How To Find Motivated Sellers Quickly With Proven Strategies

Learn how to find motivated sellers with proven real estate strategies using public records, direct mail, and AI tools for faster deal growth.

By James Le

Spotting motivated sellers isn’t guesswork—it begins by tuning into urgent life-event triggers and cross-referencing them with robust data sources. In practice, that means pairing foreclosure or probate alerts with neighborhood-level insights to flag homeowners who need to move quickly. Do this right, and you’ll have a pipeline filling up in a matter of days.

Quick Strategies To Find Motivated Sellers

In my experience, the fastest way to unearth motivated sellers is by zeroing in on pre-foreclosure and probate records. Those public filings are concrete signals of financial pressure. At the same time, running ads in ZIP codes where pre-foreclosure rates spike captures folks already researching their options online. Layer on street-level intel, and you’ll surface deals before most investors even know the property exists.

- Public records reveal pre-foreclosure notices and probate filings—both powerful indicators and easy sources for names and addresses.

- Geotargeted digital ads reach homeowners who are already browsing market comparisons. Facebook and Google remain top performers.

- Door-knocking in run-down areas—often called drive for dollars—lets you connect with owners before their properties hit the MLS.

Savvy investors report 5–10% response rates when they combine these techniques.

Summary Of Top Motivated Seller Methods

Below is a quick side-by-side snapshot of the most effective ways to source motivated sellers:

| Method | Primary Trigger | Best Channel |

|---|---|---|

| Public Records | Pre-foreclosure Notice | Direct Mail |

| Targeted Ads | Local Market Research | Facebook Ads |

| Drive for Dollars | Vacancy Indicators | Door Knocking |

Use this as a cheat sheet to decide which approach aligns with your budget and market.

I once tracked probate filings and sent a tailored postcard series—turning 20 leads into conversations within 48 hours. Another investor layered absentee-owner lists with geofenced campaigns and booked five listings in a single week.

You might be interested in our guide on Drive for Dollars strategies.

Real-world results like these prove you don’t need a massive budget to start converting motivated sellers. Pick your method, test it, and watch the offers roll in.

Identify High Propensity Seller Signals

Life rarely offers blatant “for sale” signs when someone’s ready to move. Instead, clues hide in divorce filings, probate announcements and company transfer notices. Spotting these events early can mean the difference between catching a motivated seller and missing out entirely.

What to Watch For:

- Divorce Filings indicate impending asset division—and a homeowner under pressure to sell.

- Probate Records often point to heirs eager to turn inherited property into cash.

- Job Transfer Notices come with relocation deadlines that force quick sell-or-lease decisions.

A colleague of mine noticed a spike in Cook County divorce records last summer. After skip-tracing those names and mailing postcards, response rates climbed from 1% to 4% in just seven days.

By 2025, life-event triggers drove over 40% of all motivated-seller leads. For a deeper dive into which signals matter most, check out InvestorRa’s Motivated Seller Statistics.

Access Public Record Sources

County clerks handle records differently, but most make divorce and probate dockets accessible at no charge. I usually:

- Scan the county clerk’s portal for batch downloads (CSV whenever possible).

- Resort to a quick screen scrape if exports aren’t offered.

- Lean on third-party vendors when I need a unified feed across several counties.

Fresh data is everything. Some feeds update daily, others lag by weeks—so align outreach with the newest filings to keep reply rates high. Once you have a list of names:

- Skip-trace phone numbers and emails. Paid lookup services can drive match rates above 90%.

- Clean contact details against tax records or utility data to avoid wasted calls and mailings.

- Time your outreach within 10 days of the original filing. A recent divorce is a far hotter lead than one from six months ago.

Key Takeaway Target life-event signals early and pair them with verified contact data for the highest response rates.

Perfect Your Outreach Timing

Momentum fades fast if you let weeks slip by between mail drops and follow-ups. In my experience, simple automations—think scheduled email reminders or automated SMS nudges—work wonders. I set reminders for day 3 and day 7 after the initial postcard lands.

Small tweaks can yield big gains. For example, swapping a bland “cash buyer” headline for “quick close” lifted engagement by 25% in one campaign. And once you fine-tune that combination of signal, timing and message, you’ll see real improvements. I’ve spoken with investors who bumped reply rates from 2% all the way to 8% after dialing in these variables.

