How To Buy Pre Foreclosure Listings: How To Buy Pre Foreclosure Listings

Discover how to buy pre foreclosure listings with a step-by-step guide, risk alerts, and deal-spotting tactics to protect your capital.

By James Le

Buying a pre-foreclosure home means finding properties where the owners have fallen behind on payments but still have the right to sell. It's a chance to negotiate directly with a motivated seller, often locking in a deal below market value before the bank repossesses the property or it gets thrown into a crowded auction.

This strategy isn't for the faint of heart, though. It demands solid research, quick action, and a real understanding of the homeowner's tight spot.

Why Pre-Foreclosures Are a Modern Investor's Goldmine

The whole game of finding distressed properties has been turned on its head. For decades, the go-to plays were bank-owned homes (REOs) and the chaotic circus of public foreclosure auctions. But today, those wells are running dry. Fierce competition and shrinking inventory have made finding a profitable deal through those old channels next to impossible.

This massive market shift has thrust pre-foreclosure listings directly into the spotlight, creating what I believe is the single biggest opportunity for investors right now. These aren't just distressed assets; they're unique situations where you can engineer a true win-win. You get to buy a property for less than it’s worth, and in the process, you help a homeowner sidestep the financial devastation of a formal foreclosure destroying their credit.

The Undeniable Rise of Pre-Foreclosure Investing

This isn't just a gut feeling—the numbers tell the story loud and clear. Over the last decade, pre-foreclosure sales have steadily taken over the distressed housing market. Back in 2019, they made up a third of all distressed property sales, a huge leap from just 12% during the 2008 Great Recession.

The trend has only picked up steam. By 2020, pre-foreclosures were on pace to account for nearly half of all distressed deals. You can dig into more of the data behind this shift over on Scotsman Guide.

When you focus on pre-foreclosures, you're not just buying a property; you're solving a serious problem. You're stepping in before the banks take over, giving the homeowner a dignified way out while protecting your own potential profit margin.

Think of this guide as your playbook for mastering this niche. We’ll walk through every critical step, from sourcing exclusive leads straight from county records to structuring offers that actually work for the homeowner. Because successfully buying pre-foreclosure properties is about more than just finding a list; it’s about building a repeatable system.

Here’s why this strategy works so well:

- Less Competition: Forget the public auctions swarming with bidders. You’re often one of the only investors—if not the only one—talking to the homeowner.

- More Negotiation Power: You’re dealing directly with a seller who needs a solution, which creates flexibility to craft a deal that makes sense for everyone.

- Higher Potential Equity: Buying a property at a steep discount means you walk in the door with a built-in equity cushion from day one.

How To Find Pre-Foreclosure Deals Before Anyone Else

The secret to winning in pre-foreclosures is simple: get there first.

Forget the saturated national lists where you're just another investor in a massive crowd. Real, repeatable success comes from building your own deal-sourcing engine. That means tapping directly into fresh, county-level data.

It's a shift from outdated tactics like "driving for dollars" toward a focus on what I call proprietary distress signals. These are the earliest possible indicators that a homeowner is in financial trouble and might be highly motivated to sell. To really nail this, you have to adopt a modern playbook for real estate agent lead generation that's built for today's market.

