Off Market Property Sales: How To Find And Close Hidden Deals

Uncover proven ways to source and secure off market property sales, with expert strategies for pricing, positioning, and closing hidden real estate deals.

By James Le

Off-market property sales are exactly what they sound like: transactions that happen directly between a buyer and a seller, completely outside the public view of the Multiple Listing Service (MLS). Think of it like a restaurant's secret menu—it offers exclusive opportunities you won't find advertised anywhere else, giving you a serious leg up on the competition. For investors, mastering these deals is the key to bypassing bidding wars and uncovering truly unique properties.

Why Off-Market Deals Are Your Competitive Edge

In today's hyper-competitive real estate world, the properties you see plastered all over the MLS are just one piece of the puzzle. The other part—that hidden inventory—is where the smartest investors make their money. These off-market properties aren't publicly advertised, which translates to drastically less competition and a whole lot more room to negotiate.

Picture two investors. The first one is glued to Zillow, getting into dogfights with dozens of other buyers over the same overpriced house. The second investor, meanwhile, is talking directly to a homeowner who needs to sell fast because of a job relocation. They shake hands and close the deal before it ever gets a "For Sale" sign in the yard. That proactive approach is the very soul of off-market investing.

The Power Of Motivated Sellers

The real secret sauce to off-market deals is getting to the heart of the seller's motivation. These aren't your typical homeowners just "testing the waters." They're people with a specific problem that a quick, quiet sale can solve.

Some common motivations you'll run into include:

- Privacy: High-profile individuals or families dealing with sensitive situations like divorce often want to keep their business out of the public eye.

- Speed and Convenience: Many sellers are more than willing to accept a slightly lower price in exchange for a fast, no-fuss closing without the headache of showings or repairs.

- Financial Distress: Homeowners staring down pre-foreclosure, tax liens, or other financial pressures need to move the property quickly to get out from under the weight.

- Inherited Property: Heirs who live across the country would often rather take a simple, direct cash offer than try to manage a property from a distance.

These sellers don't want a bidding war; they want certainty and simplicity. That creates the perfect opening for an investor to step in with a solution that works for everyone. It’s a fundamental shift from passively waiting for listings to pop up to actively creating your own deal flow.

To give you a clearer picture, let's break down the core differences between the two worlds.

On Market Vs Off Market Properties At A Glance

This table gives you a quick comparison, highlighting the fundamental differences between properties you'd find on the public market versus those sourced through private, off-market channels.

| Characteristic | On Market Properties (MLS) | Off Market Properties |

|---|---|---|

| Visibility | High. Publicly advertised to everyone. | Low. Private, word-of-mouth, or direct outreach. |

| Competition | Extremely high, often leading to bidding wars. | Minimal to none. You're often the only buyer. |

| Price | Typically at or above market value. | Often below market value due to seller motivation. |

| Negotiation | Limited leverage for the buyer. | Significant room for negotiation on price and terms. |

| Speed | Slower process with contingencies and financing. | Can close very quickly, often with cash. |

| Seller Motivation | Usually looking for the highest possible price. | Driven by a need for speed, privacy, or convenience. |

As you can see, the dynamics are completely different. While the MLS offers volume, the off-market world offers value and control.

Navigating A Low-Inventory Market

Let's be honest: today's real estate market is notoriously tight. In most major metros, off-market sales are no longer a tiny niche; they're a significant chunk of the action. Industry analysts estimate that 10–20% of single-family transactions in constrained markets happen off-market. With the broader U.S. housing inventory still 20–30% below prior troughs, the market has been described as 'largely frozen.'

This structural shortage is precisely what's pushing serious investors to hunt for deals outside the traditional channels. You can read more about this off-market gold rush and its impact on housing supply.

By focusing on off-market property sales, you aren't just finding deals—you are creating them. You step out of the crowded public arena and into a space where you can directly address a seller's needs, often resulting in better terms and more profitable investments.