Checklist Before You Launch:

- Verify daily docket updates for new life-event filings

- Cross-reference each prospect’s equity position

- Prioritize leads under 10 days old

- Confirm mailing addresses against tax or utility records

With these pieces locked in, you’ll move seamlessly into building your prioritized prospect lists next.

Build And Prioritize Your Prospect Lists

When you have a handful of raw leads, the real work begins: ranking them by urgency and equity. A smart checklist helps you skip the dead ends and zero in on owners who are ready to negotiate.

Common prospect streams break down like this:

- Expired MLS Listings house sellers frustrated by 90+ days without an offer.

- FSBO Records often signal owners who control their timeline—and might say yes to cash.

- Out-of-State Owners juggle management headaches and tax worries from afar.

- Distressed Landlords are tired of repairs and tenant drama.

Ranking Leads By Equity And Time On Market

Put together a simple score that reflects equity, days listed, and stress indicators. For example, award 5 points for properties with over 30% equity, 3 points if they’ve been listed under 60 days, then tweak for vacancies or code issues.

A transparent formula keeps your team aligned:

- Equity Percentage × 2

- Time On Market Score × 1

- Pain Point Indicator × 1

Consistency in scoring lets you focus on the hottest opportunities.

Before we dive into the shortlist, let’s look at how each source stacks up:

Comparison Of Prospect List Sources

Here’s a quick snapshot of how different lists perform on equity and seller motivation. Use this to decide which leads to tackle first.

| Source Type | Average Equity | Motivation Rating |

|---|---|---|

| Expired Listings | 25% | High |

| FSBO Records | 20% | Medium |

| Out-of-State Owners | 15% | Medium |

| Distressed Landlords | 30% | High |

With this breakdown, you can pivot your outreach budgets and dial-in messaging depending on where each owner sits on that spectrum.

A teammate once ran 3,000 expired listings through this framework and carved out 150 prospects in under a day. That shortlist turned into eight seller meetings within a week.

Blending FSBO And Out-Of-State Data

Cross-referencing FSBO lists with absentee owner records can light up hidden opportunities. In one local test, about 30% of FSBOs had been on the market for 45+ days. Layer in out-of-state data and you’ll spot fatigued landlords who are prime for a phone call.

When we dialed into that combined pool, three meetings surfaced in just ten days. It proves the power of mixing sources rather than chasing them separately.

Filtering Down To A High-Value Shortlist

Once every lead carries a score, trim the bottom third and dig deeper into the rest. Here’s how to refine that list:

- Apply a score cutoff to weed out low-priority records.

- Verify phone numbers and emails against tax or utility databases.

- Enrich your data with absentee owner insights—see our guide on absentee owner lists for advanced filtering tactics.

- Segment the remaining contacts by neighborhood and urgency for more personal outreach.

A targeted pipeline ensures your budget touches only the most responsive sellers.

By focusing on equity-rich downsizers and landlords itching to offload, you build a lean, powerfully engaged prospect list. Next up: crafting outreach that speaks directly to each pain point.

Use Outreach Techniques And Message Templates

Once you’ve assembled a hot list of prospects, your outreach needs to land at just the right moment—and feel genuinely personal. Tested scripts help you sidestep cold-call jitters and stare-at-blank-page icebreakers. These ready-to-go templates will lift engagement almost immediately.

Blending clarity with warmth goes a long way. Slip in a recent sale price down the street or mention the neighborhood block party last weekend. Those small details show you’ve done your homework—and you’re not just pitching every homeowner in town.

- Direct Mail postcards with benefit-driven headlines and clear CTAs

- Cold Call scripts that spark conversations rather than monologues

- Door Knocking pitches that come across as friendly neighbors, not pushy salespeople

- Digital Ads targeting life-event signals, each with an unmistakable call to action

Direct Mail Postcards That Convert

A personalized postcard in a sea of bills and flyers stands out. Use the homeowner’s name upfront and lead with a bold headline. Investors report reply rates climbing by 25% when they get this right.

Here’s a simple three-part layout you can follow:

- Headline: Go specific—for example, Need Cash In 7 Days?