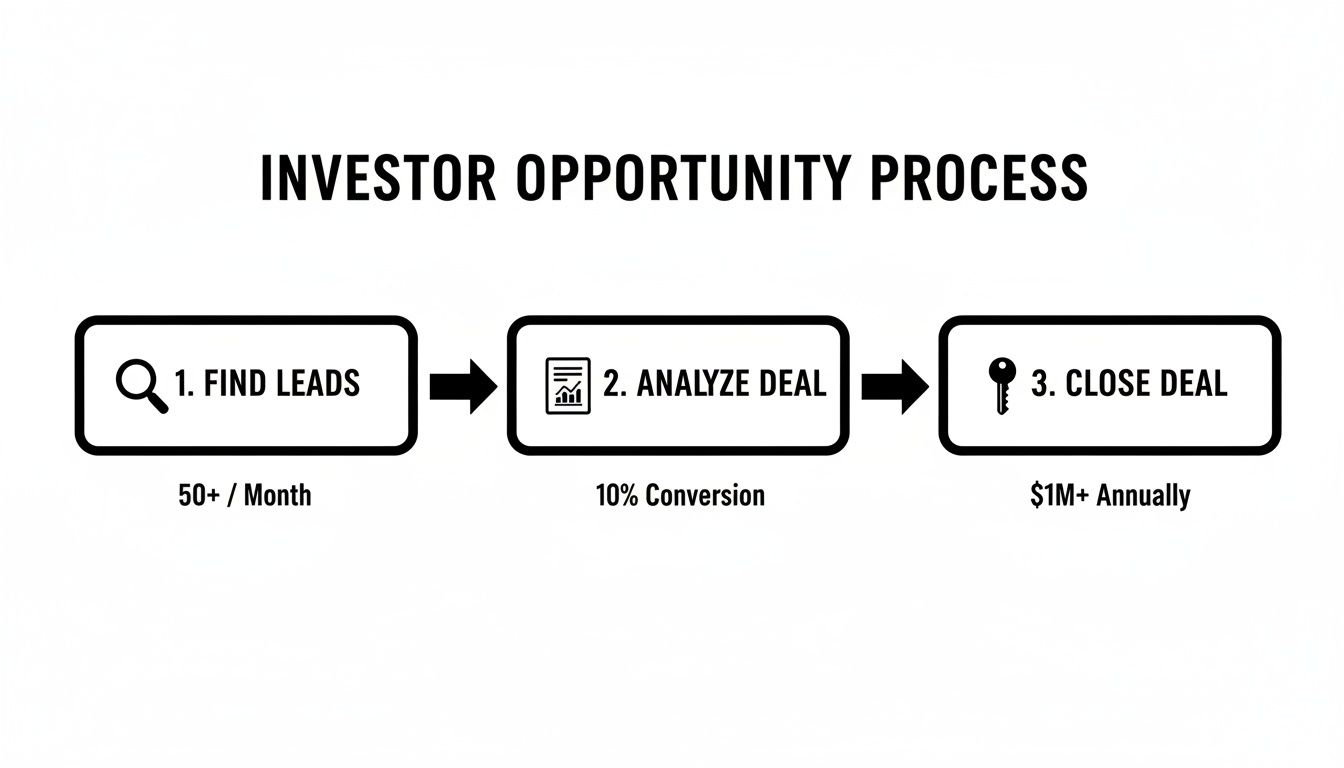

The entire investor process, from start to finish, hinges on this initial step. Finding exclusive, high-quality leads is the fuel for your entire pipeline.

As you can see, a strong deal always starts with a strong lead. Your sourcing method isn't just a part of your strategy—it is your strategy.

Going Straight To The Source For Fresh Leads

The most valuable pre-foreclosure leads aren't sitting on popular websites; they're buried deep in public records at your local county courthouse. By accessing this data directly, you gain a massive time advantage over competitors who are waiting for that same information to be repackaged, marked up, and sold on national platforms.

Here are the gold mines of data that form the foundation of an exclusive deal pipeline:

- Notice of Default (NOD) or Lis Pendens Filings: This is the official starting gun. When a lender files an NOD or Lis Pendens, it’s a public declaration that the homeowner has officially defaulted and the foreclosure clock has started. This is your primary signal.

- Tax Lien and Delinquency Records: Unpaid property taxes are a huge red flag. Homeowners struggling to keep up with their mortgage are almost certainly falling behind on property taxes, too. These records often surface months before a formal NOD is even filed.

- Civil Court Records: Keep an eye out for lawsuits from other creditors. Things like a mechanic's lien from a contractor or a judgment from a credit card company signal broader financial distress. A homeowner juggling multiple debts is far more likely to consider a quick sale to clear the slate.

- Probate and Inheritance Filings: When someone inherits a property, they often inherit a mortgage and upkeep costs they never wanted. These "accidental landlords" are frequently motivated to sell quickly and cash out.

The real goal isn't just to find a distressed property. It's to find layers of distress. A property with a tax lien and a civil court judgment is a much, much hotter lead than one with just a single missed payment.

Sourcing pre-foreclosure leads boils down to two primary approaches: the old-school manual methods and the newer, data-driven automated systems. Each has its place, but they serve very different types of investors.