Adopting this strategy requires a different mindset. It’s less about finding a perfect house and more about finding a motivated person with a property problem you can solve. Once you learn to spot these situations, you can build a resilient, predictable pipeline of opportunities, no matter how heated the public market gets.

How To Find Lucrative Off-Market Real Estate Deals

Finding great off-market properties isn't about luck. It’s about building a repeatable system that generates its own deal flow. Instead of passively waiting for deals to pop up on the MLS, you're proactively hunting for them. This shift in mindset transforms you from a buyer who takes what they can get into a strategic deal hunter with a resilient pipeline.

To make this happen, you need to move beyond theory and build a practical playbook. The best strategies combine several sourcing channels, each tapping into a different corner of the hidden market. Let's break down the essential channels you need to master.

Mine Public Records For Distress Signals

Public records are a goldmine. This data, filed with county and city governments, tells a story about a property owner's situation—often one of distress. For a savvy investor, these records are the breadcrumbs that lead to a motivated seller.

Think of yourself as a real estate detective. You’re looking for clues that suggest a homeowner might need a fast, simple solution. Key records to focus on include:

- Probate Filings: When someone passes away, their property often goes through probate court. The heirs might live out of state and have no interest in managing a lengthy, complicated sale. A quick cash offer can be a perfect solution for them.

- Tax Liens and Delinquencies: Homeowners falling behind on property taxes are almost always under financial pressure. A direct offer can give them the cash they need to settle their debts and avoid foreclosure.

- Pre-Foreclosure Notices (Lis Pendens): This is the official starting gun for foreclosure proceedings. The homeowner is on the clock. They still have a window to sell the property and pay off the mortgage, which makes them incredibly motivated to hear a fast offer.

- Code Violations: Properties drowning in code violations—for things like overgrown yards, structural problems, or unpermitted work—are often owned by someone who can't afford the upkeep. These are prime candidates for an off-market deal.

By systematically tracking these public records, you can build hyper-targeted lists of homeowners who are far more likely to pick up the phone.

Master Direct Outreach Campaigns

Once you have a list of potential leads, it's time to reach out. This is where you make first contact and start building a connection. A good outreach campaign is personal and professional, focusing on solving the seller's problem, not just on your desire to buy their house.

The most effective outreach methods are still the classics:

- Direct Mail: A personalized letter or postcard remains a surprisingly powerful tool. Something as simple as a handwritten-style font or unique envelope helps it stand out from the junk mail and make a real impression.

- Cold Calling: It’s more direct, but a phone call gives you immediate feedback. A polite, empathetic script that quickly gets to the seller's pain points can open doors that a letter just can't.

- Digital Campaigns: Using skip tracing to find email addresses or social media profiles opens up another front. Targeted digital ads or direct messages can be a great way to reach younger or more tech-savvy owners.

The real key to outreach is consistency. Most deals aren't closed on the first call. They’re nurtured over time with persistent, helpful follow-up.

A successful outreach strategy is built on empathy. You are not just trying to buy a house; you are offering a solution to a person's difficult situation. Framing your communication this way builds trust and dramatically increases your response rate.

Leverage Strategic Networking

Beyond data and direct mail, some of the best off-market deals come from who you know. Building a strong professional network puts you in the direct path of opportunities before they ever become public. Your network is full of gatekeepers who are the first to know when someone needs to sell quietly.

Your network should absolutely include:

- Wholesalers: These are the ground troops of off-market real estate. They specialize in finding distressed properties and getting them under contract, giving you access to a curated stream of deals.

- Attorneys: Divorce, probate, and bankruptcy attorneys are constantly dealing with clients who need to liquidate real estate assets quickly and without a fuss.

- Contractors and Property Managers: People like plumbers, roofers, and property managers are on the front lines. They see firsthand which properties are being neglected and which landlords are ready to throw in the towel.