- Benefit Statement: Tell them you’ll buy AS-IS, with no fees and no repairs required.

- Call To Action: Encourage a quick call to schedule a free home valuation.

“Switching the CTA doubled our mail responses,” says investor Mia.

Space your mail drops seven days apart to stay top of mind without clogging mailboxes. Then, follow up with a friendly call to turn that postcard into a real conversation.

Cold Call And Door Knock Scripts

Empathy outperforms hard sells every time. Start by referencing a recent nearby sale and ask if it’s okay to talk about options. A little courtesy goes a long way.

- Ask open-ended questions like, How soon would you like to move?

- Mirror their objections—this shows you heard them.

- Really listen; most sellers just want to feel understood.

One investor knocked out 120 calls and secured 15 face-to-face meetings in a single week by keeping this approach on repeat.

| Channel | Avg Response | Best Time |

|---|---|---|

| Cold Call | 3–5% | 4–6 PM |

| Door Knock | 1–3% | 10 AM–2 PM |

When sellers face financial stress, tone and timing matter even more. 54% of distressed homeowners expect offers within three months of listing. And targeting pre-foreclosure addresses with postcards can boost response rates to 5–10%—with 67% of those sellers open to virtual tours. For a deeper dive, check out Motivated Seller Leads in Real Estate.

Crafting Digital Ad Messages

Digital ads scale your reach without extra phone calls. Zero in by ZIP code and life-event triggers, then keep the copy under 25 words for mobile readers.

- Headline: Cash Offer In 7 Days grabs attention in a crowded feed.

- Visual Cue: Use a house icon or a familiar local landmark.

- Button: Get My Offer drives clicks.

In one week, an investor’s $200 Facebook split test produced 50 high-intent homeowner clicks. Daily headline tweaks slashed cost per lead by 30%.

Key Takeaway: Rotate scripts and templates until you find the winning mix.

Plug these ad formulas into your Tab Tab Labs workflows for automated follow-up reminders and real-time status updates.

Personalization And Timing Hacks

A sharp personal detail can cut response times in half. Note a fresh coat of paint on the porch or the new playground down the street—these touches show you care.

- Mention specific property facts, like the number of bedrooms or a recent remodel.

- Mail on Tuesdays or Thursdays, when curiosity peaks.

- Add a P.S. offering a free neighborhood market report.

Aim follow-up calls about 48 hours after the mail drop, when the postcard is still top of mind. A quick text after voicemail can bump callbacks by up to 15%.

Keep testing subject lines, message tweaks and timing in your CRM. Track which outreach sparked the first reply, then double down on what works. Over time, real-world data will refine your campaigns better than any “one-size-fits-all” approach.

Streamline Qualification Workflows And Compliance

Speeding up seller qualification starts with a clear intake flow. In a motivated-seller pipeline, getting compliance right from the first touch matters most.

Pairing concise call scripts with smart digital forms can shave off more than 50% of your qualification time. At the same time, automated nudges keep prospects moving—no manual follow-ups required.

Rapid Lead Intake Process

Begin with a short form to capture key details: property specs, motivation level, and contact information. A follow-up call within 24 hours—using a compliant script—separates serious sellers from tire-kickers fast.

- Capture homeowner data through an online form that adapts to each answer

- Push form entries straight into your CRM so nothing falls through the cracks

- Send an instant SMS confirmation to let sellers know you’ve got their info

Key takeaway rapid qualification cuts wasted calls and lifts appointment rates.

Compliance And CRM Documentation

Staying on the right side of regulations means logging every interaction. Your CRM should paint a complete picture and keep you audit-ready.

Tag anyone who opts into a Do Not Call registry. Then automate a weekly suppression update so blocked numbers never get dialed again.

| Task | Tool | Frequency |

|---|---|---|

| Interaction Log | CRM | Real-Time |

| DNC Check | Compliance Tool | Daily |

| Record Backup | Cloud Storage | Weekly |

This level of discipline keeps your team both compliant and responsive.