Comparing Pre-Foreclosure Lead Sources

| Lead Source | Data Freshness | Exclusivity | Scalability | Best For |

|---|---|---|---|---|

| National Lists (Zillow, etc.) | Stale (Weeks/Months old) | Very Low | High | Beginners testing the waters with a small budget. |

| Direct Mail to NOD Lists | Moderate (Days/Weeks old) | Low | Moderate | Investors in smaller markets with less competition. |

| Manual County Records Search | Fresh (Daily/Weekly) | High | Very Low | Hyper-focused investors targeting one specific niche. |

| Automated Data Platforms | Real-Time (Daily) | High | Very High | Serious investors looking to build a scalable, repeatable business. |

The takeaway is clear: if you're trying to build a serious operation, relying on stale, public-facing data is a recipe for frustration. The competitive edge lies in getting proprietary data faster than anyone else.

Why Proprietary Data Is The New Standard

The landscape of distressed investing has completely changed. The days of scooping up bank-owned (REO) properties after the auction are long gone. That market collapsed after the 2008 crisis.

By 2023, the total number of REO properties had plummeted to just 42,090—a staggering decline of 96% from the peak in 2010.

This market shift means the game has moved upstream. To maintain a healthy pipeline, you absolutely must get in front of homeowners before the foreclosure auction. This is where automated data acquisition becomes non-negotiable for serious operators.

Platforms like Tab Tab Labs are the new standard. They scrape county sources daily, pulling fresh filings and, more importantly, cross-referencing them to find those crucial layered distress signals. This approach completely bypasses the stale, over-fished national lists. Our guide on how to find pre-foreclosure homes dives deeper into these advanced techniques.

Instead of manually digging through clunky county clerk websites or paying for outdated information, you get a curated, real-time list of the most motivated sellers in your target market. This is how you stop competing for scraps and start creating your own exclusive, off-market opportunities before anyone else even knows they exist.

Analyzing Deals To Separate Winners From Duds

A long list of pre-foreclosure leads is just raw data. Until you can quickly and accurately separate the real opportunities from the time-wasters, it's pretty much useless. This is where your due diligence framework comes in, acting as a filter to sniff out the properties with actual profit potential.

Seasoned investors run a series of essential checks before ever making contact with a homeowner. This isn't about making a final decision; it's about qualifying the lead to see if it’s even worth a phone call. The goal is to spend your valuable time only on the deals that have the highest chance of actually closing.

Running A Preliminary Title And Lien Search

Before you even start crunching numbers, you have to understand the property's financial baggage. A preliminary title search is your first, non-negotiable step. It reveals any "clouds" on the title that could complicate or completely kill a deal. You’re hunting for liens—legal claims against the property for unpaid debts.

You can often knock out this initial search through online public records or specialized data services. Honestly, getting this right is half the battle in learning how to buy pre-foreclosure listings successfully.

Here’s what you’re looking for:

- Mortgage Liens: This is the big one—the primary loan in default. You need the outstanding balance to see if there's any equity left.

- Junior Liens: Think second mortgages, HELOCs, or other loans tacked onto the property. Every single one has to be paid off at closing.

- Tax Liens: Unpaid property taxes create a lien that jumps to the front of the line, taking priority over almost everything else. Ignoring these is a rookie mistake that can cost you dearly.

- Mechanic's Liens: A contractor did work and didn't get paid? They can slap a lien on the property.

- Judgement Liens: These pop up from lawsuits where a creditor won a judgment against the homeowner.

Finding multiple liens isn't always a red flag. In fact, it often points to a highly motivated seller who needs a clean slate. It just means your offer has to be sharp enough to make every single creditor happy.

Calculating Potential Equity And Profit

Once you've got a handle on the debt, it's time to run the numbers. At its core, every good deal comes down to equity—the difference between what the property is worth and the total amount owed against it.

A simple formula gets you started:

[After Repair Value (ARV)] - [Total Debt + Estimated Repairs + Closing Costs] = Potential Equity

A property might look fantastic on paper, but if the total debt is more than its market value, it's "underwater." In these situations, a short sale—where the lender agrees to take less than what they're owed—is often the only way forward.

Let’s say a home’s ARV is $300,000. The total mortgage and lien debt adds up to $220,000, and you ballpark $20,000 in repairs. Right away, that looks promising. You've got a potential equity cushion to work with, which lets you craft a win-win offer for the homeowner.