These relationships take time to build, but the payoff is a steady flow of high-quality, exclusive leads. To get a better feel for the broader dynamics at play, you can look into more general real estate market information. And when you're ready to start mining data, learning how to build effective absentee owner lists is a fantastic starting point for targeting out-of-town owners who might be motivated to sell.

Your Proven Workflow From Sourcing To Closing A Deal

Finding a promising lead is just the starting line. The real work—the part that separates seasoned pros from the rest—is turning that raw data into a closed deal. This is where a systematic workflow comes into play, guiding a potential seller from that first tentative phone call to the closing table with confidence.

Wing it, and you'll watch opportunities evaporate. Nail down a proven process, and you'll build a predictable, repeatable pipeline of deals.

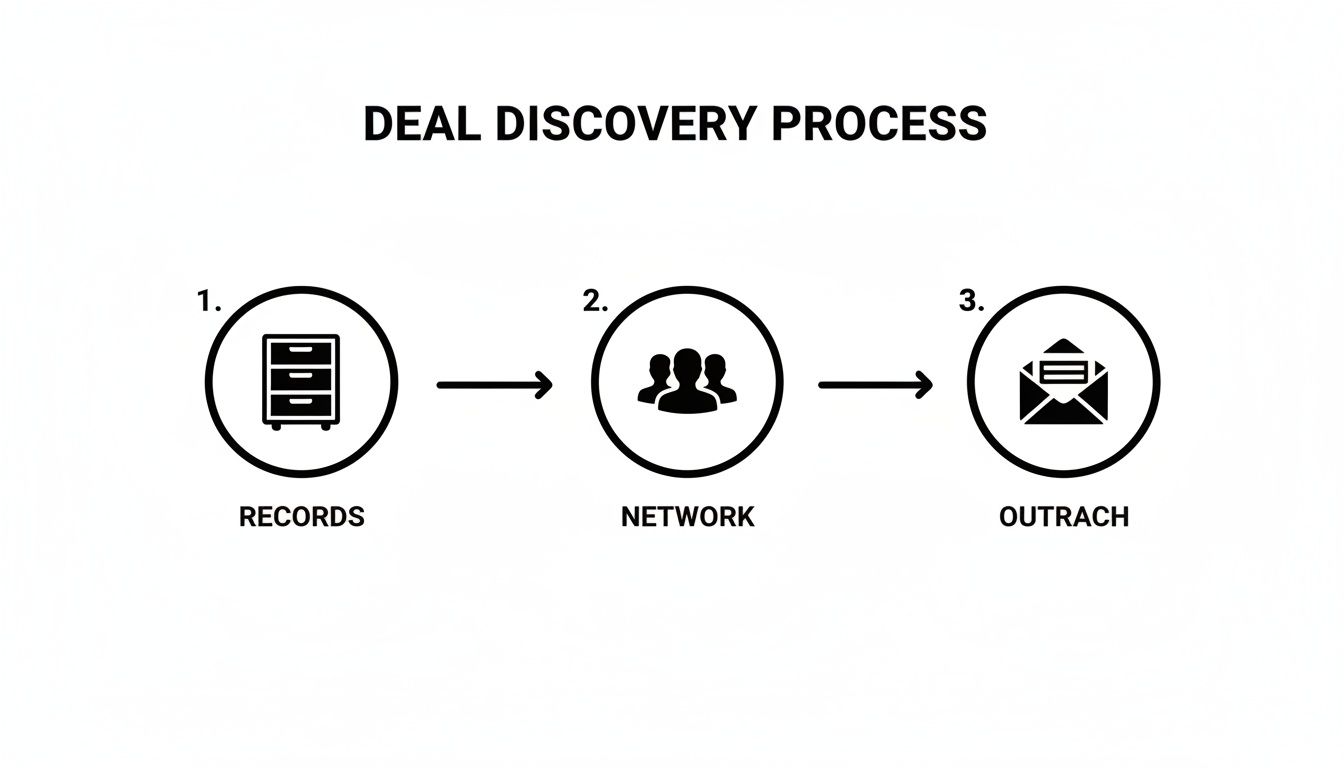

The whole discovery process really boils down to three key phases: digging through records, tapping your network, and then making direct contact.

