Motivated Seller Leads: Find & convert with proven tactics

Discover motivated seller leads and how to convert distress signals into quick closings with data mining and proven outreach tactics.

By James Le

Motivated seller leads are the lifeblood of any serious real estate operation. They represent homeowners who aren't just thinking about selling, but who need to sell—and fast. Getting in front of these opportunities before anyone else is how you consistently land high-value deals.

What Exactly Is a Motivated Seller Lead?

Think of it like someone racing to catch the last train of the night versus a tourist casually waiting for the next one to arrive. A typical seller can afford to wait, testing the market for the highest possible price. A motivated seller, on the other hand, is up against a deadline.

This urgency doesn't come out of nowhere. It's almost always driven by some kind of distress—a difficult situation that makes a slow, traditional sale impractical or impossible.

These pain points typically fall into one of three buckets:

- Financial Stress: The most common driver. Think pre-foreclosure notices, mounting liens, or an inability to keep up with mortgage payments.

- Personal Life Events: Major life changes often force a quick move. This could be a divorce, a sudden job relocation, or inheriting a property they can't manage.

- Property-Related Burdens: Sometimes the house itself is the problem. Code violations, extensive deferred maintenance, or penalties on a vacant property can make a homeowner desperate to offload it.

Understanding Seller Triggers

These triggers are more than just background noise; they’re the flashing signals that tell you a homeowner needs a solution, not just a sale. Understanding the why behind their urgency is your key to crafting an offer that solves their actual problem.

The table below breaks down the core traits of motivated sellers and what they mean for you as an investor.

Key Characteristics of a Motivated Seller

| Characteristic | Description | Implication for Investors |

|---|---|---|

| Urgency | The seller operates on a tight, non-negotiable timeline driven by external pressures. | Your ability to close quickly becomes your single biggest advantage. |

| Price Flexibility | They are often willing to trade some equity for the certainty and speed of a sale. | This creates an opportunity for off-market deals below retail value. |

| Problem-Focused | The seller's primary goal is to resolve a painful situation (e.g., avoid foreclosure, settle an estate). | Frame your offer as a solution to their specific problem, not just a number. |

By recognizing these signs, you can shift your focus from casting a wide net to zeroing in on the prospects who genuinely need what you have to offer.

If you want to dig deeper into the mechanics of a speedy transaction, our guide on what a quick sale of a house is a great next step.

Why Their Motivation Matters to You

Knowing a seller's 'why' isn't just about building rapport—it directly shapes your entire strategy.

For instance, a homeowner facing foreclosure is under immense financial pressure. They're likely to be most receptive to a cash offer that closes before the auction date, even if it's below market value. Speed and certainty are everything.

On the flip side, a seller relocating for a new job might be less concerned about the final price and more focused on a guaranteed closing date so they can move on without hassle. Their priority is a smooth, predictable timeline.

Drilling down into their motivation helps you:

- Craft a tailored offer that speaks directly to their most pressing need.

- Allocate your time and resources to the leads that are most likely to convert.

- Build genuine trust by demonstrating that you understand and can solve their problem.

This is the foundation. Before we get into specific outreach strategies and automation, you have to master the art of identifying true motivation. In the next section, we’ll dive into the specific public records—like pre-foreclosure notices and tax liens—that point you directly to these opportunities.

How to Identify High-Value Distress Signals

Spotting a genuine distress signal is like seeing a flare in the night. It’s an urgent call for help from a homeowner who needs to sell, and fast.

These aren't your average listings. These are properties tied to people racing against a clock, trying to solve a serious problem. If you can learn to read these signals and understand the story behind them, you’ll unlock a steady stream of the most valuable motivated seller leads.

Financial Pressure Signals

Nothing motivates a seller like financial strain. Think of a foreclosure notice not just as a piece of paper, but as a ticking time bomb. The owner is under immense pressure, and that panic often leads them to prioritize a quick, certain sale over holding out for top dollar.

Pre-foreclosure filings are the most obvious red flag, signaling that mortgage payments have stopped. Similarly, tax delinquencies and property liens show mounting debts that can force an owner’s hand. These are public records, often updated weekly as simple PDF lists on county websites.

- Pre-Foreclosure Notices: This means a lender has officially started the process and a sale deadline is looming.

- Tax Delinquencies: Unpaid property taxes can lead to liens or even a tax auction, creating a hard deadline for the owner.

- Judgments and Liens: These are legal claims against the property that must be paid off, often pushing the owner to sell.