Property valuation is everything here. If you want to dive deeper into metrics that can help, check out our guide on calculating cap rate for rental property.

The Power Of Automated Analysis

Let's be real: manually pulling tax records, running lien searches, and calculating equity for dozens of leads every week is a soul-crushing time sink. This is exactly where modern automation gives you a massive edge.

Platforms like Tab Tab Labs do all of this heavy lifting for you. The system instantly takes a new distress signal and cross-references it with property data, tax records, and lien info. It can automatically flag properties that have enough equity, run preliminary profit margins, and score leads based on what you're looking for.

This lets you fly through hundreds of deals with more accuracy and speed than you could ever manage by hand. Instead of getting buried in research, you can focus your energy where it actually counts: connecting with motivated homeowners and closing deals.

Connecting With Homeowners And Structuring Your Offer

Once your initial analysis flags a property as a potential winner, the real work begins. This is where the rubber meets the road—the most delicate phase of learning how to buy pre foreclosure listings. Here, empathy and a smart strategy are just as critical as the numbers on your spreadsheet.

If you're thinking about using aggressive, high-pressure sales tactics, forget it. They almost never work in these situations. Your goal is to be a credible, professional problem-solver who can offer a legitimate way out of a serious jam.

This isn't about swooping in to "get a deal" at their expense. It's about building genuine rapport and figuring out what's really driving their decisions. Are they terrified of ruining their credit score? Do they just need enough cash to pack up and start fresh somewhere else? Or are they completely overwhelmed and just want a quick, painless exit? Your entire approach, from that first phone call to the final offer, has to be built around their answer.

Crafting Your Initial Outreach

How you first make contact can make or break the entire deal. It sets the tone for everything that follows. A clumsy first touch can get the door slammed in your face—literally or figuratively—before you even get a chance to explain how you can help. The key is to be respectful, direct, and professional.

Every situation is unique, but here are a few methods that have worked for me over the years:

- Direct Mail: A well-written, personal letter is often the best way to open the door. It’s not intrusive, and it gives the homeowner time to process the information and respond when they’re ready.

- Phone Calls: A respectful phone call can be powerful, but you have to be ready for a tough conversation. Always lead with empathy, clearly state your purpose, and prepare to listen way more than you talk.

- Door Knocking: This is obviously the most direct method, and it requires a tremendous amount of tact. If you do it right, you can build instant rapport. But if you come across as pushy or opportunistic, it will backfire spectacularly.

Your opening line should never, ever be, "I want to buy your house." Instead, try something much softer, like, "Hi, I'm a local property owner, and I came across some public information that suggests you might be facing a challenge with your property. I specialize in helping homeowners find solutions, and I just wanted to see if I could offer any assistance."

This simple shift reframes the entire conversation. You're not a predator; you're a problem-solver. It’s an approach that is far more likely to get a positive response.

Understanding Homeowner Motivation

Once you've made contact and the homeowner is willing to talk, your single most important job is to listen. Seriously. Your ability to craft an offer they'll actually accept depends entirely on understanding what they truly need. The money is often secondary to the solution they're desperate for.

This is where you have to move beyond the spreadsheet and connect with the human side of the deal. Ask open-ended questions to discover what a "win" really looks like for them.

- "In a perfect world, what would be the ideal outcome for you in this situation?"

- "If you were to sell, what's most important to you—getting the highest price, closing as quickly as possible, or something else entirely?"

- "What has been the most frustrating part of this whole process for you so far?"

Their answers are the blueprint for your offer.

Matching Offers To Homeowner Motivations

A one-size-fits-all offer almost never closes the deal in pre-foreclosure. The smartest investors are the ones who can tailor their proposals to solve the homeowner's specific, unique problem. When you align your offer with their primary motivation, you create a genuine win-win scenario that they are far more likely to say "yes" to.