This just goes to show that the best sourcing strategies don’t rely on a single magic bullet. They blend data mining, human relationships, and direct communication to keep the leads flowing.

Step 1: Lead Qualification

Let's be honest: not every lead is a good one. The first, and arguably most important, step is to qualify your list. You've got to separate the genuinely motivated sellers from all the background noise. Get this right, and you save an incredible amount of time and money by focusing your energy where it actually counts.

Your mission is to pinpoint property owners who have a compelling, urgent reason to sell quickly and quietly.

Here’s what I look for:

- Multiple Distress Signals: Does the property have both a tax lien and a code violation? Or maybe it's a probate property that's also vacant. Multiple issues are a huge indicator of high motivation.

- Equity Position: A homeowner with a good chunk of equity has room to negotiate. It gives them the flexibility to accept a price that works for everyone.

- Good Contact Info: Can you actually find the owner with skip tracing? Bad data kills a campaign before it even starts. There's nothing worse than a great lead you can't reach.

This initial filtering makes your outreach targeted and potent, which is how you dramatically boost your response rates.

Step 2: Effective Outreach

Once you have a qualified list, your outreach needs to build rapport and trust from the first word. A generic, "I want to buy your house" message is destined for the trash can. Instead, your communication has to be empathetic, professional, and laser-focused on solving the seller's problem.

Whether you're sending direct mail, making cold calls, or trying digital methods, the message has to be crystal clear: who you are, why you're contacting them specifically, and how you can make their life easier. Don't frame your offer as a lowball bid; frame it as a fast, simple solution to whatever challenge they're facing.

A successful outreach campaign isn't about sales pressure; it's about opening a conversation. Your primary goal is to listen to the seller's story and understand their needs before ever discussing a price.

Step 3: Accurate Property Valuation

You’ve made contact and the seller is interested. Great. Now you need to figure out what the property is actually worth. This is a lot trickier for off-market deals. You can't just pull up recent MLS comps for a house that might be in total disrepair or has a unique story behind it.

To put together a fair, data-backed offer, you have to get good at off-market valuation methods:

- "As-Is" Value: This is simple. What would someone pay for the property today, in its current condition, without you lifting a single hammer?

- After Repair Value (ARV): This is your north star. It's an estimate of the property's market value after you've completed all the necessary renovations.

- Repair Cost Estimation: You need a rock-solid budget for getting the property from its "as-is" state to its ARV. This isn't just materials and labor—don't forget holding costs, permits, and a contingency fund.

Running the numbers properly is the foundation of any good offer. If you're looking for a solid framework, you can find excellent resources to guide this process, like this real estate comparative market analysis template from Bounti. A detailed analysis like this is what gives you the confidence to make your offer.

Step 4: Win-Win Negotiation

Negotiating off-market deals isn't a battle; it's a collaboration. The investors who consistently close deals are the ones who focus on creating a true win-win. The seller gets their goal (a fast, hassle-free sale) and you get yours (a profitable investment).

Show up to the conversation prepared. Walk the seller through your numbers—show them your ARV calculations and your repair estimates. This kind of transparency builds massive credibility. It shows them your offer is based on the reality of the market, not just you trying to get a steal.

And remember, be flexible on the terms, not just the price. Sometimes a seller values a quick closing or the ability to leave a house full of unwanted junk behind far more than an extra few thousand dollars.

Step 5: Smooth Closing Process

The final stretch is getting through the legal and financial paperwork to actually close the deal. A smooth, professional closing is critical. It protects your reputation and makes sure everyone involved is covered. This means teaming up with a reputable title company or real estate attorney to handle all the details.