Expert investor John Doe notes that combining tax delinquency and foreclosure data increases lead conversion by 45%.

You can pull these records directly from your county clerk’s office or through online databases. Some counties even provide daily foreclosure lists for anyone to access.

We've seen that 73% of homeowners facing an auction will sell their property within 60 days if an investor reaches out with a credible solution.

Personal Situation Triggers

Life happens. And when it does, it can create an immediate, powerful need to sell a property.

Divorce is a classic example. Splitting assets is a messy, emotional process, and many couples would rather take a fair cash offer and move on than drag out the sale through a drawn-out court battle.

Probate is another major trigger. When someone inherits a property, they often inherit a headache. They might live out of state, lack the experience to manage a rental, or simply want to liquidate the asset quickly to distribute the funds among heirs.

- Court Filings: Probate court records will show you exactly when property ownership is being transferred due to inheritance.

- Domestic Records: Family court dockets can reveal divorce proceedings and associated deadlines for asset division.

- Obituary Notices: While it requires a softer touch, an obituary can be a leading indicator of a future estate sale.

A weekly check of local court records can put you miles ahead of the competition. Sellers in these situations are almost always looking for speed and simplicity, not the highest possible price.

| Trigger Type | Why It Matters | Where To Find It |

|---|---|---|

| Divorce Deadline | A legal timeline forces a quick decision. | Family court dockets |

| Probate Notice | Signals an inherited asset, often unwanted. | County probate listings |

| Medical Emergency | Creates an urgent need for cash. | ER or hospital filings |

Property Condition Alerts

Sometimes, the house itself is the source of distress. A property plagued by physical issues can become a financial and emotional black hole for the owner.

Code violations are a goldmine. When a city inspector flags a property, the owner is often facing fines and a mandate to make costly repairs they can't afford. Vacant homes are another huge signal; they attract vandals, squatters, and city fines for neglect, ratcheting up the owner's urgency to sell.

- Code Violations: These are public records, often found on municipal enforcement websites.

- Vacant Property Registrations: Many cities require owners to register vacant homes, creating a list of neglected properties.

- Abandoned Building Notices: This is the most extreme signal, indicating severe neglect and an owner who has likely given up.

Many municipal websites and code enforcement offices publish these alerts. Some counties even provide geocoded maps of violations, allowing you to spot entire neighborhoods ripe with opportunity.

A key strategy is stacking distress signals. A vacant property that's also in pre-foreclosure is a Grade-A lead. The more problems, the higher the motivation.

Refine Lead Scoring

Finding these signals is the first step. The next is figuring out which ones are worth your time. This is where a more structured approach comes in handy.

Going beyond just identifying distress, you can pinpoint the most promising leads by applying principles from understanding lead scoring methodologies. This involves assigning points to different signals—a foreclosure might be worth 10 points, while a code violation is worth 5—to rank your opportunities.

Setting a score threshold helps you filter out the noise and focus your energy on the leads most likely to convert. When you combine raw distress signals with a smart lead scoring system, you create a laser-focused pipeline.

The real magic happens when you automate this process. You can build systems that scrape county data, score new leads automatically, and push alerts directly to your CRM or calendar when a high-value property hits your threshold.

By layering these data sources and automating the workflow, you transform raw public records into an exclusive, actionable list of motivated seller leads. You'll be the first one to contact sellers right when their need is greatest, putting you in a position to solve their problem and close the deal.

Where to Find Leads in Public and County Records

Knowing what a distress signal looks like is only half the battle. The real game is knowing where to find them. While your competition is busy spending a fortune on the same recycled, overpriced lists everyone else is using, you can get a massive edge by going straight to the source: public and county records.

Think of public records as a treasure map. Every document—a tax lien, a notice of default, a probate filing—is a clue pointing you toward a homeowner who genuinely needs your help. Learning to navigate these sources is a skill that pays for itself over and over again. It’s the difference between being a passive buyer of leads and an active hunter of exclusive, off-market opportunities.

This isn't about getting lucky. It's about building a repeatable system to pull data from a few key government offices, creating a proprietary pipeline of leads that nobody else has.

Tapping into the County Clerk and Tax Assessor

The county clerk’s office is ground zero for some of the most potent distress signals out there. This is where you'll find the paper trail of financial hardship that creates immense pressure for a homeowner to sell. Pre-foreclosure filings, often called a Lis Pendens, are probably the most valuable records here, marking the official start of the foreclosure process.

At the same time, the tax assessor’s office keeps lists of homeowners who are behind on their property taxes. This is a crystal-clear sign of financial strain, and the looming threat of a tax sale gives the owner a hard deadline to find a solution.