Sample Workflow From Top Investors

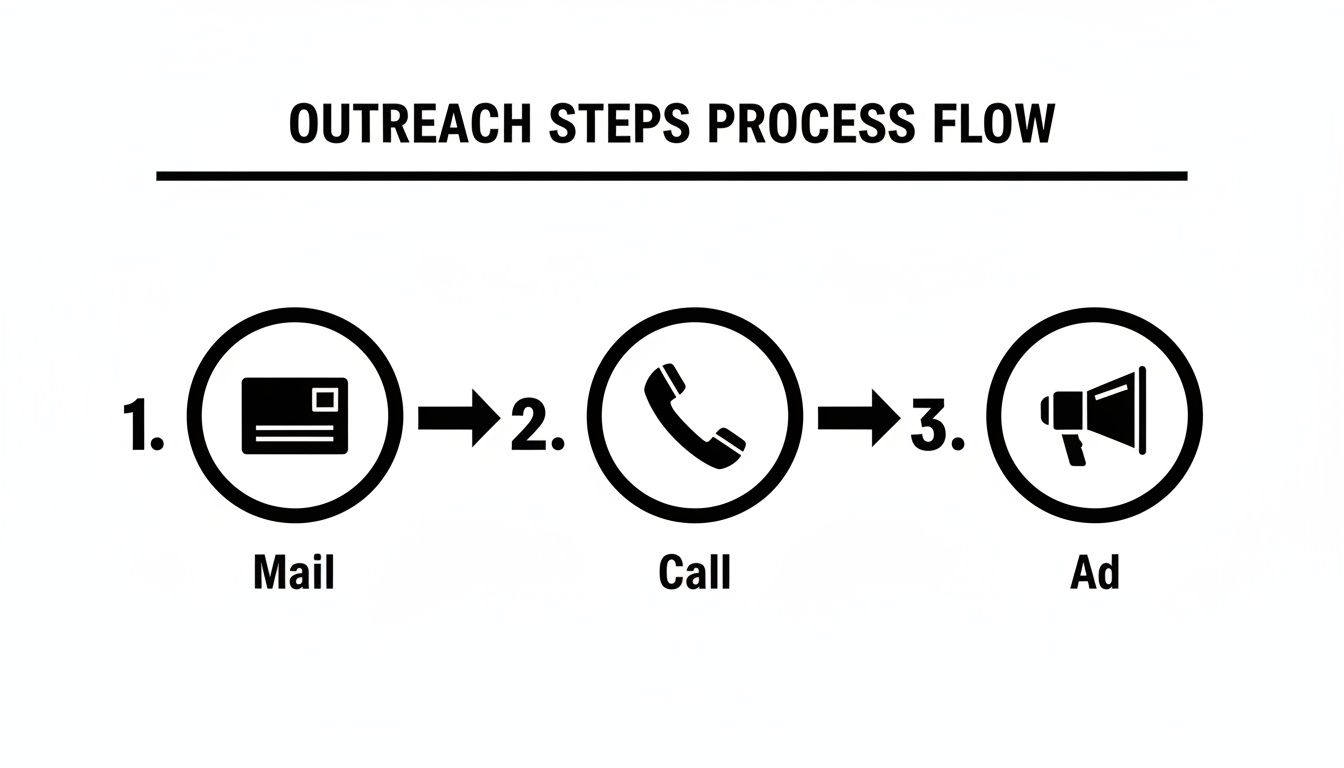

That chart lays out a horizontal flow across Mail, Call, and Ads channels. In practice, weaving these steps together can shave three days off the average appointment turnaround.

Integrating your call scripts into CRM templates ensures every lead hears the same strong opening. If a form isn’t finished, automated reminders jump in to keep momentum alive.

- Trigger script templates right after form submission so reps stay on message

- Use SMS follow-ups for unanswered calls and recapture warm leads

- Attach each call recording to the CRM record as proof of contact

Pro tip review call transcripts weekly to spot the phrases that actually close deals.

Automate Reminders And Follow Ups

Timely prompts make all the difference. A thoughtful mix of email and SMS reminders can bump response rates by 20%.

- Day 1: Thank-you email with clear next steps

- Day 3: Quick SMS check-in to answer questions

- Day 7: Friendly call reminder to confirm the appointment

Consistent follow-up builds credibility and keeps sellers moving through your funnel.

By combining a fast intake, automated nudges, tight compliance checks, and real-data workflows, you turn seller qualification into a predictable system. That frees you to focus on what really matters: crafting offers and closing deals.