Your closing checklist is non-negotiable:

- Signed Purchase Agreement: A clear, legally sound contract that spells out every single term of the sale. No ambiguity.

- Title Search: This ensures the property has a clean title, free of any surprise liens or claims that could derail the deal.

- Funding Secured: Whether you're using cash, hard money, or private lending, have your financing locked in and ready to wire.

- Final Walk-Through: One last inspection to confirm the property's condition hasn't changed since you signed the contract.

By sticking to a structured workflow like this, you take the chaotic, unpredictable nature of finding hidden deals and turn it into a repeatable, scalable business process.

How To Scale Your Deal Flow With AI And Automation

Let’s be honest: manually scraping county records and banging out hundreds of cold calls is a grind. Sure, it can produce deals, but it’s brute force. To truly dominate the world of off-market property sales, you have to evolve beyond that and build a system that actually scales.

This is where technology—specifically AI and automation—gives you a massive leg up. It’s about transforming the frustrating, time-sucking hunt for deals into a predictable, deal-generating machine.

Instead of fighting over the same stale lists that every other investor has already chewed through, modern tools let you build your own proprietary pipeline of exclusive opportunities. This is how the top operators stop chasing deals and start getting qualified, motivated sellers booked directly onto their calendars.

Building Your Modern Tech Stack

At its heart, a modern tech stack for off-market investing automates the most soul-crushing parts of the job: finding leads, qualifying them, and making that first contact. Think of it as building a digital assembly line for your deal flow. The exact tools will vary, but the most effective systems all nail a few key functions.

The foundation is automated data acquisition. Platforms like Tab Tab Labs’ Distressed Appointments Engine plug directly into county-level data sources, pulling records for fresh distress signals in near real-time.

This isn't just generic data. We’re talking about triggers like:

- Probate Filings: Spotting inherited properties the moment they hit the court system.

- Tax Liens: Flagging homeowners who just fell behind on their property taxes.

- Pre-Foreclosure Notices: Getting alerts on new lis pendens filings before they ever show up on mainstream data aggregators.

- Code Violations: Uncovering properties with serious deferred maintenance or structural problems.

This automated scraping means you're always working with the freshest, most accurate information out there, giving you a crucial head start on everyone else.

The goal of automation isn't just to do things faster. It’s to create a system that surfaces opportunities no one else even sees. By layering multiple distress signals from different sources, you can build an incredibly accurate profile of a truly motivated seller.

How AI-Powered ISAs Transform Outreach

Once you have that high-quality data, the next bottleneck is outreach. This is where AI-powered Inside Sales Agents (ISAs) change the game. These aren't just clunky chatbots; they are sophisticated systems designed to engage potential sellers 24/7.

The moment a distress signal is flagged, an AI ISA can instantly text or email the new lead. It then handles the initial back-and-forth, asking the right questions to gauge motivation, timeline, and the property's condition. This alone frees up your team from wasting hours on dead-end calls.

Here’s what that process looks like in practice:

- Instant Engagement: The AI reaches out to a new lead within seconds of the data being scraped. No delays.

- Intelligent Qualification: It uses conversational AI to figure out if the seller is genuinely motivated or just kicking tires.

- Seamless Handoff: Once a lead is qualified, the AI books an appointment directly into your acquisition manager's calendar and pushes all the relevant data straight into your CRM.

This automated workflow ensures that your team only spends time talking to pre-vetted, motivated sellers who are actually ready to have a serious conversation. The result? A predictable pipeline that can deliver 15-20 qualified seller appointments every single month. For real estate professionals looking to apply these principles more broadly, our guide on how to use AI for real estate agents offers additional valuable insights.

By combining automated data scraping with AI-driven outreach, you’re not just working harder—you’re building an engine that consistently fills your pipeline. This is how you stop competing and start owning your market, turning the unpredictable art of finding off-market deals into a reliable science.