Here’s a quick rundown of the key documents and what they tell you:

- Pre-Foreclosure Filings: This document means a lender has started legal action because of missed payments. It's a highly time-sensitive lead; the owner needs to sell before the property goes to auction.

- Tax Delinquency Lists: This is a simple list of properties with overdue taxes. The longer someone is on this list, the more motivated they typically are to sell and avoid losing their home for pennies on the dollar.

- Mechanic’s Liens: Filed by contractors who haven't been paid for their work, these liens signal both money problems and potential property neglect—a powerful combination for a motivated seller.

By combining data from multiple sources, you can build a richer profile of a seller's motivation. A property with both a tax lien and a pre-foreclosure filing is a prime candidate for immediate outreach.

For a deeper dive into this specific lead type, check out our complete guide on how to find pre-foreclosure homes. It breaks down the entire process, step-by-step, for tracking down and connecting with these highly motivated sellers.

Uncovering Opportunities in Court Records

Beyond financial filings, court records open a window into personal situations that often create an urgent need to sell a property. The two goldmines here are the probate court and the family court.

Probate court records track the process of settling an estate after someone passes away. The heirs, who might live out of state or just don't want the hassle of managing an inherited property, are often incredibly motivated to get a fair cash offer and move on.

Family court dockets can point you to divorce proceedings. When a couple splits up, the court frequently orders them to sell shared assets, and the family home is usually at the top of that list. For these sellers, a fast, drama-free transaction is the main priority.

Systematizing Your Research Process

To turn public records from a random source of leads into a consistent, predictable pipeline, you absolutely need a system.

Start by bookmarking the websites for your target county's clerk, tax assessor, and probate court. Then, block out time on your calendar each week to check for new filings. Many counties update their online databases daily or weekly, so consistency is what will put you ahead of the competition.

Once you have the raw data, get it organized. A simple spreadsheet is all you need. Track the essentials: owner's name, property address, the specific type of distress, and the filing date. This organized list is now your proprietary database—the foundation for all of your targeted and effective outreach.