This table breaks down how you can match different offer structures to common homeowner needs you'll encounter.

| Homeowner's Primary Motivation | Potential Offer Structure | Key Talking Point |

|---|---|---|

| Needs to Save Their Credit | Offer a price that fully covers the mortgage and all liens, even if it means a lower profit for you. | "My offer is designed to pay off your lender in full, which can help protect your credit from the damage of a foreclosure." |

| Needs Cash for a Fresh Start | Structure a cash offer that provides them with a specific amount of money at closing, after all debts are paid. | "Once the mortgage and any other debts are cleared, you'll walk away with $15,000 in cash to help you get settled." |

| Wants to Stay in the Home | Propose a sale-leaseback agreement where you buy the house and they rent it from you for a set period. | "This allows you to get the equity out of your home now, resolve the issue with the bank, and stay right where you are." |

| Is Overwhelmed and Wants Out | Emphasize a fast, as-is closing with no repairs, no showings, and no hassle. You handle everything. | "You won't have to fix a single thing. We can close in as little as 10 days, and you can simply take what you want and leave the rest." |

As you can see, the "best" offer isn't always about the highest price. More often than not, the terms of the deal and the solution you provide are far more valuable to a seller in distress. By zeroing in on what they truly need, you transform yourself from just another buyer into their best possible way out.

Navigating The Financing And Closing Process

Getting a signed contract is a huge win, but don't pop the champagne just yet. The deal isn't done. Now you've got to shepherd it through the often-choppy waters of financing and closing, where tight deadlines and hidden liens can torpedo an otherwise perfect opportunity.

This final stretch demands a different skillset. It's less about persuasion and more about meticulous, high-stakes execution. Unlike a standard real estate deal, closing a pre-foreclosure is a sprint against the auction clock. Every single day of delay amps up the risk that the whole thing falls apart. Your ability to get funding locked in and clear the title fast is what separates a successful closing from a frustrating "almost."

Choosing Your Financing Strategy

The right financing is everything here—it dictates your speed and your leverage. Traditional bank loans? Forget about them. They’re almost always too slow for the compressed timelines you’re working with.

You need to think like a specialist. These are the go-to funding avenues:

- Cash Offers: This is the undisputed king. Cash is fast, it's certain, and it completely sidesteps the risk of a loan falling through. For a seller staring down the barrel of an auction, a guaranteed cash offer is the most compelling story you can tell.

- Hard Money Loans: If you don't have all the cash on hand, hard money is your next best bet. These are short-term, asset-based loans from private lenders who understand the investor world. You can get funded in days, not weeks or months. The trade-off? Higher interest rates and points, but speed is what you're paying for.

- Creative Financing (Subject-To): "Subject-to" is a powerful, more advanced strategy where you take over the seller's existing mortgage payments. This works beautifully when the homeowner has little equity but a great interest rate locked in. It requires a sharp real estate attorney to paper it correctly, but it lets you acquire property with very little of your own money.

Your financing choice sends a powerful signal. Showing up with proof of funds for a cash offer or a pre-approval letter from a reputable hard money lender tells the seller you're serious and can perform. It builds the confidence you need to get the deal across the finish line.

The pressure to close quickly is only getting more intense. After a few quiet years thanks to pandemic-era programs, foreclosure activity is ticking up noticeably. In September 2025, there were 35,602 foreclosure filings across the country, a jump of 20% from the year before. This trend is creating a critical window for savvy investors, but it also means fast, reliable financing isn't just a nice-to-have; it's your biggest competitive advantage. You can dig into what these trends mean by looking at current foreclosure rate data.

The Critical Role Of The Title Company

Once you have your funding lined up, your next call should be to a battle-tested title company or real estate attorney. They are your most important partner in this final phase. Their job is to make sure you get a "clean" title, meaning the property is free of any surprise claims or liens that could come back to haunt you later. This step is absolutely non-negotiable.

The title company will perform a deep-dive title search, going way beyond the preliminary check you did. They'll scour public records to uncover every single debt attached to the property.

You can expect them to find and account for everything that needs to be paid off at closing:

- The primary mortgage that's in default.

- Any second mortgages or home equity lines of credit (HELOCs).

- Delinquent property taxes.

- HOA or condo association liens.

- Mechanic's liens from unpaid contractors.

- Personal judgments against the homeowner that have attached to the property.

They take all this information and prepare the settlement statement (you'll see it called a HUD-1 or Closing Disclosure), which is a detailed ledger of all the money changing hands. It itemizes every debt and confirms your purchase price is enough to cover everything and deliver a clear title. Think of the title company as the gatekeeper; they make sure every 'i' is dotted and every 't' is crossed before you get the keys. If you want to understand the very first legal filing that kicks off this whole process, check out our guide on what a Lis Pendens notice means.