Navigating The Legal And Ethical Landscape

Finding a great off-market deal is only half the battle. Success in this space is really about building a trustworthy, reputable business, and the hidden nature of these transactions demands a serious commitment to legal and ethical standards. Get this wrong, and you’re risking more than just your reputation—you’re facing real legal consequences.

Think about it: you’re often dealing with sellers in tough spots. They might be facing foreclosure, trying to manage an inherited property, or just going through a personal crisis. That dynamic puts a huge responsibility on your shoulders to act with total integrity. Every single interaction has to be transparent and fair.

Upholding Disclosure And Transparency

Full disclosure isn't just a nice-to-have; it's the bedrock of any ethical off-market deal. Sellers need a crystal-clear, honest picture of the transaction, their property's true potential, and what you plan to do with it. Hiding information or using confusing jargon isn't just shady—it can get the whole contract thrown out.

Here’s what real transparency looks like in practice:

- Be Clear About Your Intentions: Don’t beat around the bush. You’re an investor looking to buy their property, fix it up, and likely sell it for a profit. Misrepresenting yourself as a typical homebuyer is a massive ethical red line.

- Show Your Work on Valuation: When you make an offer, walk the seller through the numbers. Explain exactly how you arrived at your price, including the After Repair Value (ARV) and your estimated renovation budget. This simple act builds trust and shows your offer is based on solid data, not just a gut feeling.

- Put Disclosures in Writing: Always use the state-required property condition disclosures. Even if you're buying "as-is," failing to disclose known material defects is a lawsuit waiting to happen.

Remember, many of the sellers you'll meet are under a ton of stress. Your role is to be a professional problem-solver, not a predator. An ethical deal is one where the seller walks away feeling respected and relieved, not cornered or tricked.

Understanding The Rules Of Engagement

The off-market world has its own set of rules, and you have to know them inside and out, especially if you’re a licensed agent or working with one. These regulations exist to keep the playing field level.

The National Association of Realtors® (NAR) put its Clear Cooperation Policy in place to make sure all buyers get a fair shot at listings. This rule effectively ended the old-school "pocket listing," where an agent could privately shop a property around for weeks or months.

Today, if a property is marketed publicly at all—we’re talking everything from a yard sign to an email blast—it has to be on the MLS within one business day. This doesn’t kill private deals, though. Office exclusives, where a listing is shared only within a single brokerage, are still fair game.

On top of that, investors need to be savvy about legal filings that signal distress, like pre-foreclosure notices. If you want to dive deeper into this, our guide explains what is a lis pendens notice and what it means for a property owner.

Navigating Dual Agency And Conflicts Of Interest

One of the biggest ethical minefields is dual agency. This is when a single agent tries to represent both the buyer and the seller in the same deal. While it’s technically legal in some states (with full disclosure), it’s a built-in conflict of interest. How can one person truly fight for the seller's highest price and the buyer's lowest price at the same time?

Frankly, it's a situation you should avoid entirely in off-market investing. If you're a licensed agent buying for your own portfolio, your primary duty is to your investment. It’s almost impossible to simultaneously uphold a fiduciary duty to the seller. The cleanest path is to operate strictly as a principal buyer, leaving no room for confusion about your role.

When you prioritize clear legal boundaries and unwavering ethics, you build a sustainable business that runs on integrity—creating deals where everyone truly wins.

Real World Examples Of Off Market Success

Theory and workflows are great, but nothing beats seeing how these strategies play out in the real world. The real magic of off market property sales happens when you solve genuine human problems with creative, flexible solutions. It's about more than just numbers on a spreadsheet.

Let's walk through a couple of anonymized case studies. These stories show how deals really get done, creating a win-win for everyone at the table. Think of them as a blueprint you can adapt for your own success, following the simple arc from a seller's challenge to an investor's profitable solution.

Case Study 1: The Inherited Probate Property

-

The Seller's Challenge: Two siblings inherited their mom's house after she passed away. The problem? They lived in different states, had their own busy families, and had zero desire to manage a traditional sale. The house was dated and needed a ton of work, making an on-market listing feel like an expensive, time-sucking nightmare. They just wanted it done.