Executing Outreach That Actually Gets a Response

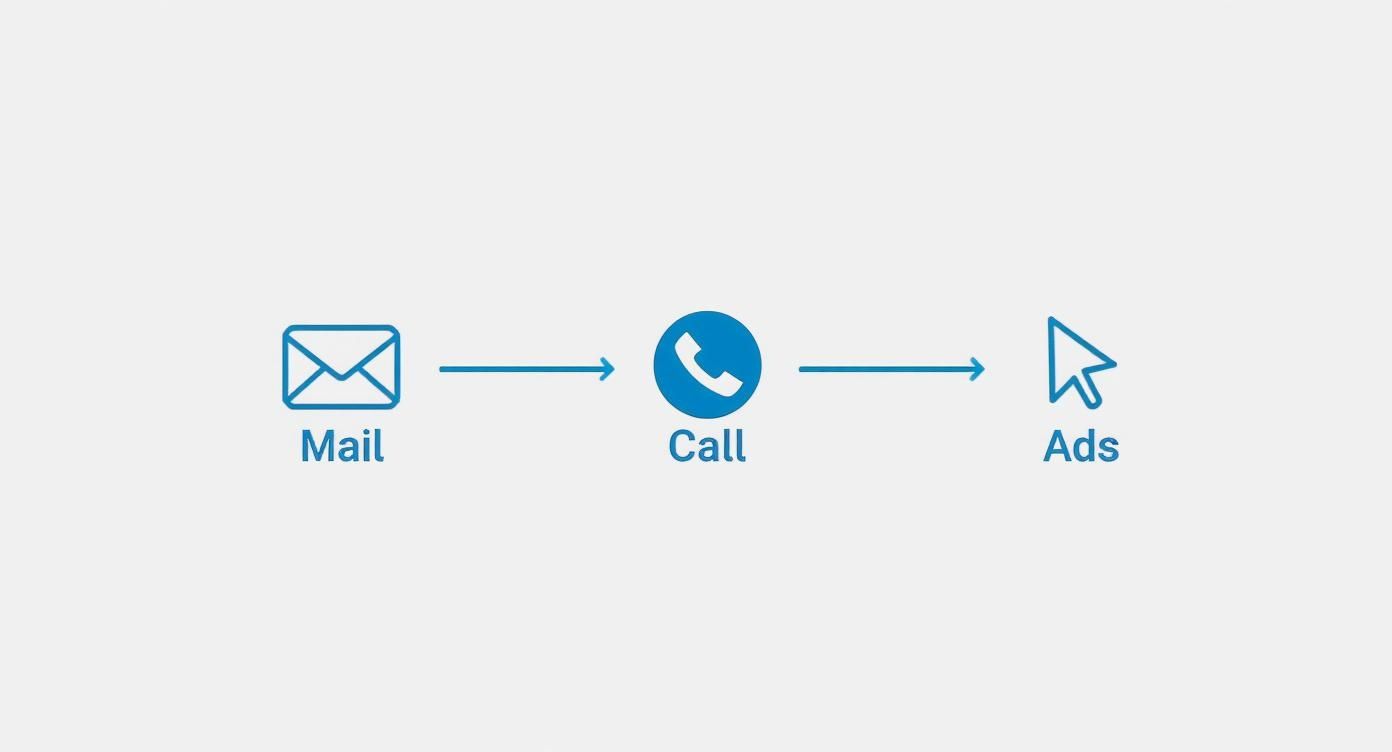

Once you've built your list of potential sellers, the real work begins. You need a playbook that cuts through the noise and gets you noticed. Forget blasting a single channel and hoping for the best; a multi-channel approach is the only way to consistently connect with motivated sellers.

The sweet spot is a blend of direct mail, cold calling, and targeted digital ads. Each one plays a specific role, and when you get them working together, the results are far greater than the sum of their parts. We'll walk through how to make each one work.

Direct Mail Strategies

In a world of overflowing inboxes, a physical piece of mail can really stand out. But it has to feel personal. A well-crafted letter can feel less like an ad and more like a lifeline to a homeowner under stress.

- Use handwritten or handwriting-style fonts on envelopes. It dramatically increases the chances it gets opened.

- Don't beat around the bush. Lead with a clear, empathetic message that speaks directly to their potential problem.

- Keep the call to action dead simple: a phone number and a website link. That’s it.

Cold Calling Techniques

Cold calling is still a beast, driving roughly 50% of agent leads. But dialing for dollars without a plan is a fast track to burnout. You need a solid script and a clear purpose for every call. For more data on this, check out these motivated seller lead generation insights.

A tight script isn't about being robotic; it's about building trust in the first 30 seconds. Focus on empathy and a problem-solving tone to make an instant connection.

- Start with a friendly, low-pressure opening that mentions their property.

- Ask a simple, open-ended question about their situation or timeline.

- Suggest a clear and easy next step, like a quick follow-up call.

Digital Ads That Convert

Online ads give you incredible targeting power. Platforms like Facebook and Google Ads let you put your message right in front of homeowners based on demographics, location, and even online behavior.

The key here is to focus on solutions. Your ad copy should scream "fast closing," "cash offer," or "no repairs needed." Use headlines that mirror the distress signals you identified earlier to grab their attention immediately.

- Try Facebook carousel ads to showcase a few quick-sale case studies.

- Run Google search ads targeting keywords like “sell my house fast for cash.”

- Use remarketing ads to stay in front of people who have already visited your website.

“When messages reflect real seller needs, response rates can double.”

Comparison of Motivated Seller Outreach Channels

Choosing the right channel depends entirely on your budget, timeline, and who you're trying to reach. Some methods are cheap but labor-intensive, while others offer broad reach for a higher price. This table breaks down the most common options to help you decide where to focus your energy.

| Channel | Average Cost | Typical Response Rate | Best For |

|---|---|---|---|

| Direct Mail | $0.50 - $2.00 per piece | 1-5% | Targeting hyperlocal lists where you know the specific distress signal (e.g., probate, pre-foreclosure). |

| Cold Calling | $0.30 - $0.70 per call | 2-4% | Quick, personal follow-up after a mailer has landed or for building immediate rapport. |

| Digital Ads | $1,000+ per month | 1-3% | Casting a wider net to find sellers who are actively searching for solutions online or fit a specific demographic profile. |

Ultimately, you shouldn't be picking just one. The real magic happens when you layer these channels. A seller might ignore your letter, but then they see your ad on Facebook, and a day later your call comes in. That's when you move from being a random marketer to a persistent, credible solution.

Social Media Engagement

Don't sleep on social media. It's not about hard-selling; it's about warming up your audience and building trust over time. Use your profiles to share value, answer questions, and prove you're an expert who can solve their problems.

- Post a short video testimonial from a happy seller.

- Use polls to ask your followers about their biggest selling challenges.