- Schedule a free demo to see live workflows in action.

- Get a sample lead list today.

Automate And Scale With Data And AI

Growing from a few dozen contacts to thousands means building solid data pipelines that keep up with every new filing. Public record APIs surface live updates—everything from foreclosures and liens to probate records—so you’re always working with the freshest intelligence.

With AI-powered routines handling deduplication, record merges, and enrichment, you can say goodbye to manual CSV wrangling and stale lists.

- Pull deed histories, tax liens, and code-violation details directly through API endpoints.

- Automate skip-trace refreshes to uphold 90%+ match rates.

- Schedule daily pulls so your list never goes stale.

Hook Up Public Record Feeds

Start by tapping county portals or vendor APIs and centralizing every signal in a single hub. Some feeds update daily, others weekly—mix them to match your budget and urgency.

For instance, lining up probate filings alongside deed changes highlights owners under the most pressure. Tag each lead by event type and timestamp, then order your outreach by urgency.

Key Insight: Real-time data integration lifts response rates by 30% compared to monthly batch pulls.

Use Predictive Scoring Models

Rather than eyeballing a list, let a model rank prospects based on sale history, equity position, and life events. The result? A prioritized queue of your hottest leads.

| Approach | Avg Response Rate | Setup Time |

|---|---|---|

| Manual List Curation | 5% | 4 hours |

| AI Predictive Scoring | 12% | 2 hours |

Teams I’ve worked with often double their qualified appointments within two weeks of switching to AI scoring. Your reps spend time only on calls that move the needle.

Train AI Inside Sales Agents

Virtual ISAs offer the first touch with prospects, carrying out natural conversations that sound human, not robotic. They uncover motivation, handle objections, and even book appointments.

- Draft call paths with key questions and objection responses.

- Upload real sample recordings so the agent nails your tone.

- Listen to those early calls, tweak prompts, and watch accuracy climb.

Pro Tip: Review agent transcripts weekly to refine scripts and drive higher booking rates.

This blend of personalization and scale supercharges conversions while lightening your reps’ load.

Read our guide on AI tools for real estate agents: AI Tools for Real Estate Agents.

Bringing together automated data flows and AI-driven outreach transforms your motivated-seller funnel. You’ll keep a steady pipeline of hot prospects and spend less time chasing leads.

Scale Follow-Ups With Automated Workflows

Link everything into your CRM so reminders, status alerts, emails, and texts fire off without lifting a finger. Simple triggers send welcome emails and SMS updates at just the right intervals.

This setup can boost follow-up rates by up to 20%—and more follow-ups mean more closed deals.

Get started today.

Frequently Asked Questions

When you’re out in the field or at the office, the same questions tend to come up: How do I pinpoint truly motivated sellers—fast, and above board? Let’s dive into the answers I share with investors day in, day out.

What Qualifies a Seller as Motivated?

In my experience, life events create the real urgency. Think divorce settlements, probate cases or an unexpected job relocation. When time is money, sellers often opt for a quick close and might even entertain creative structures—leasebacks or subject-to deals—to make things happen.

How Often Should I Update My Prospect Lists?

I recommend refreshing every 2–4 Weeks. That schedule lets you grab brand-new filings while pruning out contacts who never responded. The result? A pipeline that feels alive, and noticeably higher connection rates on calls and mailers.

Prospect List Updates

Are Direct Mail Campaigns Still Effective?

Absolutely. Targeted postcards sent to pre-foreclosure or probate addresses consistently return 5–10% response rates. Small tweaks—rotating headlines, experimenting with visuals—can move that needle even further.

“After three weeks of split-testing different postcard designs, our callbacks jumped 25%.”

– A peer in the trenches

How Do AI Tools Improve Seller Outreach?

I’ve trialed several platforms that use AI-driven lead scoring to rank prospects by equity position and urgency. Meanwhile, AI-enabled ISAs handle initial outreach, so you spend your time on high-value conversations. On the numbers front:

- Smart scoring engines push response rates up to 12%

- AI ISAs book qualified appointments in seconds

- Automated county-data integrations keep lists razor-sharp

Ready to accelerate your deal flow? Book your free strategy call with Tab Tab Labs and let’s get you in front of the right sellers—every single week.