-

The Investor's Strategy: An investor who systematically tracks local probate filings flagged the property. Instead of a generic "I buy houses" postcard, he sent a thoughtful, personalized letter. It started by offering condolences and then gently pivoted to a no-obligation cash offer to help settle the estate quickly and painlessly.

-

The Creative Solution: The investor came in with a fair "as-is" price that baked in the cost of renovations. The real selling point, though, was pure convenience. He told the siblings to take whatever they wanted from the home and simply leave the rest. He would handle the entire clean-out. No dumpsters, no stress.

-

The Final Result: The siblings had cash in their hands in just 21 days. They avoided months of headaches, repair costs, and realtor commissions. The investor, in turn, executed a six-figure renovation and sold the polished property on the open market for a healthy profit.

Case Study 2: The Financially Distressed Landlord

-

The Seller's Challenge: An out-of-state landlord was in a tough spot. A difficult tenant had left his rental in shambles, and he was thousands of dollars behind on the mortgage. The bank had just filed a lis pendens (a formal notice of a pending foreclosure lawsuit), and he was desperate to sell immediately to avoid foreclosure and salvage his credit.

-

The Investor's Strategy: This investor used an automated data service that alerted them the moment the pre-foreclosure was filed. The team's first call wasn't about buying the house; it was about partnership. They positioned themselves as a solution provider who could help the landlord escape the worst-case scenario.

-

The Creative Solution: The investor proposed a "subject-to" deal. This meant they would take over the landlord's existing mortgage payments, instantly relieving his financial pressure. The deal also included a small cash payment to the landlord at closing, giving him some funds to get back on his feet.

-

The Final Result: The landlord walked away without a foreclosure on his record, a massive win for his financial future. The investor took control, renovated the property while making the existing mortgage payments, and then refinanced it into their own name, adding a solid cash-flowing rental to their portfolio.

Got Questions About Off-Market Deals?

Diving into the world of off-market properties for the first time? It’s natural to have a few questions. This isn't your typical real estate rodeo, after all. Let’s clear up some of the most common ones so you can move forward with confidence.

Are Off-Market Property Sales Even Legal?

Yes, off-market property sales are completely legal. The whole game hinges on absolute transparency and playing by the rules—specifically, your state and local real estate laws. Disclosures are everything.

But legality is just the floor. Ethically, you have to treat sellers fairly. Make sure they understand every line of the offer and steer clear of any predatory tactics. A good reputation is built on deals where everyone walks away feeling like they won.

How Can I Possibly Compete With Big-Shot Investors?

You win by not playing their game. While large investment firms are busy chasing volume, you can be more agile, creative, and personal. Focus on building real relationships in a specific niche. Become the go-to person for probate attorneys in your city, for example. That's a moat the big guys can't easily cross.

Plus, modern automation tools have completely leveled the playing field. They give you the same access to high-quality data and efficient outreach systems that the bigger players use, letting you find and act on prime opportunities just as fast—if not faster.

Can I Get Financing For These Kinds Of Properties?

Absolutely, but your options might look a little different than a standard mortgage. Many off-market properties need some work or come with unique situations, so investors often turn to alternative funding.

You'll frequently see deals funded with hard money loans, private money from other investors, or even seller financing arrangements where the owner carries the note. Building a solid network of these lenders is just as important as finding the deals themselves. That said, for a property in good shape, a conventional loan is still very much on the table.

Once you get these fundamentals down, you'll find the off-market landscape a lot less intimidating and a whole lot more profitable.

Ready to stop fighting over stale lists and start building a predictable pipeline of exclusive deals? At Tab Tab Labs, we combine proprietary data with AI automation to book 15-20 qualified seller appointments directly on your calendar each month. Schedule your free strategy call today and find out how to own your market.