- Make a point to respond to every comment with helpful advice within 24 hours.

Sample One-Week Playbook

Putting it all together can feel overwhelming, so here’s a sample playbook for a single week. The goal is to create a coordinated sequence of touchpoints that build on each other.

- Day 1: Send your introductory direct mail letter and launch a targeted Facebook ad campaign to the same list.

- Day 2: Start your first round of calls, referencing the letter they should have just received.

- Day 3: Post a seller success story on your social media channels (Instagram, Facebook, LinkedIn).

- Day 4: Retarget anyone who clicked on your ad or visited your site with a short video ad.

- Day 5: Send a follow-up postcard that highlights a unique benefit, like a guaranteed cash offer.

- Day 6: Dig into the response data. Who opened, who clicked, who answered? Use this to refine your messaging for next week.

- Day 7: Focus on scheduling calls with the warmest leads to get those appointments booked.

This isn't a one-and-done strategy. It's a living system. By using your CRM to track every interaction and automate reminders, you turn random outreach into a predictable engine for generating leads.

Now that you know how to get them to respond, let's talk about how to turn those initial conversations into qualified appointments.

Turning Initial Contact Into Qualified Appointments

Landing a reply feels like winning the first round—but it’s really just the beginning. Now, your challenge is to transform that spark of interest into a confirmed, qualified appointment. Without a tight system to qualify and follow up, even the most promising motivated seller leads will cool off.

Imagine you’re a triage nurse in a busy emergency room. You size up each case in seconds, flag the urgent ones, and steer them toward the right treatment path. A clear, structured qualification framework does exactly that for your leads—so you invest time only where the payoff is highest.

A Simple Qualification Framework

You don’t need to overcomplicate things—just four checkpoints to find the sellers ready to move. We borrow the core of BANT, fine-tuned for real estate investors:

- Budget (Equity): Does the homeowner hold enough equity to make a fair offer? Public records can give you a ballpark, and a quick chat reveals their mortgage balance.

- Authority: Are you talking to the actual decision-maker? Confirm you’re on the line with the owner listed on title.

- Need: What’s pushing them to sell? A looming foreclosure, an inherited property, or a divorce all signal higher motivation.

- Timeline: When must they close? Sellers aiming to wrap up in the next 30 days jump to the top of your list, while six-month-out prospects sit lower.

This framework guides your opening conversation and arms you with the facts needed to classify each lead and plot the next move.

Building Your Automated Follow-Up Machine

Once a lead checks your boxes, timing is everything. That’s when a solid CRM becomes your operations hub, ensuring no one slips through the cracks.

Picture branching paths funneling into your qualification engine:

From direct mail to calls and digital ads, every touchpoint feeds the same system. In your CRM, build tailored sequences for each lead tier:

- Hot Leads: Sellers who meet every criterion and need to close fast. These deserve an immediate, personal phone call—ideally within minutes—to secure an appointment.

- Warm Leads: Motivated owners with a slightly longer deadline. Nurture them with an automated email and text series that delivers value and keeps you top of mind.

- Nurture Leads: Prospects who might sell down the line. Add them to a long-term monthly or quarterly newsletter, so you’re front and center when they’re finally ready.

The global lead generation market is projected to reach USD 15.55 billion by 2031, yet conversion rates can be tough. Critically, leads contacted within five minutes are nine times more likely to convert, highlighting the urgent need for a rapid, systematic follow-up process. You can explore more real estate lead generation statistics to see just how important speed is.

For more advanced strategies on automated follow-up, explore our guide on creating a powerful real estate email drip campaign.

Using AI To Accelerate Screening

Chatbots were just the start—today’s AI-powered ISAs can run your first-screening playbook around the clock. They greet new leads via text or web chat, ask your core questions, assess motivation and timeline, and even lock in appointments on your calendar.

The result? Instead of trading messages all day, you wake up to a calendar filled with high-intent sellers. Your time shifts from chasing basics to having in-depth conversations that actually move deals forward.

How To Measure And Scale Your Lead Generation

Generating motivated seller leads shouldn’t feel like a guessing game. It needs a repeatable, trackable method you can tweak and then roll out across more markets. You want an engine that hums along predictably—and grows when you ask it to.

Think of your outreach side-by-side with an investment portfolio. You wouldn’t scatter cash across random stocks and hope for the best. You’d monitor performance, shift capital away from losers, and back your best bets. Lead gen works the same way.

Defining Your Key Performance Indicators

KPIs act as the vital signs for your lead pipeline. They shine a light on what’s humming and where you need to tighten the screws. Without them, you’re flying blind—never knowing which channels are worth another dollar.

