmare into a genuine opportunity to build rapport from the first hello.

Answering Your Top Questions

Getting into the off-market world naturally brings up a few questions. Let's tackle some of the most common ones so you can move forward with confidence.

Is Finding Off-Market Real Estate Legal?

Absolutely. Sourcing properties off-market is a completely legitimate and legal investment strategy. The entire process is built on a foundation of public records—information like tax assessments, property deeds, and court filings that are, by design, available to everyone.

The real key is making sure your outreach—whether that's calling, texting, or sending mail—is by the book. You have to be diligent about following regulations like the Telephone Consumer Protection Act (TCPA) and any local marketing laws. Stay compliant, and you're golden.

How Much of a Discount Can I Expect?

This is the million-dollar question, but the truth is, there's no standard discount for an off-market real estate deal. The final price is always a unique negotiation. It comes down to the seller's personal situation, how motivated they are to sell, and the actual condition of the property.

While avoiding a bidding war on the MLS can often lead to a better price, the real wins are usually speed, certainty, and getting exclusive access to properties no one else sees. The goal isn't just to get a discount; it's to find a fair price that works for you and solves a problem for the seller. That’s a true win-win.

Can I Find Off-Market Deals Without a Big Budget?

You can, but a budget definitely helps you move faster and scale your efforts. If you're just starting out, there are several low-cost ways to get your feet wet.

Think of it as sweat equity. You can get started by:

- Networking: Get to know local attorneys, contractors, and property managers. These are the people who often hear about potential deals first and can send them your way.

- Driving for Dollars: This is old-school but effective. You literally drive through neighborhoods looking for signs of distress—overgrown yards, boarded-up windows, etc.—and then track down the owner.

- Manual Research: You can dig through county websites for public records yourself. It's free, but be warned: it's incredibly time-consuming.

These hands-on methods can definitely uncover gems, but they are tough to scale into a predictable deal flow.

Ready to stop fighting over the same stale lists and build a predictable pipeline of exclusive off-market deals? At Tab Tab Labs, we combine proprietary county data with AI-powered automation to put 15-20 pre-qualified seller appointments on your calendar every month. Schedule a free strategy call to see how it works.