Successfully closing a pre-foreclosure is the ultimate test of an investor's mettle. It demands a rock-solid financing plan, a great legal team, and the discipline to stay organized under immense pressure. Master this last mile, and you'll be able to consistently turn promising leads into profitable assets.

Your Pre-Foreclosure Questions, Answered

Diving into pre-foreclosures can feel like navigating a maze. It’s totally normal to have questions as you learn the ropes. This last section is all about giving you clear, no-fluff answers to the queries we hear all the time from investors, both green and seasoned.

Getting these fundamentals down solid is what gives you the confidence to jump on a great opportunity when it pops up.

Is It Actually Legal To Contact These Homeowners?

Yes, it’s 100% legal to contact a homeowner in pre-foreclosure. The whole process kicks off with a public filing, like a Notice of Default. These are public records, available to anyone who wants to look them up at the county courthouse or through a data service.

But here’s the thing: legality is just one piece of the puzzle. How you make contact is what really counts. You have to play by the rules, sticking to federal and local laws like the Telephone Consumer Protection Act (TCPA), which has strict guidelines for calls and texts.

More than that, your whole approach needs to be built on respect and empathy. You're there to offer a potential solution, not to prey on someone’s misfortune.

What Should I Expect To Pay For a Pre-Foreclosure Home?

There’s no magic number or standard discount here. While many investors shoot for a price somewhere between 10% to 30% below market value, that's more of a ballpark figure than a hard-and-fast rule. The final price really boils down to a few critical variables.

Equity is king.

If a homeowner has a $300,000 house with a $200,000 mortgage, you’ve got a lot of room to negotiate a deal that works for everyone. But if they owe $290,000 on that same house, the margins are razor-thin. Your offer has to be enough to clear their debt—mortgage, liens, back taxes—while still leaving enough on the table for you to make a profit after repairs and closing costs.

The best pre-foreclosure deals aren’t just about nabbing a property for a rock-bottom price. They're about structuring an offer that solves the homeowner's immediate financial crisis while also hitting your own investment targets. It’s a delicate dance between the numbers and the human element.

What Are The Biggest Risks I Should Watch Out For?

While the upside is huge, this isn't a risk-free game. The major traps usually fall into three buckets.

First, surprise title issues. You run a preliminary check and things look clear, but then the official title search uncovers a junior lien or a last-minute judgment. Suddenly, your numbers are completely blown. A professional, in-depth title examination isn't optional; it's essential.

Second, blowing the rehab budget. This is a classic rookie mistake. A property that’s been neglected financially is often neglected physically. What seems like a few cosmetic touch-ups can easily hide a failing HVAC system or a leaky roof. Always, always get a thorough inspection and bake a hefty contingency fund into your budget.

Finally, deals can simply fall apart. The homeowner might find a way to get current with their lender, file for bankruptcy (which slams the brakes on any sale), or just get cold feet. You have to go into every deal mentally prepared for the fact that not every contract you sign will cross the finish line.

How Does Automation Really Give Me an Edge?

In today's market, automation and AI aren't just fancy add-ons; they're a core competitive advantage. The main benefit? Speed and scale that you could never achieve manually. It's the difference between digging with a spoon and using an excavator.

AI-driven data platforms like Tab Tab Labs can sift through millions of public records every day, spotting distress signals sometimes just hours after they’re filed. That speed lets you be the first one to reach out.

From there, automated systems can instantly pull property data, check for liens, and run equity numbers, qualifying or junking a lead in seconds. No more wasting hours chasing down deals that were never going to work.

And on top of that, AI assistants can handle the initial outreach, warming up leads and filtering for the sellers who are genuinely motivated to talk. This whole stack—speed, intelligence, and efficiency—frees you up to do what you do best: build relationships, negotiate creative solutions, and close more deals.

Ready to stop fighting over stale lists and start building a predictable pipeline of exclusive, off-market deals? At Tab Tab Labs, we provide the proprietary data and AI-driven automation that serious real estate operators use to own their markets. Schedule a free strategy call with us today and see how our Distressed Appointments Engine can deliver 15-20 pre-qualified seller appointments directly to your calendar each month.