Keep a close eye on four metrics in particular:

- Cost Per Lead (CPL): Divide the total campaign spend by the number of leads you pulled in. Spend $1,000 on a mailing piece and get 20 responses? Your CPL is $50.

- Cost Per Acquisition (CPA): This tells you what it truly costs to close a deal. That same $1,000 mailer that nets one signed contract? Your CPA sits at $1,000.

- Response Rate: The percentage of contacts who reply. A 2% response on a postcard shows you how well it resonated.

- Conversion Rate: Track the ratio from lead to appointment and from appointment to signed deal.

By keeping these numbers in your back pocket, you’ll know exactly when to double down on winners—and cut the dead weight. That kind of data-driven clarity is how you scale without burning cash.

Maintaining Compliance And Professionalism

When you ramp up calls and outreach, legal rules aren’t suggestions; they’re must-dos. The National Do Not Call (DNC) Registry lists folks who’ve opted out of telemarketing. Cross-checking your list against it is non-negotiable.

Miss this step and you’ll risk fines, wasted effort, and a reputation hit you can’t fix overnight. Instead, run every new contact list through a trusted scrub service. It takes minutes and keeps you on the right side of the law.

If you want to capture leads directly on your site, there’s no better way than pairing your contact form with effective live chat strategies for lead generation. You’ll qualify visitors in real time—and book appointments before they click away.

Knowing When To Grow Your Operations

Scaling means more than upping your ad spend. It’s about building the right team, systems, and tools—at the moment it makes sense. Rushing in too early or too late wastes both time and money.

Look for these three clear signals:

- Outsourcing Admin Tasks: If you spend more hours on spreadsheets than on the phone, bring in an assistant—virtual or in house.

- Upgrading Software: When Google Sheets groans under your workload, switch to a CRM that automates follow-up, tracks your KPIs, and links to your calendar.

- Boosting Your Budget: Once you can prove a channel returns positive ROI, fund it heavily. That’s how you turn a reliable tactic into a true growth machine.

By focusing on the right metrics, staying compliant, and expanding your resources only when the numbers say go, you’ll shift lead gen from a daily scramble to a predictable engine. Ready to scale? Start measuring today—and watch your real estate business take off.

Got Questions? We've Got Answers.

We get asked a lot about the nuts and bolts of finding and converting motivated sellers. Let's tackle some of the most common questions head-on.

Whether you're just starting out or looking to sharpen your team's process, these answers cut right to the chase.

- Distress Triggers: Keep an eye out for foreclosure, probate, or lien filings. These are blinking red lights for high urgency.

- Best Outreach: Don't put all your eggs in one basket. Layering direct mail, calls, and digital ads lets you connect with sellers wherever they're most comfortable.

- Follow-up Timing: The clock starts ticking the second a lead comes in. Contacting them within 5 minutes can boost your conversion chances by a staggering 9×.

Think of those as the golden rules. Most investors just want to know how to stop wasting time on stale leads and dead-end outreach. The secret isn't a secret at all: it's all about keeping your data fresh and your process tight.

Common Concerns

How can you be sure a lead is actually motivated? Look at the filing date. If a public record was filed within the last 60 days, you're looking at a fresh, high-potential opportunity.

What if they don't pick up the first time? Don't sweat it. A gentle follow-up text or piece of mail a couple of days later often does the trick. It’s about persistence, not pressure.

“Consistent multi-channel outreach lifts response rates and helps you stand out.”

Which metrics should I obsess over? Keep your eyes glued to your Cost Per Lead (CPL), Cost Per Acquisition (CPA), response rate, and conversion rate. These numbers tell you the real story of which channels are actually making you money.

Can AI really help with this? Absolutely. Think of an AI ISA as your front-line screener. It can engage new contacts the moment they come in, ask the right qualifying questions, and even book appointments straight into your calendar while you sleep.

Quick Tips

Small, consistent habits can have a massive impact on your results.

- Always scrub your lists against the Do Not Call registry before starting a call session. Compliance isn't optional.

- Pull fresh county data at least every two weeks. New opportunities pop up daily.

- Use automated appointment reminders. They drastically cut down on no-shows.

- Set up alerts in your CRM for your hottest leads so you can jump on them immediately.

Mastering these little things is what separates the pros from the amateurs. It’s all about disciplined execution.

Ready to scale your pipeline with exclusive motivated seller leads? Start now with Tab Tab Labs.